iShares Silver Trust

Latest iShares Silver Trust News and Updates

PSLV or SLV: Which Is a Better ETF Stock to Buy and Bet on Silver?

The Sprott Physical ETF (PSLV) and the iShares Silver Trust (SLV) are among the popular ETFs to get exposure to silver. Which is a better stock to buy?

Is Silver More Valuable as a Precious Metal or an Industrial Metal?

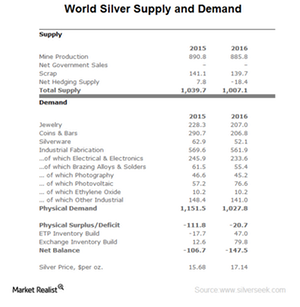

Silver has been falling over the past few years, despite surging demand for its industrial use. Fundamentally, silver seems to be strong due to rising demand and a year-over-year shortfall in its supply.

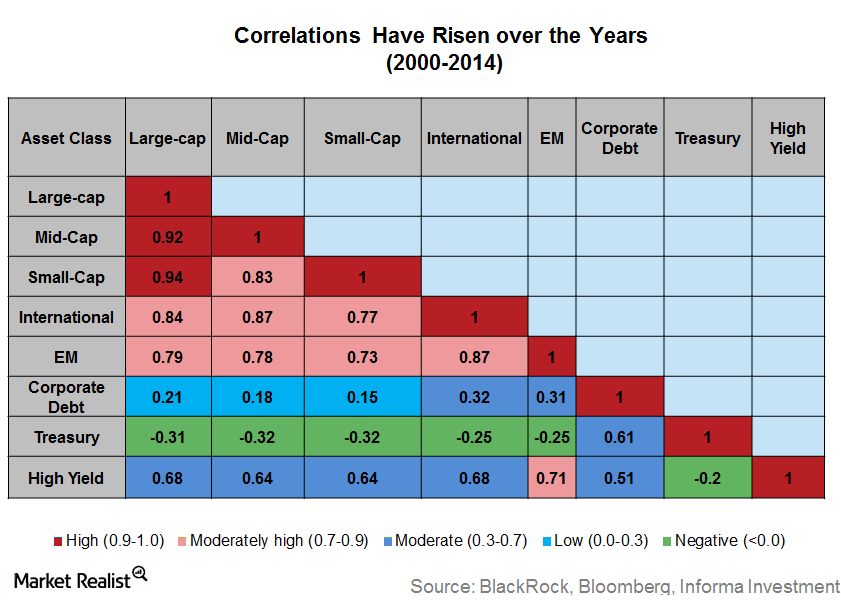

Diversify Broadly and Consider Alternative Investments

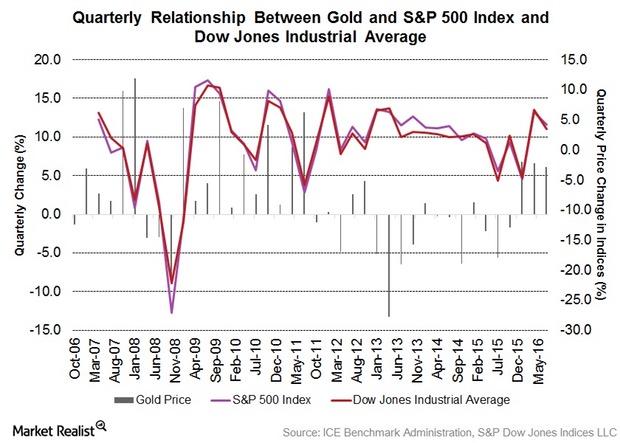

Rising correlation across asset classes is a sticky problem that investors face while investing in today’s markets.

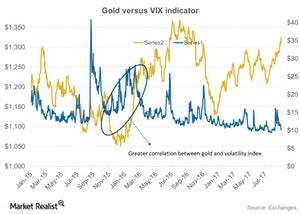

How the Economic Sentiment Is Playing on Gold

During the past week, average hourly earnings, excluding the farming industry, were below analysts’ expectation of 0.10%.Must-know fundamentals about the US Consumer Price Index

