New Gold Inc.

Latest New Gold Inc. News and Updates

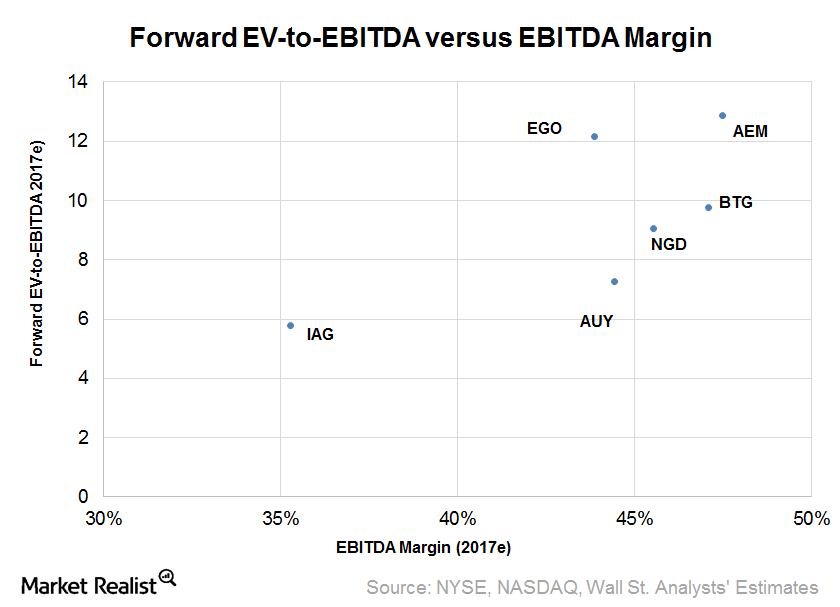

What Could Drive IAMGOLD Corp.’s Valuation Going Forward?

IAG stock could continue to gain traction due to its high operational leverage, at least as long as the upward trend in gold prices continues.

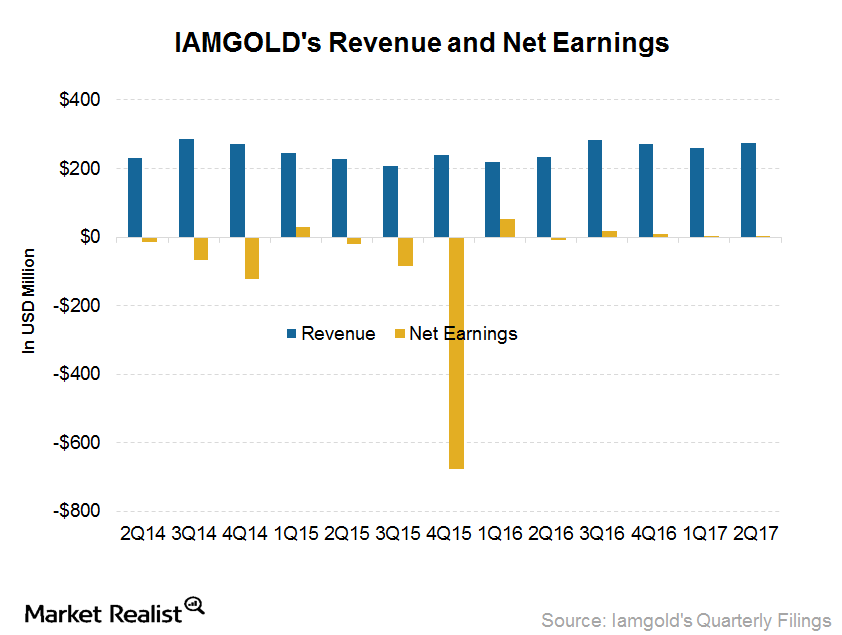

Understanding IAMGOLD’s 2Q17 Earnings Highlights

IAMGOLD’s (IAG) 2Q17 production was 223,000 ounces of gold—growth of 26,000 ounces or 13% year-over-year (or YoY).

