First Majestic Silver Corporation

Latest First Majestic Silver Corporation News and Updates

Is Silver More Valuable as a Precious Metal or an Industrial Metal?

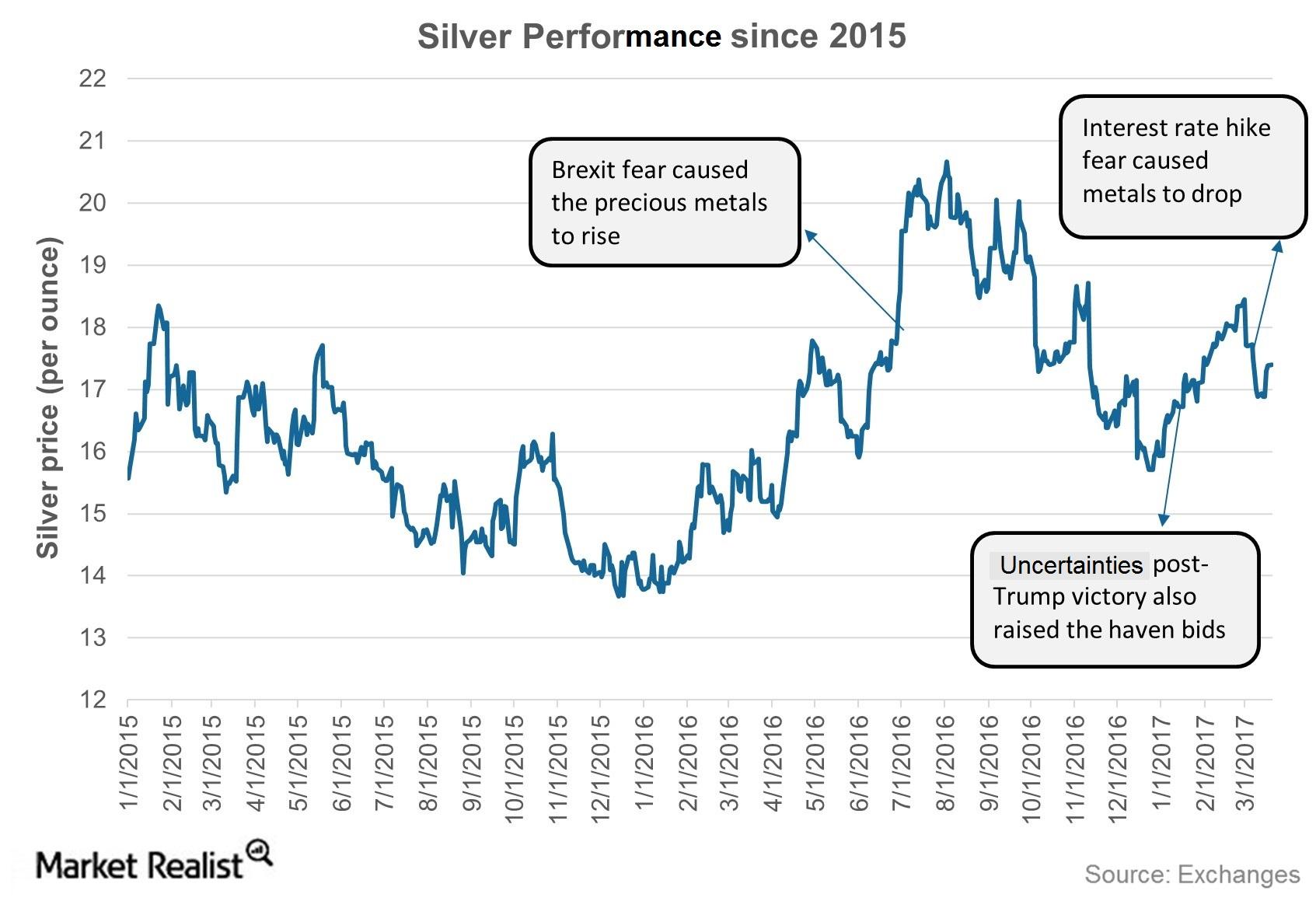

Silver has been falling over the past few years, despite surging demand for its industrial use. Fundamentally, silver seems to be strong due to rising demand and a year-over-year shortfall in its supply.

