BTC iShares MSCI EAFE ETF

Latest BTC iShares MSCI EAFE ETF News and Updates

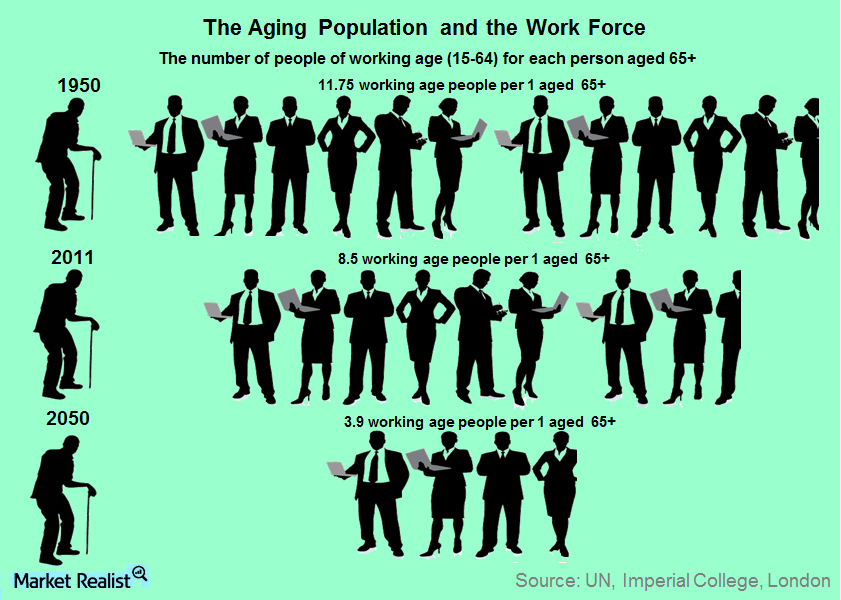

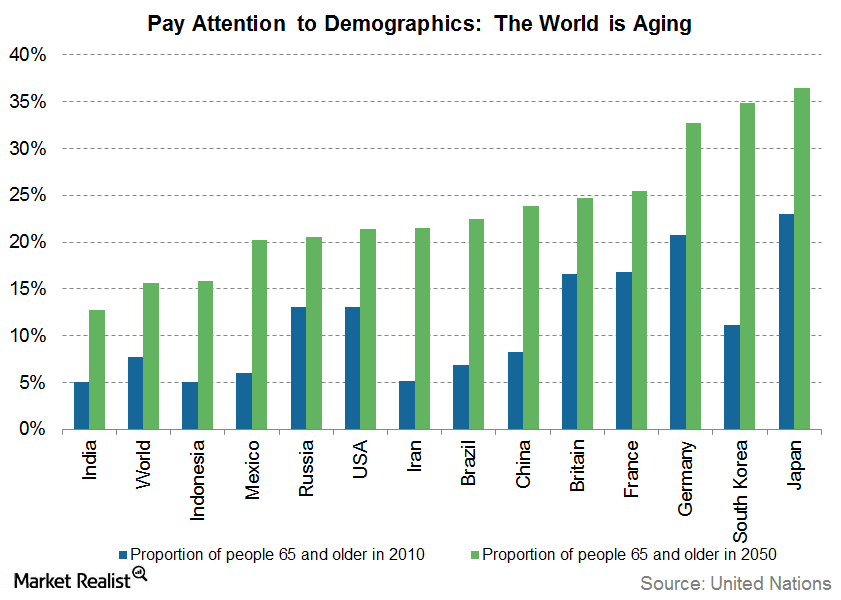

Aging Population May Keep Global Growth Muted

An aging population is likely to keep global economic growth muted in the years to come. This is primarily because the dynamics of the population are rapidly changing.

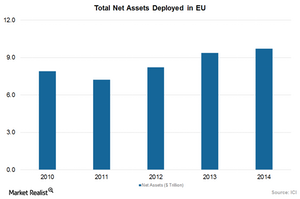

Fund Flows Continue to Rise in the European Union

Fund flows in European equities (EFA) have expanded at a slower pace since 2011. Overall, they’ve grown at an average of 10% over the past three years.

How Will the Fed Affect the Earnings Recovery Environment?

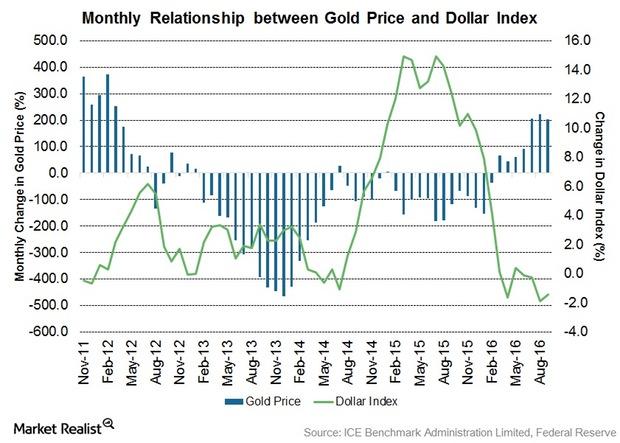

The dollar index (UUP) rallied about 22% between October 2014 to July 2016.

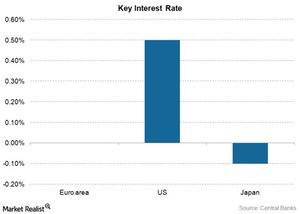

Why Do Central Bankers Continue to Surprise Bill Gross?

In his recent webcast by Janus Capital, Bill Gross expressed his surprise at the extent to which central bankers of the developed world (EFA) (VEA) have distorted the financial system.

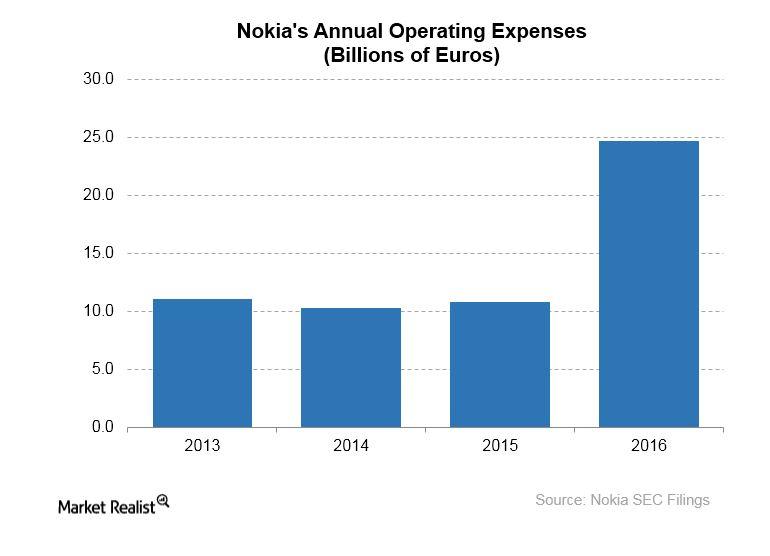

Why Nokia Is Cutting Jobs in France

Nokia’s French R&D unit, where the company is required to have hired a total of 2,500 employees before the end of 2018, is expected to be spared the layoff.

