Nicholas Chapman

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Nicholas Chapman

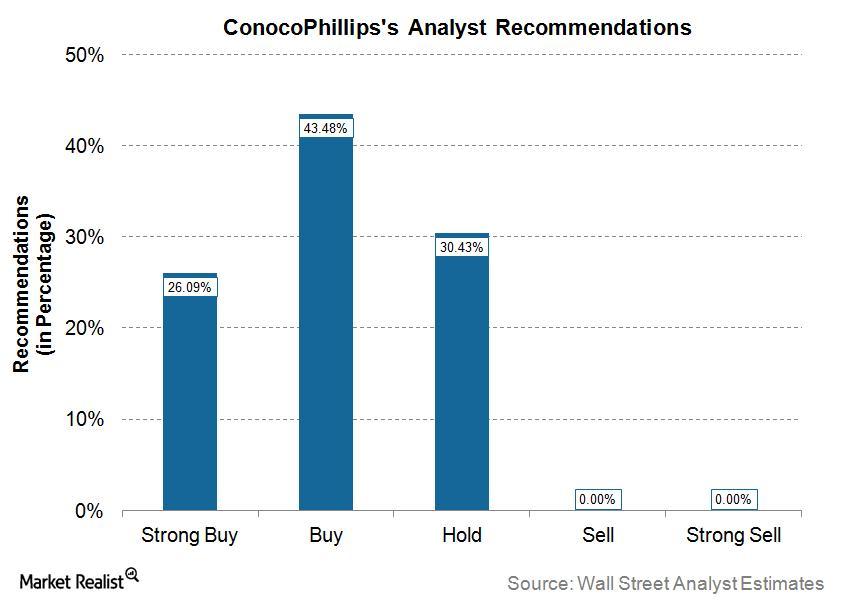

What Wall Street Analysts Are Saying about ConocoPhillips

As of July 28, 2017, 43.48% of the total Wall Street analysts covering ConocoPhillips (COP) have a “hold” recommendation on ConocoPhillips.

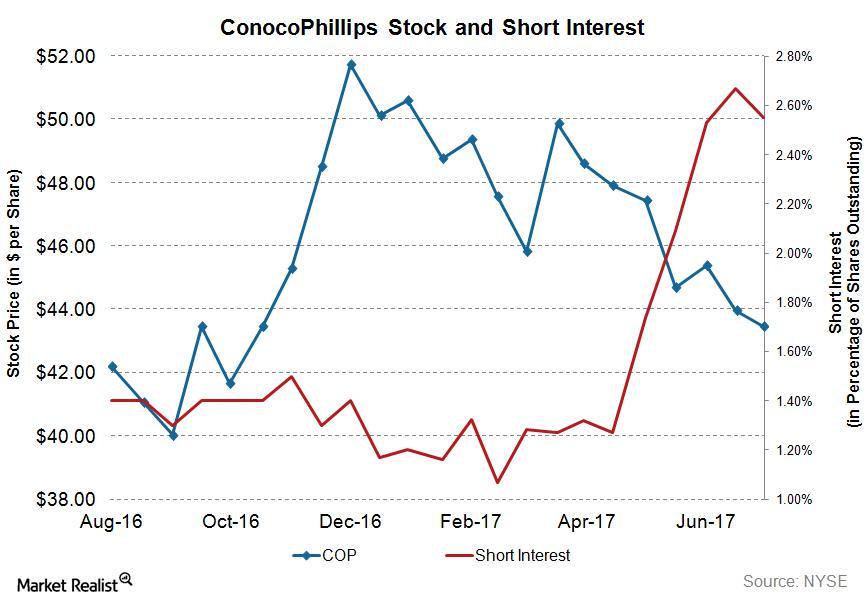

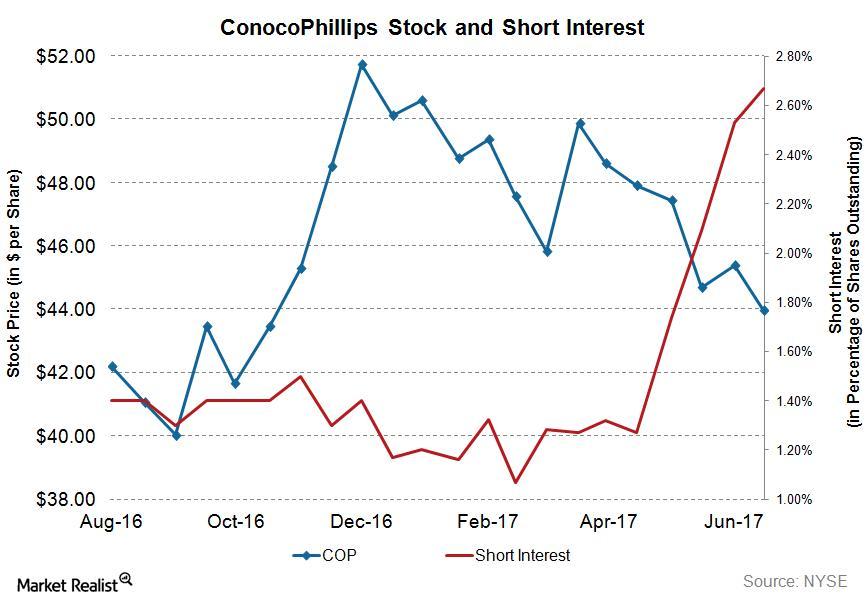

Analyzing Short Interest Trends in ConocoPhillips’s Stock

As of July 14, 2017, ConocoPhillips’s (COP) total shares shorted (or short interest) stood at ~31.48 million, whereas its average daily volume is ~5.91 million.

