Direxion Daily Jr Gld Mnrs Bull 3X ETF

Latest Direxion Daily Jr Gld Mnrs Bull 3X ETF News and Updates

How Investor Appetite for Risk Impacts Precious Metals

Gold and silver have seen trailing-five-day losses of 0.9% and 2.7%, respectively. The reason behind the fall in the precious metals is the buoyancy of the equity markets and the gains in the US dollar.

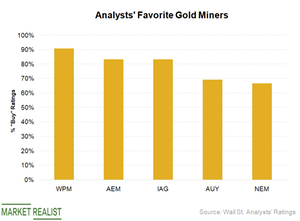

Which Gold Stocks Do Analysts Love and Hate?

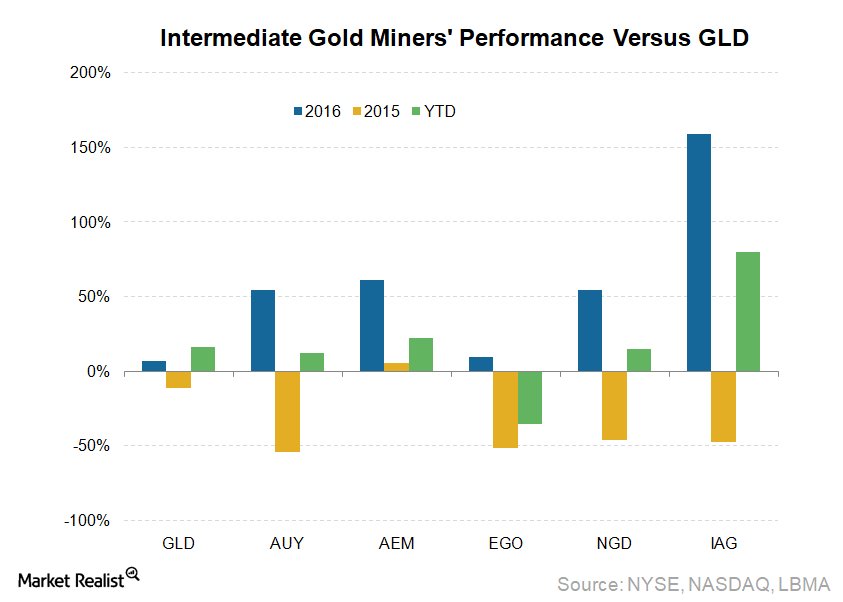

Gold price’s reversal this year has created opportunities in gold stocks. The SPDR Gold Shares ETF (GLD) had gained 11% year-to-date as of Friday.

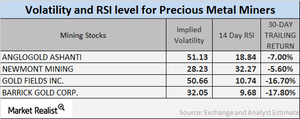

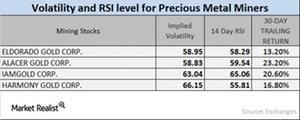

What Falling Miner RSI Levels Suggest

The RSI levels of our four select mining giants have all increased lately due to their higher stock prices.

Why Are Intermediate Gold Miners so Exuberant?

Intermediate gold miners are smaller than senior gold miners in terms of production and market capitalization, but they are still generally liquid.

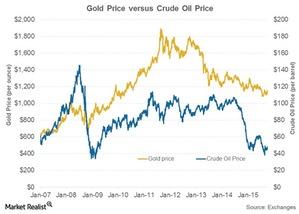

The Correlation between Gold and Oil

Oil is widely used in mining exploration, and a surge in oil prices may squeeze miners’ margins, leading to a fall in their share prices.

Trump, Trade War, Powell: More Upside for Gold Prices?

Gold hit a fresh six-year high on Friday as trade tensions between the US and China escalated. The SPDR Gold Shares ETF (GLD) closed up 2%.

Why Jeffrey Gundlach Likes Gold

During DoubleLine’s investor webcast on June 13, Jeffrey Gundlach said, “I am certainly long gold.” His call on gold is based on his expectation that the US dollar (UUP) will finish lower this year.

The Five Gold Stocks Wall Street Is Loving Lately

Gold miners usually act as a leveraged play on gold prices. In 2018, the VanEck Vectors Gold Miners ETF (GDX) fell 9.3%, amplifying the 1.9% fall in gold prices (GLD).