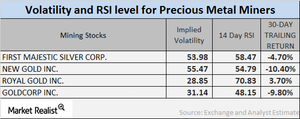

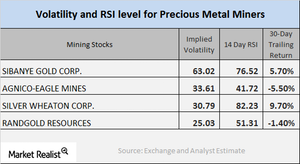

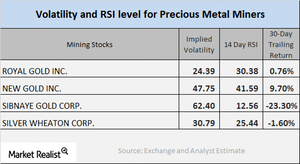

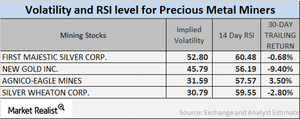

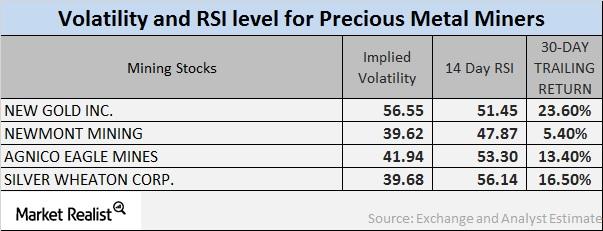

How Mining Stock Volatility Numbers Are Moving Now

First Majestic, New Gold, Agnico, and Silver Wheaton now have RSI scores of 60.5, 56.2, 57.6, 59.6, respectively.

Which Gold Stocks Do Analysts Love and Hate?

Gold price’s reversal this year has created opportunities in gold stocks. The SPDR Gold Shares ETF (GLD) had gained 11% year-to-date as of Friday.

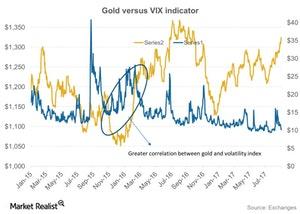

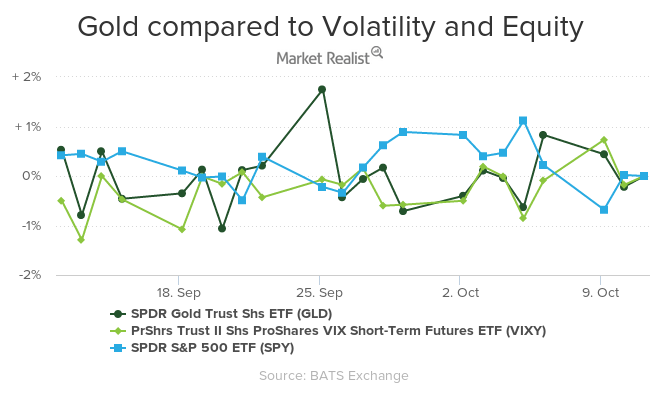

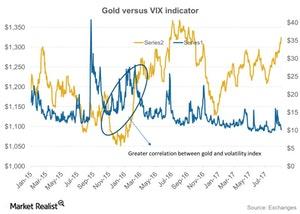

How the Economic Sentiment Is Playing on Gold

During the past week, average hourly earnings, excluding the farming industry, were below analysts’ expectation of 0.10%.