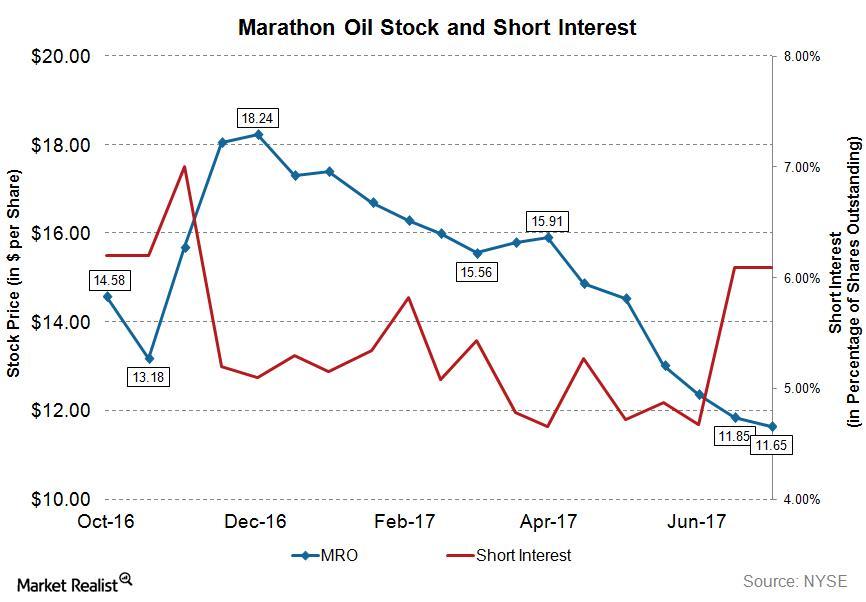

What’s the Short Interest in Marathon Oil Stock?

As of July 14, 2017, Marathon Oil’s (MRO) total shares shorted (or short interest) stood at ~51.8 million.

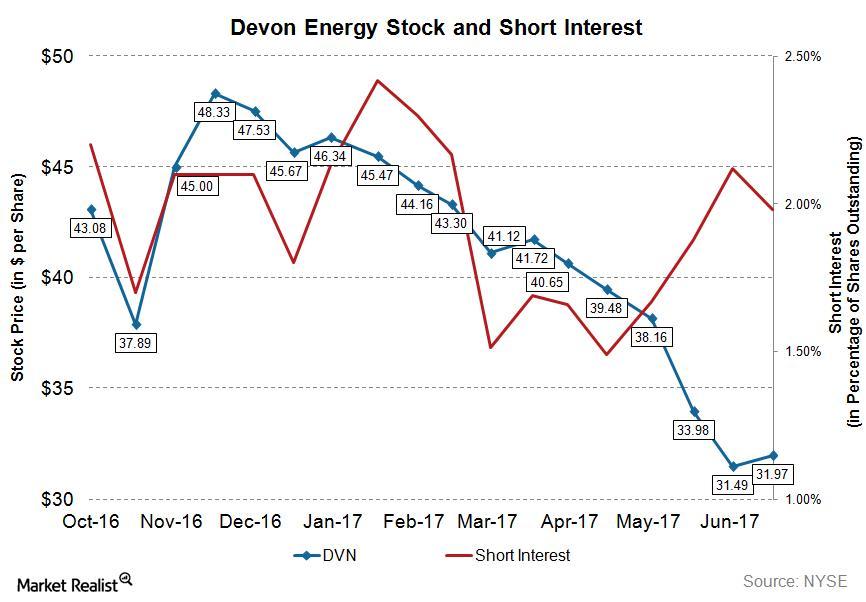

Analyzing Short Interest in Devon Energy Stock

As of June 30, 2017, Devon Energy’s (DVN) total shares shorted (or short interest) stood at ~10.4 million, whereas its average daily volume was ~5.9 million.

Analyzing Short Interest in ConocoPhillips Stock

On March 31, 2017, 1,282 13F filers held ConocoPhillips (COP) stock in their portfolios. However, only 19 filers featured COP in their top ten holdings.

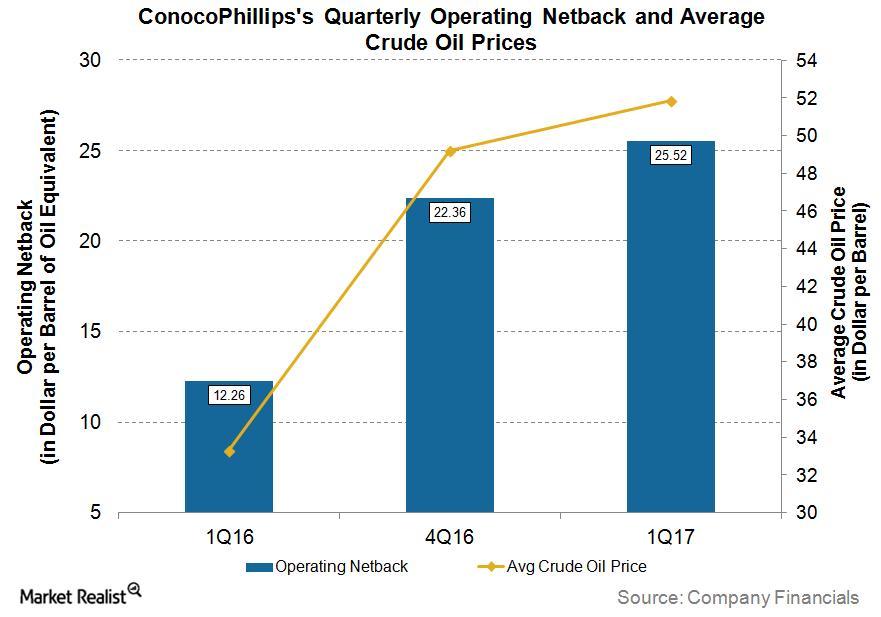

Chart in Focus: ConocoPhillips’s Operating Netback

What is the operating netback? The operating netback (also referred as production netback) is oil and gas revenue realized per boe (barrel of oil equivalent) after all costs to bring one boe to the market are subtracted from the realized price. The operating netback is derived by subtracting production expenses (or field operating expenses), production taxes, […]

