Market Vectors® Russia ETF

Latest Market Vectors® Russia ETF News and Updates

Are Tougher Days ahead for Global Equities?

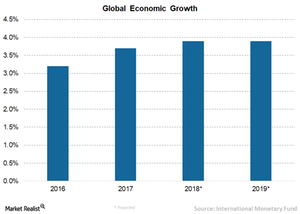

The IMF revealed that emerging Asia is expected to grow ~6.5% in 2018 and 2019.

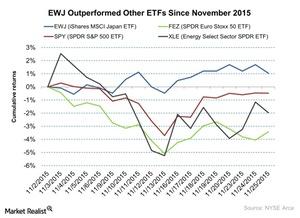

Overall Snapshot of the Market on November 25

On November 25, the SPDR S&P 500 ETF closed on a flat note ahead of the holiday. It closed at $209.3. The Energy Select Sector SPDR ETF fell by 0.81% on the day.

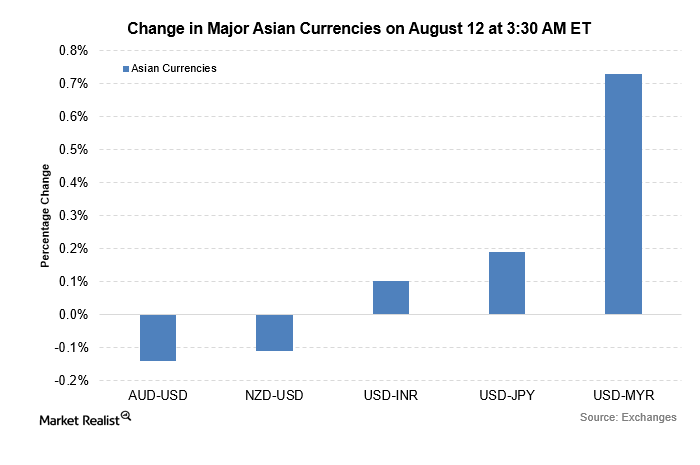

Notable Gainers and Losers among Major Currency Pairs

Major Asian currency pairs were trading on a negative bias against the US dollar on August 12, 2016. The US dollar broadly rose against the other currencies.Consumer Overview: What is Pipelineistan?

As percentages of the worlds’ total reserves, Russia holds 45% of the gas, 23% of the coal, 14% of the uranium, and 13% of the oil. Currently, Russia is the world’s largest energy supplier.

Russian GDP Continues to Fall, Taiwan’s Export Orders Drop

The Russian economy fell by 0.6% on an annual basis in July—compared to Market expectations of a 1.0% decline and lower than a decline of 0.5% in June.