Inside Facebook’s Top 3 Priorities

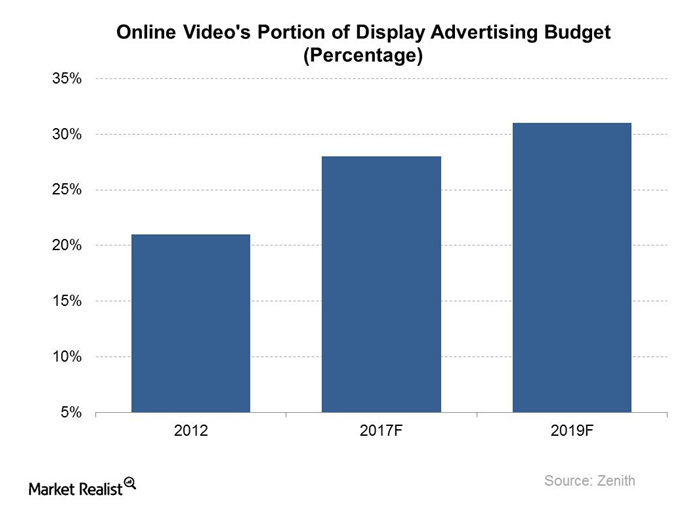

Investment research firm Zenith estimates that worldwide spending on online video ads rose 23.0% to $27.2 billion in 2017.

How the World Is Dealing with the Climate Challenge

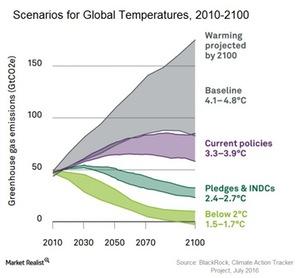

Extreme climate change events hamper productivity, thus affecting industries such as agriculture, fishing, energy, trade, transportation, and tourism.

REER 101: An Introduction to Real Effective Exchange Rates

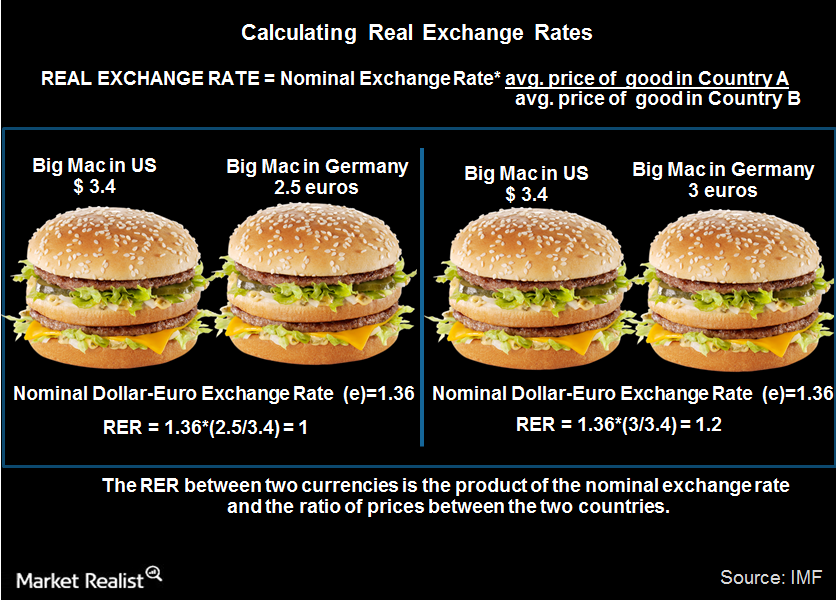

The International Monetary Fund defines REER as an average of the bilateral real exchange rates between a country and its trading partners, weighted by their respective trade shares.