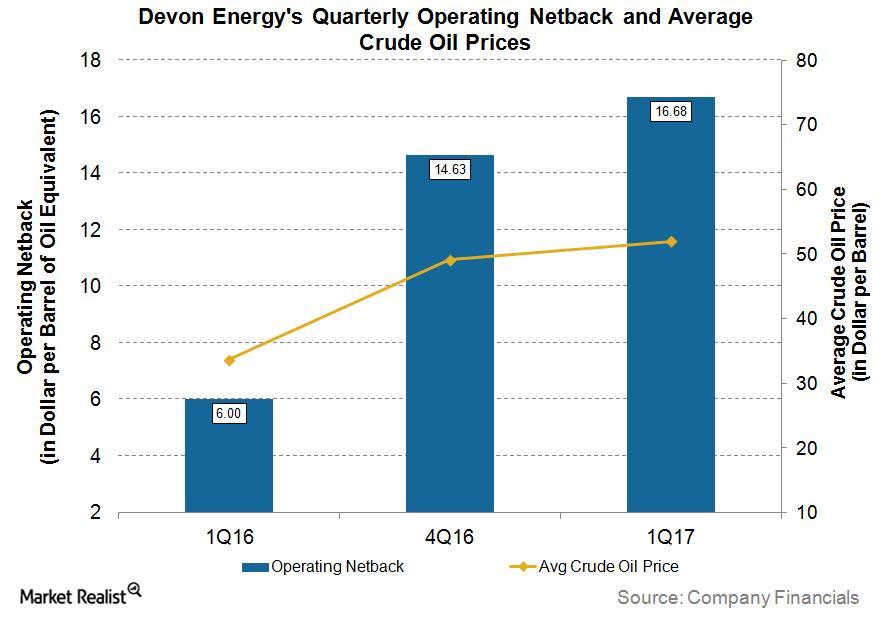

Devon Energy’s Operating Netbacks

In 1Q17, Devon Energy’s (DVN) reported operating netback was ~$16.68 per boe (barrel of oil equivalent), which is ~178% higher than in 1Q16.

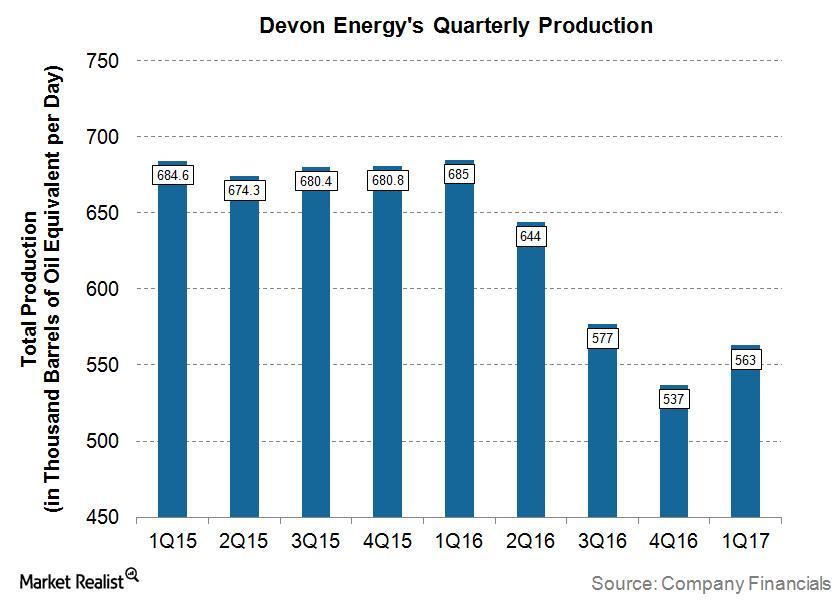

Understanding Devon Energy’s Production Volumes

For 1Q17, Devon Energy (DVN) reported total production of 563 MBoepd, which is ~18% lower when compared with 1Q16.

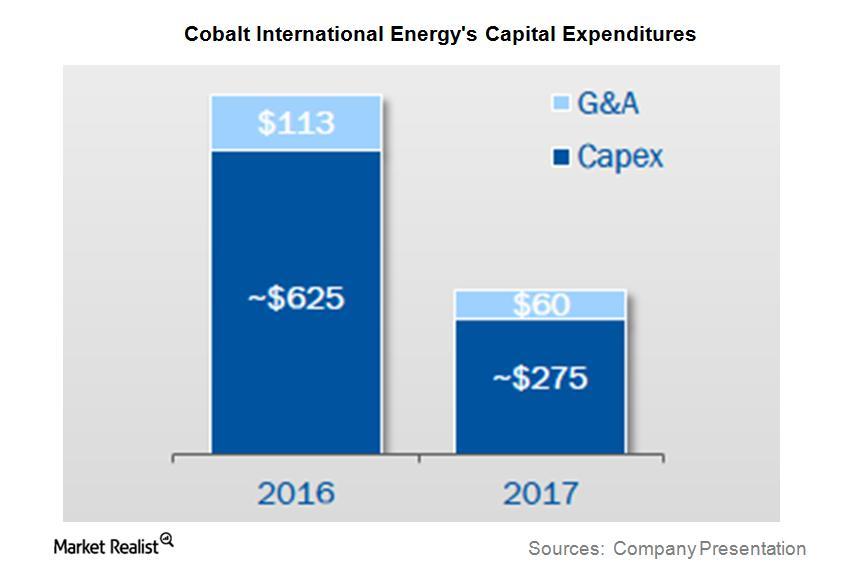

Cobalt International Energy’s Capital Expenditure Guidance

For fiscal 2017, Cobalt International Energy (CIE) plans to spend significantly lower on capex (capital expenditure), or ~56.0% less than fiscal 2016.