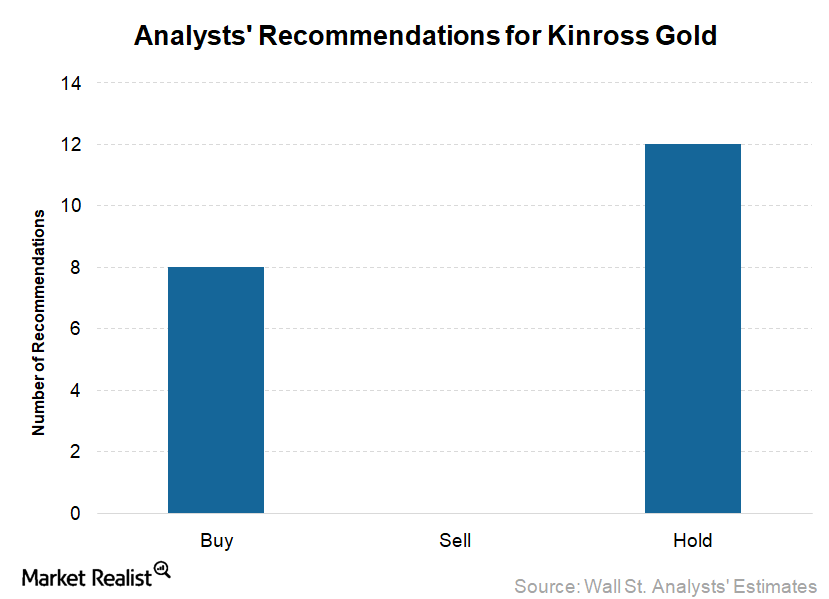

A Look at Recent Analyst Ratings for Kinross Gold

None of the analysts covering Kinross Gold (KGC) recommended a “sell” rating on the stock. 40% of them have “buy” ratings, while 60% suggest a “hold” for the stock.

Reading the Technicals of Mining Shares in September 2017

Most mining shares witnessed an up day on Monday, September 25, 2017, as precious metals increased over the ongoing global tensions.

Unpacking the Technical Indicators for Mining Stocks

Mining stocks have bounced back from the choppy markets we’ve seen over the past month. On July 20, most mining stocks saw upward movements in their prices.

Have Miners’ Relative Strength Levels Revived?

In this article, we’ll look at some important technical indicators for Coeur Mining (CDE), Barrick Gold (ABX), Buenaventura (BVN), and AngloGold Ashanti (AU).

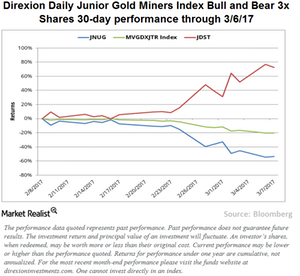

Why Gold Stocks Edged Higher after Rate Hike

After remaining subdued for the past few months, gold futures last week recorded their highest weekly gain of 2.4% since February 3.

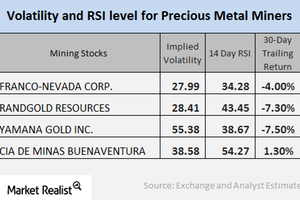

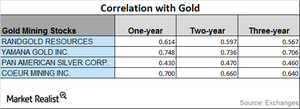

Analyzing the Upward-Downward Correlation of Precious Metals

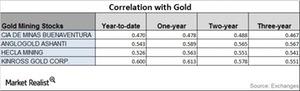

Mining companies with high correlations to gold include Randgold Resources (GOLD), Yamana Gold (AUY), Pan American Silver (PAAS), and Coeur Mining (CDE).

Where Are Mining Stocks’ RSI Numbers and Volatility Pointing?

The trailing 30-day returns of most mining companies are positive due to precious metals’ diminishing safe-haven appeal.

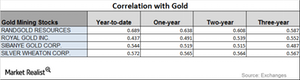

Understanding the Correlation of Mining Stocks in 2017

Precious metal prices have been falling since Trump won the US Presidential election on November 8, 2016. Mining stocks quickly followed suit.

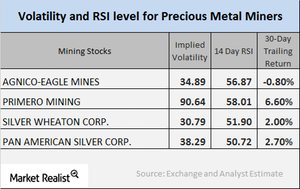

What’s the Correlation between Mining Stocks and Gold?

Mining companies that have high correlations with gold include Agnico Eagle Mines (AEM), Alacer Gold (ASR), Alamos Gold (AGI), and AngloGold Ashanti (AU).

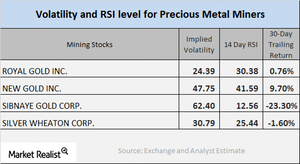

How Mining Stocks Reacted to Plummeting Metals

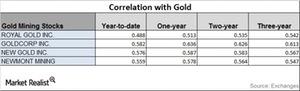

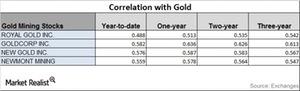

Mining companies that have high correlations to gold include Royal Gold (RGLD), Goldcorp (GG), New Gold (NGD), and Newmont Mining (NEM).

How Are Miners and Gold Correlated?

The substantial returns of most mining companies have been due to safe-haven bids that boosted gold and other precious metals.Macroeconomic Analysis How Has the US Dollar Affected Platinum Prices?

The current weakness in the rand made it fall to all-time lows against the US dollar in early 2016 but has helped mining companies.

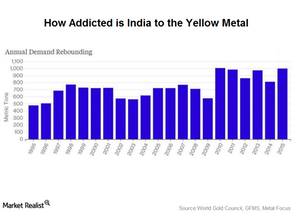

India’s Gold Demand May Touch 1000 Tonnes in 2015

The World Gold Council predicted that India’s gold demand in the October–December quarter would be muted. Gold imports shrank 36.5% to $3.53 billion in November.