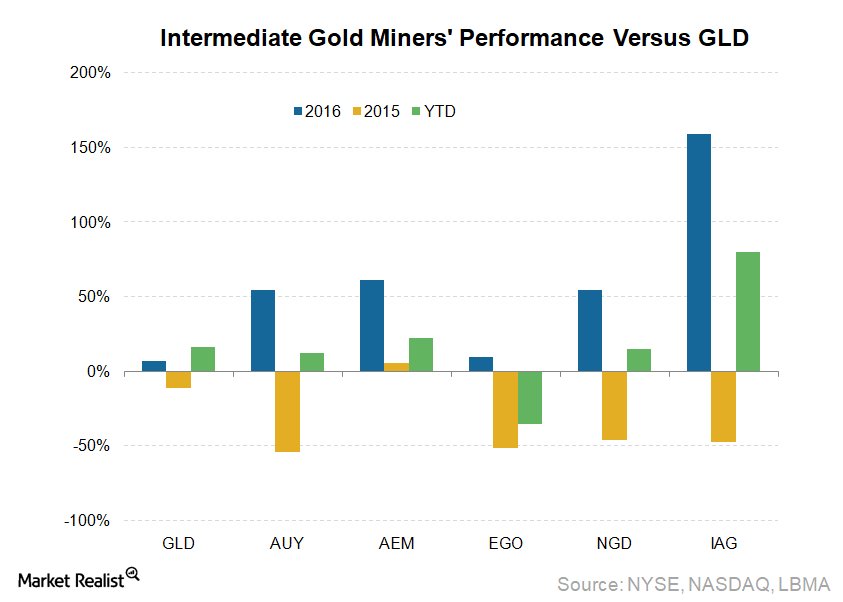

Why Are Intermediate Gold Miners so Exuberant?

Intermediate gold miners are smaller than senior gold miners in terms of production and market capitalization, but they are still generally liquid.

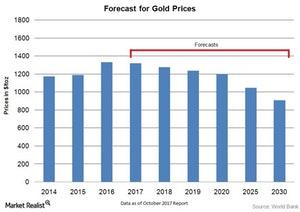

Gold’s Outlook for 2018

Looking ahead for 2018, industry analysts stated in a Bloomberg article that they expect gold to perform better early in the year led, by the “January effect.”

What Miners’ Moving Averages Indicate

NGD and HL are both trading below their longer-term 100-day moving averages.

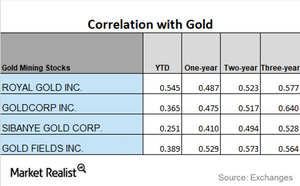

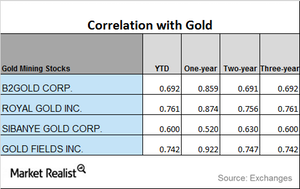

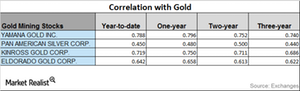

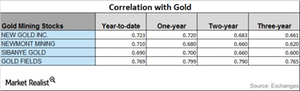

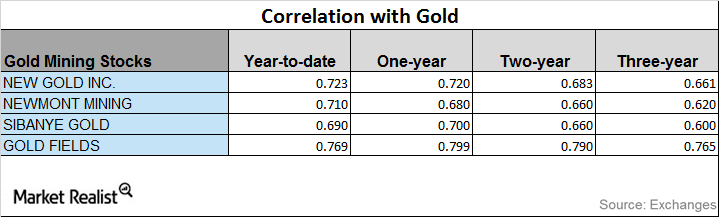

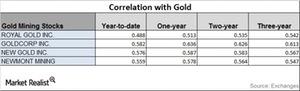

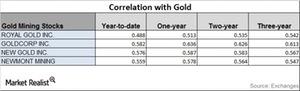

What’s the 3-Year Correlation between Miners and Gold?

Gold is the most influential precious metal, and most miners follow its price trends.

Mining Stocks Follow Precious Metals: Technical Insights

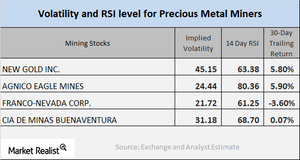

New Gold, Agnico-Eagle Mines, Franco-Nevada, and Cia de Minas Buenaventura have call-implied volatilities of 45.2%, 24.4%, 21.7%, and 31.2%, respectively.

Your End-of-2017 Correlation Study of the Major Miners

The PowerShares DB Gold Fund (DGL) and the VanEck Merk Gold Trust (OUNZ) rose 2.2% over the five trading days leading up to December 27, 2017.