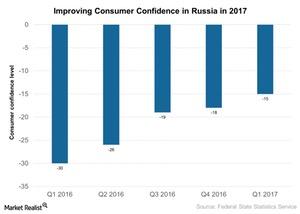

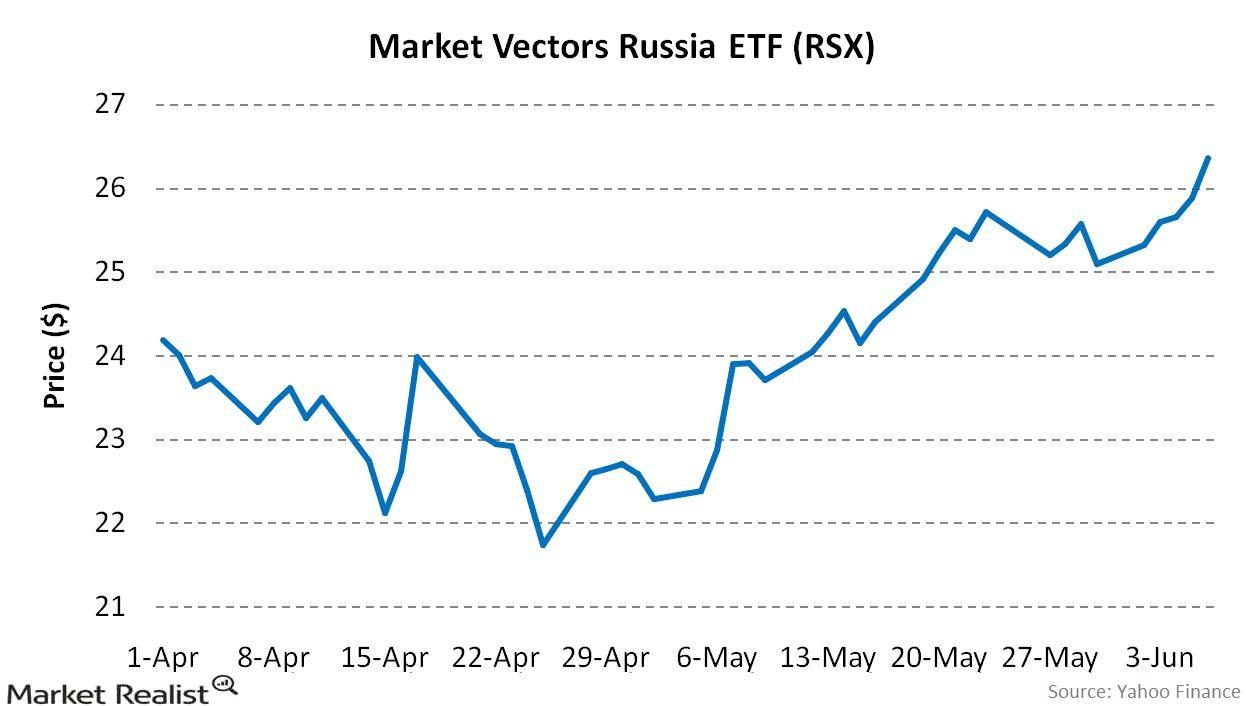

Russian Consumer Confidence Is on the Rise

Several macroeconomic indicators are suggesting that the Russian (RSX) economy is improving.

How Has the Russian Stock Market Changed?

The Russian stock market is upbeat, which adds to the ruble’s strength.

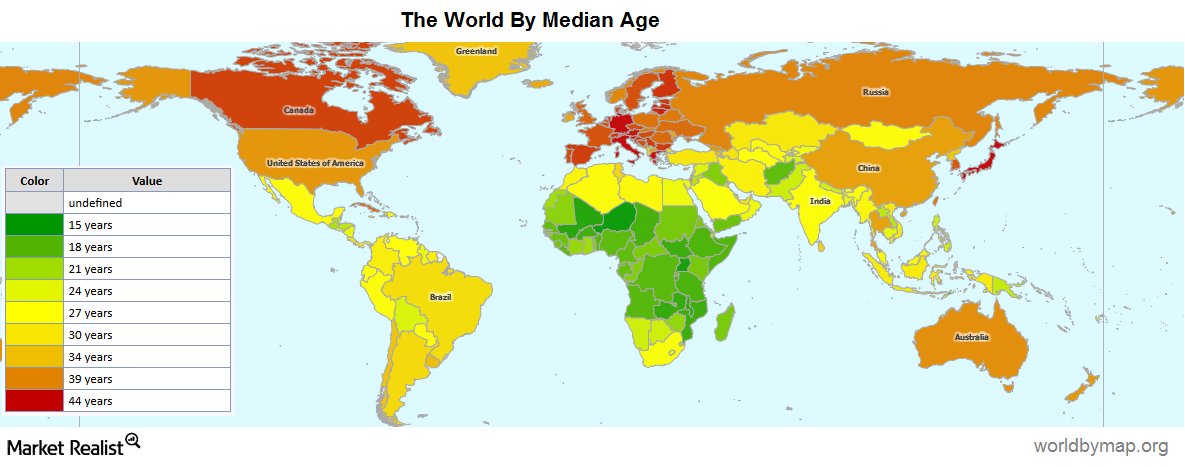

How Demographics Are the Key to India’s Growth

Demographics are the key to India’s growth story. India’s strength in numbers is one of its biggest advantages over the rest of the world.

