ProShares Ultra Silver

Latest ProShares Ultra Silver News and Updates

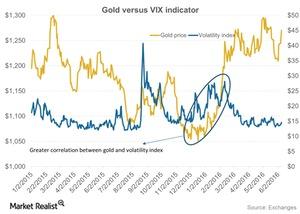

How Much Could Brexit and Volatility Control Gold?

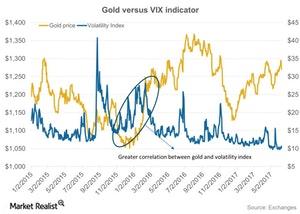

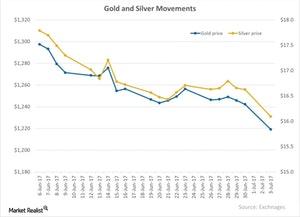

Fears in the overall financial market about a Brexit, the possible exit of Britain from the European Union, have abated. This helped gold fall.

How Investor Appetite for Risk Impacts Precious Metals

Gold and silver have seen trailing-five-day losses of 0.9% and 2.7%, respectively. The reason behind the fall in the precious metals is the buoyancy of the equity markets and the gains in the US dollar.

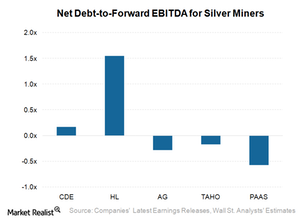

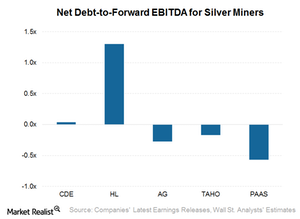

Behind Silver Miners’ Debt Repayment Capacities

Silver companies try to maintain an optimal level of debt-to-equity to lower their costs of capital and maintain an optimum level of risk-reward for shareholders.

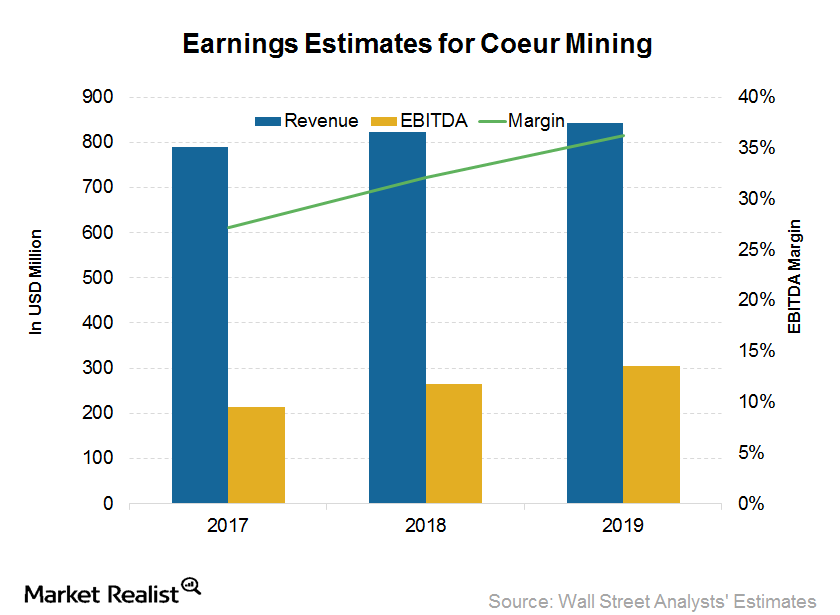

Analysts Are Optimistic about Coeur Mining

Market sentiment for Coeur Mining Coeur Mining (CDE) is a high-cost producer compared with peers (RING) (SIL). While it has initiated several measures to bring down its costs in the last few years, they remain high. Higher costs make CDE more leveraged to gold and silver prices than other low-cost producers such as Barrick Gold (ABX) […]