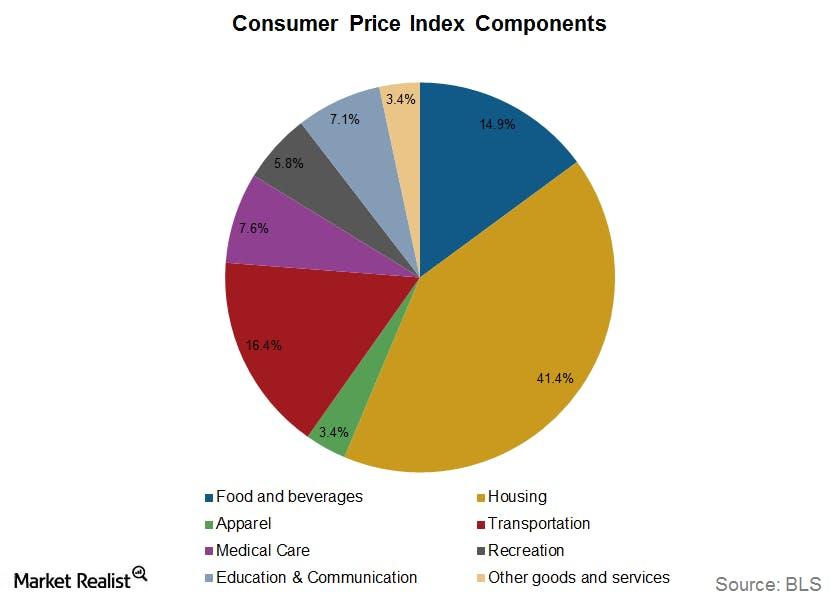

The Bureau of Labor Statistics (or BLS) developed the U.S. CPI in 1913 to measure the change in prices.Materials Is gold no longer an inflation hedge?

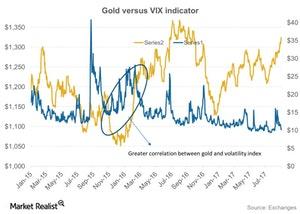

Gold certainly can be an inflation hedge, and it has worked in the past. Obviously, one of the reasons gold has been weak of late is that people are becoming less concerned about inflation.

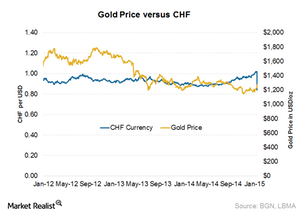

Why the Swiss National Bank removed the cap against the euro

A cap was put in place to stop the currency’s appreciation. An appreciating local currency is detrimental to exporters.

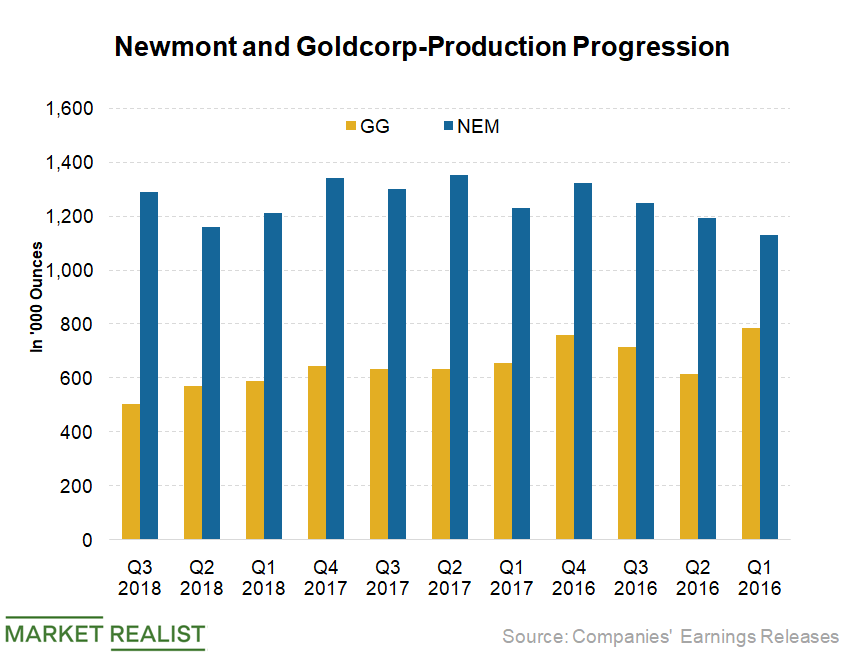

What Synergies Does Newmont Expect from Merger with Goldcorp?