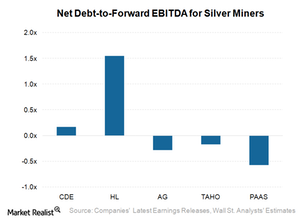

Behind Silver Miners’ Debt Repayment Capacities

Silver companies try to maintain an optimal level of debt-to-equity to lower their costs of capital and maintain an optimum level of risk-reward for shareholders.

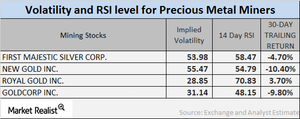

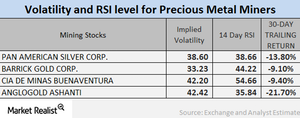

How Mining Stock Volatility Numbers Are Moving Now

First Majestic, New Gold, Agnico, and Silver Wheaton now have RSI scores of 60.5, 56.2, 57.6, 59.6, respectively.

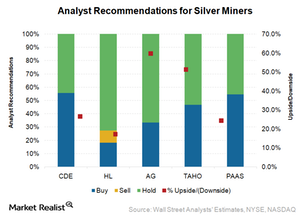

How the Ratings and Potential Upsides for Silver Miners Look Today

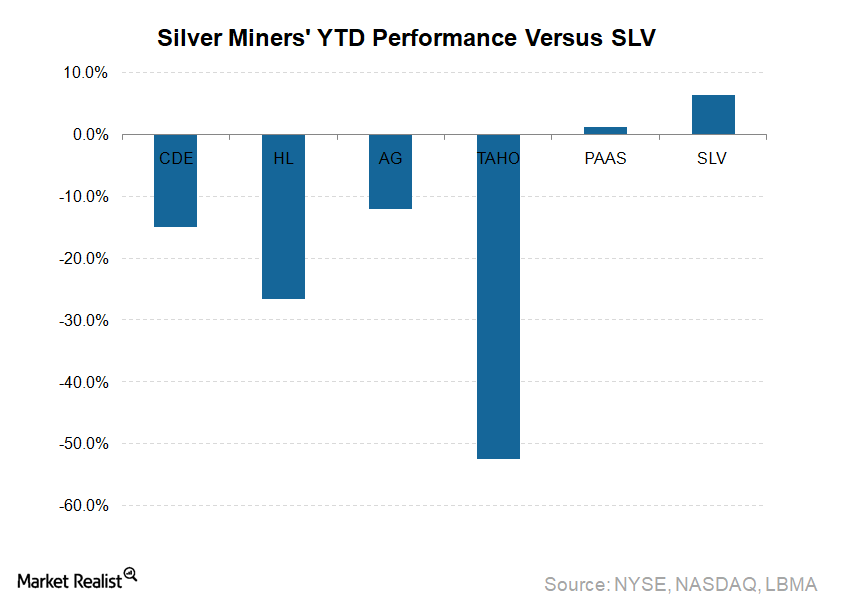

The performances of precious metal miners with substantial exposure to silver have been disappointing in 2017. As a group, they’ve returned just 0.9% YTD.