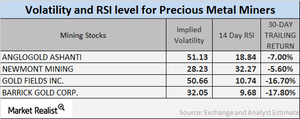

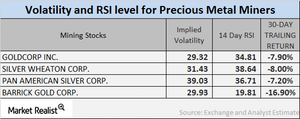

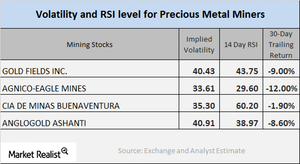

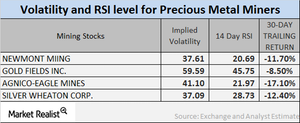

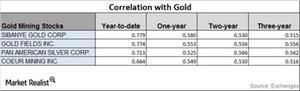

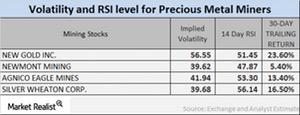

What Falling Miner RSI Levels Suggest

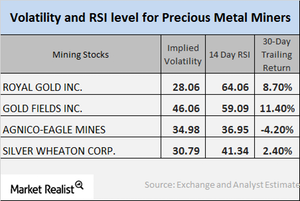

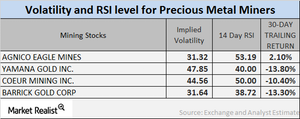

The RSI levels of our four select mining giants have all increased lately due to their higher stock prices.

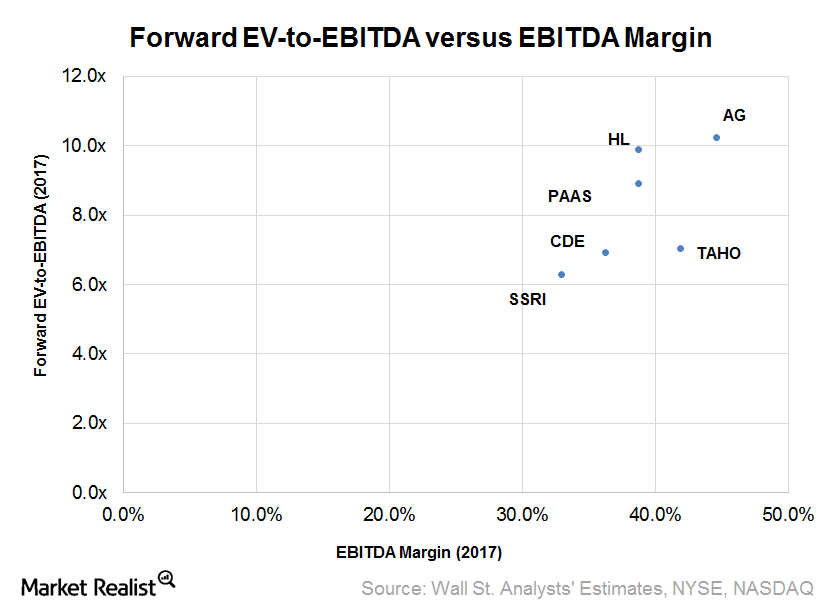

Analyzing Silver Miners’ Relative Valuations

Precious metals miners with substantial exposure to silver are usually classified as silver miners.

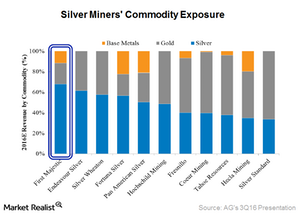

Which Silver Miners Offer Diversified Exposure to Commodities?

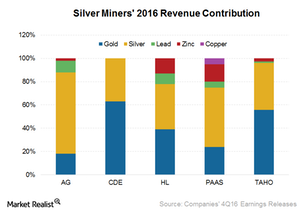

For investors considering silver stocks due to their leveraged exposure to silver prices, the higher the company’s revenues derived from silver, the better.

Mining Stocks Are Recovering from Their Slump

The Direxion Daily Gold Miners (NUGT) and the ProShares Ultra Silver (AGQ), both leveraged mining funds, both have recovered and jumped 19.4% and 24.9%, respectively, on a five-day trailing basis.