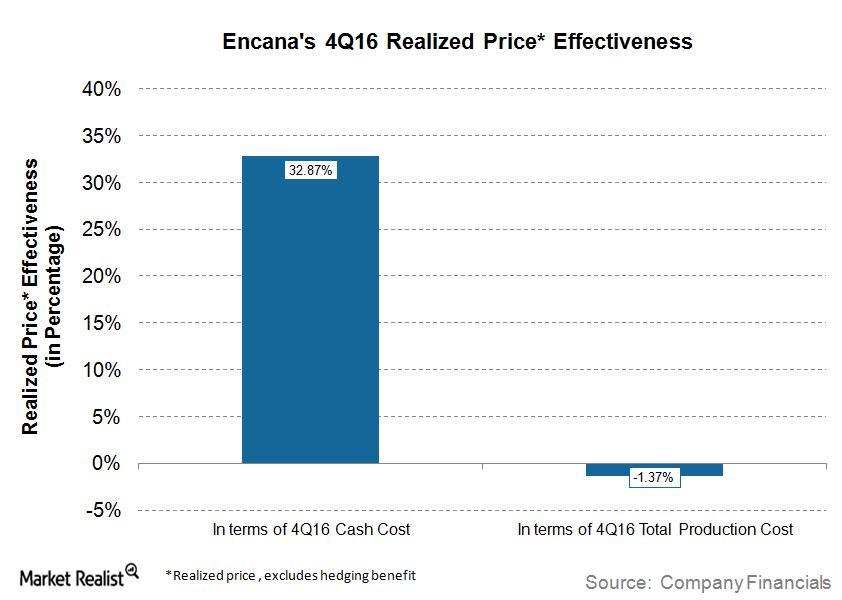

Analyzing Encana’s Realized Price Effectiveness

Encana’s (ECA) production cash cost has increased on a year-over-year basis. For 4Q16, Encana’s production cash cost was $17.92 per boe, higher than $17.74 per boe in 4Q15.

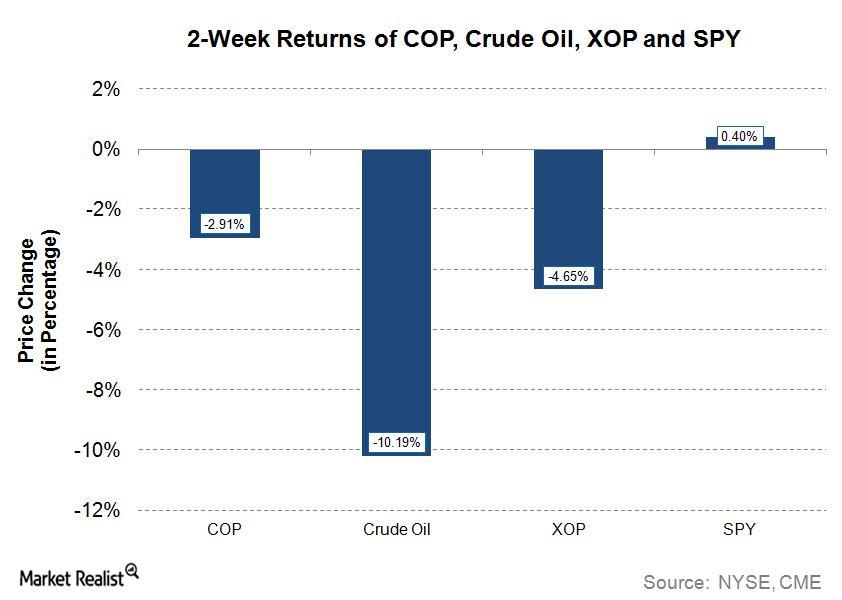

Why ConocoPhillips Stock Is Outperforming Crude Oil and Peers

In the last two weeks, the stock of ConocoPhillips (COP), a crude oil (USO) and natural gas (UNG) producer, has outperformed crude oil prices.

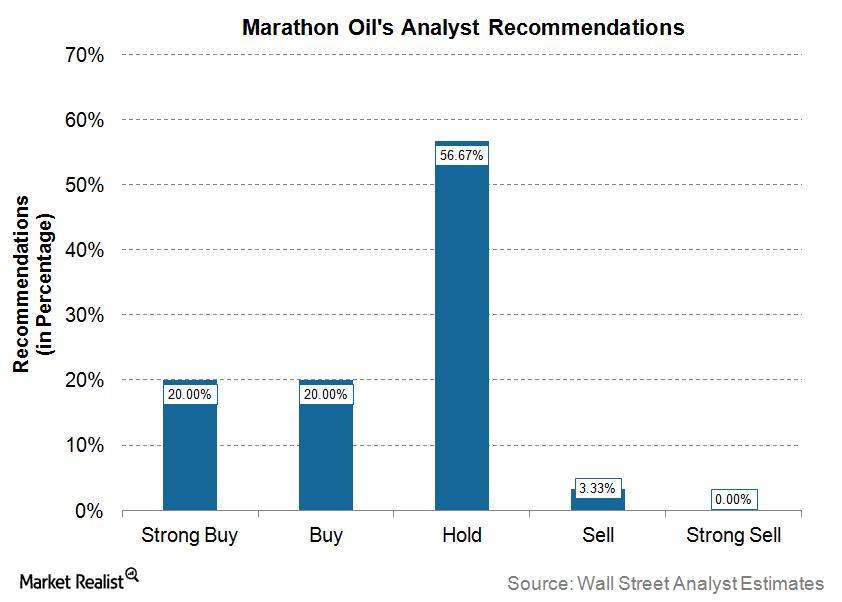

What Are Analysts Saying about Marathon Oil?

