Rabindra Samanta

I have been working at Market Realist since August 2015. My primary area of expertise includes qualitative and quantitative analysis of crude oil and the natural gas market. This focus also includes tracking macroeconomic indicators. But, later into my career, I also started covering global markets, hedge fund manager commentary, and other macro developments.

I completed the PGDBM degree in 2014. Prior to Market Realist, I worked with one of India's largest brokerage house, Kotak Securities. My primary responsibilities include market analysis, portfolio advisory, and investor presentations.

After my graduate degree, I worked as an Associate at Vedanta Resources CPP (captive power plant) and IPP (Independent Power plant) project at Jharsuguda Odisha.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Rabindra Samanta

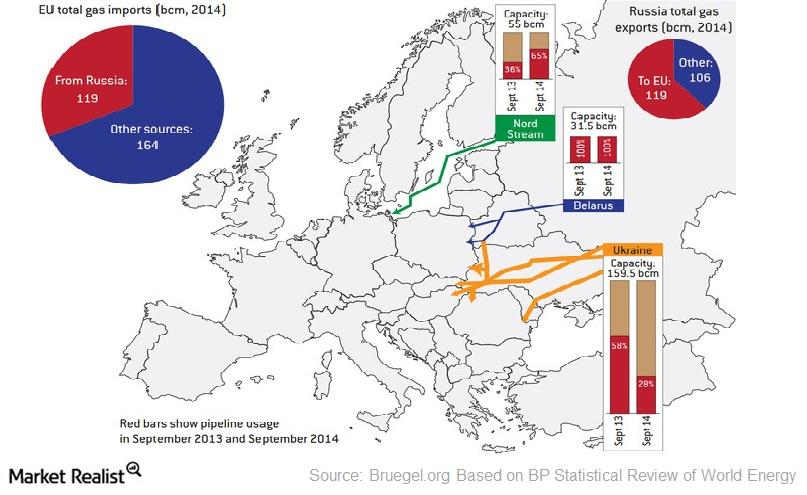

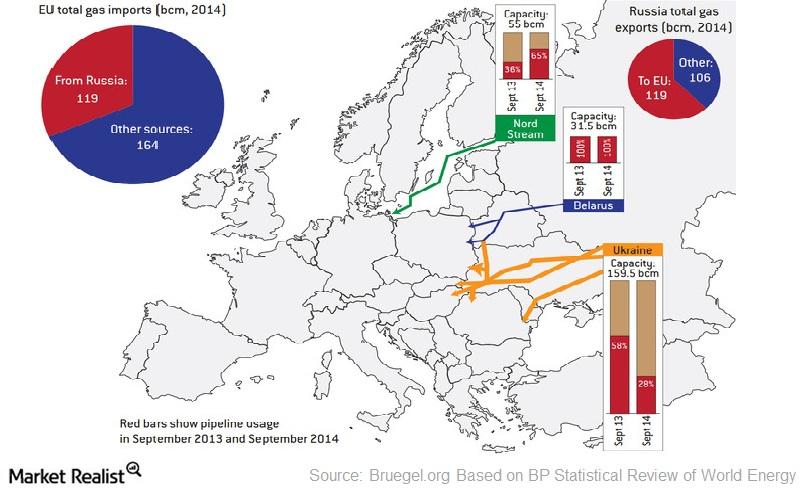

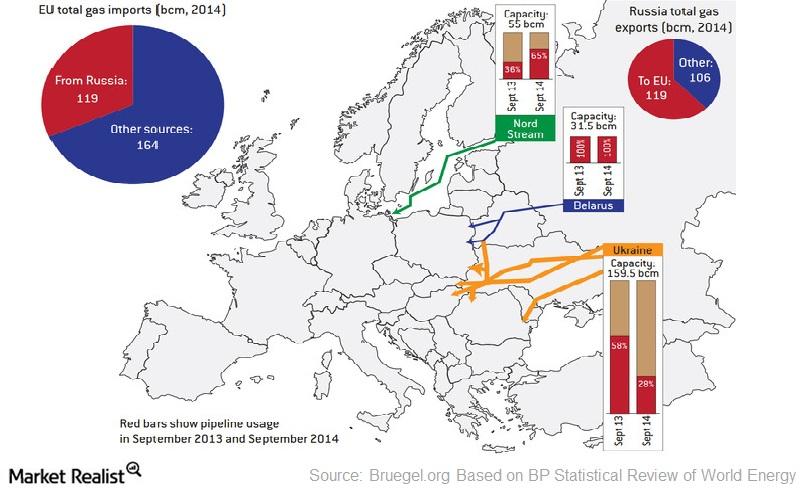

Russia’s Gas Pipeline Network in Europe

The European Union (FEZ) depends mostly on imports to meet its gas needs. Europe accounts for a significant portion of Russia’s gas exports.

Fall in Crude Oil Demand Could Impact Saudi Arabia the Most

Crude exports account for more than 85% of Saudi Arabia’s revenue. The economy still isn’t diversified. Saudi Arabia is already experiencing high fiscal deficit.