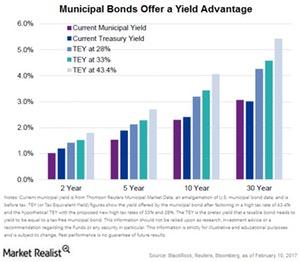

Larry Fink Says Lower Rates Hampered Savings around the World

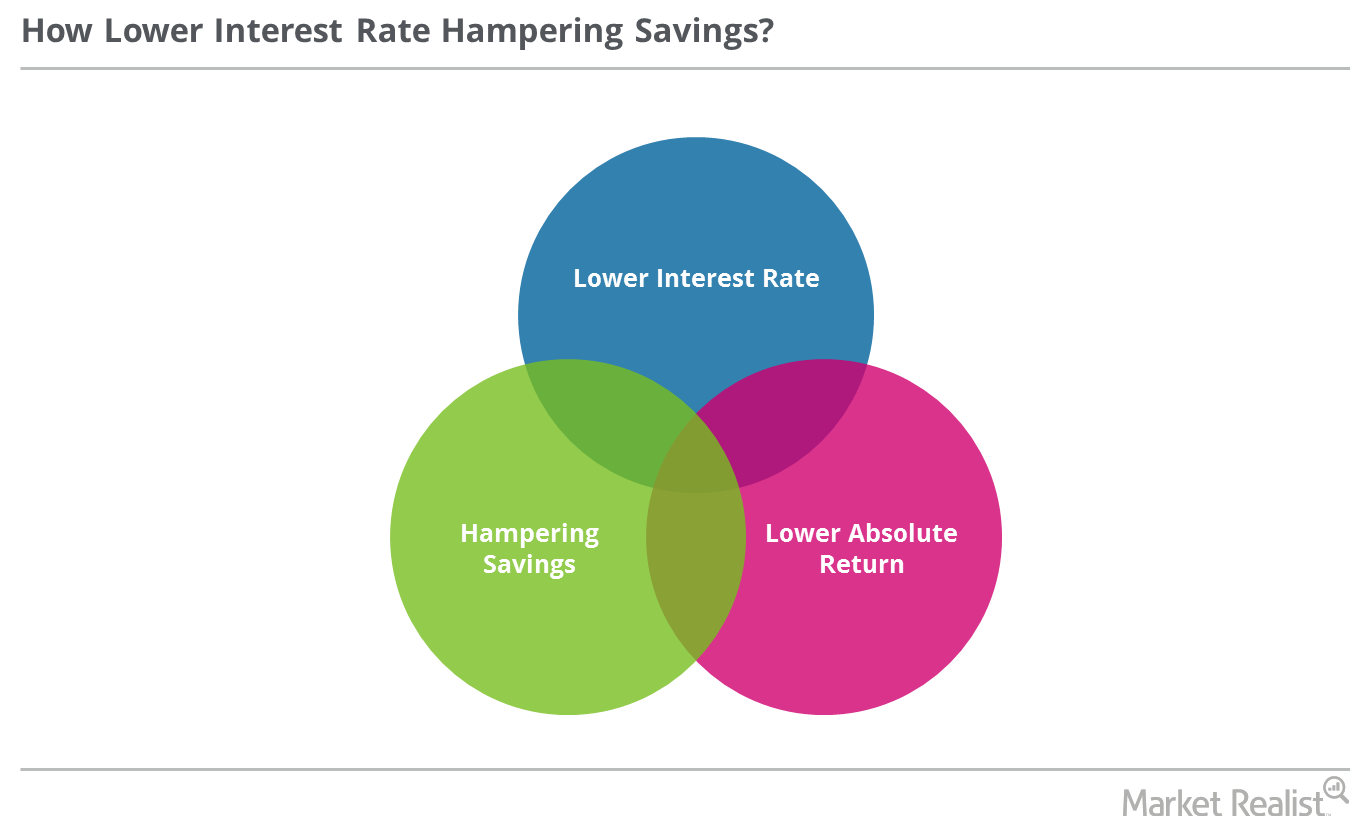

Various central banks in developed nations (EFA) have lowered their key interest rates close to the zero level to revive their economies.

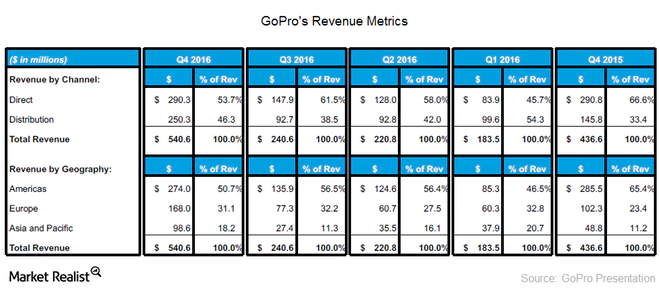

Why GoPro Is So Optimistic about Asia Sales

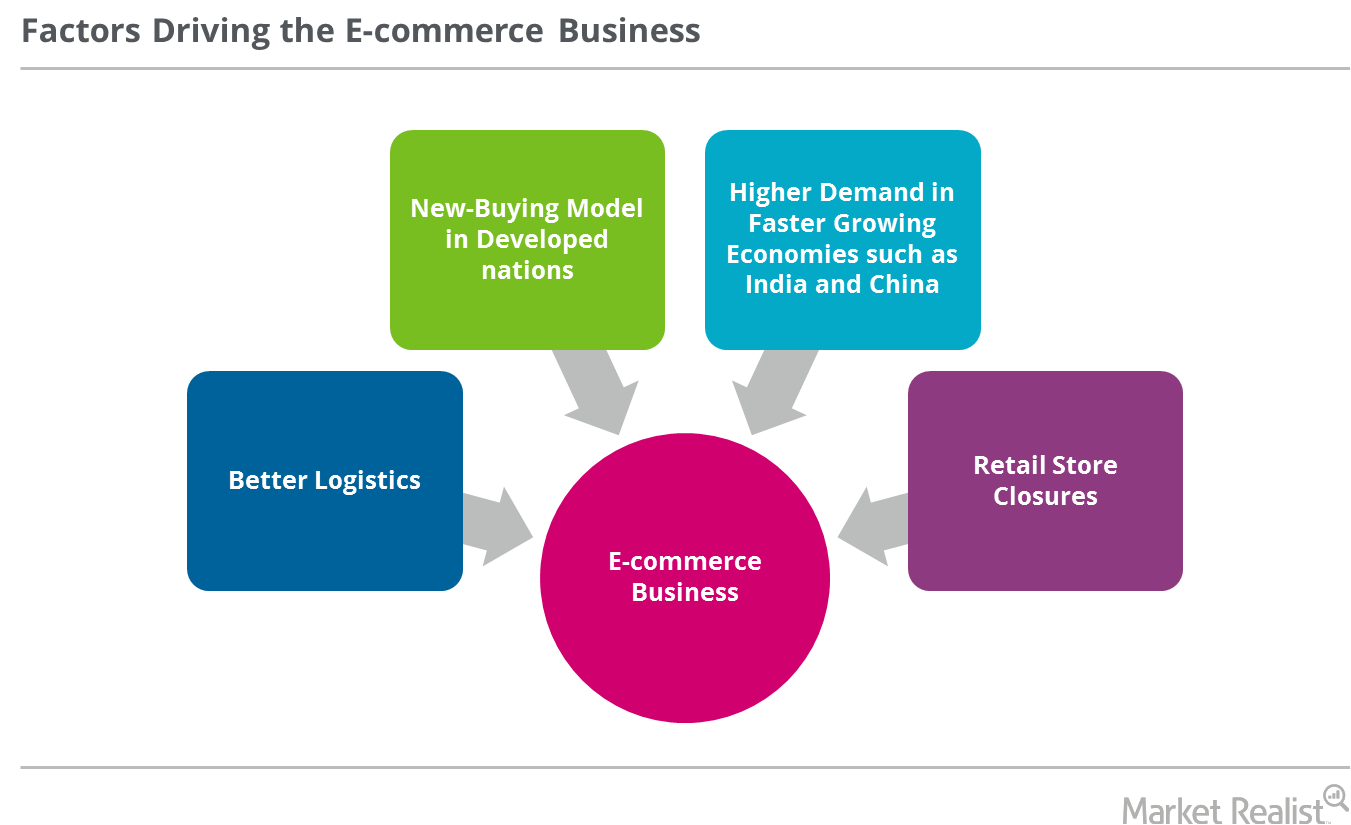

GoPro believes it can grow sales in developing economies such as India and China by focusing on online sales.

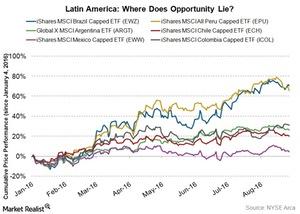

Investing in Latin America Can Bear Fruit, but Should We?

With commodity prices recovering and major developed markets (EFA) (VEA) caught in the lull, Latin America should see sunnier days ahead.Financials Bank of Japan announces QQE2, expanded monetary stimulus

At its monetary policy meeting held on October 31, the Bank of Japan (or BOJ) announced new stimulus measures. The measures come in addition to those it announced earlier.