Mining Stocks Today: Your Technical Updates

On October 5, Gold Fields, Agnico-Eagle, Cia De Minas Buenaventura, and AngloGold had implied volatility readings of 40.4%, 33.6%, 35.3%, and 40.9%, respectively.

What Are Mining Stock Technical Indicators Telling Us?

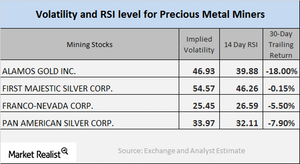

On September 29, Alamos, First Majestic Silver, Franco-Nevada, and Pan American had call implied volatilities of 46.9%, 54.6%, 25.5%, and 34%, respectively.

Reading the Technicals of Mining Shares in September 2017

Most mining shares witnessed an up day on Monday, September 25, 2017, as precious metals increased over the ongoing global tensions.

How Gold, Silver, and Mining Companies Performed on September 18

On September 18, gold fell 1.1% and closed at $1,306.90 per ounce. Of the precious metals, silver fell 3.1% and closed at $17.10 per ounce.

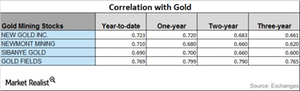

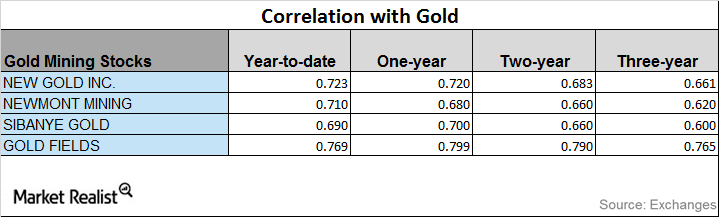

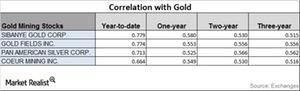

A Correlation Study of Mining Stocks in September 2017

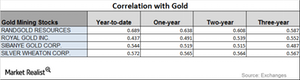

Among the four miners we’re looking at, Gold Fields has the highest correlation to gold on a YTD basis, while Sibanye Gold has the lowest correlation to gold.

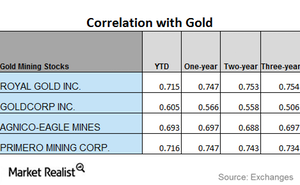

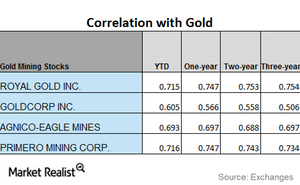

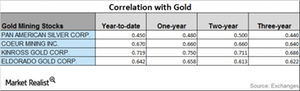

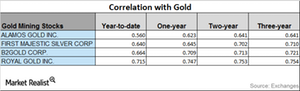

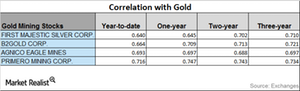

A Look at Mining Stocks’ Correlation with Gold

Miners’ correlation with gold In this part, we’ll look at mining stocks’ correlation with precious metals by comparing their price movement. Specifically, we’ll analyze Alamos Gold (AGI), First Majestic Silver (AG), B2Gold (BTG), and Royal Gold (RGLD). The mining stocks have recovered in the past few weeks. The Direxion Daily Gold Miners Bull 3x Shares […]

The Correlation Analysis of Miners through August 2017

Silver Wheaton has a three-year correlation of ~0.70 with gold and a year-to-date correlation of ~0.80.

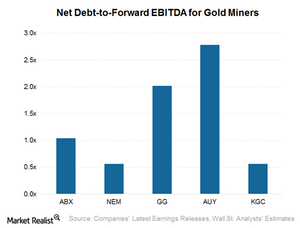

Assessing Gold Miners’ Capacity to Repay Debt through Earnings

Yamana Gold’s (AUY) net-debt-to-forward EBITDA ratio is 2.8x, which is higher than its peers’ ratios.

