Why Did ConocoPhillips’s Revenue Grow in 1Q18?

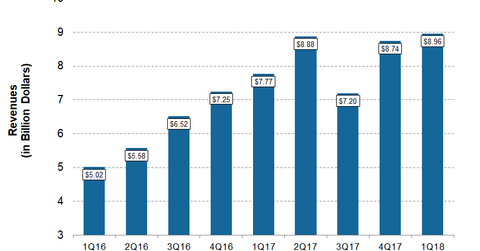

For 1Q18, ConocoPhillips (COP) reported revenues of ~$9.0 billion—higher than analysts’ consensus of ~$8.8 billion.

Dec. 4 2020, Updated 10:53 a.m. ET

ConocoPhillips’s 1Q18 revenues

For 1Q18, ConocoPhillips (COP) reported revenues of ~$9.0 billion—higher than analysts’ consensus of ~$8.8 billion. For 1Q18, ConocoPhillips reported sales and other operating revenues of ~$8.8 billion—a gain on dispositions of ~$7 million and other revenues of ~$156 million. For ConocoPhillips, ~98% of its revenues came from oil and gas production sales and purchased commodities. ConocoPhillips’s other revenues include equity in affiliates’ earnings and other income.

On a YoY (year-over-year) basis, ConocoPhillips’ 1Q18 revenues are ~15% higher compared to its 1Q17 revenues of ~$7.8 billion. Sequentially, ConocoPhillips’s 1Q18 revenues are ~3% higher compared to its 4Q17 revenues of ~$8.7 billion.

Reasons behind higher 1Q18 revenues

Despite the YoY decrease of ~20% in ConocoPhillips’ 1Q18 production, the company reported significantly higher total realized prices for crude oil, natural gas, and natural gas liquids in 1Q18. ConocoPhillips’s total realized price increased ~40% to $50.49 per boe (barrel of oil equivalent) in 1Q18 from $36.18 per boe in 1Q17.

Southwestern Energy (SWN) reported revenues of ~$920 million in 1Q18—better than analysts’ consensus of ~$847 million.

Next, we’ll discuss ConocoPhillips’s production.