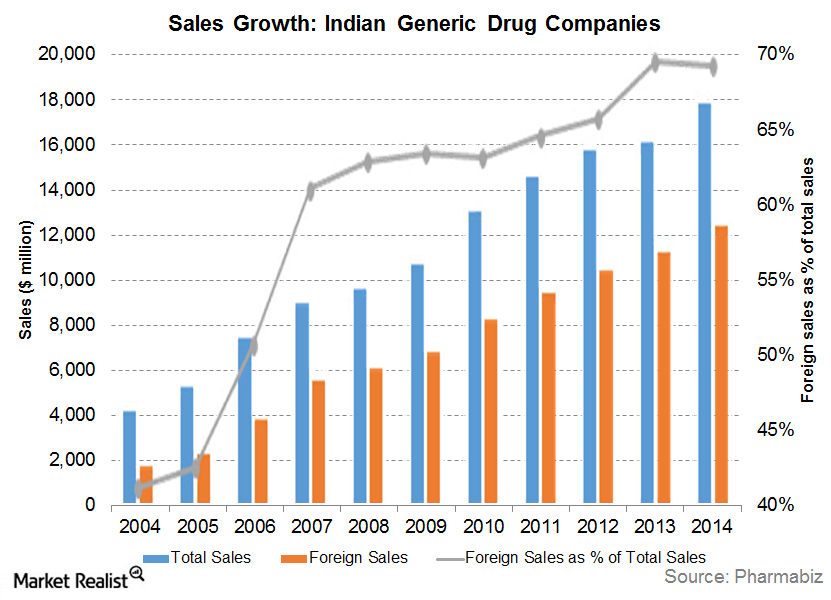

Why India Is So Important for Global Pharma

There are several compelling reasons for India’s rising pharma stature, including inexpensive labor, strong government support, and lower production costs.

Emerging Markets Have Been Leading Stock Returns in 2016

While developed markets have been caught in a lull, we’ve seen emerging markets grab the spotlight. Emerging markets have been leading stock market returns so far in 2016.

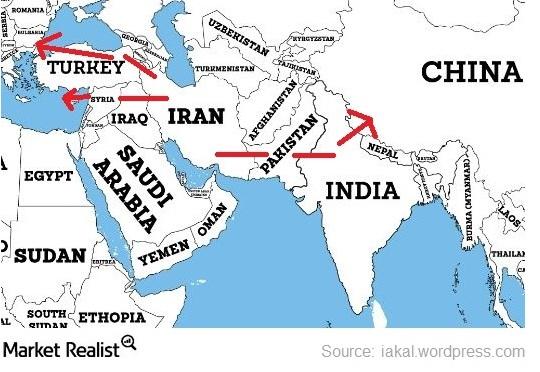

Overview: Why Eurasia is the center of world power

Investors continue to flock to secure their funds in exchange-traded funds (or ETFs) tracking Asian securities like the VanEck Vectors Russia ETF (RSX).

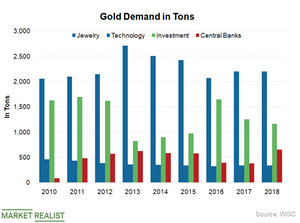

Central Banks Purchased the Most Gold in 50 Years in 2018

According to the gold demand trend released by the World Gold Council on January 31, annual gold demand increased by 4% in 2018.

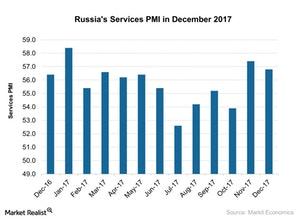

How Russia’s Service Activity Looked in December 2017

According to a report by Markit Economics, Russia’s service PMI (purchasing managers’ index) showed a weaker improvement in December as compared to November 2017.

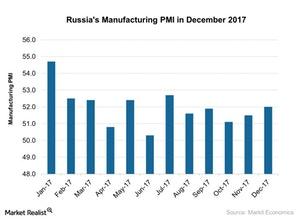

Russia’s Manufacturing PMI Improved in December 2017

According to a report by Markit Economics, the final Russia manufacturing PMI (purchasing managers’ index) improved in December as compared to November 2017.

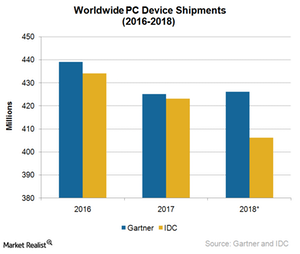

How Will PC Market Impact Different Semiconductor Companies in 2018?