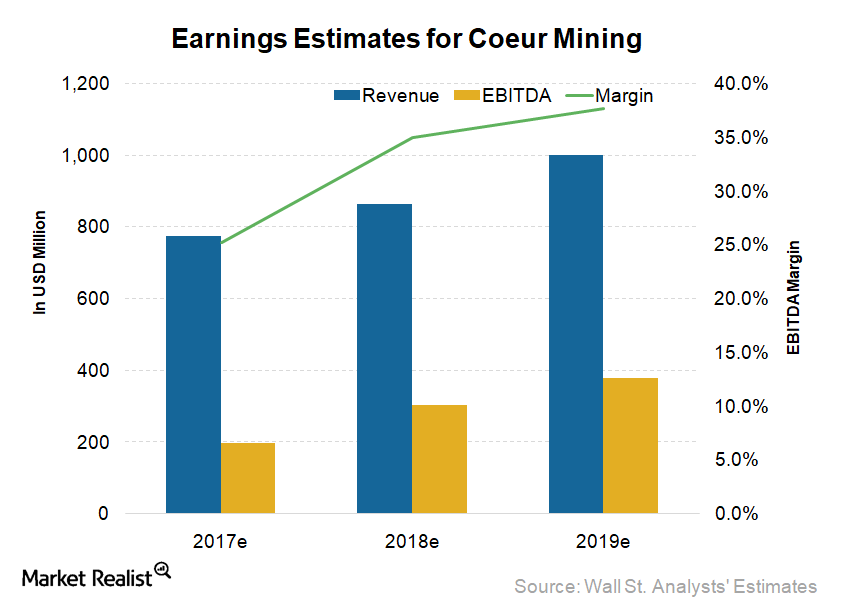

The Market Sentiment for Coeur Mining as 4Q17 Begins

CDE stock has risen 2.6% year-to-date. However, during the same period, silver prices gained 4.7% and the Global X Silver Miners ETF (SIL) rose 5.5%.

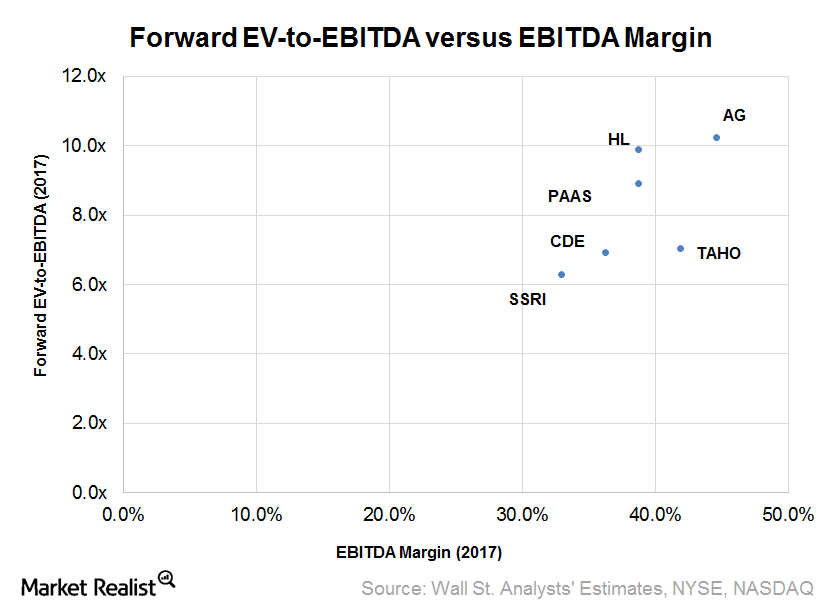

Analyzing Silver Miners’ Relative Valuations

Precious metals miners with substantial exposure to silver are usually classified as silver miners.

How Silver Prices Are Influencing Major Silver Miners

Mining companies like First Majestic Silver (AG), Silver Wheaton (SLW), Pan American Silver (PASS), Coeur Mining (CDE), and Hecla Mining (HL) are primarily into silver exploration.

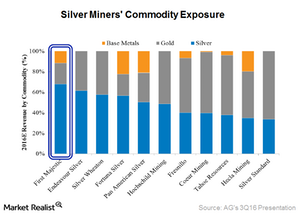

Which Silver Miners Offer Diversified Exposure to Commodities?

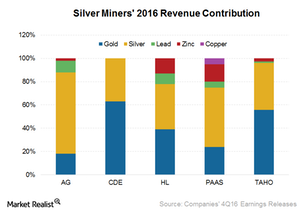

For investors considering silver stocks due to their leveraged exposure to silver prices, the higher the company’s revenues derived from silver, the better.

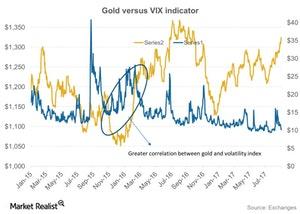

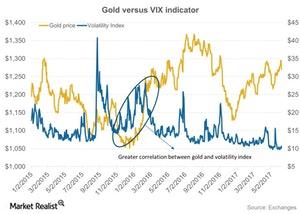

How the Economic Sentiment Is Playing on Gold

During the past week, average hourly earnings, excluding the farming industry, were below analysts’ expectation of 0.10%.

