Weighing the Reserve Replacement Cost Metric of Upstream Energy Companies

The Reserve Replacement Cost metric gives us the cost incurred by an upstream company by considering the per-barrel-of-oil equivalent of a new reserve.

Dec. 14 2015, Updated 10:06 a.m. ET

Need for new oil and reserves

In this part of our series, we’ll look at one more very important parameter in measuring an upstream energy company: Reserve Replacement Cost. As we discussed previously in this series, every upstream company has certain a certain reserves-to-production ratio, which is measured in years. But in order to maintain cash flow visibility beyond the current reserves-to-production ratio, every upstream company has to increase its portfolio of oil and gas reserves.

What is Reserve Replacement Cost?

The problem is that adding new oil and gas reserves to an existing portfolio can be an extremely cash-consuming activity for upstream companies. Not all reserves are equal—there are different prices tag for different reserves. This price tag varies according to costs incurred during exploration, the location of the reserve, the type of reserve, and the quality of reserve itself.

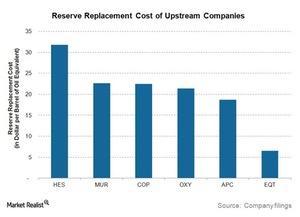

Sometimes upstream companies add new oil and gas reserves by means of acquiring smaller players. But how do we know if they are paying a fair price for the acquisition? Moreover, how do we know at what costs an upstream company is increasing their oil and gas reserves? These questions can be answered by calculating Reserve Replacement Cost, which tells us the cost incurred by an upstream company by considering a per-barrel-of-oil equivalent of the new reserve.

Reserve Replacement Cost has a direct bearing on the future profitability of any upstream company. If a company’s Reserve Replacement Cost is too high compared to peers, it’s generally not good for the future margins or future profitability of the company. According to Ernst and Young, the current Reserve Replacement Cost in the upstream energy industry is approximately around $20 per barrel of oil equivalent. Sometimes an upstream company might go for a higher Reserve Replacement Cost if they think the underlying commodity will appreciate substantially in coming years.

Companies with upstream operations and ETFs

Upstream energy companies that focus on conventional resources include Occidental Petroleum Corporation (OXY) and Noble Energy (NBL), whereas companies that focus on unconventional resources include EOG Resources (EOG) and Southwestern Energy Company (SWN).

Apart from investing directly in these companies, investors can also gain exposure to upstream energy companies like these by investing in the SPDR S&P Oil and Gas Exploration & Production ETF (XOP). The First Trust ISE-Reverse Natural Gas ETF (FCG) invests specifically in natural gas producers.

Continue to the next part of this series for a discussion of credit ratings.