Increased shareholder returns were the main motivation behind the Newmont Mining and Goldcorp merger.

How Do Gold Miners’ Leverage Ratios Look?

Barrick has reduced its debt more than 57% in the last four years from $13.4 billion at the end of 2014 to $5.7 billion at the end of 2018.

A Quick Look at the Technicals of the 4 Precious Metals

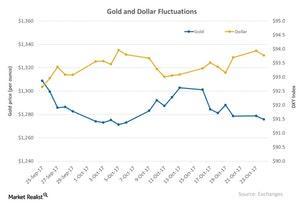

Gold’s price dipped 0.13% to $1,312.8 per ounce on May 9. The fall in gold was extended for a number of reasons.Miscellaneous How Is the Dollar Affecting Precious Metals?

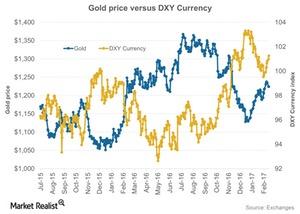

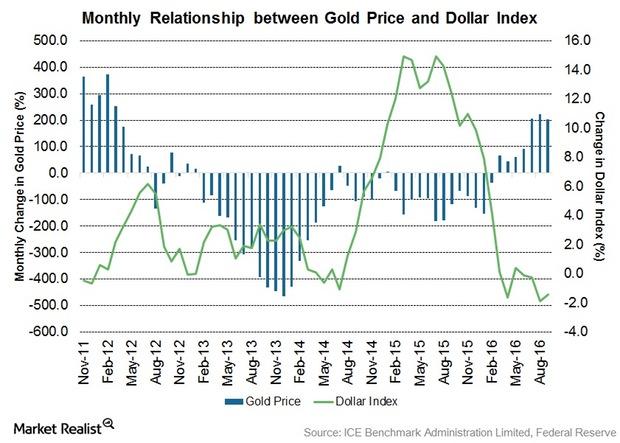

Besides ongoing geopolitical concerns, a crucial factor that gold keeps looking to for directional moves is the US dollar.

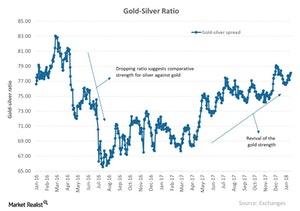

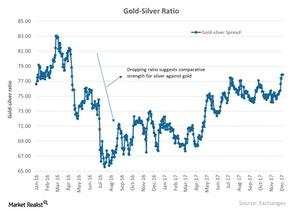

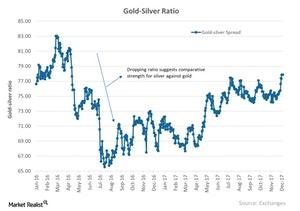

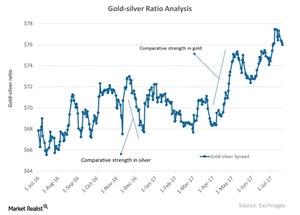

A Brief Analysis of the Gold-Silver Spread in January 2018

A quick look at the relationship between the two core precious metals, gold and silver, could also be helpful in the analysis of the overall precious metals market.

All 4 Precious Metals Rose on December 20, 2017

All four precious metals had an up day on December 20, 2017. Gold increased 0.43% on the day and closed at $1,267.80 per ounce.

A Brief Look at December 2017’s Precious Metal Spread Measures

In this article, we’ll discuss the gold-silver, gold-platinum, and gold-palladium spreads. These three spreads stand at 77.9, 1.38, and 1.23, respectively.