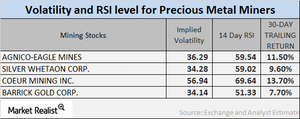

Unpacking the Technical Indicators for Mining Stocks

Mining stocks have bounced back from the choppy markets we’ve seen over the past month. On July 20, most mining stocks saw upward movements in their prices.

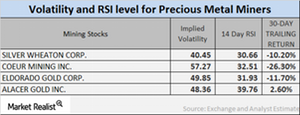

Have Miners’ Relative Strength Levels Revived?

In this article, we’ll look at some important technical indicators for Coeur Mining (CDE), Barrick Gold (ABX), Buenaventura (BVN), and AngloGold Ashanti (AU).

How Has Miners’ Volatility Trended in July?

Mining stocks have bounced back from the choppy markets seen over the past week.

How Precious Metals’ Slump Dragged Mining Shares and Funds Lower

Gold tumbled to an eight-week low on July 3, 2017. Gold futures for August delivery fell almost 1.9% to settle at $1,219.2 per ounce.

These Mining Companies Are Showing an Uptrend Correlation with Gold

When we try to interpret the performance of precious metals, it’s crucial to study the impact of metal price variations on mining shares.

Mining Stocks’ Relative Strength Index Hits Rock Bottom

The rise and fall of precious metals also significantly impact mining-based leveraged funds like the Direxion Daily Gold Miners (NUGT) and Proshares Ultra Silver (AGQ).

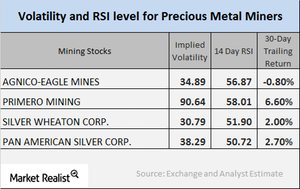

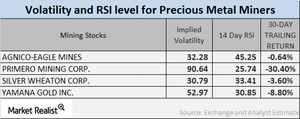

Why RSI levels of Mining Shares Are Rising

On June 6, the implied volatilities of Alamos Gold, Primero Mining, Silver Wheaton, and Franco-Nevada were 51.1%, 90.6%, 30.8%, and 24.5%, respectively.

How Silver Miners Rank Based on Debt Repayment Capacity

Coeur Mining (CDE) has a net debt-to-forward-EBITDA ratio of 0.40x, which seems comfortable. Hecla Mining’s (HL) ratio is slightly higher at 1.3x.

How Are the Correlations of Mining Stocks Moving?

Fears surrounding a potential upcoming interest rate hike took over precious metals recently, and they fell at the beginning of May 2017.

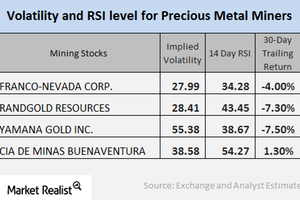

Reading the Mining Stocks’ Falling RSI Numbers

Newmont Mining, Silver Wheaton, Randgold, and Yamana have RSI levels of 45.5, 37.1, 41.2, and 43.0, respectively.

Correlation Trends of Miners to Gold

Among the leveraged mining funds, the Direxion Daily Gold Miners ETF (NUGT) and the Proshares Ultra Silver ETF (AGQ) have seen considerable losses over the past month.

A Look at Mining Stocks’ Correlation with Gold in 2017

Mining stocks and precious metals As global tumult grips markets and investors are turning to mining stocks as safe havens, it’s crucial to understand which stocks are closely tied to precious metals. Stocks with a higher correlation with precious metals will likely be impacted more by global indicators that influence precious metals. The Direxion Daily […]

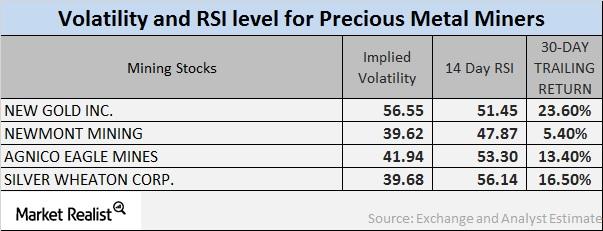

Behind Mining RSI Levels and Volatility Now

Leveraged mining funds including the Direxion Daily Gold Miners (NUGT) and the Proshares Ultra Silver (AGQ) saw big jumps in early 2017 due to the revival in precious metals.