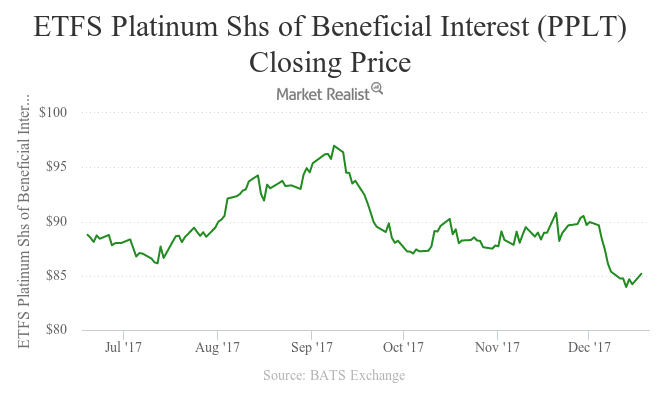

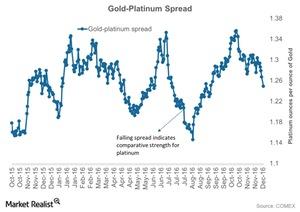

Why Platinum Led the Precious Metals Pack on December 18

All four precious metals except palladium witnessed an up day on December 18, 2017. Platinum touched the day’s high of $915.3 and ended up at $913.2 per ounce.

How Turbulence in the Market Has Moved Precious Metals

Often, gold, silver, platinum, and palladium react to the overall risk in the market.

India’s Gold Imports Have Fallen: What’s Going On?

For India, gold imports have fallen 16% in value to ~$2.9 billion in October 2017 compared to $3.5 billion in the corresponding month last year.

Directional Changes in the Correlation of Miners to Gold

New Gold and Goldcorp have seen upward trends in their correlations with gold, while Newmont Mining has seen its correlation decline.

Behind the Technical Details of Key Mining Stocks Today

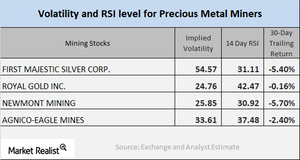

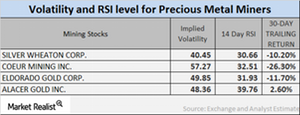

The Sprott Gold Miners (SGDM) and Global X Silver Miners (SIL) have fallen 0.21% and 1.9%, respectively, on a 30-day-trailing basis.

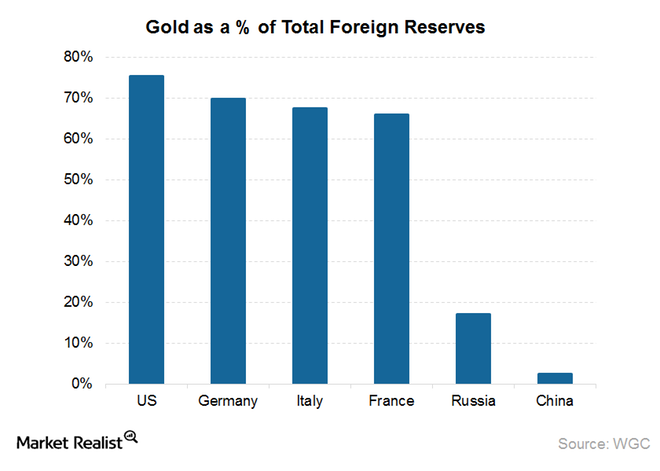

How Central Banks’ Gold Buying Spree Coud Benefit Prices

While China and Russia have the fifth and sixth largest gold reserves globally, the movements in them are the most watched by gold investors the world over mainly because these economies have been quite vocal about adding gold reserves.

Analyzing Miners’ Trends in October

Mining stocks’ correlation with precious metals Most of the time, mining stocks’ performance follows that of precious metals. However, they can deviate. Correlational analysis can give investors some insight into how mining stocks relate to gold and silver. In this part of our series, we’ll compare Royal Gold (RGLD), Goldcorp (GG), New Gold (NGD), and Newmont Mining (NEM). Mining […]

Reading the Correlation Movements of Precious Metal Miners with Gold

The iShares MSCI Global Gold Min (RING) and the VanEck Vectors Junior Gold Miners (GDXJ) fell 2.6% and 1.5%, respectively, on October 26.

A Technical Analysis of Mining Shares in October

When investors look at mining stocks, it’s important that they do a technical analysis of the stocks.

How Global Indicators Are Affecting Precious Metals

Gold reached its two-week high price of $1,294.5 an ounce on Tuesday, October 10, and ended the day at $1292.1 per ounce.