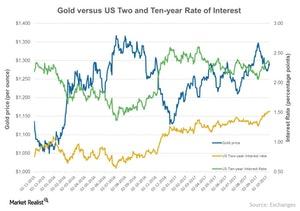

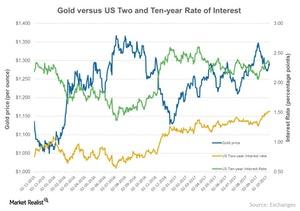

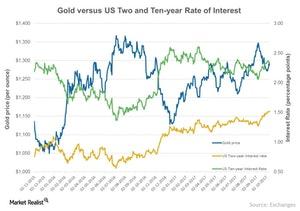

How the Federal Reserve’s Rate Hike Affected Precious Metals

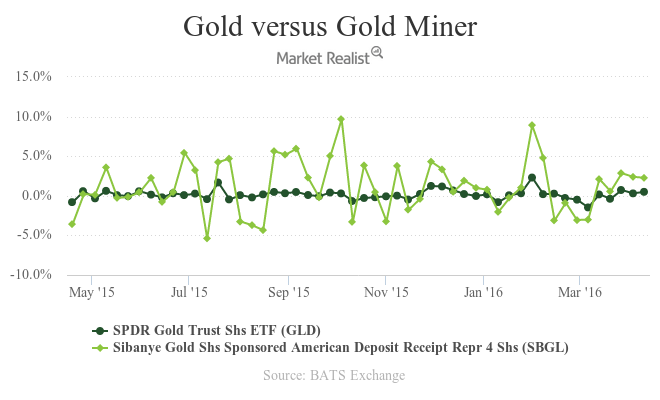

Precious metals and miners saw some relief on December 13 after the Fed raised rates as expected. Sibanye Gold (SBGL), Aurico Gold (AUQ), and Goldcorp (GG) rose 3.5%, 3.6%, and 5.8%, respectively.

How Eager Are Precious Metals to Hear the Fed’s Decision?

Gold, silver, and platinum all had a down day on Tuesday, December 13, mainly due to speculations over the Federal Reserve’s pending interest rate decision.

Where Are Precious Metal Spreads Moving?

In this part of the series, we’ll look at the gold-silver spread, the gold-platinum spread, and the gold-palladium spread.

How Inflation Becomes a Core Determinant of the Price of Gold

The possible interest rate hike is taking a lot of market participants’ attention. Many policymakers are also focusing on inflation numbers.

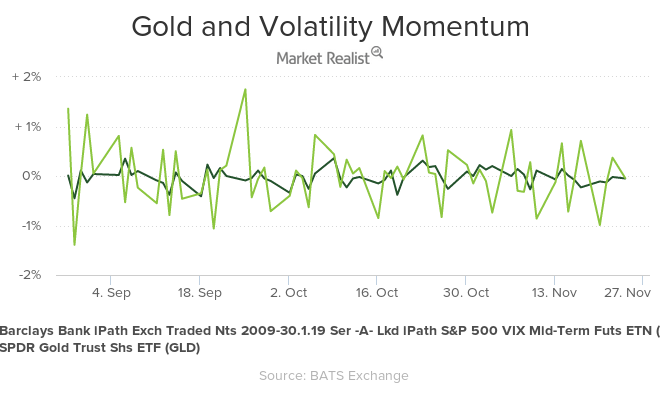

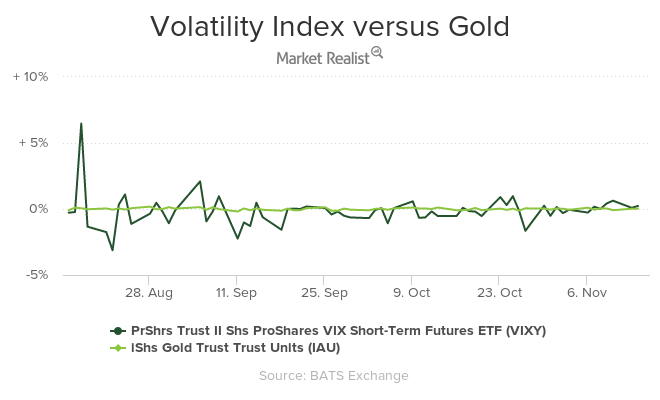

An Update on the Precious Metals as November Comes to an End

The US stock markets were closed on Thursday, November 23, 2017, for Thanksgiving, and the next day (Black Friday) was quite slow for precious metals. Gold played in a narrow range that day.

Analyzing Gold’s Market Performance

Besides the impact of interest rates, there are also other global indicators that could play on precious metals—the most important being the US dollar.

These Factors Are Affecting Gold

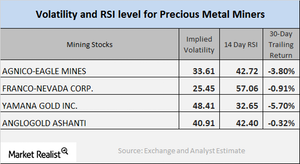

Gold, silver, platinum, and palladium have a five-day trailing loss of 0.67%, 0.44%, 1.1%, and 1.5%, respectively.

Mining Shares: RSI Numbers and Implied Volatility

As of October 19, Sibanye Gold, Agnico Eagle Mines, Silver Wheaton, and Randgold Resources had implied volatility readings of 63%, 33.6%, 30.8%, and 25%.