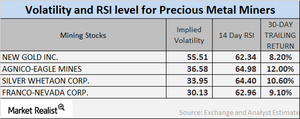

Analyzing the Volatility of Mining Stocks

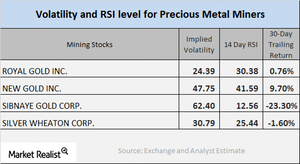

As of April 6, 2017, the volatilities of New Gold (NGD), Agnico Eagle (AEM), Silver Wheaton (SLW), and Franco-Nevada (FNV) were 55.5%, 36.6%, 34%, and 30.1%, respectively.

How Are Mining Stocks Performing at the Start of April 2017?

As of April 4, 2017, the volatilities of New Gold (NGD), Agnico Eagle Mines (AEM), Silver Wheaton (SLW), and Randgold Resources (GOLD) were 51.5%, 35.4%, 61.7%, and 54.1%, respectively.

Understanding Mining Stock Volatility in March

Now that mining companies have begun witnessing revivals from their losses earlier this year, it becomes crucial to examine the volatility figures and RSI.

Mining Stock RSI levels: What the Indicators Suggest

NUGT and AGQ have seen YTD rises of 18.6% and 27.5%, respectively. But the volatility of such mining funds can be higher than that of precious metals.

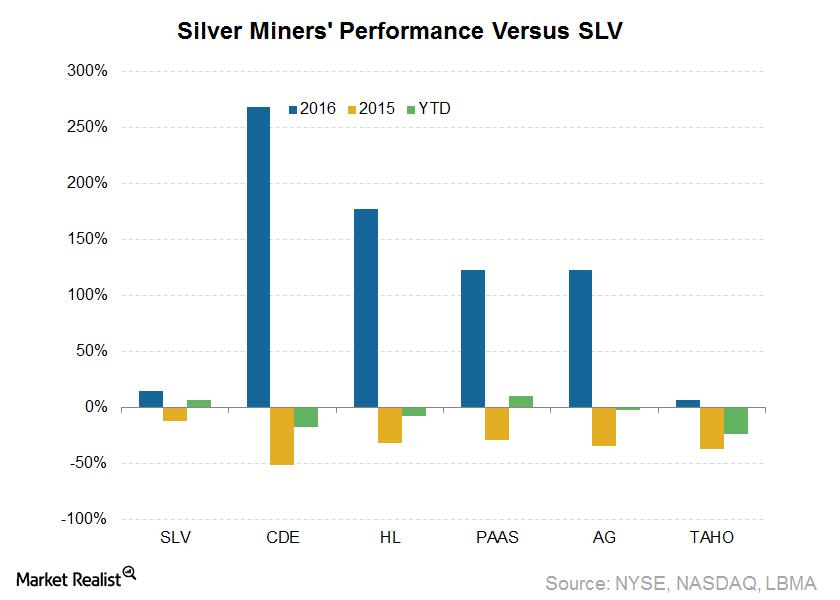

A Look at Silver Miners’ 2016 Commodity Exposure

Commodity exposure In the previous part of this series, we looked at miners’ geographic exposure, which is important to consider due to the geopolitical risks some jurisdictions face. It’s equally important to consider their revenue compositions in terms of commodity exposure. Contribution from silver Silver companies are rarely pure-play miners. For investors considering silver […]

Analyzing the Correlation between Silver Prices and Miners

Mining funds such as the iShares MSCI Global Gold Min (RING) and the leveraged ProShares Ultra Gold (AGQ) have also seen significant correlations with their respective precious metals.

Looking at Silver Miners after the Federal Reserve’s Rate Hike

Silver miners (SIL) are usually a levered play on gold. Notably, silver has outperformed gold year-to-date.

