Pan American Silver Corp

Latest Pan American Silver Corp News and Updates

Is Silver More Valuable as a Precious Metal or an Industrial Metal?

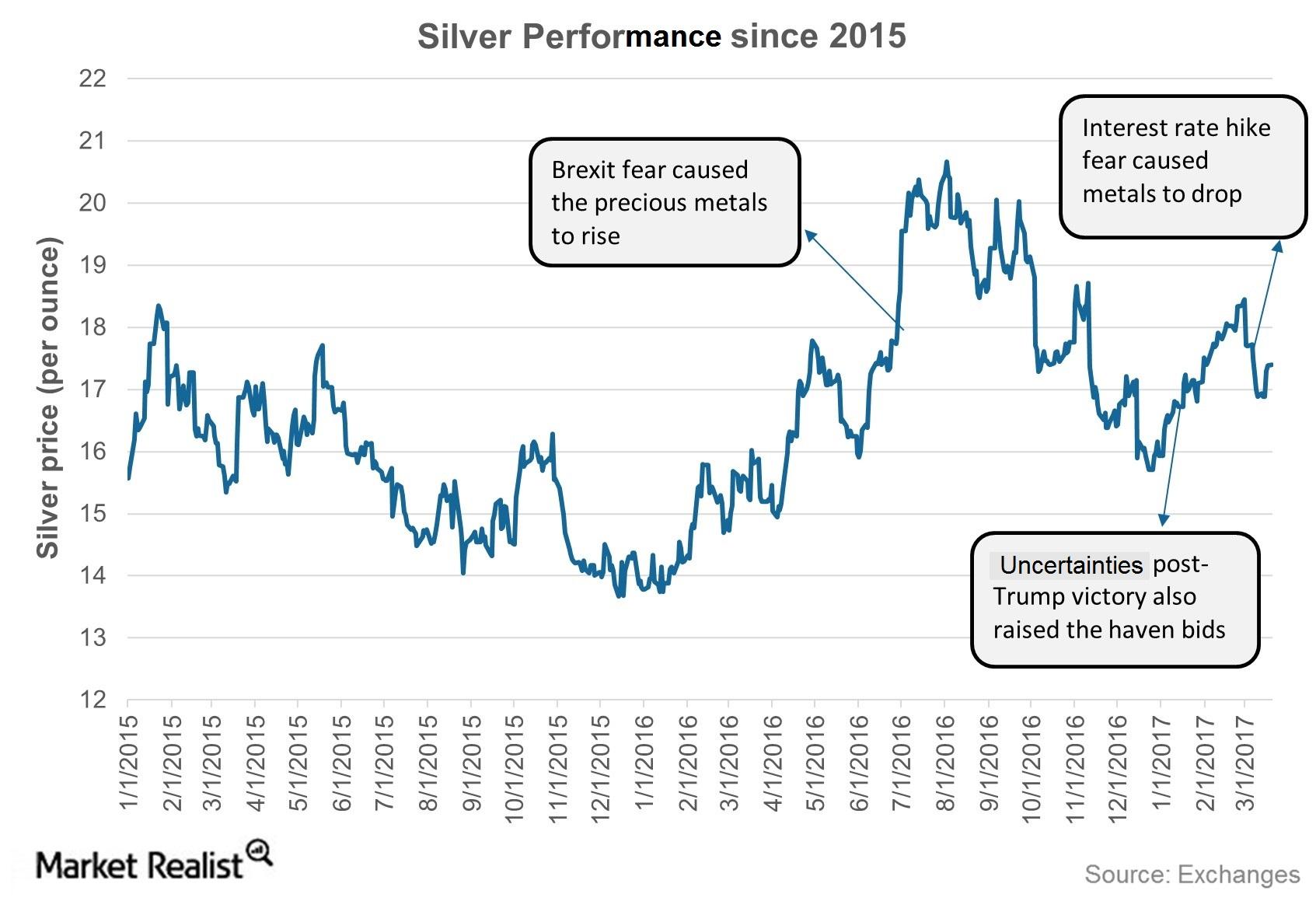

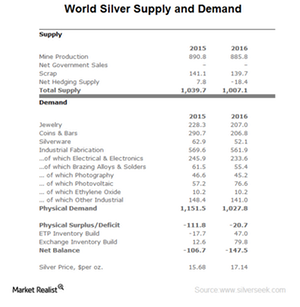

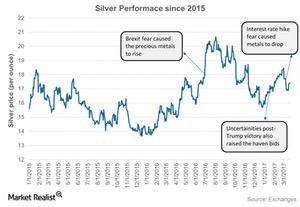

Silver has been falling over the past few years, despite surging demand for its industrial use. Fundamentally, silver seems to be strong due to rising demand and a year-over-year shortfall in its supply.

