Mining Stocks Follow Precious Metals: Technical Insights

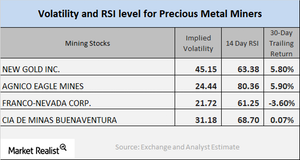

New Gold, Agnico-Eagle Mines, Franco-Nevada, and Cia de Minas Buenaventura have call-implied volatilities of 45.2%, 24.4%, 21.7%, and 31.2%, respectively.

Jan. 5 2018, Updated 12:10 p.m. ET

Technical analysis

In the final part of our series, we’ll look at the technical indicators for mining stocks. We’ll discuss the call-implied volatility and RSI (relative strength index) metrics for New Gold (NGD), Agnico-Eagle Mines (AEM), Franco-Nevada (FNV), and Cia de Minas Buenaventura (BVN).

Volatility analysis

New Gold, Agnico-Eagle Mines, Franco-Nevada, and Cia de Minas Buenaventura have call-implied volatilities of 45.2%, 24.4%, 21.7%, and 31.2%, respectively. The call-implied volatility measures the changes in an asset’s price given the changes in the call option.

Among the four miners that we’re discussing, Franco-Nevada had a 30-day trailing loss of 3.6%. New Gold, Agnico-Eagle Mines, and Cia de Minas Buenaventura rose 5.8%, 5.9%, and 0.07%, respectively, on a 30-day trailing basis.

RSI level

If a stock’s RSI level is above 70, it indicates that it could be overbought and the price could fall. When the RSI level is below 30, it suggests that it could be oversold and the price could increase. New Gold, Agnico-Eagle Mines, Franco-Nevada, and Cia de Minas Buenaventura have RSI scores of 63.4, 80.4, 61.3, and 68.7, respectively.

The famous gold and silver-based funds that closely track the movement in precious metals are the Physical Swiss Gold Shares (SGOL) and the Physical Silver Shares (SIVR). They rose 0.89% and 0.67%, respectively, on December 29—the last trading day of 2017. They had a five-day gain of 3.4% and 5%, respectively.