What’s the Break-Even Cost for the Top Oil Exporters?

Venezuela accounted for 17.5% of the world’s total proved crude oil reserves in 2014. BP (BP) conducted a study. It’s break-even cost is ~$23.50.

Jan. 8 2016, Updated 11:06 a.m. ET

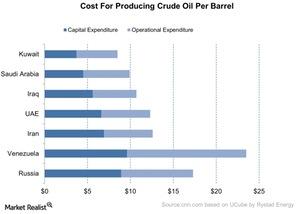

Break-even cost for top oil exporters

According to data compiled by Rystad Energy, the cost of production per barrel of crude oil is $17.20 in Russia—compared to $9.90 in Saudi Arabia. Saudi Arabia accounts for 15.7% of the world’s total crude oil reserves. Russia (RSX) accounts for 6.1% of the world’s total crude oil reserves. However, there are other reserves in the Arctic Circle. This could increase its share in the total crude oil reserves. Investors must understand that these are standard costs. There could be other variable costs like storage and transportation. The costs could have a marginal impact on the overall cost.

Venezuela accounted for 17.5% of the world’s total proved crude oil reserves in 2014. BP (BP) conducted a study. It’s break-even cost is ~$23.50.

The other member countries like Iran and Iraq have break-even costs of $12.60 and $10.60. Kuwait has the lowest production cost of ~$8.50. It takes a break-even cost of $12.30 in the UAE (United Arab Emirates) to produce one barrel of crude. The above chart shows the break-even cost for different countries.

Break-even cost for other countries

The data suggest that the cost to produce a barrel of crude oil in the US (SPY) is $36.20. In Canada, it costs $41 to produce a barrel of crude oil. Imperial Oil (IMO) and Suncor Energy (SU) are Canada-based integrated oil and gas companies. Occidental Petroleum (OXY) is a US-based integrated oil and gas company.

In the next part, we’ll discuss the fiscal break-even cost for economies that depend on oil.