Key for Investors: Understanding Mining Cost Structures

The cash cost has been the dominant measure of the gold mining cost structure. It represents what the mine costs are for each ounce of gold.

Sept. 23 2015, Updated 8:36 a.m. ET

Bullion market rout

We saw a melting bullion market in the past year—specifically the July rout that left the gold industry in dismay. The futures contracts on COMEX, the commodity division of the NYSE, have lost significantly. Gold, silver, platinum, and palladium have lost ~6.60%, ~6.50%, ~18.50%, and ~27% respectively. Bullion ETF investments like the iShares Gold Trust (IAU) and the iShares Silver Trust (SLV) have also given up approximately equal to their respective bullion on a YTD (year-to-date) basis.

Gold mining companies Kinross Gold (KGC), Iamgold (IAG), and New Gold (NGD) have also seen a YTD loss. These three equities contribute 6.15% to the price movements of the VanEck Vectors Gold Miners ETF (GDX).

Mining business survivability

A gold miner’s survivability, profitability, and relative position in the business are substantially determined by the cost structures it faces. A relative comparison of the current market capitalization and its cash in hand position is vital for the mining business. Companies with strong and positive cash flows have virtually zero risk of bankruptcy.

Miners cost structure

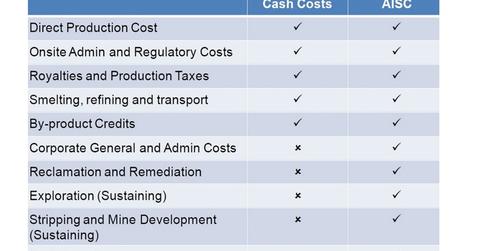

There are different references to cost that you will find in a miner’s balance sheet. A few of the costs are:

- Cash cost – It’s the cost of production at the mine site. It doesn’t include the head office costs, interest expense, capitalized development, off-site costs—like smelting or refining costs, taxes, or depreciation.

The cash cost has been the dominant measure of the gold mining cost structure. It represents what the mine costs are for each ounce of gold. It’s the acid-test measure of what it costs the gold miners to sell gold. A lower cash cost is preferred by the company investors because it gauges the profitability of the investment.

- Total cash costs – cash costs plus offsite costs and head office costs

Total costs represent the total cash costs plus depreciation, interest, and taxes.

- All-in cash costs – cash costs plus exploration expense, head office costs, and sustaining capital

All-in cash costs are considered a superior cost measure by the experts because they include all of the corporate-level administrative expenses along with all of the costs required to maintain and enhance existing production levels. The major items included are reclamation and remediation along with all of the exploration, mine development, and capital expenditures necessary to sustain the current production levels.

In the next few parts, we’ll explore the major mining companies worldwide.