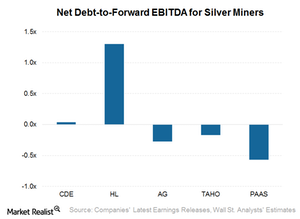

Behind Silver Miners’ Debt Repayment Capacities

Silver companies try to maintain an optimal level of debt-to-equity to lower their costs of capital and maintain an optimum level of risk-reward for shareholders.

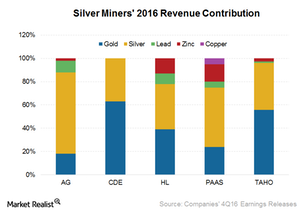

Which Silver Miners Offer Diversified Exposure to Commodities?

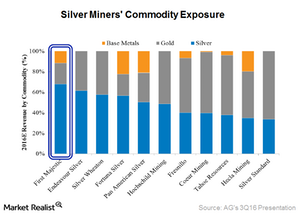

For investors considering silver stocks due to their leveraged exposure to silver prices, the higher the company’s revenues derived from silver, the better.

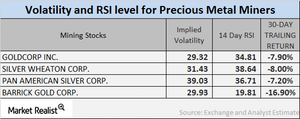

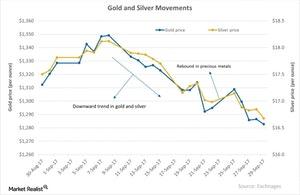

Mining Stocks Are Recovering from Their Slump

The Direxion Daily Gold Miners (NUGT) and the ProShares Ultra Silver (AGQ), both leveraged mining funds, both have recovered and jumped 19.4% and 24.9%, respectively, on a five-day trailing basis.

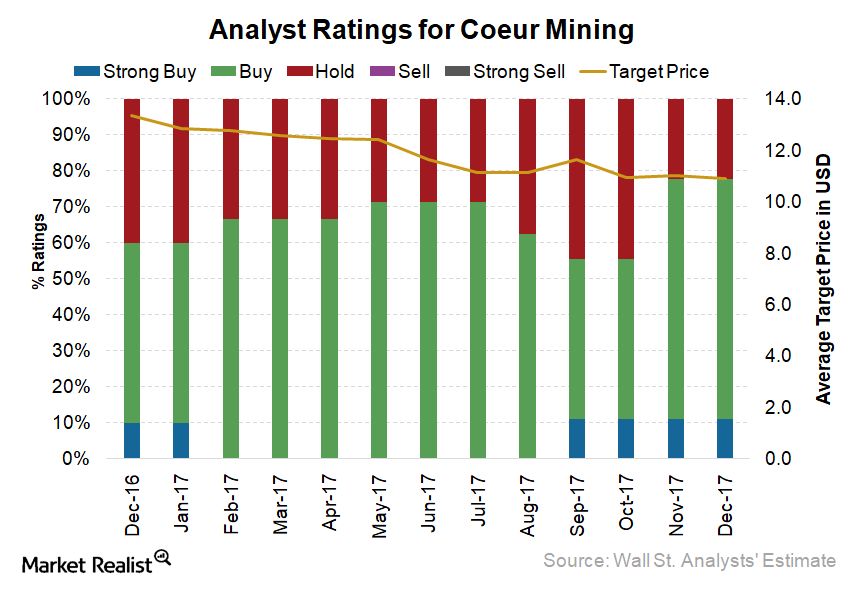

What Put Coeur Mining in 2nd Place?

Right now, of the nine Wall Street analysts covering CDE stock, according to Thomson Reuters, 78% recommend a “buy,” while 22% recommend a “hold.”Miscellaneous How Is the Dollar Affecting Precious Metals?

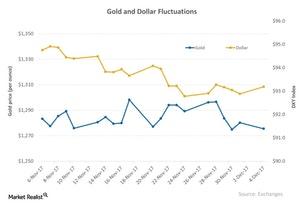

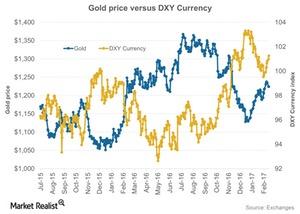

Besides ongoing geopolitical concerns, a crucial factor that gold keeps looking to for directional moves is the US dollar.