How Strongly Can North Korea Move the Precious Metals Market?

Gold futures for September expiration have risen ~3.9% over the past one-month period. Silver, platinum, and palladium have followed the same track as gold.

How the Gold-Silver Spread Is Trending

The gold-silver spread measures the price of one ounce of gold in relation to silver.

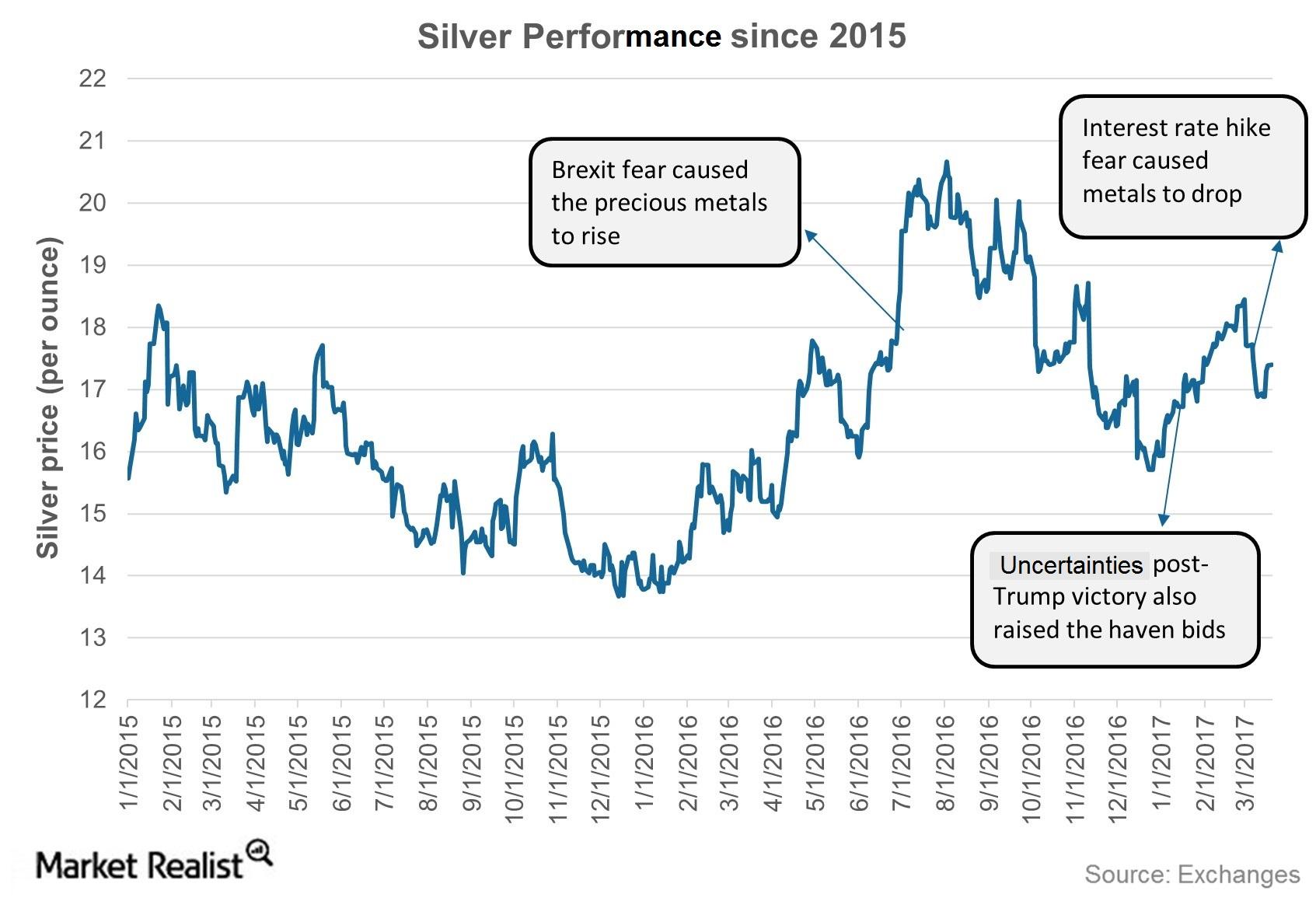

Insight into the Silver Market in June 2017

Silver has seen a five-day trailing loss of 2.6%, while gold and platinum fell 1.7% and 1.9%, respectively.

