Two Yuan: What’s the Difference between CNY and CNH?

When understanding the Chinese markets and their prospects for internationalizing the yuan, it’s crucial to study both onshore and offshore yuan.

April 27 2016, Published 3:18 p.m. ET

CNH versus CNY

When understanding the Chinese markets and their prospects for internationalizing the yuan, it’s crucial to study both onshore and offshore yuan. So far in this series, we’ve discussed only CNY, the domestic currency (or the onshore yuan) as opposed to CNH, the offshore currency.

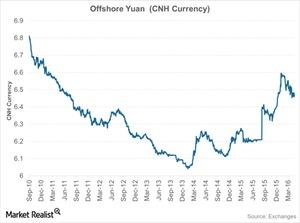

The crucial difference between CNY and CNH is that CNH doesn’t fluctuate within a tight band like CNY, and it’s free of China’s control over currency movements.

The offshore currency came into being as China increasingly wanted to internationalize its currency. As China decided to extend its currency globally without fully opening up its capital account, CNH came into being. Singapore, London, and Taiwan have developed the offshore CNH market.

Arbitraging profits

Many arbitrageurs are booking profits due to the price discrepancies between the onshore and offshore yuan markets. Many companies also accept CNY payments from Chinese importers and convert them into US dollars at a comparative attractive offshore rate. Similarly, for gold investments, investors could gain arbitraging profits by buying the cheaper yuan and selling the more expensive one.

As China wants to encourage capital inflows into the country, it has taken several measures to reduce barriers, and the gold fix initiation is one of them. Because the new gold fix can help the domestic CNY gain relative significance in the global markets, it will also boost CNH currency.

Though the new fix may not have a global impact immediately, it will likely make the markets think that a fully convertible Chinese yuan will boost China’s pricing power on the LBMA (or London Bullion Market Association). The funds that closely follow gains and losses in the precious metal market include the Proshares Ultra Gold (UGL), the ProShares Ultra Silver (AGQ), and the Velocity Shares 3X Long Gold (UGLD).