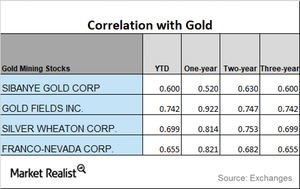

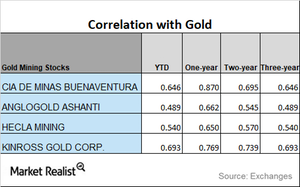

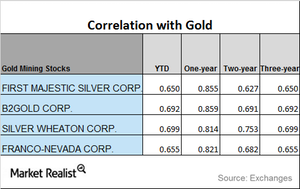

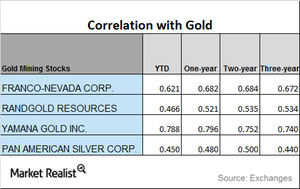

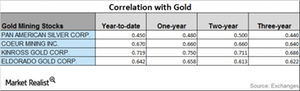

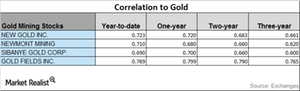

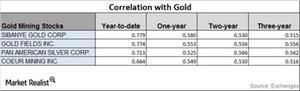

How Are Miners’ Correlations to Gold Trending?

Mining stocks tend to take their cues from gold.

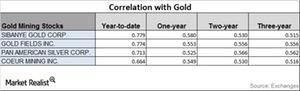

Analyzing the Correlation between Miners and Gold in January

Most mining stocks have risen over the past one month due to the revival in gold prices.

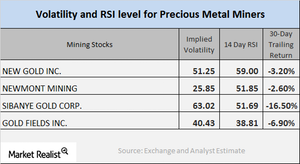

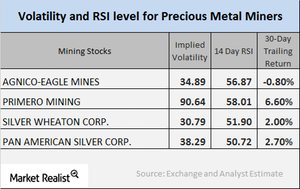

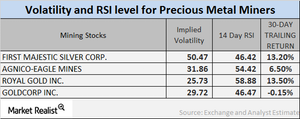

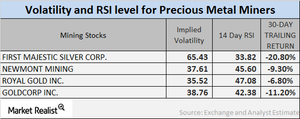

How Do Miners’ Technical Details Look?

Most of the mining companies have risen during the past few weeks. The miners tend to move according to precious metal prices rather than the equities market in general.

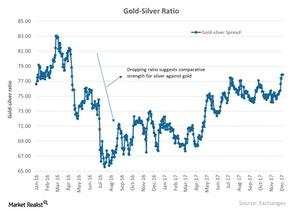

Reading the Recent Gold-Silver Spread

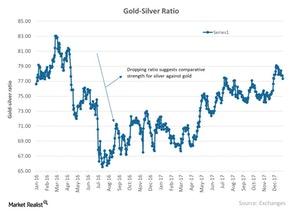

Among these spreads, the gold-silver spread is the most talked about because it measures the number of silver ounces it takes to buy a single ounce of gold.

The Revival of Miners and Technical Indicators on December 20

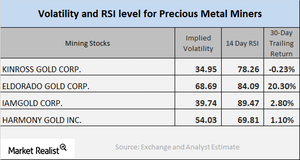

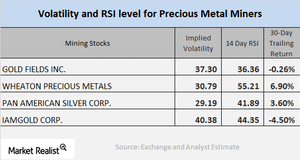

Alamos Gold, Sibanye Gold, Agnico Eagle Mines, and Pan American Silver have call-implied volatilities of 43.2%, 50.5%, 22.1%, and 27.5%, respectively.

A Brief Look at December 2017’s Precious Metal Spread Measures

In this article, we’ll discuss the gold-silver, gold-platinum, and gold-palladium spreads. These three spreads stand at 77.9, 1.38, and 1.23, respectively.

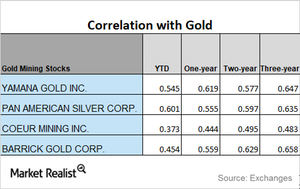

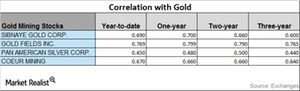

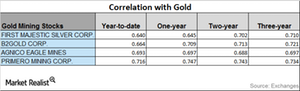

Where Are Miners’ Correlations with Gold Headed?

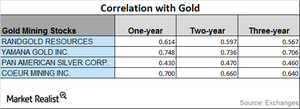

In this article, we’ll aim to study the correlations of Yamana Gold (AUY), Pan American Silver (PAAS), Coeur Mining (CDE), and Barrick Gold (ABX) with gold.

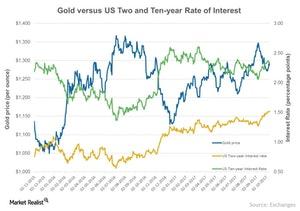

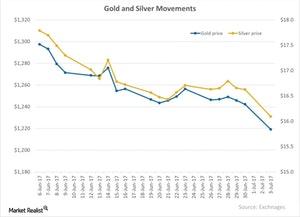

How Eager Are Precious Metals to Hear the Fed’s Decision?

Gold, silver, and platinum all had a down day on Tuesday, December 13, mainly due to speculations over the Federal Reserve’s pending interest rate decision.