2017 has been good for the PC market, as its shipment decline slowed. Although the traditional desktop market continued to fall, growth was high for laptops, notebooks, and gaming PCs.

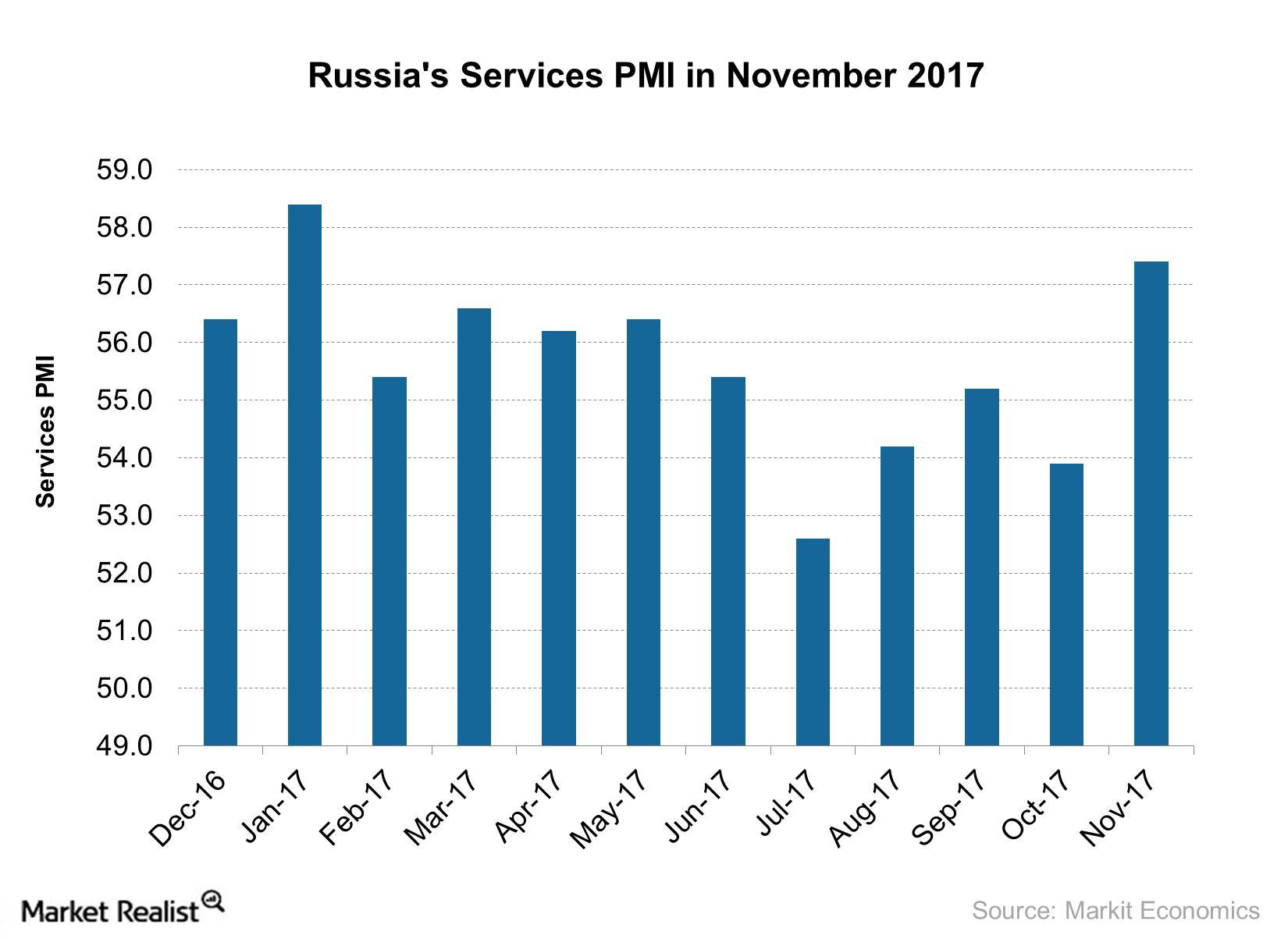

Why Russia’s Service Sector Strengthened in November 2017

Russia’s service sector in November According to a report by Markit Economics, Russia’s service PMI (purchasing managers’ index) showed a solid improvement in November 2017, rising to 57.4 from 53.9 in October. The figure beat the market expectation of 55.0 and marked the highest rise since January 2017. The strong improvement in Russia’s service PMI […]

Key Economic Indicator Data Released Last Week

In this series, we’ll analyze major emerging nations’ manufacturing and service PMIs (purchasing managers’ indexes).