The Most Crucial Element in the Precious Metals Downtrend

Gold ended the day almost flat on Wednesday, May 2, and closed at $1,304.90 per ounce.

A Quick Look at the Precious Metals Revival, Miners’ Performances

Precious metals prices shot up on January 19, 2018, with concerns looming over the shutdown the of the US government.

Analyzing the Correlation of Gold to Miners in January 2018

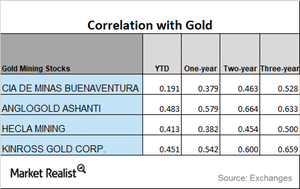

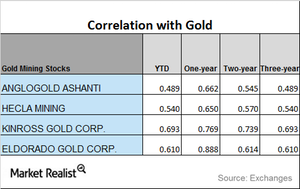

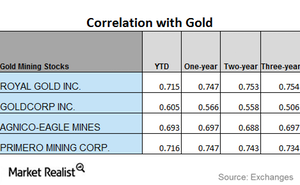

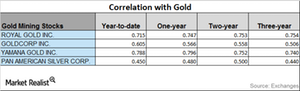

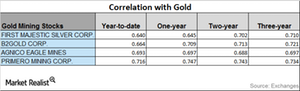

First Majestic Silver saw correlation drop during the past three years. On a three-year basis, its correlation with gold was 0.57.

A Brief Analysis of Silver Miners in January 2018

The target prices of the four miners we’re covering in this part are higher than their current trading prices, which could lead to an optimistic outlook on their prices.

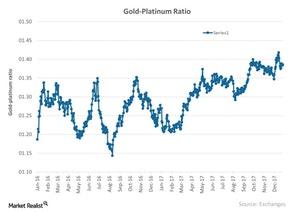

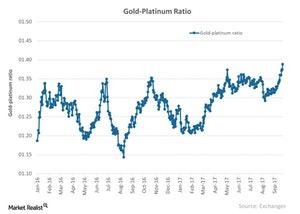

Understanding the Recent Gold-Platinum Cross Rate

When analyzing platinum markets, it’s important to compare the metal’s performance with that of gold, which is the most crucial of the precious metals.

Will Gold Maintain Its Close Correlation to Inflation?

The rise in inflation could be a positive sign for the current scenario.

A Quick Look at the Performance of Silver Miners in December 2017

Coeur Mining and Hecla Mining have seen a loss in their prices on a year-to-date basis, falling 17.9% and 24.0%, respectively.

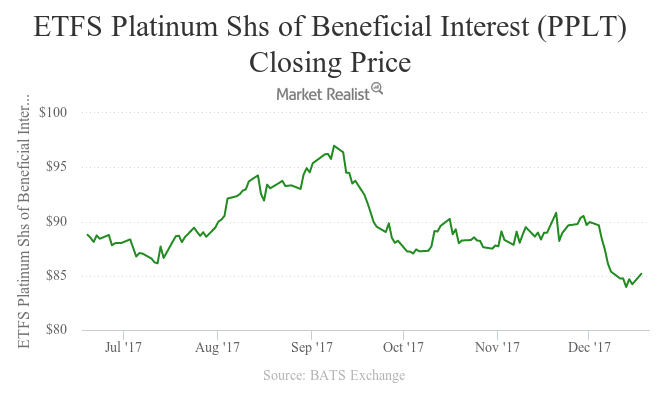

Why Platinum Led the Precious Metals Pack on December 18

All four precious metals except palladium witnessed an up day on December 18, 2017. Platinum touched the day’s high of $915.3 and ended up at $913.2 per ounce.

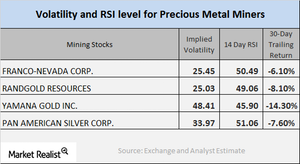

Today’s Correlation Study of Key Mining Stocks with Gold

The Global X Silver Miners ETF (SIL) and the Sprott Gold Miners (SGDM) have fallen 3.5% and 4.4%, respectively, on a 30-day trailing basis.