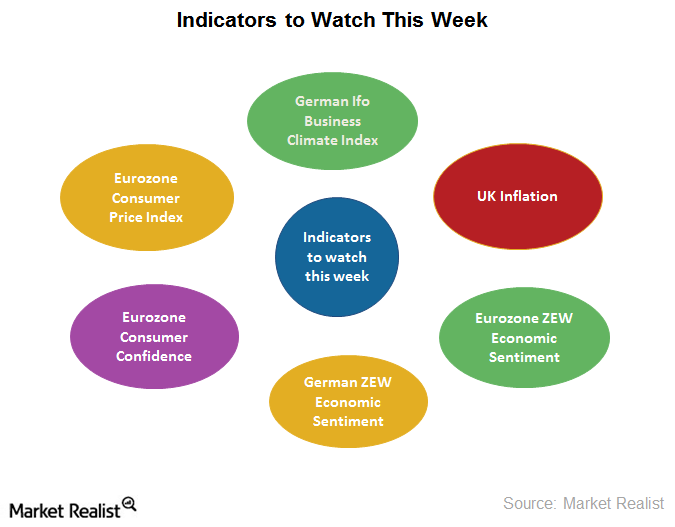

Economic Indicators Investors Should Watch This Week

If major Eurozone economic indicators improve in the coming months, we could expect those economies to regain some strength.

Ray Dalio: The Next Downturn May Be a Difficult One to Reverse

“The next downturn may be a difficult one for central banks to reverse,” warned Ray Dalio, CEO of the world’s largest hedge fund.

Stanley Druckenmiller Exited Position in EEM

Stanley Druckenmiller also sold his position in the iShares MSCI Emerging Markets ETF (EEM).

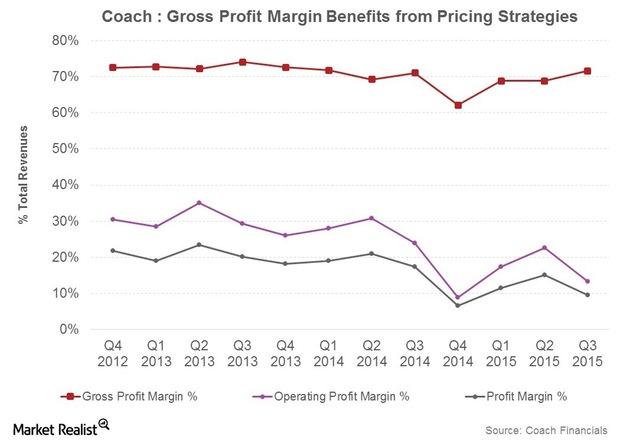

Coach’s Pricing Strategies Benefit Its Margins

Coach’s gross margin expanded to 71.6% in 3Q15 from 71.1% in 3Q14. Coach reduced the frequency of its in-store and online promotions, which should boost its margins.

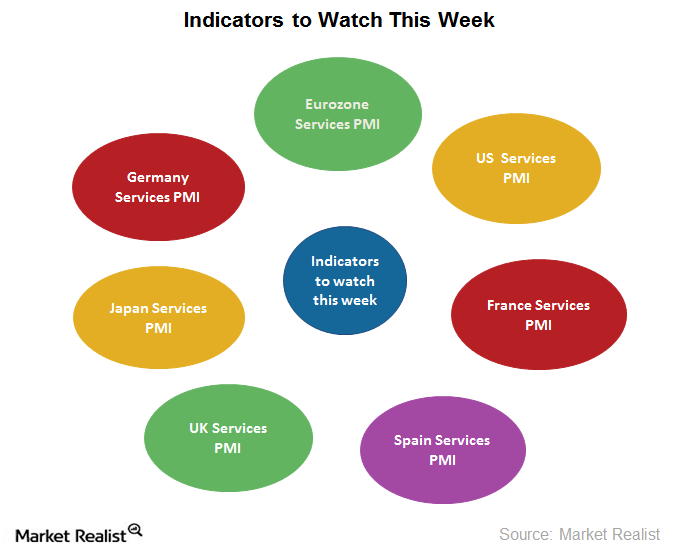

Economic Indicators Investors Should Watch for This Week

Economic indicators Key economic indicators investors should watch for this week are: US (SPY) services PMI data UK (EWU) services PMI data Eurozone (IEV) (VGK) services PMI data German (EWG) services PMI data Spanish services PMI data French (EWQ) services PMI data Japanese services PMI data US ADP employment data US non-farm payroll data Wrapping up […]

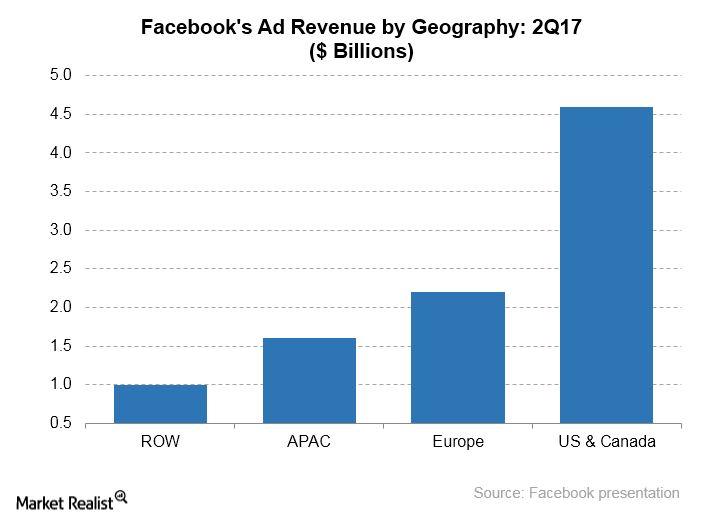

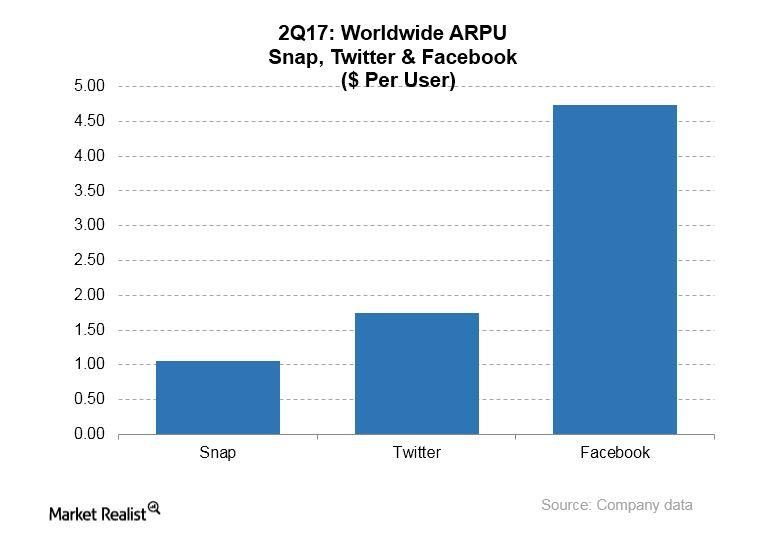

How Facebook’s International Business Is Looking

The US (SPY) accounts for the greatest portion of Facebook’s revenues with more than 49% of overall revenue in the latest quarter coming from the US and Canada.