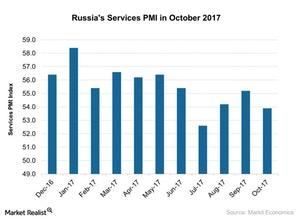

How Russia’s Services PMI Trended in October 2017

According to a report by Markit Economics, the final Russia Services PMI (purchasing managers’ index) fell in October 2017 as compared to September.

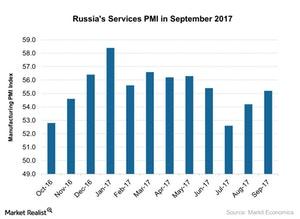

Russia’s Services PMI Improves: A Stronger Business Climate?

The final Russia Services PMI (Purchasing Managers’ Index) was 55.2 in September 2017 compared to 54.2 in August 2017.

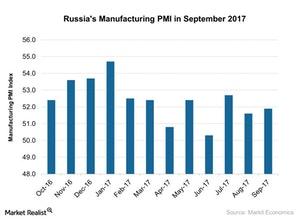

Russia’s Manufacturing PMI Improved Marginally in September

The final Russia Manufacturing PMI (Purchasing Managers’ Index) rose marginally in September 2017. It was 51.9 in September compared to 51.6 in August.

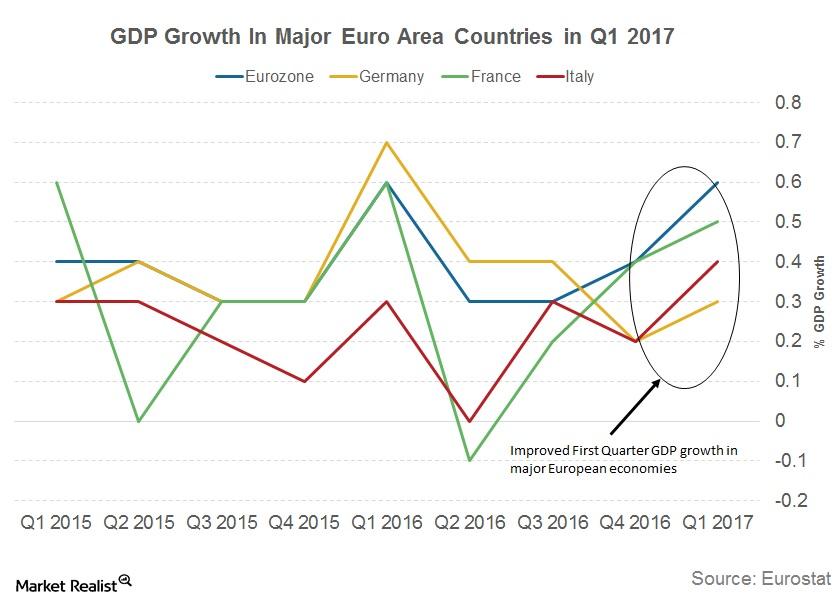

Why the International Monetary Fund Expects Continued Euro Growth

Growth projections for Euro area upgraded The International Monetary Fund (or IMF) has revised its growth projections for France, Germany, Italy, and Spain. Growth projections for Germany (FGM), France (EWQ), and Italy (EWI) were upgraded by 0.2% for 2017, and 0.1% for 2018. Spain (EWP) had a higher upgrade to growth expectations, with a change of […]

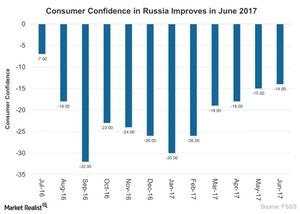

Why Consumer Confidence Improved in Russia in June 2017

Many macroeconomic indicators in Russia (ERUS) are showing signs of improvement in 2017.