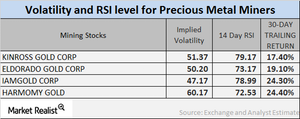

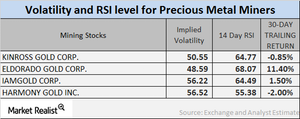

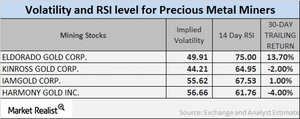

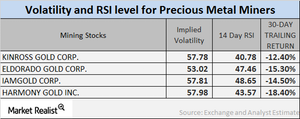

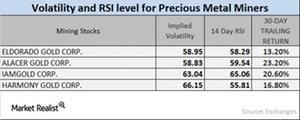

Reading Mining Companies’ Volatilities and RSI Levels

Mining companies’ volatilities are significant to the buying process. The mining shares we’ve selected in this article are Kinross Gold, Eldorado Gold, IAMGOLD, and Harmony Gold.

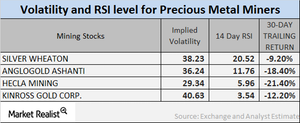

Analyzing Mining Stocks’ Volatility

As of March 15, the volatilities of Silver Wheaton, AngloGold Ashanti, Hecla Mining, and Kinross Gold were 38.2%, 36.2%, 29.3%, and 40.6%, respectively.

Are Miners Rebounding from Last Week’s Slump?

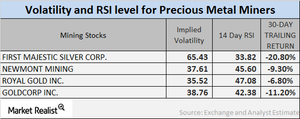

Monitoring the implied volatilities of large mining stocks is important. We should also watch their RSI (relative strength index) levels, particularly in the wake of changing precious metals prices.

How Precious Metals Have Performed amid Volatility

Precious metal mining stocks are known to closely track the performances of precious metals.

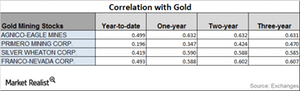

Mining Stocks: An Upward or Downward Correlation to Gold?

Agnico-Eagle Mines has the highest correlation to gold year-to-date. Primero Mining is the least correlated to gold.

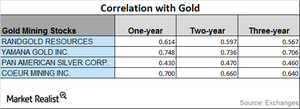

Analyzing the Upward-Downward Correlation of Precious Metals

Mining companies with high correlations to gold include Randgold Resources (GOLD), Yamana Gold (AUY), Pan American Silver (PAAS), and Coeur Mining (CDE).

Reading the Correlation Movement of Mining Stocks

Sibanye Gold has the closest correlation to gold on a YTD basis among the four miners under review.

How Miners’ Correlations Are Moving

Precious metals prices have risen from the ten-month lows they saw in December 2016. As a result, most mining stocks have also risen substantially.

Analyzing the Volatility of Miners in February 2017

Call implied volatility takes into account the changes in an asset’s price due to variations in the price of its call option.

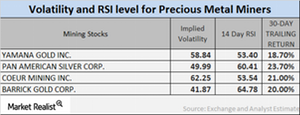

How Interest Rates Are Impacting Precious Metals

Many of the recent changes in precious metals have been determined by changes in the interest rates offered on US Treasuries.

Reading the Volatility Numbers for Mining Stocks

It’s important to monitor the implied volatilities and RSI levels of large mining stocks, particularly in the wake of the changes in precious metal prices.

Where Are Mining Stocks’ RSI Numbers and Volatility Pointing?

The trailing 30-day returns of most mining companies are positive due to precious metals’ diminishing safe-haven appeal.

Reading the Volatility and RSI Levels for Miners

Precious metal mining stocks are known to closely track the performance of their respective precious metals. Mining stocks often show more volatility than metals.

Understanding the Correlation of Mining Stocks in 2017

Precious metal prices have been falling since Trump won the US Presidential election on November 8, 2016. Mining stocks quickly followed suit.