ProShares Ultra Silver

Latest ProShares Ultra Silver News and Updates

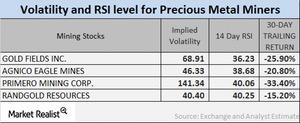

Volatility among the Miners in 2017

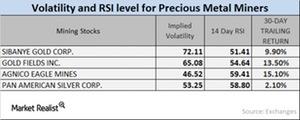

Sibanye Gold, Gold Fields, Agnico-Eagle Mines, and Pan American Silver had RSI levels of 51.4, 54.6, 59.4, and 58.8, respectively.

Why Mining Stocks Are Seeing Rising RSI Levels

In this part, we’ll look at the implied volatilities of large mining stocks and their RSI levels in the wake of precious metal prices.

What’s the Correlation between Mining Stocks and Gold?

Mining companies that have high correlations with gold include Agnico Eagle Mines (AEM), Alacer Gold (ASR), Alamos Gold (AGI), and AngloGold Ashanti (AU).

What Are Miners’ Volatility and RSI Levels?

Precious-metal-based funds such as the ProShares Ultra Silver (AGQ) and the Direxion Daily Gold Miners (NUGT) have seen a revival in their price during the last month.

Analyzing Silver’s January Technicals

Among the other precious metals trading on the COMEX, silver shares for March expiration maintained an almost flat end to the day on January 11, 2017.

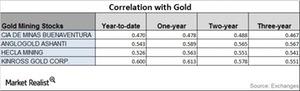

How Mining Stocks Reacted to Plummeting Metals

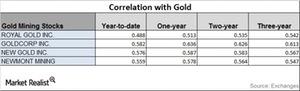

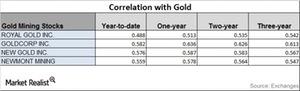

Mining companies that have high correlations to gold include Royal Gold (RGLD), Goldcorp (GG), New Gold (NGD), and Newmont Mining (NEM).

What Were Mining Stocks’ Correlations during December?

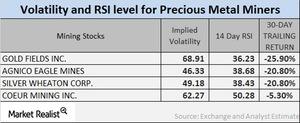

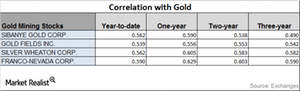

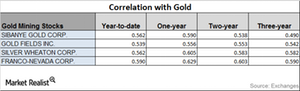

Precious metals had a great start to 2016. Franco-Nevada’s correlation rose from an ~0.59 three-year correlation to an ~0.63 one-year correlation.

Analyzing Mining Stocks’ Correlation in 2016

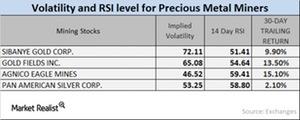

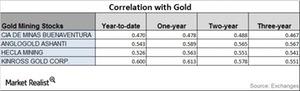

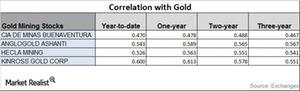

Mining companies that have high correlations with gold include Buenaventura (BVN), AngloGold Ashanti (AU), Hecla Mining (HL), and Kinross Gold (KGC).

Analyzing Upward and Downward Correlations among Miners

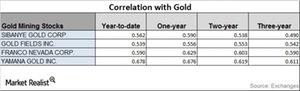

Precious metals had a great start to 2016, but they’ve been falling since Donald Trump won the US presidential election. As a result, mining stocks have also been falling.

How Are Miners and Gold Correlated?

The substantial returns of most mining companies have been due to safe-haven bids that boosted gold and other precious metals.

Reading the Correlation of the Mining Stocks

Mining stocks and gold Although precious metals were doing well at the beginning of 2016, it’s important to know which mining stocks overperformed and underperformed precious metals. Precious metal prices have been falling since Donald Trump won the US presidential election on November 8, 2016. As a result, mining stocks have also been falling. Mining […]

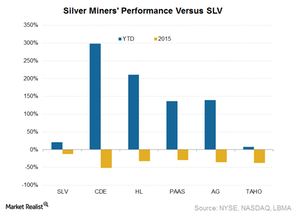

What’s in Store for Silver Miners after the Fed’s Rate Hike?

Silver miners have shown a significant correlation to gold prices, at 0.84 from the start of 2013 to December 14, 2016.

Which Mining Stocks Have Highest Correlation to Gold?

Mining companies that have high correlations with gold include Cia de Minas Buenaventura (BVN), AngloGold Ashanti (AU), Hecla Mining (HL), and Kinross Gold (KGC).

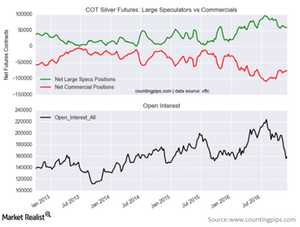

Commercial and Non-Commercial Positions in Silver Are Falling

Silver-based mining funds like the Global X Silver Miners Fund (SIL) have been negatively impacted by the drop in silver prices.

Which Mining Stock Is Most Correlated to Gold?

Mining companies that have high correlations with gold include Sibanye Gold (SBGL), Gold Fields (GFI), Silver Wheaton (SLW), and Franco-Nevada (FNV).

Analyzing the Correlation of Mining Stocks

Mining companies that have high correlations with gold include Alamos Gold (AGI), First Majestic Silver (AG), B2Gold (BTG), and Royal Gold (RGLD).Macroeconomic Analysis How Has the US Dollar Affected Platinum Prices?

The current weakness in the rand made it fall to all-time lows against the US dollar in early 2016 but has helped mining companies.

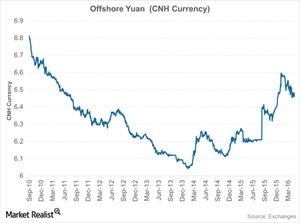

Two Yuan: What’s the Difference between CNY and CNH?

When understanding the Chinese markets and their prospects for internationalizing the yuan, it’s crucial to study both onshore and offshore yuan.