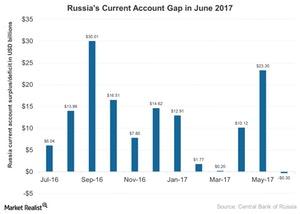

Is Russia’s Current Account Deficit in June Temporary?

Russia’s (ERUS) current account recorded a $0.3 billion gap in 2Q17 as compared to a $23.3 billion surplus in the previous quarter and a $2 billion surplus in the same period.

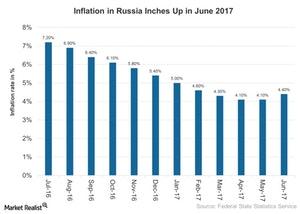

Inflation in Russia Moved away from Target Rate in June 2017

The consumer prices in Russia (ERUS) rose 4.4% on a year-over-year basis in June 2017 following a 4.1% rise in the previous month.

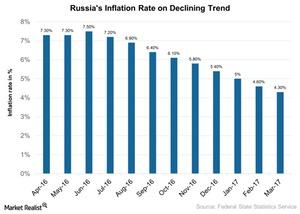

Russian Economy Gains Traction as Inflation Nears Target

Russia’s central bank recently lowered its key interest rate by half a percentage point to 9.25% in April 2017.

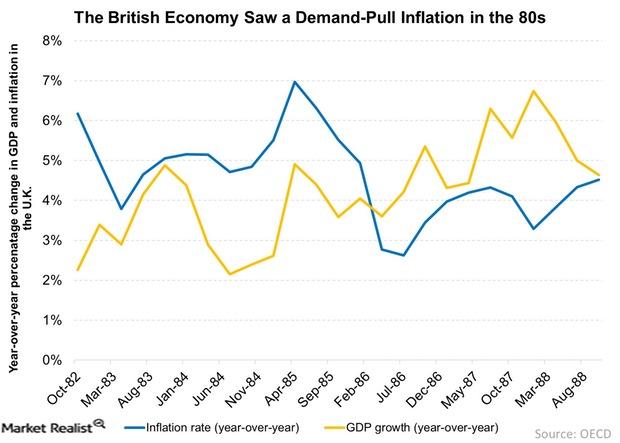

What Is Demand-Pull and Cost-Push Inflation?

Both Russia (RSX) and Brazil (EWZ) are experiencing cost-push inflation. Both economies are highly dependent on commodities.

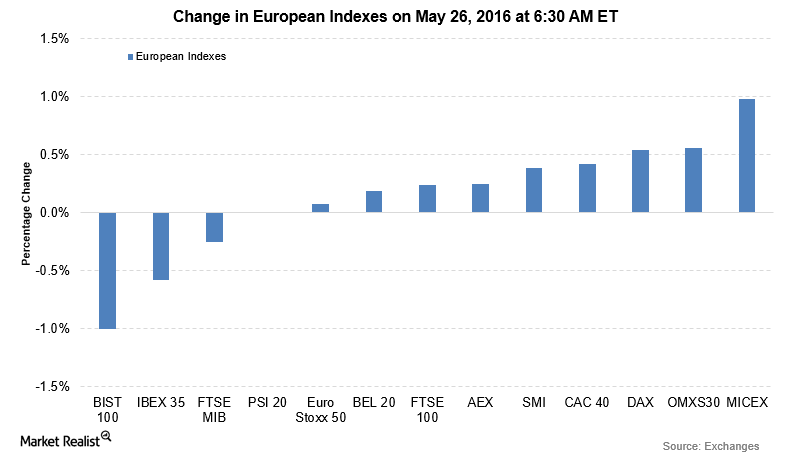

European Market Flat as Investors Await G7 Leaders’ Brexit Views

Major European indexes (DBEU) were trading with caution on May 26, 2016, as they awaited G7 leaders’ views on the Brexit referendum.