Recommendations Currently, 30 analysts cover Marathon Oil (MRO). They’ve given six “strong buy,” six “buy,” 17 “hold,” and one “sell” recommendation on the stock. There were no “strong sell” recommendations. Target price Analysts’ median target price for MRO is $20, which is ~25% higher than the closing price of $16.05 on February 9, 2017. The mean […]

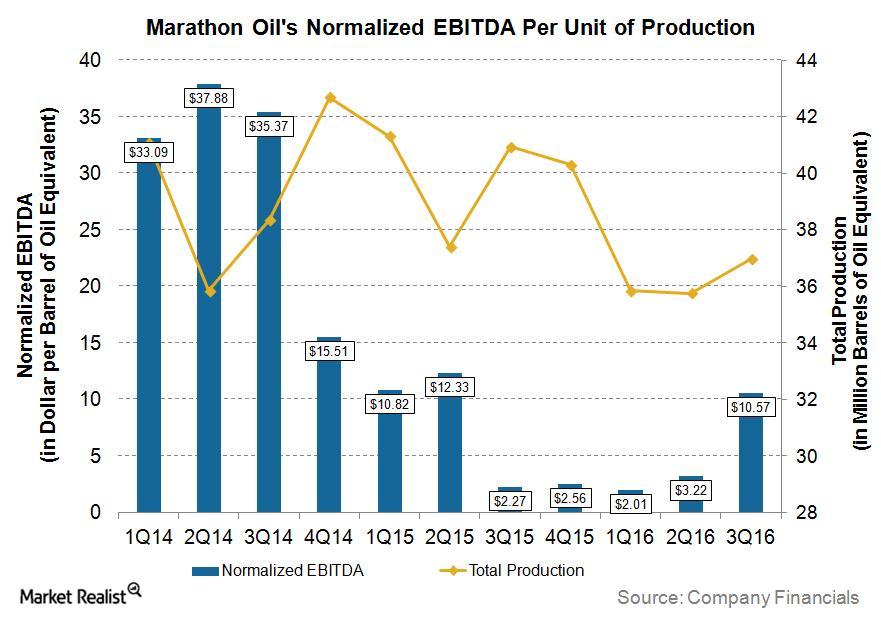

Understanding Marathon Oil’s EBITDA Normalized to Production

In 3Q16, Marathon Oil (MRO) reported normalized EBITDA per unit of production of ~$10.57 per boe, which was ~366% higher than in 3Q15.

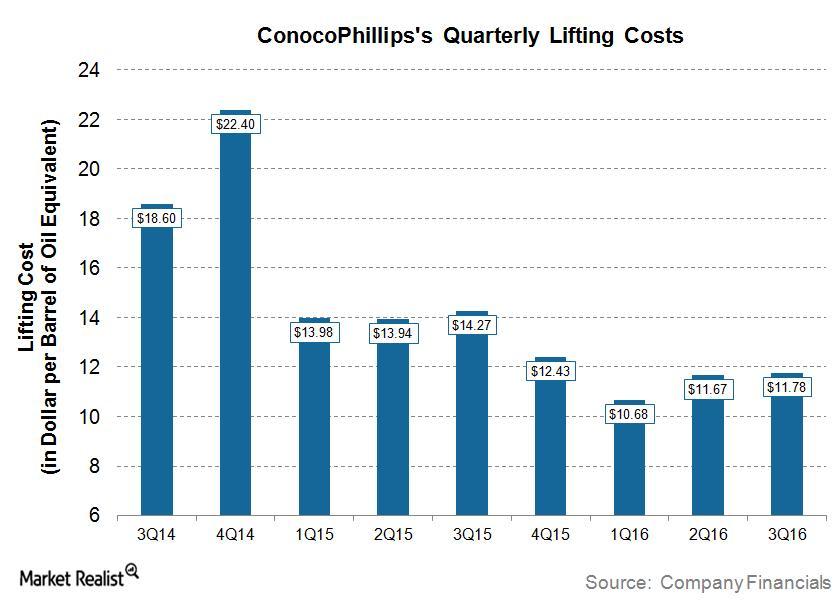

Analyzing ConocoPhillips’s Lifting Costs

In 3Q16, ConocoPhillips (COP) reported lifting costs of ~$11.78 per boe (barrel of oil equivalent), which is ~17.0% lower than 3Q15.

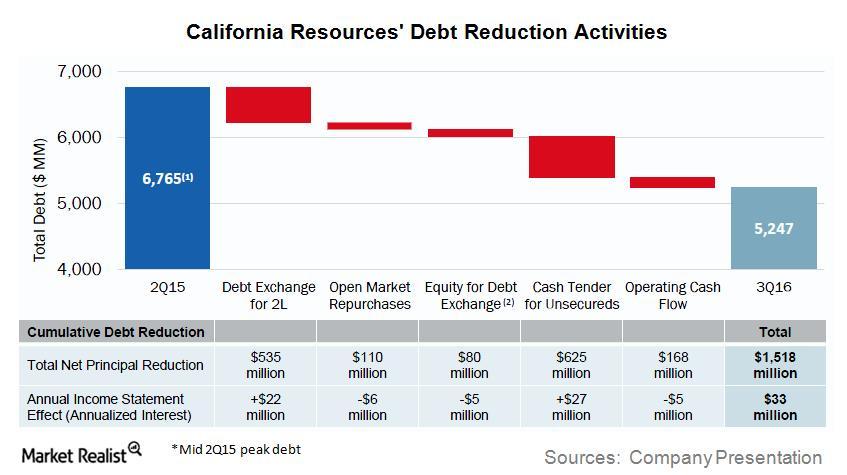

California Resources Has Taken These Steps to Reduce Its Debt

On September 30, 2016, California Resources’ (CRC) total debt stood at ~$5.3 billion. California Resources has been intently focusing on reducing its debt load.