The Correlation Trends of Miners in 2017

If we look at the YTD correlations of the select mining shares to gold, there has been a reasonable fall. On a YTD basis, Sibanye Gold has the least correlation to gold.

What Factors Could Drive Coeur Mining Stock in 2018?

Coeur Mining (CDE) was one of the stocks to gain significantly in 2016, rising ~270%. The situation in 2017 has reversed completely.

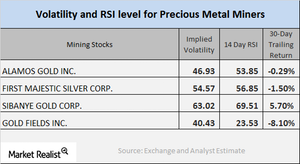

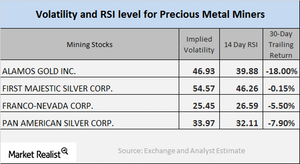

A Quick Look at Miners’ Technical Details

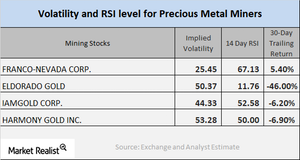

As of November 16, 2017, Alamos Gold, First Majestic Silver, Sibanye Gold, and AngloGold Ashanti had call-implied volatilities of 46.9%, 54.6%, 63%, and 40.9%, respectively.

A Quick Look at Miners’ Recent Performance

Precious metal miners saw mixed performance on Tuesday, November 14. Gold and silver saw an up-day while platinum and palladium were low.

Yield Changes for Precious Metals: What Could Be the Impact?

If we look beyond the dollar influence on precious metals, we can analyze how the probability of an interest rate hike could influence precious metals and their miners.

Silver Mining Stock Technicals as of Last Week

AG, CDE, and HL have shown YTD losses of 12%,16%, and 9.2%, respectively. The silver-based Global X Silver Miners Fund (SIL) has a YTD loss of 0.31%.

A Look at the Correlation Trends for Miners

Franco-Nevada and Silver Wheaton have seen an upward trend in their correlations with gold.

Platinum Ratio Analysis: Which Way Is Platinum Moving?

The gold-platinum spread was ~1.38 on October 23. The RSI (relative strength index) level for the gold-platinum spread is now at 93.9.

How Mining Stocks Have Moved in October

On October 23, Alamos, First Majestic Silver, Sibanye Gold, and Gold Fields had call implied volatilities of 46.9%, 54.6%, 63%, and 40.4%, respectively.

Analyzing Mining Shares’ Correlation in October

Understanding mining stocks’ correlation with gold is crucial for investors in precious metal mining stocks.

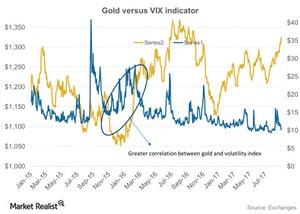

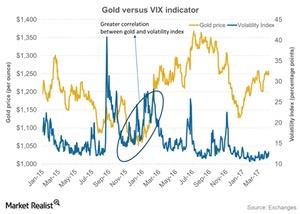

Are Global Fears Controlling Precious Metals?

Ongoing worries in North Korea and political chaos in Washington have been crucial in boosting the prices of precious metals.

Inside Mining Stock Technicals on October 12

Most precious metals had a down day on Tuesday, October 10, despite the recent overall upward movement in precious metals.

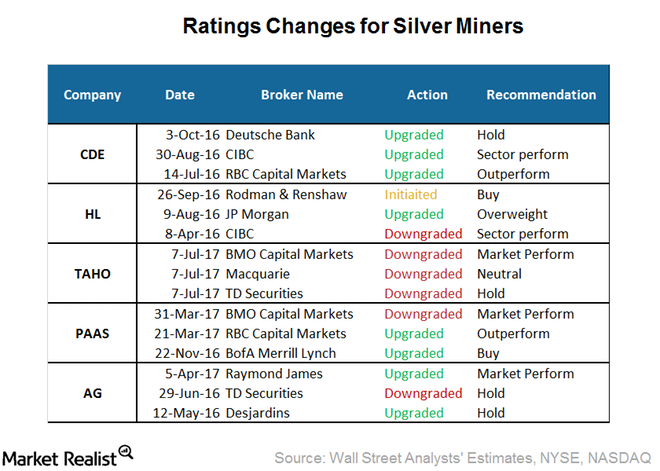

Behind the Recent Analyst Rating Changes for Silver Miners

After the Guatemalan government’s decision to suspend Tahoe Resources’ (TAHO) license, the company saw several downgrades.