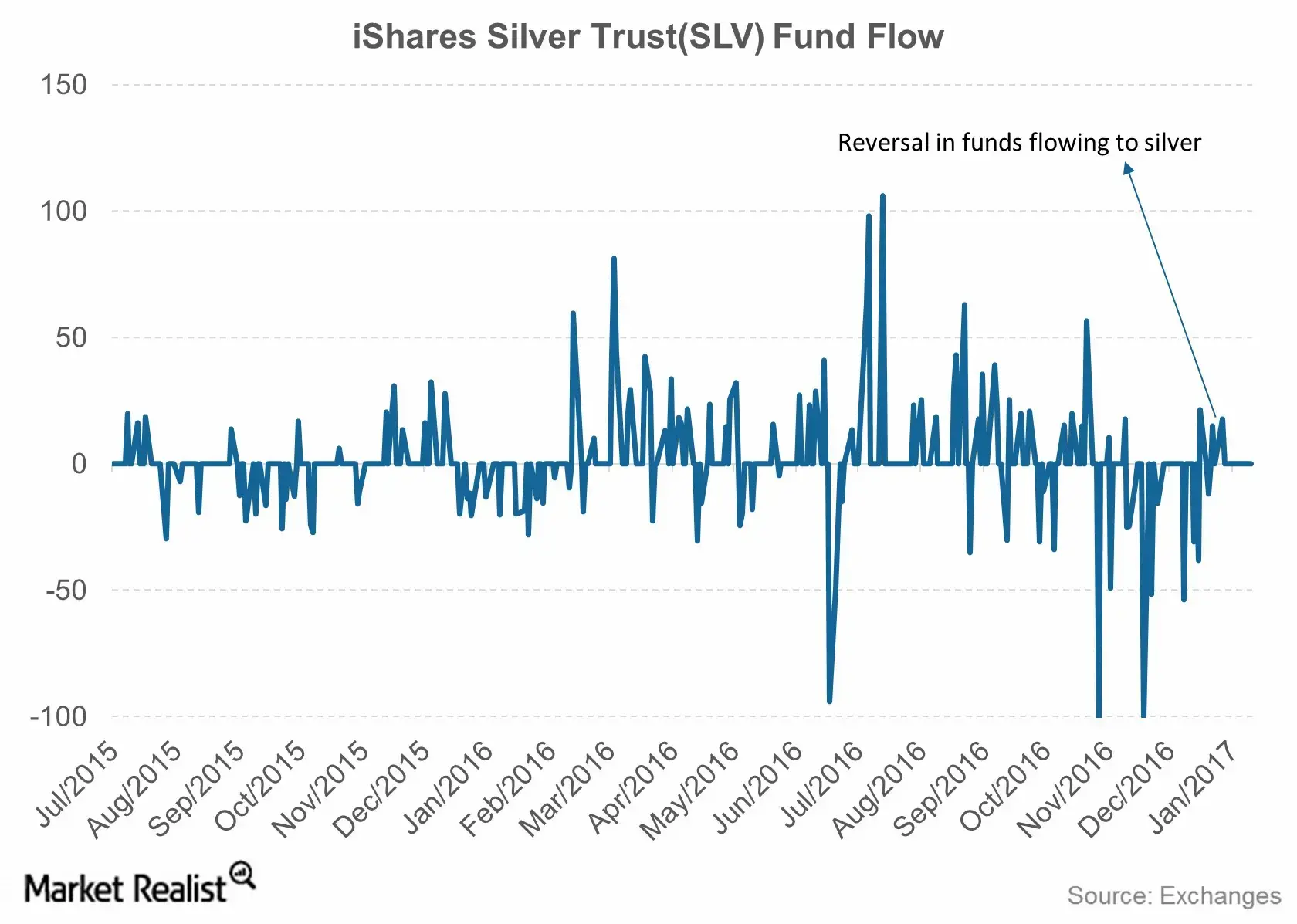

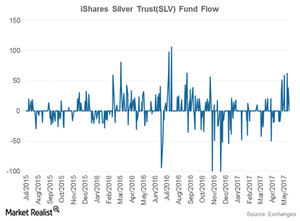

Reading the Fund Flows of the iShares Silver Trust

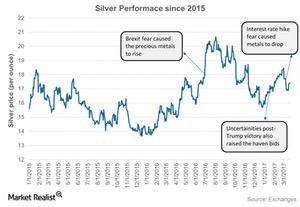

Over the past year, silver has been very volatile compared to the other three precious metals. Silver was the highest among precious metals in mid-April 2017.