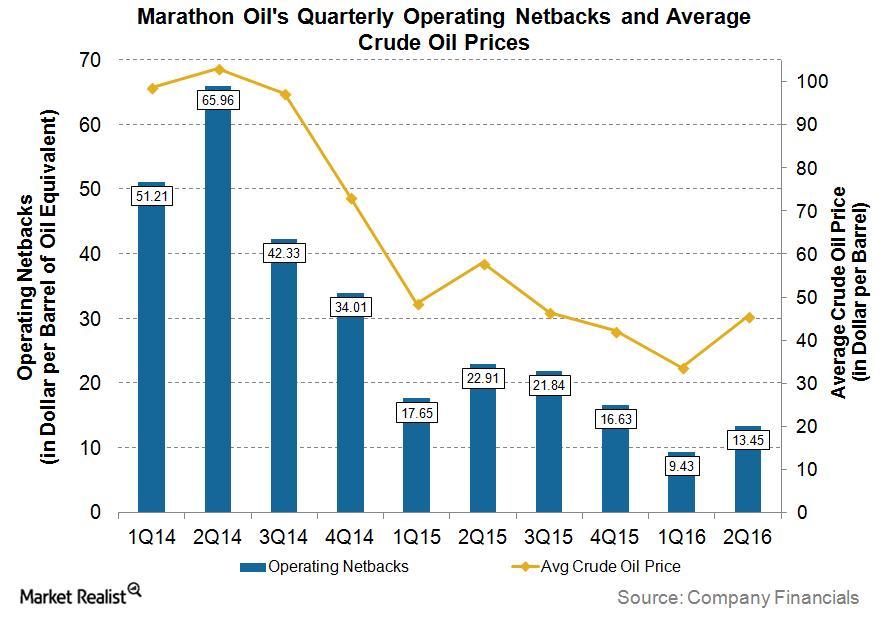

Marathon Oil’s 2Q16 Operating Netbacks Unveiled

In 2Q16, Marathon Oil (MRO) reported an operating netback of ~$13.45 per boe (barrel of oil equivalent), which is ~41% lower than in 2Q15.

Are Companies That Have Done Acquisitions Outperforming?

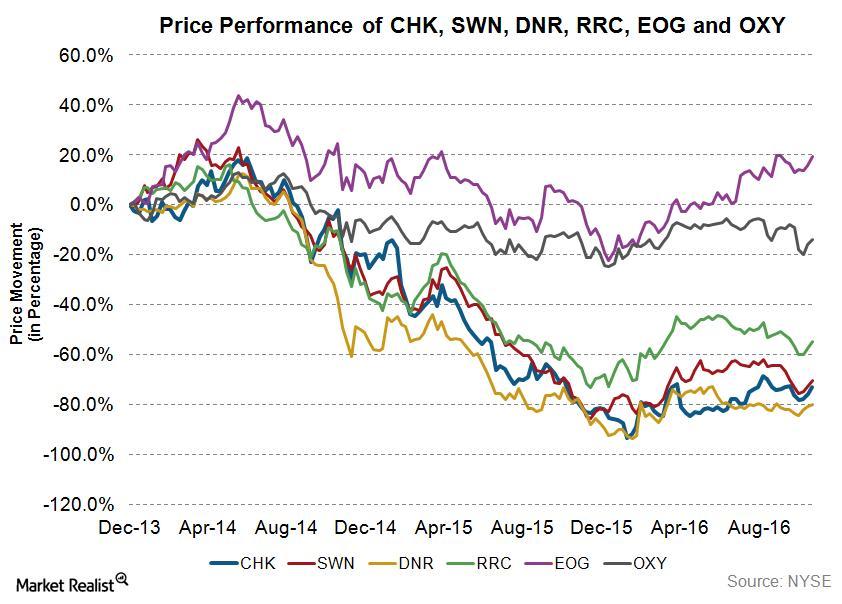

Upstream companies’ performance In the last two parts of this series, we have seen that some upstream companies, namely Range Resources (RRC), EOG Resources (EOG), and Occidental Petroleum (OXY), have taken advantage of lower crude oil (USO) and natural gas (UNG) prices through acquisitions. In this part, we’ll see if these companies are outperforming Chesapeake […]

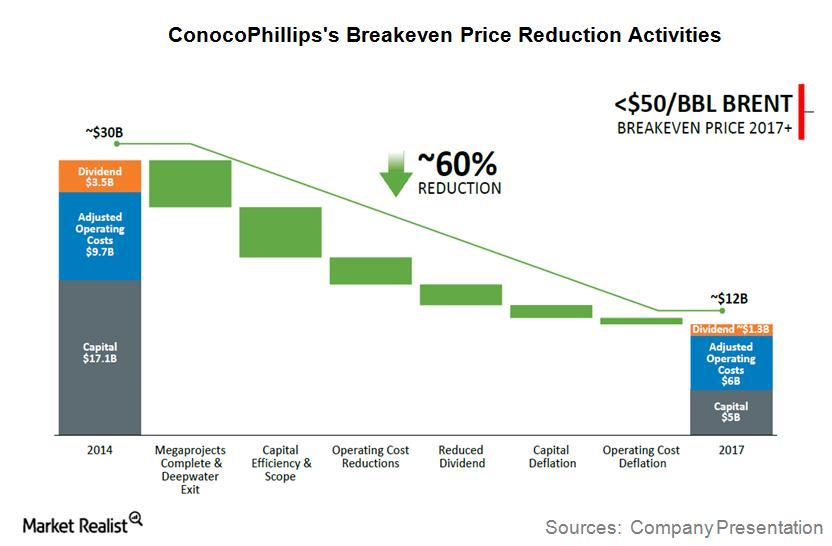

ConocoPhillips’s Steps to Reduce Its Break-Even Price

Since 2014, ConocoPhillips (COP) has been focusing on reducing its break-even price.