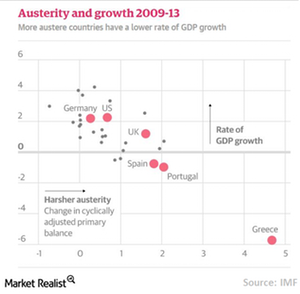

The Economic Costs That Come with Climate Goals

Climate-related policies and a transition to a low-carbon economy require capital, and most countries are already burdened with high debt.

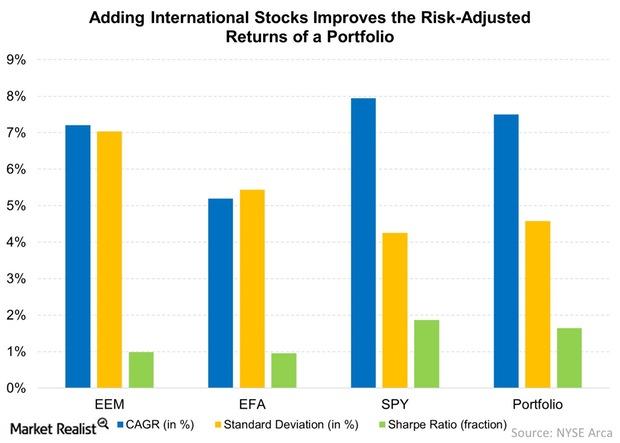

Why Diversification Is More than Just a Buzzword

Diversification is important because a diversified portfolio has higher risk-adjusted returns than a portfolio exposed to only one security.

What Caused the Muni Defaults in 2016?

In 2016, Puerto Rico defaulted on constitutionally guaranteed GO (general obligation) bonds. On May 3, 2017, Puerto Rico filed for Title III bankruptcy.

Labeled Green Bonds’ Significance to Investors

Global climate leaders have set a $1 trillion target for green finance by 2020, which would require a tenfold increase in global green bonds issuance.

A Look at Emerging Markets PMI Reports in December 2017

In this series, we’ll analyze the manufacturing and services activity of China, India, and Brazil (EEM) in December 2017.

How Demographics Are Shaping Generic Drug Growth

The generic drugs industry is likely to sustain robust growth in the coming years, and demographics are a key piece of the puzzle! In fact, demographics are shaping generic drug growth in a huge way.

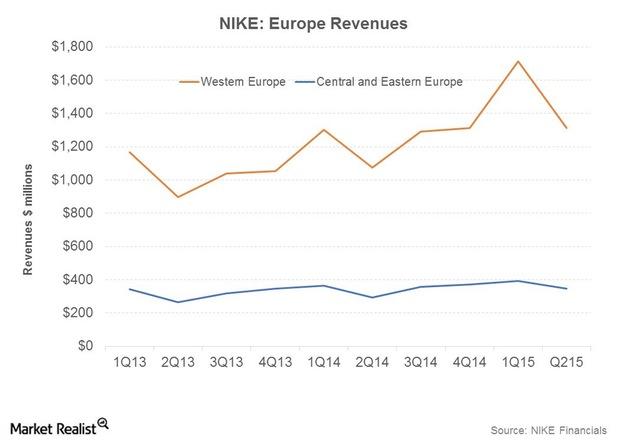

NIKE Defies Macro Headwinds In Europe

NIKE is in the midst of transforming the Western Europe market. It’s looking to improve profitability by increasing the premium on its brand.

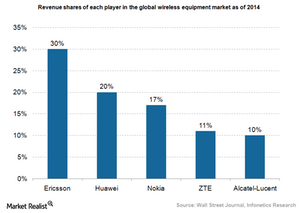

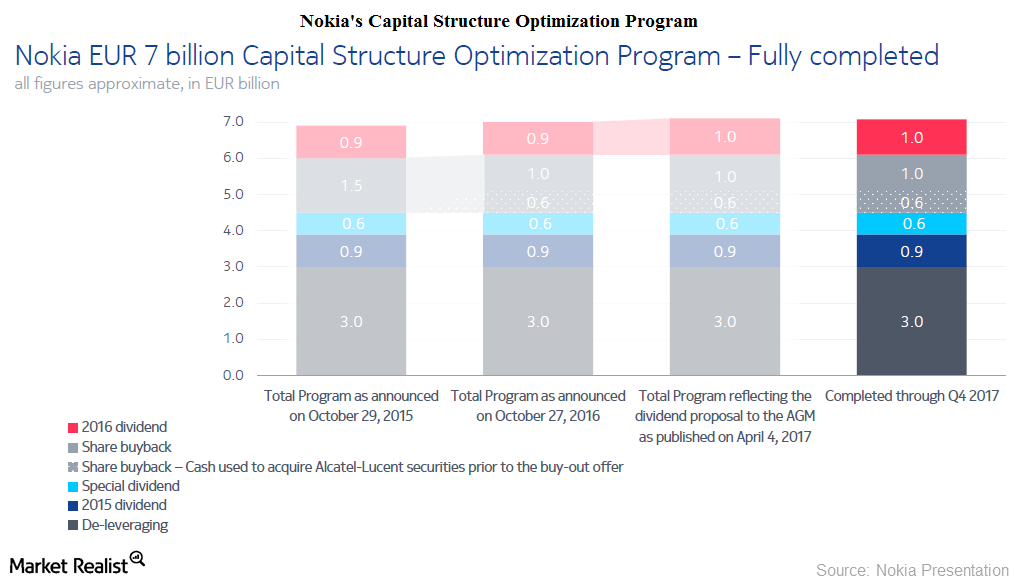

Nokia Acquires Alcatel-Lucent to Challenge Ericsson

Nokia agreed to acquire Alcatel-Lucent in an all-share transaction that values the deal at $16.6 billion. The merger will help reduce operating expenses.Financials The key arguments of the Yes campaign of the Scottish referendum

The voting result of the Scottish Referendum, due September 18, will have a direct bearing on Scotland, the United Kingdom, and the 28-member European Union as a whole.