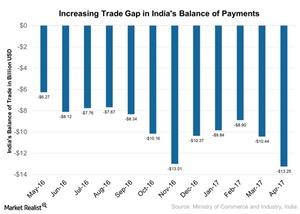

A Look at India’s Trade Gap and Its Economic Impact

India’s trade gap increased 173.5% on a year-over-year basis to ~$13.3 billion in April 2017, beating the market’s expectations of an ~$12.8 billion gap.

Analyzing Silver’s Fundamentals

When analyzing the performance of a metal, investors should look at its fundamentals. In this series, we’ll look at various metrics for silver and other precious metals.

How Silver-Based Funds Plunged Their Way through April 2017

Precious metals were doing considerably well until the first half of April 2017. As investors’ risk appetites revived, haven assets slumped. Among these metals, silver has plummeted the most.

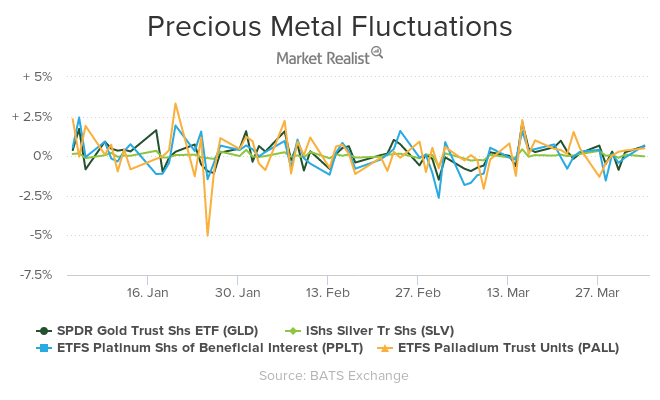

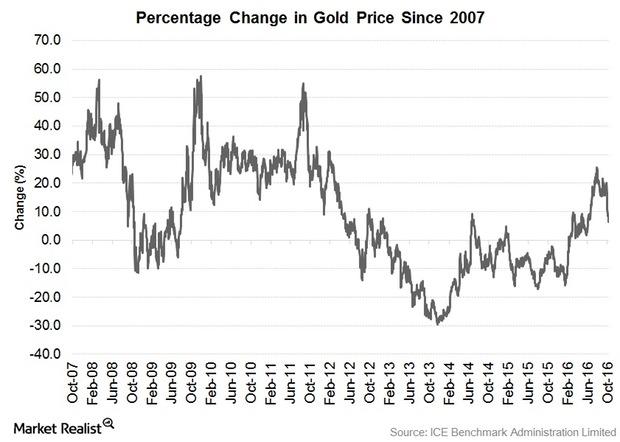

Reading the Performances of Precious Metals in 1Q17

Precious metals had a bright first quarter, which ended March 31, 2017. Gold rose about 8.4%, marking its best quarter in almost a year.

These Factors Have Been Driving Silver Prices

Silver has performed slightly better than gold and platinum on a year-to-date basis.

Understanding the Fall in the US Dollar and How Precious Metal Reacted

All four precious metals witnessed a rise in price on Monday, March 20, as the US dollar slipped to its six-week low.

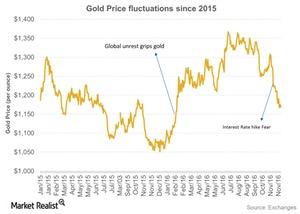

Why Did Gold Fluctuate in 2016?

Gold prices for February expiration fell on the last trading day of the year. Gold fell 0.53% and closed at $1,152 per ounce on December 30, 2016.