What Are Mining Stock Technical Indicators Telling Us?

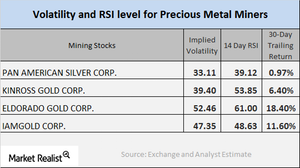

On September 29, Alamos, First Majestic Silver, Franco-Nevada, and Pan American had call implied volatilities of 46.9%, 54.6%, 25.5%, and 34%, respectively.

Understanding Mining Company Technicals amid Today’s Turbulence

Many mining stocks saw a revival in prices on Monday, September 25, 2017, since precious metals saw an upswing.

Analyzing Miners’ Technicals in September 2017

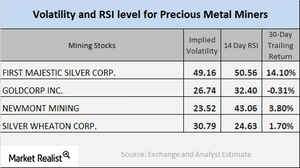

On September 22, 2017, First Majestic Silver, Goldcorp, Newmont Mining, and Silver Wheaton had volatilities of 49.1%, 26.7%, 23.5%, and 30.8%, respectively.

Why Most Mining Stocks Fell on Friday

Precious metal mining stocks follow trends in precious metals, and they’re a very volatile segment of the equity markets.

How North Korea Has Affected the Precious Metal Market

Precious metals have been buoyed by tension in North Korea. If North Korea does another missile test, it could prompt investors to move to haven assets such as gold, silver, Treasuries, and major currencies.

A Look at Mining Stocks’ Correlation with Gold

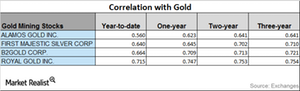

Miners’ correlation with gold In this part, we’ll look at mining stocks’ correlation with precious metals by comparing their price movement. Specifically, we’ll analyze Alamos Gold (AGI), First Majestic Silver (AG), B2Gold (BTG), and Royal Gold (RGLD). The mining stocks have recovered in the past few weeks. The Direxion Daily Gold Miners Bull 3x Shares […]

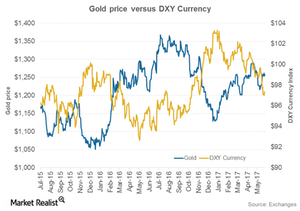

How the Euro Pushed the Dollar Lower and What It Meant for Gold

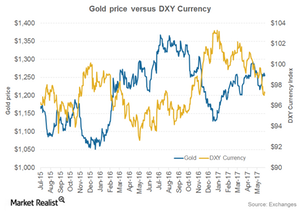

July 20, 2017, was an up day for the euro, which put downward pressure on the US dollar as represented by the U.S. Dollar Index (or DXY).

RSI Levels Have Fallen: Will Miners Rebound Soon?

Gold and silver-based funds such as SGOL and SIVR are impacted by changes in precious metal prices. They fell due to the fall in precious metals on Friday.

How Precious Metals’ Slump Dragged Mining Shares and Funds Lower

Gold tumbled to an eight-week low on July 3, 2017. Gold futures for August delivery fell almost 1.9% to settle at $1,219.2 per ounce.

Insight into the Silver Market in June 2017

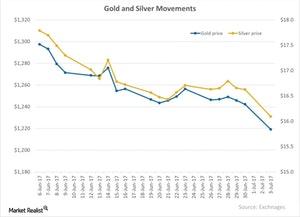

Silver has seen a five-day trailing loss of 2.6%, while gold and platinum fell 1.7% and 1.9%, respectively.

