Behind Silver Miners’ Debt Repayment Capacities

Silver companies try to maintain an optimal level of debt-to-equity to lower their costs of capital and maintain an optimum level of risk-reward for shareholders.

Nov. 20 2020, Updated 5:31 p.m. ET

Paying debt through earnings

Debt is not always a problem. In fact, companies try to maintain an optimal level of debt-to-equity in order to lower their costs of capital and, at the same time, maintain an optimum level of risk-reward for shareholders.

Moreover, investors feel secure if a company has the ability to repay its debt through its earnings, and so it’s important to analyze if a company is in a position to repay its debt through its earnings. The net debt-to-EBITDA (earnings before interest, tax, depreciation, and amortization) ratio is one such gauge. This ratio indicates how many years it will take for a company to repay its debt.

EBITDA is helpful in comparing companies with different capital structures. For the purpose of our ratios, we’ll use the forward EBITDA, which reflects a company’s earnings estimates for the future. This is important because we need to know the repaying capacity of a given company based on its ongoing earnings.

Repayment capacity

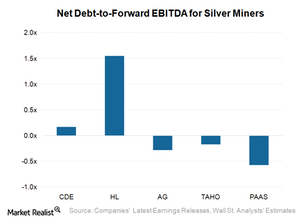

Three miners in our select peer group—First Majestic Silver (AG), Tahoe Resources (TAHO), and Pan American Silver (PAAS)—are in net cash positions. This leaves only two companies for this discussion.

Coeur Mining’s (CDE) net debt-to-forward-EBITDA ratio has improved to 0.17x, compared with 0.40x three months ago. The ratio seems quite comfortable. Hecla Mining’s (HL) ratio is slightly higher at 1.5x and is not a cause for concern. Notably, most of Hecla’s debt is long-dated, with a robust cash position.

Coeur and Tahoe together contribute 26.5% of the Global X Silver Miners ETF’s (SIL) total holdings. Investors can also access precious metal by investing in the silver ETFs (AGQ) like the iShares Silver Trust (SLV).

In the next part, we’ll analyze free cash flow upsides.