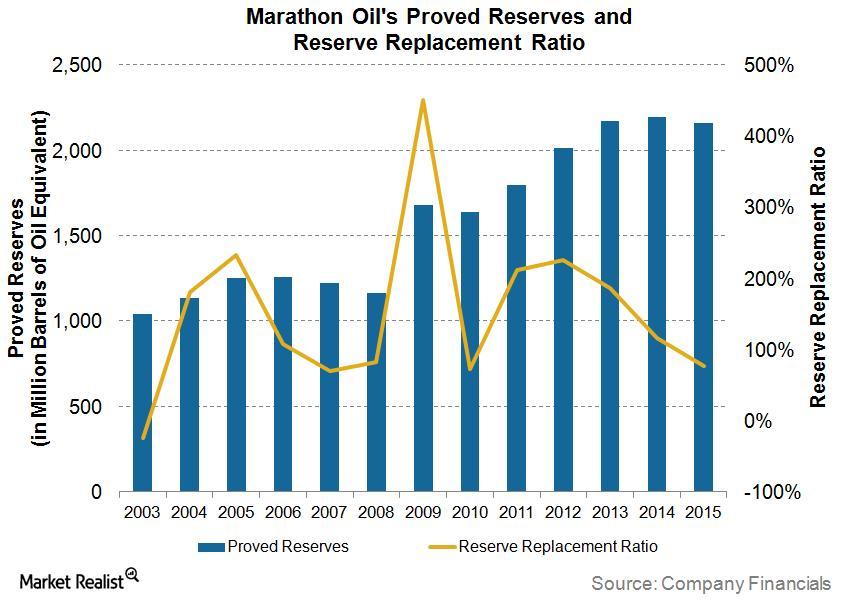

How Are Marathon Oil’s Proved Reserves Evolving?

As of December 31, 2015, the Marathon Oil’s (MRO) proved reserves totaled ~2163 MMboe, which is ~35 MMboe less than in December 31, 2014.

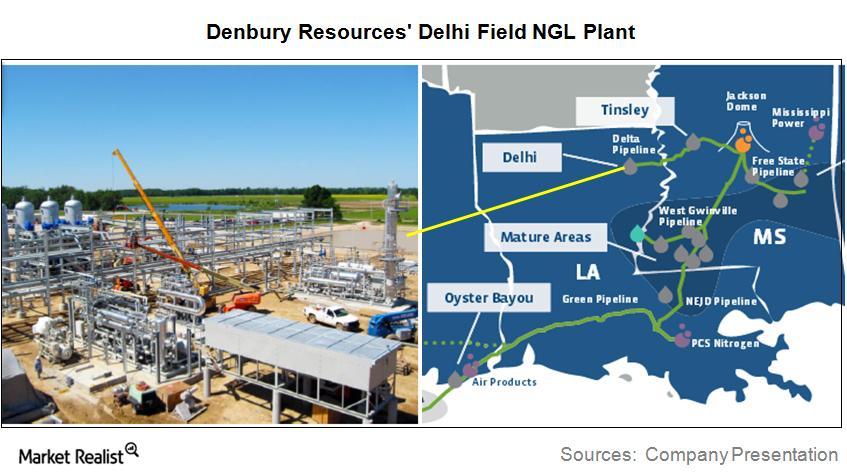

Why Denbury Resources’ Delhi Field Plant Is So Significant

Denbury Resources (DNR) is constructing an NGL (natural gas liquids) plant at its Delhi Field on the Gulf Coast.

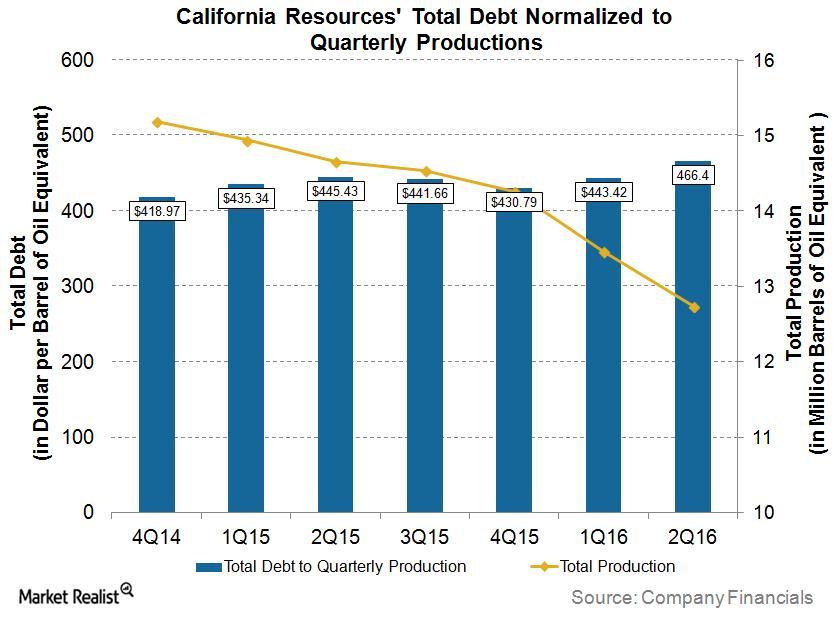

California Resources’ Debt and Production: Chart in Focus

For 2Q16, California Resources (MRO) reported total debt of ~$466 per boe (barrel of oil equivalent) of production.

How Range Resources Stock Reacted after Past Earnings Beats

In March 2016, Range Resources stock made a higher high for the first time in almost two years. Since January 2016, Range Resources stock has risen a whopping 112%.

How Marathon Oil’s Stock Has Reacted to Past Earnings Reports

After losing ~84% of its market capitalization between September 2014 and February 2016, Marathon Oil’s stock price has begun to show signs of new uptrends.