Gold Prices Recover amid Sell-Off

Demand for Gold Withstood Recent Selloff Despite the drop in the gold price in October, demand for gold bullion-backed exchange traded products (ETPs) held firm. Inflows have no doubt slowed down compared to earlier in the year (0.4% increase in holdings in October compared to 12% and 6% increases in February and June respectively), but […]

Gold and Gold Miners: Analyzing Recent Performance

Gold bullion ended September at $1,315.75 per ounce for a 0.5% gain while gold stocks experienced more positive returns. The NYSE Arca Gold Miners Index[1. NYSE Arca Gold Miners Index (GDMNTR) is a modified market capitalization-weighted index comprised of publicly traded companies involved primarily in the mining for gold] (GDMNTR) posted a 3.8% gain, while […]

India and Asia’s Festive Season Could Help Gold Prices in October

Gold has fallen below $1,300 per ounce and broken below the longer-term trend line that had been established this year.

What’s Next for Gold Investors?

Gold gave steady returns to investors for the first two months of 2016 as unrest and instability continued in the markets. However, March started with some ups as well as downs for gold.

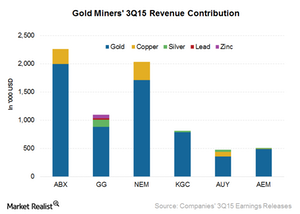

Why You Should Look Out for Gold Miners’ Commodity Exposure

It’s important to understand not only miners’ geography but also their revenue composition in terms of commodity exposure.

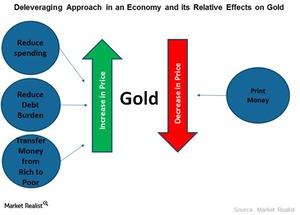

Reviewing an Economy and Its Effect on Gold Prices

Deleveraging can affect gold and other bullion prices, as well as exchange-traded funds such as the iShares Gold Trust ETF (IAU) and the iShares Silver Trust ETF (SLV).

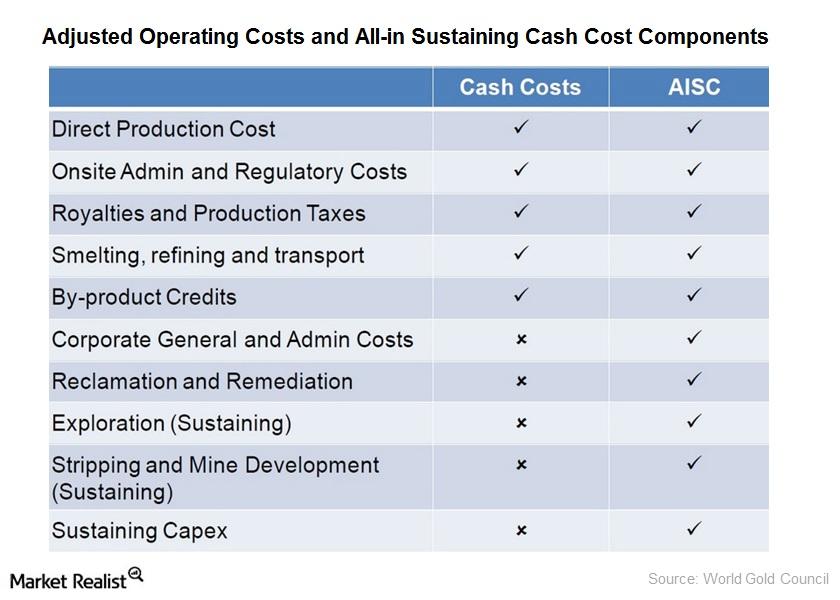

Key for Investors: Understanding Mining Cost Structures

The cash cost has been the dominant measure of the gold mining cost structure. It represents what the mine costs are for each ounce of gold.

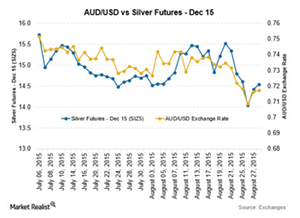

Silver Prices Show Positive Correlation with the Australian Dollar

Drop in silver prices among other precious metals With global commodity and metal prices falling in the volatile month of August, silver has been no exception. The economic slowdown in China has been slowing the demand across various commodities. Precious metals like gold and silver have been under pressure. The strength in the US dollar […]

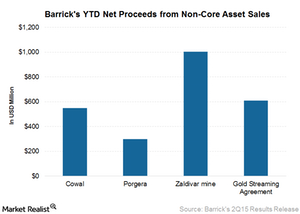

Barrick Gold in 2Q15: The Benefits of Asset Monetization

So far, Barrick has achieved 90% of its 2015 debt reduction target of $3 billion, mainly thanks to asset monetization.