VelocityShares 3x Long Gold ETN

Latest VelocityShares 3x Long Gold ETN News and Updates

Materials Are Analysts Optimistic about Miners?

Despite the ongoing slump in the precious metals market, it seems that there could be hope going forward.

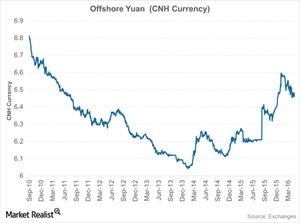

Two Yuan: What’s the Difference between CNY and CNH?

When understanding the Chinese markets and their prospects for internationalizing the yuan, it’s crucial to study both onshore and offshore yuan.