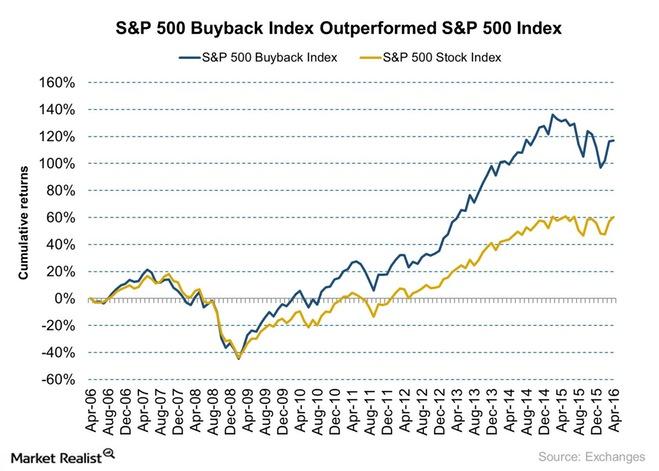

Icahn Identifies a Key Motivation behind the Buyback Spree in the US

Carl Icahn is one of the first activist investors to voice his opinion against share buybacks. He believes that companies are increasingly putting money into buybacks instead of using them for much-needed capital improvements.

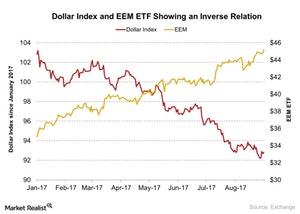

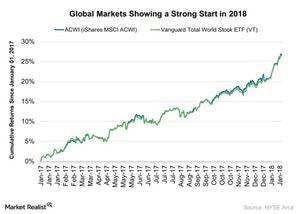

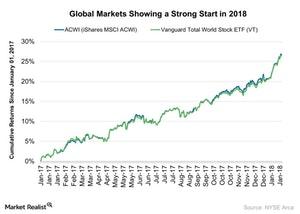

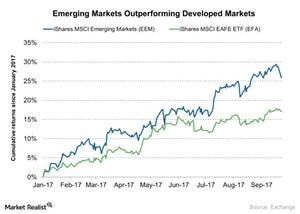

Emerging Markets Have Been Leading Stock Returns in 2016

While developed markets have been caught in a lull, we’ve seen emerging markets grab the spotlight. Emerging markets have been leading stock market returns so far in 2016.

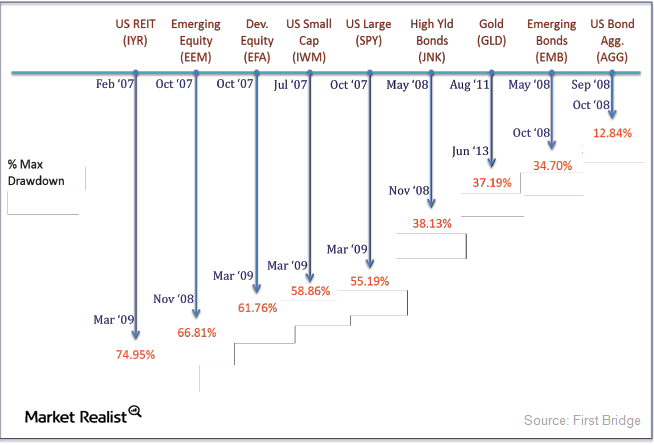

Must-know: Minimizing ETF losses by observing max drawdowns

In practice, asset owners (both retail and institutional) want to avoid significant portfolio drawdowns even if the benchmark index declines.

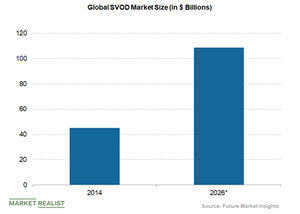

How Much Is Netflix Spending on Original Content in Europe?

Netflix plans to invest around $1 billion on original and co-produced content in Europe.

How Nokia Aims to Improve Shareholder Value

Nokia (NOK) has a dividend yield of 4.4%, indicating an annualized payout of $0.24 per share and a dividend payout ratio of 61.2%.

A Look at Emerging Market December PMI Reports

The iShares MSCI Emerging Markets ETF (EEM), which tracks the performance of emerging markets, rose 37.3% in 2017.

Twitter’s Average Revenue per User

Monetary value of a user Social media companies Twitter (TWTR), Facebook (FB), and Snap (SNAP) show how much money they make off each of their user accounts as average revenue per user, or ARPU. ARPU is a measure of monetary value a user brings to a platform. Whereas Facebook and Snap released their ARPU for 2Q17, […]

What’s the IMF’s View on Tax Reform?

According to the IMF (International Monetary Fund), a moderate progressive tax system may not negatively impact economic growth in developed economies (SPY) (EZU).

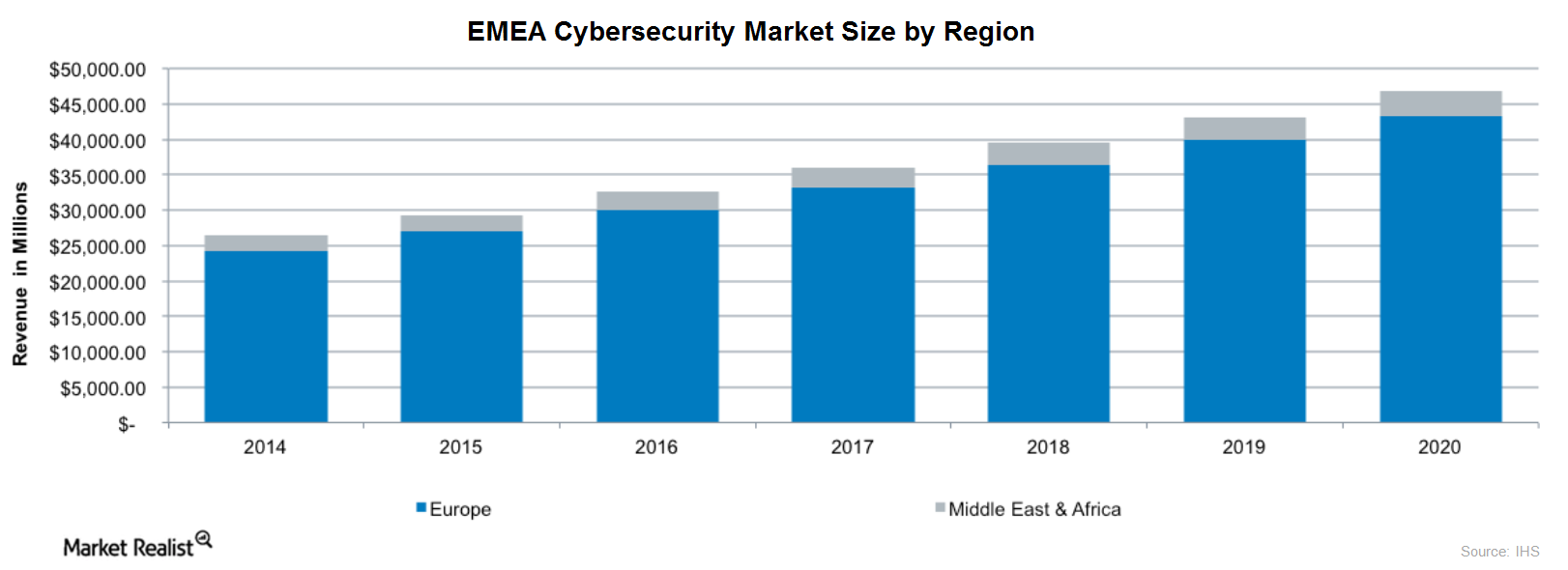

Why Europe’s Increased Focus on Cybersecurity Is Good News for FireEye

Last year, more than 4,000 ransomware attacks happened on a daily basis in the EU (EFA).

