Have Miners’ Relative Strength Levels Revived?

In this article, we’ll look at some important technical indicators for Coeur Mining (CDE), Barrick Gold (ABX), Buenaventura (BVN), and AngloGold Ashanti (AU).

July 24 2017, Published 1:18 p.m. ET

Technical readings

Though mining companies are known to follow precious metals’ movements, it’s crucial to read these companies’ technicals before investing in them. Lately, miners have been in reversal mode along with precious metals.

In this article, we’ll look at some important technical indicators for Coeur Mining (CDE), Barrick Gold (ABX), Buenaventura (BVN), and AngloGold Ashanti (AU).

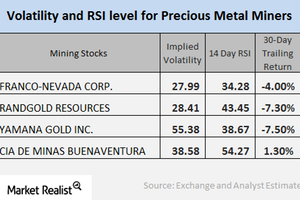

Implied volatility

Call-implied volatility measures the impact of fluctuations in the price of an asset’s call option on the price of the asset itself. On July 19, 2017, Coeur Mining, Barrick Gold, Buenaventura, and AngloGold had implied volatilities of 52.4%, 30.1%, 39.7%, and 42.8%, respectively.

Mining stocks’ volatilities are often greater than the volatilities of precious metals.

RSI level

The relative strength index (or RSI) measures whether a stock has been overbought or oversold. If a stock’s RSI is above 70, it may be overbought, and its price could fall. If a stock’s RSI is below 30, it could be oversold, and it could correct upward.

The RSI levels of the miners mentioned above have recently witnessed revivals. Coeur Mining, Barrick Gold, Buenaventura, and AngloGold have RSIs of 42.6, 50, 76.1, and 40.4, respectively.

Leveraged mining funds such as the Direxion Daily Junior Gold Miners ETF (JNUG) and the ProShares Ultra Silver ETF (AGQ) are also affected by changes in precious metals prices. These two funds have seen trailing-five-day rises of 4.8% and 4.6%, respectively.