Reviewing an Economy and Its Effect on Gold Prices

Deleveraging can affect gold and other bullion prices, as well as exchange-traded funds such as the iShares Gold Trust ETF (IAU) and the iShares Silver Trust ETF (SLV).

Sept. 24 2015, Updated 10:25 p.m. ET

The process of deleveraging

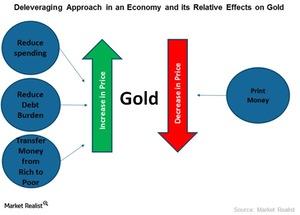

As we saw in the previous article, the deleveraging process can affect gold and gold-related assets. Let’s further discuss the different approaches to deleveraging.

Deleveraging as a process refers to reducing a country’s debt burden. Deleveraging negatively affects the economic conditions of a country.

Deleveraging can affect gold and other bullion prices, as well as exchange-traded funds such as the iShares Gold Trust ETF (IAU) and the iShares Silver Trust ETF (SLV). Plus, stocks like First Majestic Silver Corp. (AG), Barrick Gold Corp. (ABX), and Hecla Mining Co. (HL) can be affected by changes in precious metals prices. These three stocks together contribute ~8.5% to the VanEck Vectors Gold Miners ETF (GDX).

Escaping the deleveraging cycle

To get out of the deleveraging process there are four preliminary options:

- Reduce spending: People, government, and businesses would need to cut their spending, a measure referred to as austerity. A spending cut means income falls faster than debt, resulting in jobs lost and the debt burden (or debt-to-income ratio) rising rather than falling. Investors may prefer parking their money in gold during such times of economic instability.

- Reduce debt burden: Lenders or investors, who have their money parked in banks, are in a fix as banks may default due to more borrowers defaulting on their obligations. Their assets used as collateral hold less value than the banks took into account when writing the loans. This debt can be restructured for the lenders, that is, paid over a longer term or by cutting interest rates. These income cuts can lead to a recession or depression that may again boost gold’s demand and status as a safe-haven investment.

- Transfer money from the rich to the poor: The government may collect less tax revenue, as reduced income leads to less spending, as well as reduced sales and income tax revenues. The government then spends more than it earns, leading to a budget deficit and forcing it to borrow from wealthy lenders. Raising taxes on the wealthy lenders may create social tension, political instability, and economic unsuitability that may be hard to curb. Amid such rising tension, gold once again emerges as a safe bet for the investors’ money.

- Print money: Interest rates may already be pinned to zero, so the only option banks have to print money to buy financial assets and government bonds, driving up the asset prices. The central bank can print money but can buy only financial assets with it. However, the central government can buy goods and services, and it can direct funds into social programs. Such actions can fund the deficit. However, this measure is inflationary. Thus, rising asset prices may create confidence in other investments and gold demand may dip, leading to a downturn in its prices.