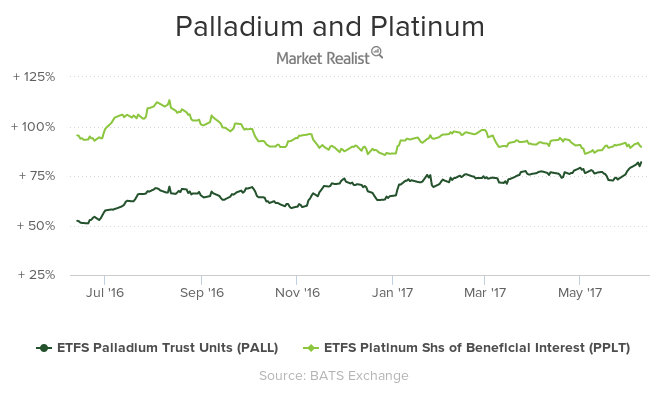

Palladium Skyrockets: A Look at What’s in Store Next

Although gold and silver had a down day on Friday, June 9, 2017, platinum and palladium rose about 0.23% and 1.2%, respectively.

What’s the Correlation between the Dollar and Gold?

The rise in gold on June 6 also boosted the other three precious metals. Silver futures for August delivery were 1.4% higher for the day and closed at $17.6 per ounce.