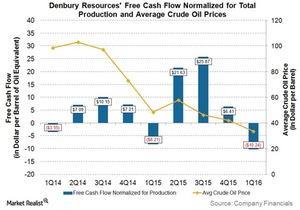

Chart in Focus: Denbury Resources’ Free Cash Flow

In 1Q16, Denbury Resources’ reported free cash flow normalized for total production of ~-$10 per boe (barrel of oil equivalent), ~$2 lower compared to 1Q15.

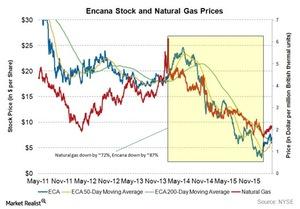

Encana: The Effect of Declining Natural Gas Prices

In this series, we’ll take a look at the effect of declining natural gas prices on Encana. We’ll also cover its May 17 Presentation for Investors on its Montney Resource Play.

Can Energen’s Stock Price Continue Its Post-1Q16 Earnings Rally?

Energen (EGN) announced its 1Q16 earnings on May 5, 2016. Following its earnings release, a contrarian reaction occurred in which better-than-expected earnings pushed Energen’s stock price down by ~4% in two sessions.

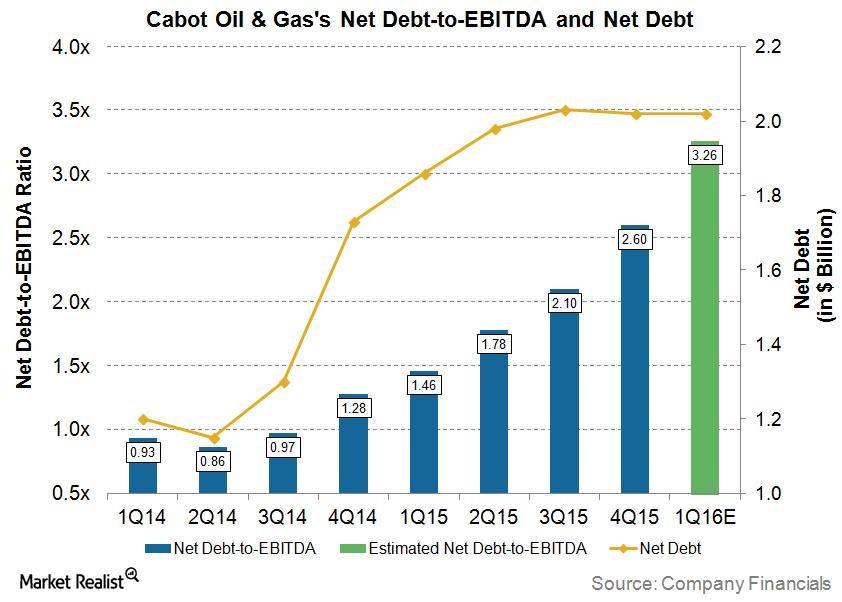

How Is Cabot Oil & Gas Dealing with Its High Debt?

On February 26, 2016, in an attempt to deal with falling earnings and high debt, Cabot Oil & Gas (COG) closed a public offering of 44 million shares of its common stock.

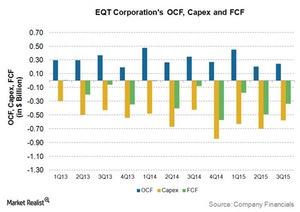

The Downward Trend of EQT’s Free Cash Flow

EQT has been reporting negative free cash flows since 2Q13. In 3Q15, EQT’s free cash flow was -$334 million.

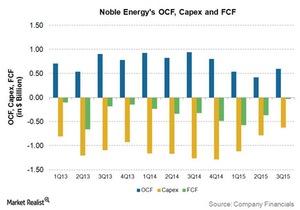

A Look at Noble Energy’s Free Cash Flow Trends

Noble Energy reported negative but improving free cash flows in 2015.

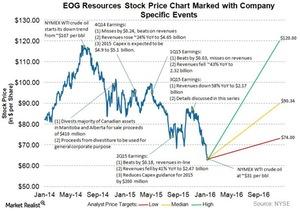

EOG Resources Failed to Hold above Its 200-Day Moving Average

In 3Q15, excluding the one-time items, EOG reported a profit of $0.02 per share, $0.32 better than the analyst consensus for a loss of $0.30 per share. Its revenues fell ~58% year-over-year to ~$2.17 billion.

Analyzing EOG Resources’ 3Q15 Earnings Call

Currently, ~67% of Wall Street analysts rate EOG as a “buy” and ~31% of analysts rate it as a “hold.” Only ~2% rate the stock a “sell.”

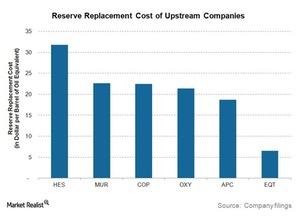

Weighing the Reserve Replacement Cost Metric of Upstream Energy Companies

The Reserve Replacement Cost metric gives us the cost incurred by an upstream company by considering the per-barrel-of-oil equivalent of a new reserve.

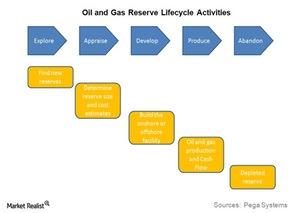

The Life Cycle of Oil and Gas Reserves: Tracking the Activities of Upstream Companies

The depletion of reserves due to production and rising demand continually creates a need for the exploration of new oil and gas reserves.

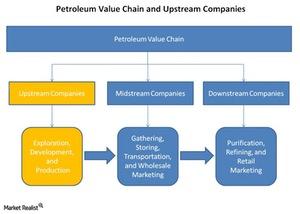

Where Do Upstream Energy Companies Sit along the Petroleum Value Chain?

Upstream energy companies are the starting point of the petroleum value chain and are involved in exploration, appraisal, development, and production.