Emerging Markets Are in Good Fiscal Shape

Many of the emerging markets that were viewed as risky or even dangerous a mere 15 years ago now appear to be more attractive than many developed countries.

June 23 2015, Published 2:28 p.m. ET

Over the past few weeks, I’ve been talking about a shift from developed to emerging markets, given slow economic growth and sovereign debt problems in many major developed market countries.

Earlier this week, I expanded my view—given recent market volatility, many of the emerging markets that were viewed as risky or even dangerous a mere 15 years ago now appear to be more attractive than many developed countries, based on their fiscal situations.

Market Realist – Some emerging markets are in good fiscal shape.

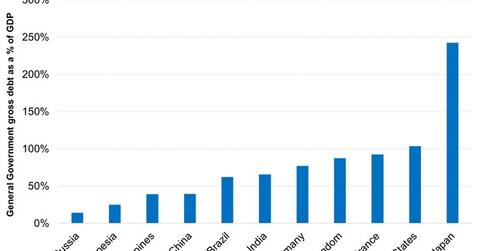

As you can see in the graph above, emerging markets (EEM) carry far less fiscal baggage than their developed counterparts (EFA). Most major emerging markets have smaller debt-to-GDP (gross domestic product) ratios than developed markets. The United Kingdom, France, and the United States’ debt levels are close to their GDP. Meanwhile, Japan’s (EWJ) debt is more than twice its GDP level.

Within the major emerging markets, India (EPI) has a relatively high debt-to-GDP ratio of 65.5%. India’s ratio is lower than Germany’s (EWG), which is 76.9%–one of the less leveraged developed economies.

Russia’s (RSX) debt-to-GDP ratio is the lowest among major economies at 14.0%. However, the Russian government is likely to issue more debt over the coming years in order to build stadiums for the FIFA World Cup in 2018.

Higher debt means that governments have to spend more on servicing debt, especially when interest rates are increasing. This means a government can spend less on other things, which would be a drag on the country’s economy. Lower debt-to-GDP ratios give emerging market governments more leeway to spend compared to their developed market counterparts.

Also, some emerging markets like China (FXI) and South Korea (EWY) have positive current account balances, which means the rate hike in the United States shouldn’t hurt their currencies much.