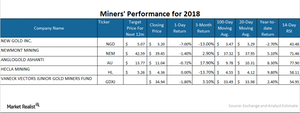

How Mining Stocks Are Performing

The precious metals continued rising on Wednesday, and gold also witnessed a rebound.

Chart in Focus: Correlation of Mining Stocks with Gold

New Gold has a three-year correlation of 0.67 and a one-year correlation of 0.88 to gold.

Reading the Technicals of Mining Shares in September 2017

Most mining shares witnessed an up day on Monday, September 25, 2017, as precious metals increased over the ongoing global tensions.

How Gold Is Coping amid Market Turmoil

Precious metals have maintained upward movement over the past month as geopolitical tensions hover.

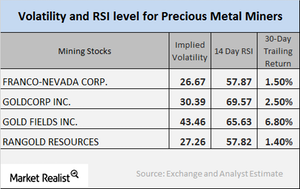

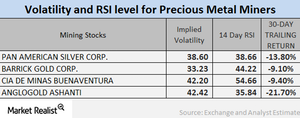

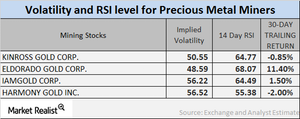

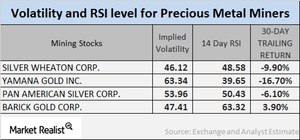

A Look at Volatilities for Precious Metal Miners

In this part of the series, we’ll look at some important technical indicators, including volatility figures and RSI levels for major miners.

RSI Levels Have Fallen: Will Miners Rebound Soon?

Gold and silver-based funds such as SGOL and SIVR are impacted by changes in precious metal prices. They fell due to the fall in precious metals on Friday.

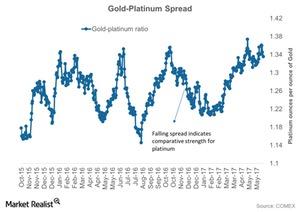

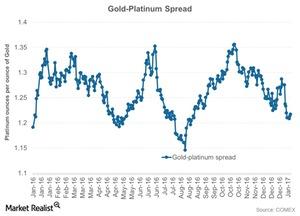

Inside the Gold-Platinum Spread Now

The platinum industry is now headed for its third-straight year of surplus, likely due to the higher demand for petroleum-based cars.

Barrick Gold’s and Other Miners’ Correlation with Gold

Metal stocks As we study the impact of global variables on precious metals and the mining sector, we should also analyze the relationship between mining stocks and gold. Correlational analysis can help us compare price movement in mining stocks and the metal. In this part of our series, we’ll examine New Gold’s (NGD), Newmont’s (NEM), Coeur […]

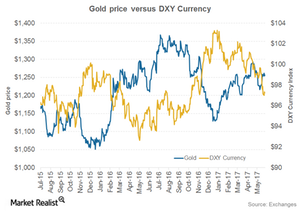

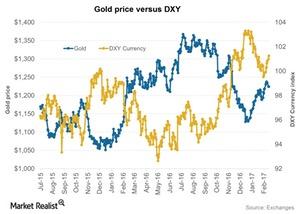

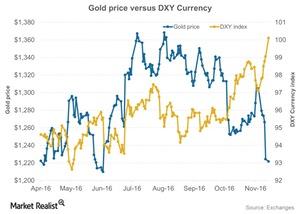

The Ups and Downs of the Dollar and Gold

On June 6, 2017, the US Dollar Index plunged to its lowest level in seven months, which helped dollar-denominated precious metals regain value.

Are RSI Numbers Moving Away from or Close to Critical Levels?

Investors are constantly speculating about the impact on precious metals of a possible Fed rate hike in June. Let’s look at some 14-day RSI scores and implied volatility.

How Are the Correlations of Mining Stocks Moving?

Fears surrounding a potential upcoming interest rate hike took over precious metals recently, and they fell at the beginning of May 2017.

Gold and Other Precious Metals Fell on May 18

Gold futures for June expiration fell 0.47% and ended May 18 at $1,252.8 per ounce. The call implied volatility in gold rose to 11.3%.