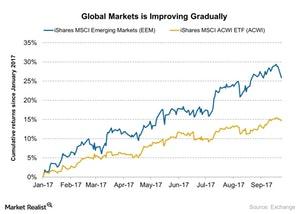

How Emerging Economies Are Supporting Global Growth

According to the report provided by the World Bank in June 2017, global (ACWI) growth is expected to strengthen to 2.7% in 2017.

Why Goldman Sachs Is Optimistic about e-Commerce

The iShares MSCI Emerging Markets ETF (EEM), which tracks the performance of emerging markets, rose nearly 27.3% on a year-to-date basis as of September 7, 2017.

Chart in Focus: Symantec’s Leadership in the Secure Web Gateway Space

According to MarketsandMarkets, the global SWG market is expected to grow at a CAGR of 20.5% to $5.6 billion by 2020, up from $2.2 billion in 2015.

Using Asian Markets’ Low Correlation with US Markets

The correlation between US and international markets varies depending on market cycles.

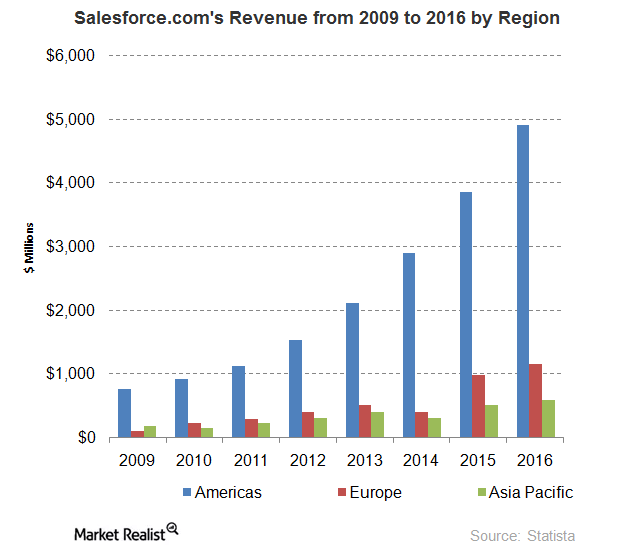

What Trump’s Victory Could Mean for Salesforce

Trump has planned a reduction in the current tax structure, and both immigration and taxation impact the IT sector—especially software sector.

India and Asia’s Festive Season Could Help Gold Prices in October

Gold has fallen below $1,300 per ounce and broken below the longer-term trend line that had been established this year.

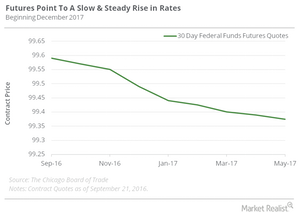

Assessing the Paradigm Shift in the Fiscal Policy

Fiscal policy has turned more expansionary, with stress on fiscal spending and monetary easing, thereby flooding the financial markets worldwide with huge liquidity.

IMF Warns about 3 Risks to the Global Financial System

The International Monetary Fund (or IMF) warned that there are three major risks to the global financial system in its latest report on global financial stability.