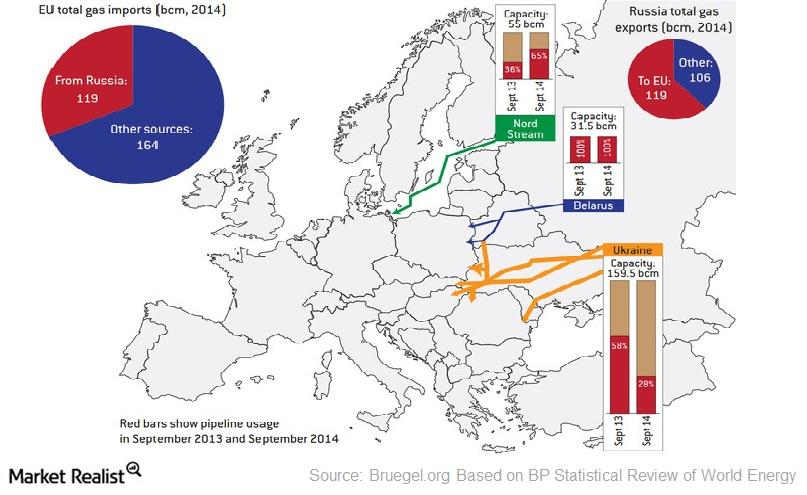

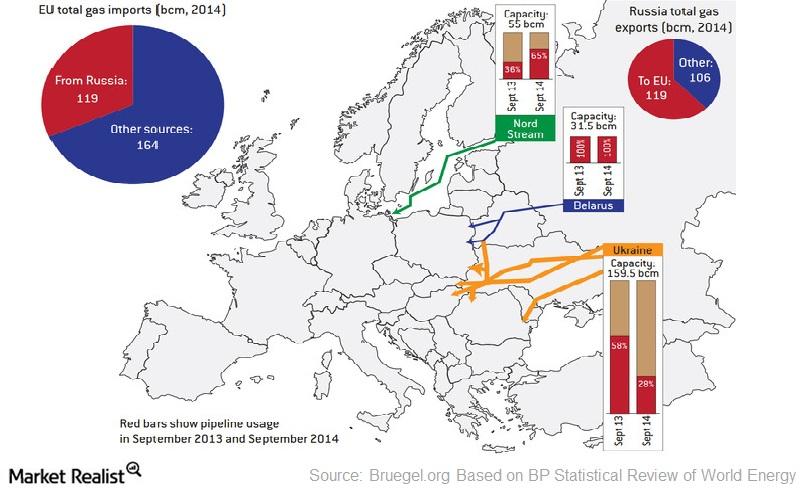

Russia’s Gas Pipeline Network in Europe

The European Union (FEZ) depends mostly on imports to meet its gas needs. Europe accounts for a significant portion of Russia’s gas exports.

Fall in Crude Oil Demand Could Impact Saudi Arabia the Most

Crude exports account for more than 85% of Saudi Arabia’s revenue. The economy still isn’t diversified. Saudi Arabia is already experiencing high fiscal deficit.

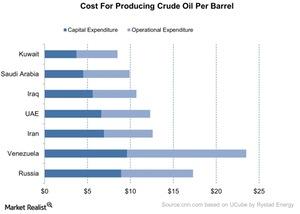

What’s the Break-Even Cost for the Top Oil Exporters?

Venezuela accounted for 17.5% of the world’s total proved crude oil reserves in 2014. BP (BP) conducted a study. It’s break-even cost is ~$23.50.

Russia Could Eye Yemen in 2016, Might Spur Oil

The price war made life difficult for Russian energy companies and Russia’s economy at large. Asia and Europe are two important markets for Russia.

Iran Could Supply Natural Gas to Europe and Asia

Geographically, Iran is between the European and Asian gas markets. Iran could be a potential supplier to China through Pakistan and India (INDY).

Understanding the Gas Pipeline from Russia to Europe

Europe is a lucrative market for Russian gas manufacturer Gazprom Pao, as it derives more than 50% of its revenue from overseas.

Why Is Indonesia Important as a Net Importer of Oil for OPEC?

Indonesia is looking for a long-term strategic alliance to support the demand of crude oil for its economy. Since 2003, Indonesia has been a net importer of oil.