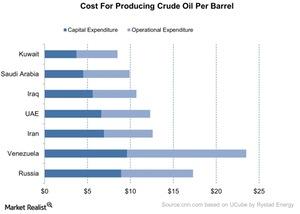

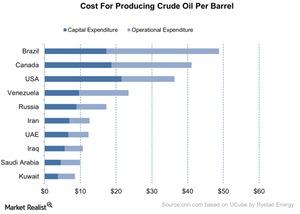

What’s the Break-Even Cost for the Top Oil Exporters?

Venezuela accounted for 17.5% of the world’s total proved crude oil reserves in 2014. BP (BP) conducted a study. It’s break-even cost is ~$23.50.

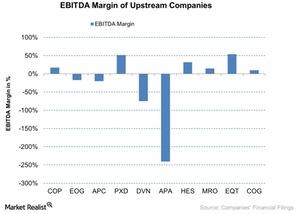

Operating Margins for Upstream Companies Rose

The operating margin of the US-based (SPY) upstream companies rose by an average of 16%.

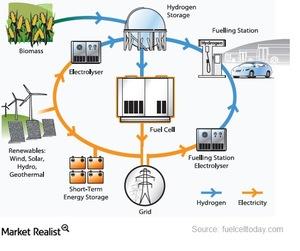

What Paris Climate Agreement Means for Fuel Cells and Solar Energy

Clean energy was one of the important issues in the Paris Climate Agreement. Fuel cells produce clean energy from a chemical reaction between anodes and cathodes.

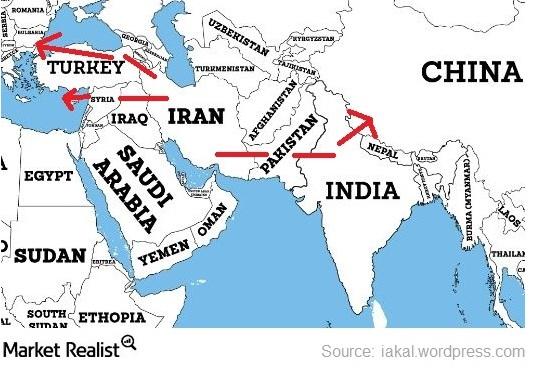

Russia Could Eye Yemen in 2016, Might Spur Oil

The price war made life difficult for Russian energy companies and Russia’s economy at large. Asia and Europe are two important markets for Russia.

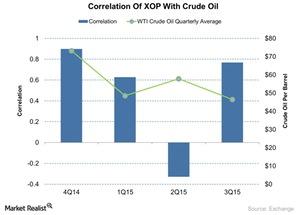

An Analysis of the Correlation between XOP and Crude Oil

Here we’ll present the results of a quarterly correlation analysis between crude oil and the SPDR S&P Oil & Gas Exploration & Production ETF (XOP).

The Break-Even Costs of the World’s Top Oil Producers

Venezuela accounted for 17.5% of the world’s total proven crude oil reserve in 2014. According to a study by BP, Venezuela’s break-even cost is ~$23.5.

How Long Can the Price War Continue in Crude Oil?

According to data compiled by Rystad Energy, the cost of production per barrel of crude oil is $17.20 in Russia—compared to $9.90 in Saudi Arabia.

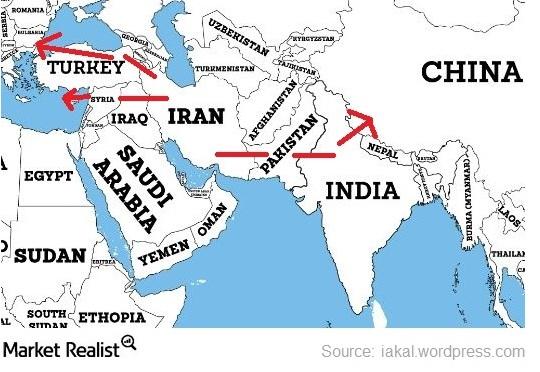

Could Iran Become a Big Gas Supplier to Europe and Asia?

Geographically, Iran is between the Europe and Asia’s gas markets. Iran could be a potential supplier to China (FXI) through Pakistan and India (INDY).

Nord Stream Pipeline: A Russian Gas Pipeline to Europe

The EU (European Union) mainly depends on imports to meet its need for gas. Europe imports a significant amount of gas from Russia.

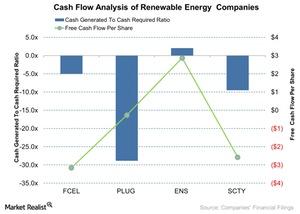

Cash Flow Analysis for Renewable Energy Companies

The cash flow is an important part of a company’s financials. Lower cash flows increase a company’s chances of being caught in a vicious cycle of debt raising and refinancing.

Iran Could Supply Natural Gas to Europe and Asia

Geographically, Iran is between the European and Asian gas markets. Iran could be a potential supplier to China through Pakistan and India (INDY).

Understanding the Gas Pipeline from Russia to Europe

Europe is a lucrative market for Russian gas manufacturer Gazprom Pao, as it derives more than 50% of its revenue from overseas.

Why Is Indonesia Important as a Net Importer of Oil for OPEC?

Indonesia is looking for a long-term strategic alliance to support the demand of crude oil for its economy. Since 2003, Indonesia has been a net importer of oil.