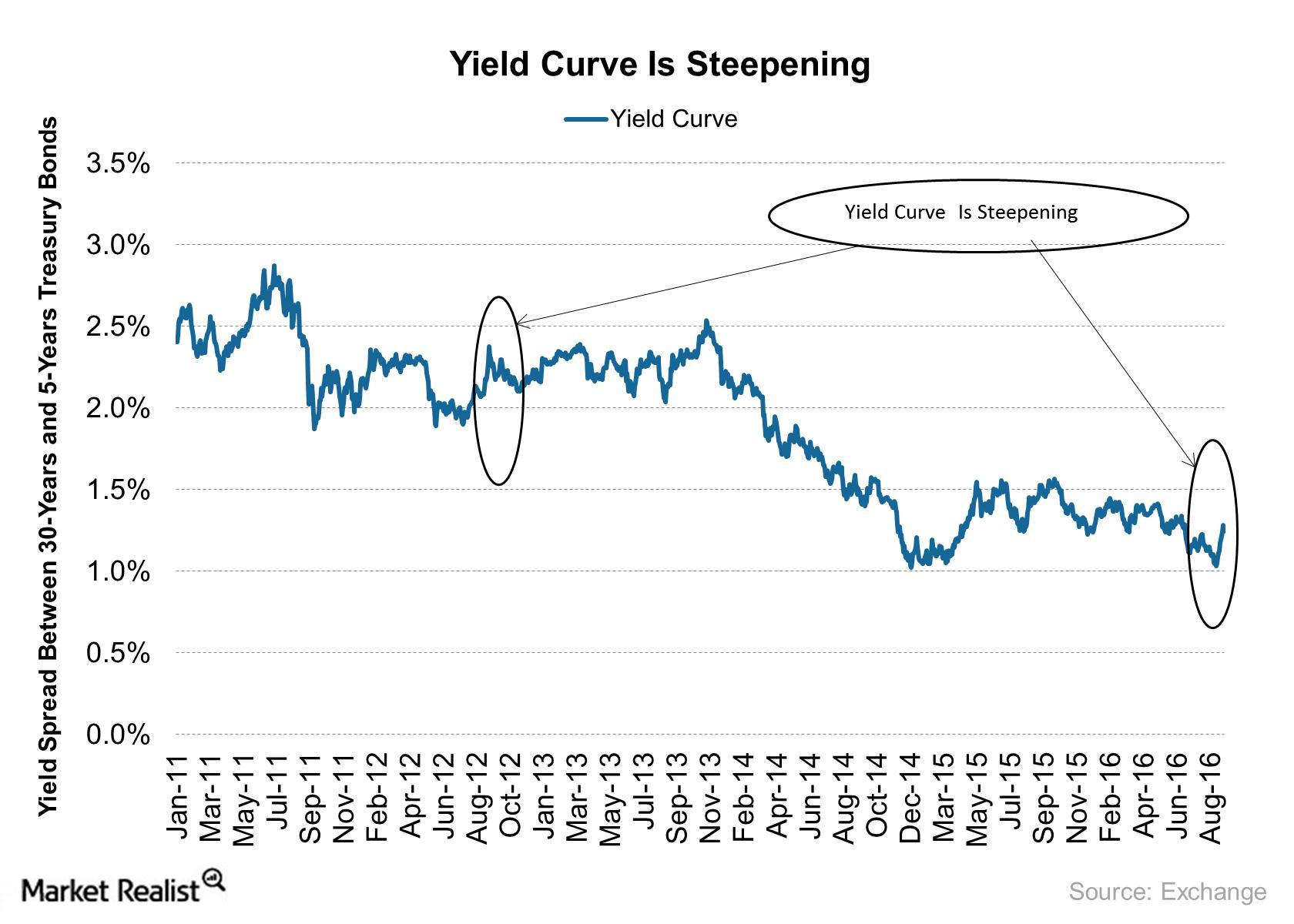

Yield Curve Is Steepening: What Does It Indicate for the Market?

In this series, we’ll compare yields across various developed markets (EFA) (VEA). We’ll also look at how a steepening yield curve affects the financial sector (XLF).

Positive Long-Term Macro Trends Can Grow the Restaurant Industry

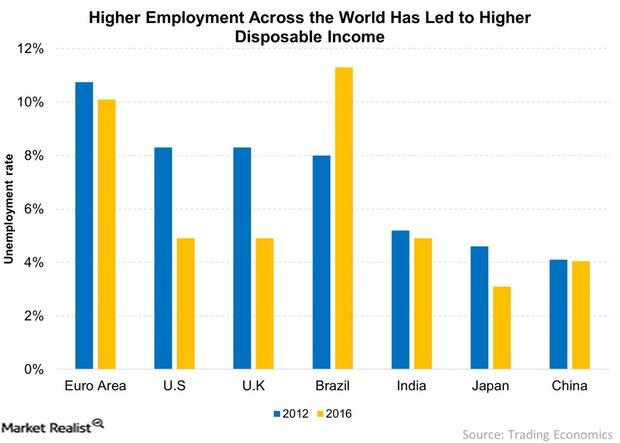

Lower oil prices and unemployment rates globally could support the restaurant industry.

International Diversification: Stepping outside the Comfort Zone

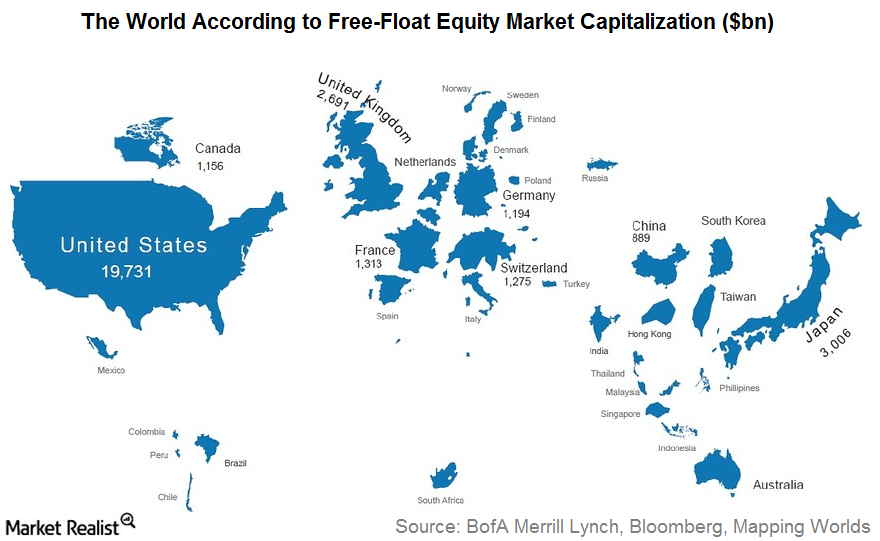

Some say investors should step step away from domestic markets to benefit from international diversification. The world has changed, and global financial markets are more interconnected.

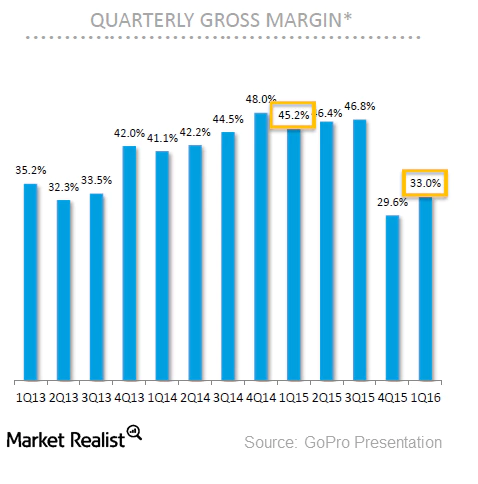

How Will GoPro’s Delayed Drone Launch Affect 2016 Revenues?

During its last earnings call, GoPro (GPRO) announced that it had delayed the launch of Karma, its much-awaited drone.

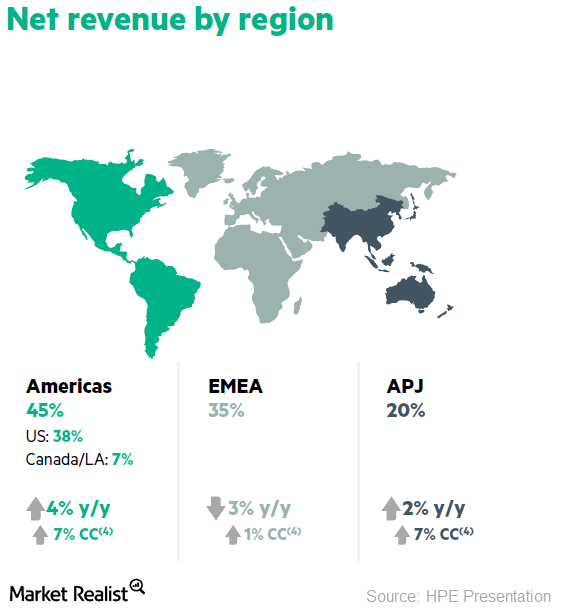

Why Hewlett-Packard Enterprise Fell on Brexit News

On Friday, Hewlett-Packard Enterprise (HPE) shares fell 7.6% on news of the United Kingdom deciding to leave the European (FEP)(EFA) Union—the Brexit.

Cisco’s Acquisitions Drive Its Collaboration Revenues

Earlier in 2016, Cisco completed the acquisition of European video conferencing startup Acano for $700 million in cash.