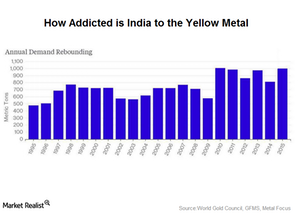

India’s Gold Demand May Touch 1000 Tonnes in 2015

The World Gold Council predicted that India’s gold demand in the October–December quarter would be muted. Gold imports shrank 36.5% to $3.53 billion in November.

Dec. 30 2015, Updated 1:24 p.m. ET

1000 tonnes?

India took the first position in gold demand from China in 2015. The total import for the country is set to touch 1000 tonnes. The prior year’s import figures stood at 900 tonnes. According to the All India Gems and Jewellery Trade Federation, India has already imported 850 tonnes of gold from January to September 2015. During the same time in the prior year, the import figure was at 650 tonnes.

Gold imports are expected to be 150 to 200 tonnes in the last quarter, as against 300 tonnes in the year-ago period. The lowered demand in the last quarter may be due to the sharp fall in precious metal prices and the looming fear of a rate hike. This may put pressure on gold prices as they don’t bear cash flows.

The World Gold Council had predicted that India’s gold demand in the October–December quarter would be more muted. The following gold imports shrank 36.5% to $3.53 billion in November due to falling prices. The curb in imports into the country could keep a check on the country’s current account deficit. Gold is the second largest import item for India after crude oil. A higher gold import bill adversely affects the country’s current account deficit.

The fall in gold prices is very much evident in the exchange-traded investments as well. The Direxion Daily Junior Bull Gold 3X (JNUG) and the iShares Gold Trust (IAU) fell 73.5% and 9.8%, respectively, on a year-to-date basis. The companies that have seen losses in their share price in the last one year, but buoyed during the month of December, include Royal Gold (RGLD), First Majestic Silver (AG), and New Gold (NGD). These three stocks make up 7.4% of the VanEck Vectors Gold Miners ETF (GDX).