How the Dollar’s Revival Is Impacting Precious Metals in May

The US Dollar Index, which prices the dollar against a basket of six major world currencies, has risen ~0.46% on a trailing-five-day basis.

Correlation Trends of Miners to Gold

Among the leveraged mining funds, the Direxion Daily Gold Miners ETF (NUGT) and the Proshares Ultra Silver ETF (AGQ) have seen considerable losses over the past month.

Gauging the Role of the US Dollar in the April 19 Fall of Precious Metals

Another important phenomenon that played on the fall of precious metals on Wednesday, April 19, was the upswing of the US dollar.

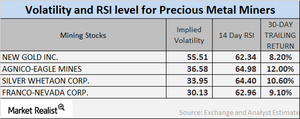

Analyzing the Volatility of Mining Stocks

As of April 6, 2017, the volatilities of New Gold (NGD), Agnico Eagle (AEM), Silver Wheaton (SLW), and Franco-Nevada (FNV) were 55.5%, 36.6%, 34%, and 30.1%, respectively.

How Are Mining Stocks Performing at the Start of April 2017?

As of April 4, 2017, the volatilities of New Gold (NGD), Agnico Eagle Mines (AEM), Silver Wheaton (SLW), and Randgold Resources (GOLD) were 51.5%, 35.4%, 61.7%, and 54.1%, respectively.

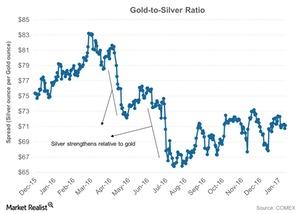

Where Is the Gold-Silver Ratio Headed?

When analyzing the precious metals market, it’s important to take a look at the relationship between gold and silver.

How Precious Metals Have Performed amid Volatility

Precious metal mining stocks are known to closely track the performances of precious metals.

A Look at the Gold-Platinum Ratio

The demand for platinum has been very fragile over the past few years due to concerns about sales of diesel-based vehicles.

Where the Gold-Platinum Spread Is Headed

Platinum is known for its use in jewelry and as an autocatalyst for diesel-based automobile engines. The demand has been very fragile over the past few years.

How the Gold-Platinum Spread Could Move More

The demand for platinum has been very fragile over the past few years, affected by the reduced market forecast for sales of diesel-based vehicles.

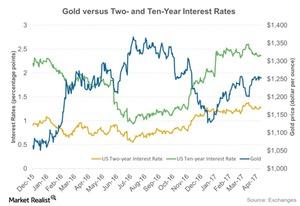

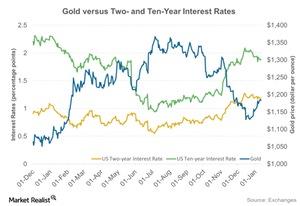

How Interest Rates Are Impacting Precious Metals

Many of the recent changes in precious metals have been determined by changes in the interest rates offered on US Treasuries.

Reading the Volatility and RSI Levels for Miners

Precious metal mining stocks are known to closely track the performance of their respective precious metals. Mining stocks often show more volatility than metals.

Analyzing the Gold-Platinum Ratio in 2017

The gold-platinum spread was ~1.2 on January 11, 2017. Platinum’s RSI (relative strength index) was 38.

How Mining Stocks Reacted to Plummeting Metals

Mining companies that have high correlations to gold include Royal Gold (RGLD), Goldcorp (GG), New Gold (NGD), and Newmont Mining (NEM).

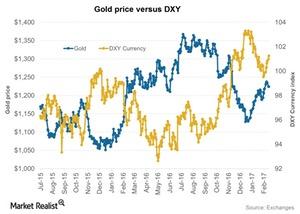

US Dollar Played on Gold in 2016

The correlation between gold and the US Dollar Index is -0.36. It means that about 36.0% of the time, gold and the dollar move in opposite directions.

How Are Miners and Gold Correlated?

The substantial returns of most mining companies have been due to safe-haven bids that boosted gold and other precious metals.

What Do Mining Stocks’ Technicals Indicate?

Many of the fluctuations in precious metals have been a result of speculation about the Federal Reserve’s interest rate stance.