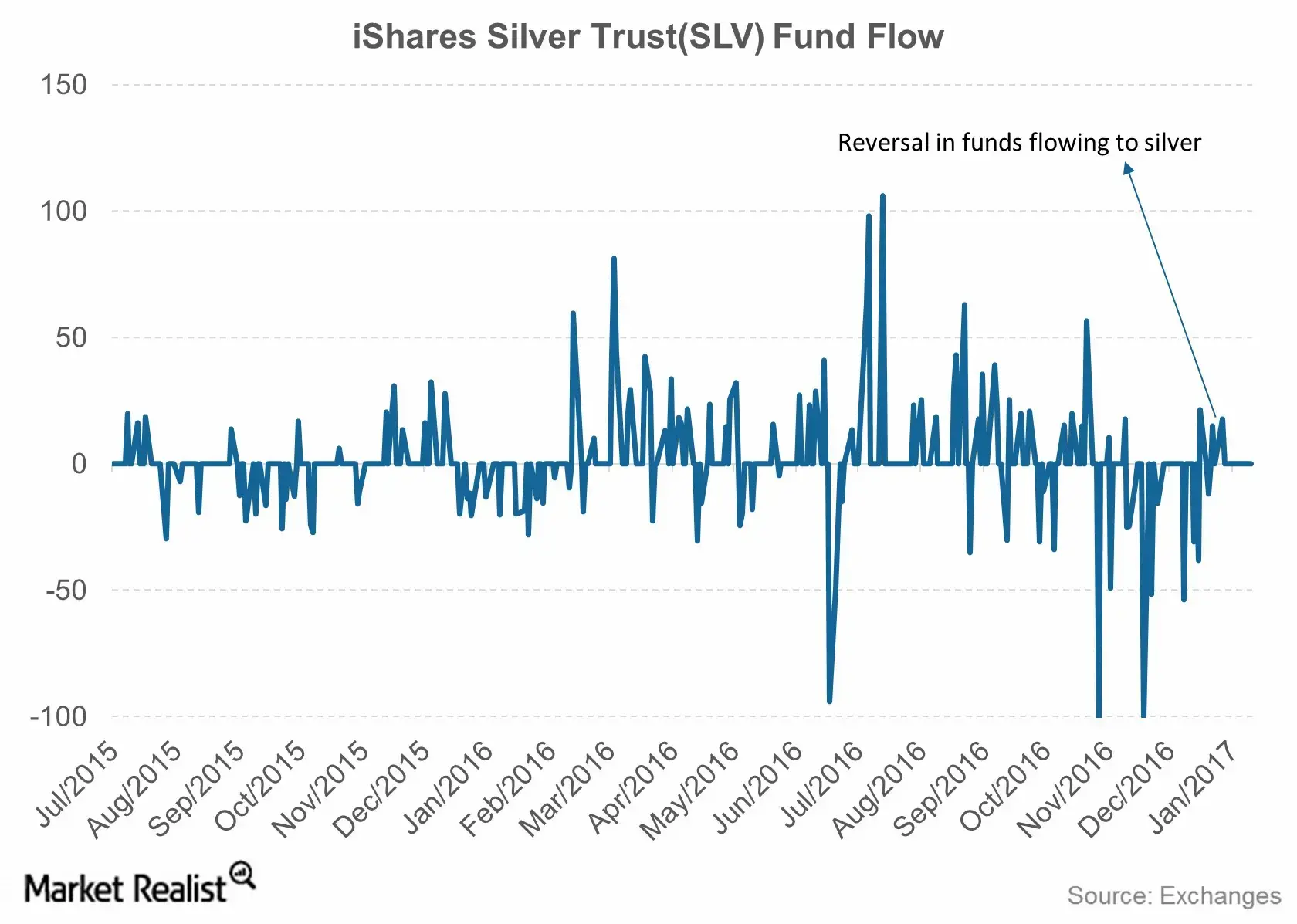

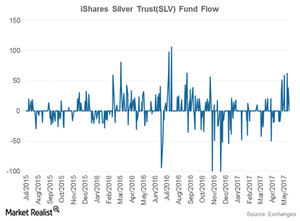

Reading the Fund Flows of the iShares Silver Trust

Over the past year, silver has been very volatile compared to the other three precious metals. Silver was the highest among precious metals in mid-April 2017.

Inside the Monthly Mining Correlations as of May 3

Metal investors have to study upward and downward trends as price change predictability can be affected by rises and falls in precious metal prices.

A Look at Mining Stocks’ Correlation with Gold in 2017

Mining stocks and precious metals As global tumult grips markets and investors are turning to mining stocks as safe havens, it’s crucial to understand which stocks are closely tied to precious metals. Stocks with a higher correlation with precious metals will likely be impacted more by global indicators that influence precious metals. The Direxion Daily […]

Upcoming French Elections Could Impact Gold

Since the French elections are right around the corner, investors might start parking their money in safe-haven assets like gold.

A Look at Silver Miners’ 2016 Commodity Exposure

Commodity exposure In the previous part of this series, we looked at miners’ geographic exposure, which is important to consider due to the geopolitical risks some jurisdictions face. It’s equally important to consider their revenue compositions in terms of commodity exposure. Contribution from silver Silver companies are rarely pure-play miners. For investors considering silver […]

Analyzing the Correlation between Silver Prices and Miners

Mining funds such as the iShares MSCI Global Gold Min (RING) and the leveraged ProShares Ultra Gold (AGQ) have also seen significant correlations with their respective precious metals.

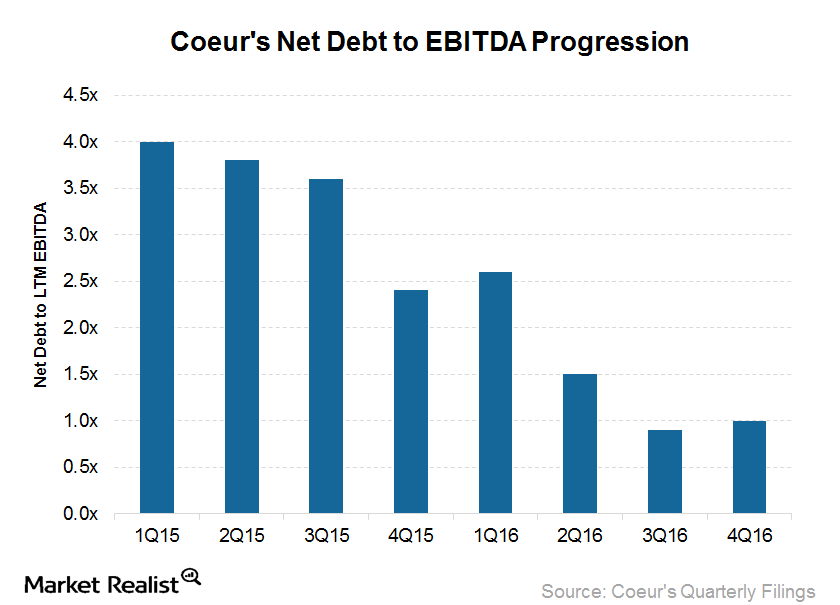

Coeur’s Financial Leverage Improves: A Word of Caution

Coeur Mining (CDE) ended 2016 with an outstanding debt of $210.9 million. That’s 57.0% less than at the end of 2015.