India and Asia’s Festive Season Could Help Gold Prices in October

Gold has fallen below $1,300 per ounce and broken below the longer-term trend line that had been established this year.

Oct. 20 2016, Published 10:15 a.m. ET

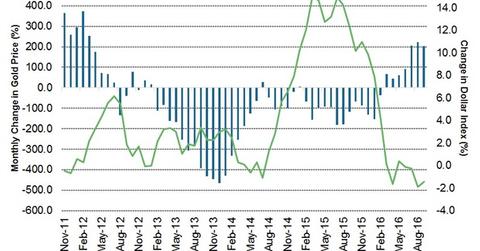

As a result, gold has fallen below $1,300 per ounce and broken below the longer-term trend line that had been established this year. This leads us to be less aggressive in our gold price expectations for 2016. It looks like the current consolidation could persist through October, dependent on any economic news that develops. However, this price action changes virtually nothing in our positive long-term outlook for gold. Price weakness is likely to spur seasonal demand out of India and Asia. We continue to believe that a Fed rate increase would ultimately be seen as another misstep that puts global growth at risk. In addition, the U.S. presidential election, implementation of Brexit, and further loss of confidence in central bank policies should support gold through 2017 and beyond.

Market Realist – Gold gains in Asia

As the US dollar (UUP) influences gold prices, gold (GLD) (IAU) may remain a safe haven bet if the dollar weakens. Plus, currency volatility (VXZ) has picked up, so gold is comparatively well supported against the pound. Post–Brexit vote, investors were cautious about investing in UK (EFA) shares or gilts and considered investing in a wider range of assets to spread out their risk.

Gold prices have been volatile (VIXY) worldwide (ACWI) (VEU), and this trend continued on October 10, 2016. However, demand during the festive season in India (EPI) (PIN)—including Dussehra and Diwali—may come to gold’s rescue. Gold gained almost $10 to $1,264.89 in Asia before it fell back down to $1,257.75 during late morning New York trading. But it still ended with a gain of 0.37%. Silver (SLV) rose as high as $17.799 and ended with a gain of 0.92%. Euro gold rose to about €1,131, platinum lost $4 to $960, and copper climbed 3 cents to about $2.20.

A weaker economy makes the Fed less likely to increase interest rates before December, which would be positive for non-yielding assets such as gold.