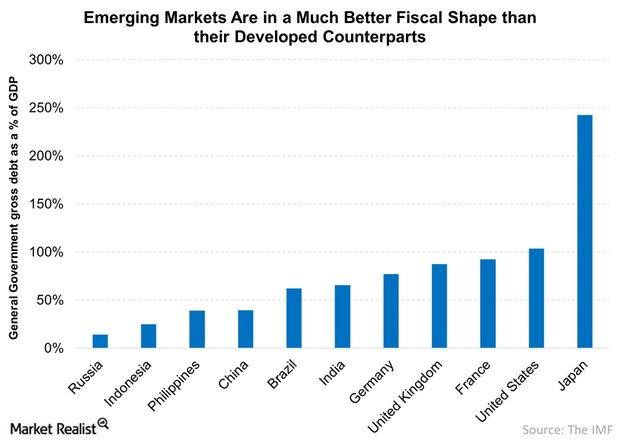

Emerging Markets Are in Good Fiscal Shape

Many of the emerging markets that were viewed as risky or even dangerous a mere 15 years ago now appear to be more attractive than many developed countries.

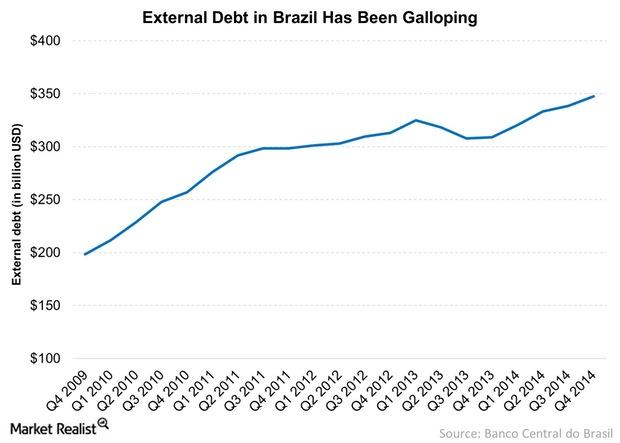

Why the Brazilian Government’s Debt Has Surged over the Years

The Brazilian government’s debt has surged over the last five years. The country’s internal debt has also increased.

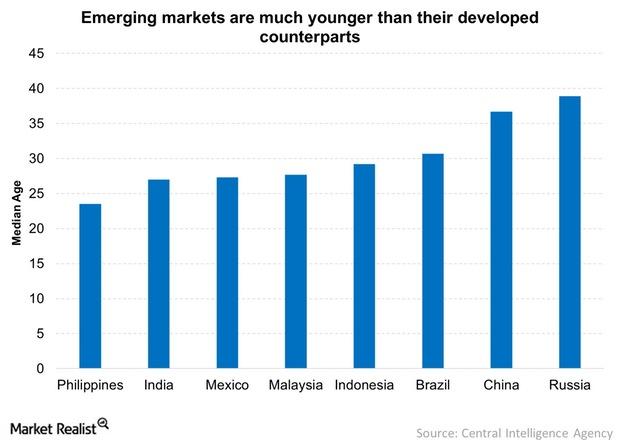

A Young Population Makes Emerging Markets Attractive

A young population in emerging markets makes them attractive, but beware! Some of the emerging economies are facing a lot of headwinds.

Russia’s sovereign credit rating downgraded to junk

Russia’s sovereign credit rating now stands on par with countries such as Turkey and Indonesia. The oil price crisis isn’t helping matters.

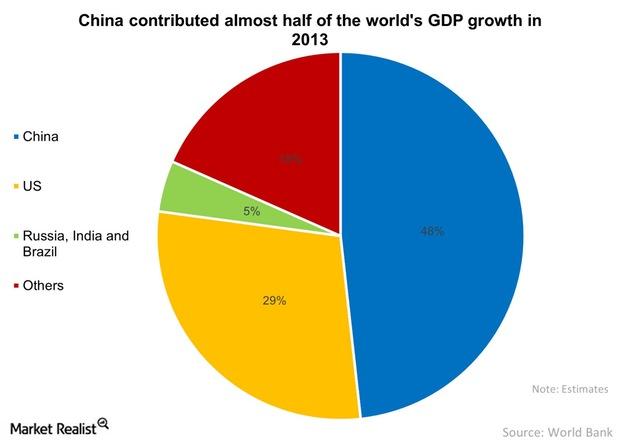

Why China Is Important To The Global Economy

As the second-biggest economy in the world, China is important. It’s also growing at a much faster rate than the biggest economy, the US.