Miners’ Correlation with Gold

Correlation analysis A correlation study of mining stocks to precious metals is important. It gives insights about miners’ potential price movement. Although the mining shares are essentially part of the market’s equity segment, they’re more coordinated with metals’ movement. Gold is the most dominant precious metals. We’ll discuss how Yamana Gold (AUY), Pan American Silver (PAAS), Coeur […]

The Tax Reform Bill’s Impact on Precious Metals

All four precious metals saw a down day on Monday, December 4, 2017, after the US dollar, in which the four metals are priced, rose $0.39%, propelled by the Senate passing its tax reform bill.

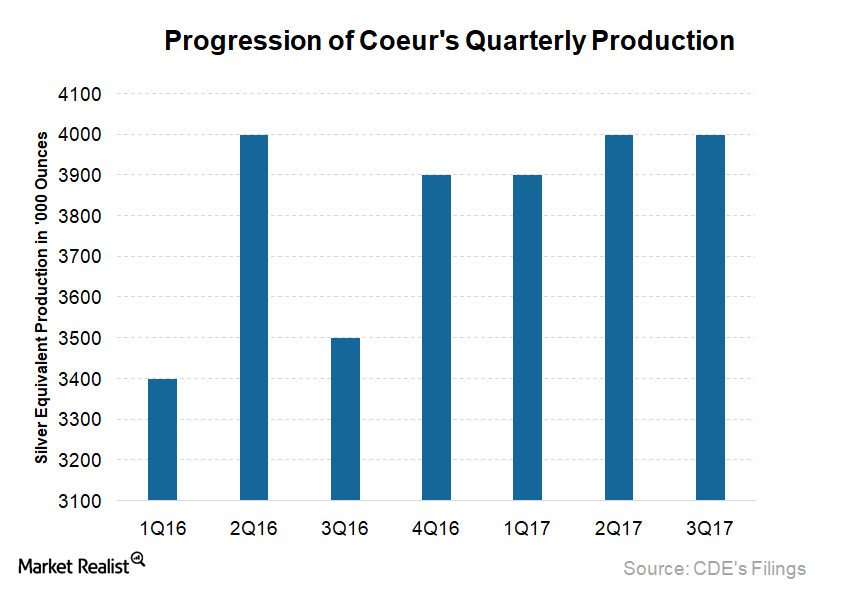

Why Coeur Mining Lowered Its Production Guidance

Coeur Mining (CDE) achieved silver equivalent ounces of 9.5 million for 3Q17. That is comprised of silver production of 4 million ounces and 93,293 ounces of gold.

What Factors Could Drive Coeur Mining Stock in 2018?

Coeur Mining (CDE) was one of the stocks to gain significantly in 2016, rising ~270%. The situation in 2017 has reversed completely.

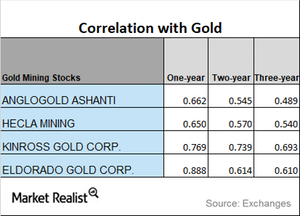

Analyzing Trends in Mining Stocks’ Correlation

Gold remains the most dominant among the four precious metals. It’s crucial that investors analyze how the miners are moving versus precious metals.

How the Higher Dollar Has Affected Precious Metals

Precious metal slump All four precious metals saw a down day on Monday, November 20. Gold fell 1.6% to $1,275.30 per ounce, after touching a one-month high on Friday, November 17. The fall in precious metals was most likely due to the rise in the US dollar. The US Dollar Index rose 0.45% on Monday. Gold, silver, platinum, […]

The Directional Correlation Move of Mining Stocks in 2017

If we look at the one-year correlation of miners, Barrick Gold has the lowest correlation with gold, while Yamana has the highest.

Mining Stocks: Analyzing Correlation Trends

Mining stocks’ performance usually depends on precious metals’ performance. However, the two can deviate. Correlation analysis can give investors some perspective on how mining stocks relate to gold and silver.

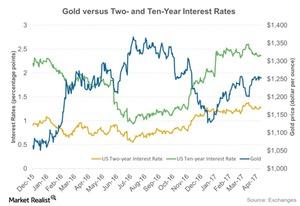

Yield Changes for Precious Metals: What Could Be the Impact?

If we look beyond the dollar influence on precious metals, we can analyze how the probability of an interest rate hike could influence precious metals and their miners.

Behind the Correlations of Key Miners Today

On a YTD (year-to-date) basis, the correlations of the above mining stocks appear to be weak when compared with last year.

Relative Strength Index Indicators of Mining Shares in October

On October 11, 2017, Randgold Resources, Pan American Silver, Barrick Gold, and Kinross Gold had implied volatility readings of 25.0%, 34.0%, 29.1%, and 41.6%, respectively.

The Reaction of Precious Metals on October 11

The last few days have seen a rise in precious metal prices. However, on Wednesday, October 11, 2017, the prices of these loved metals fell.

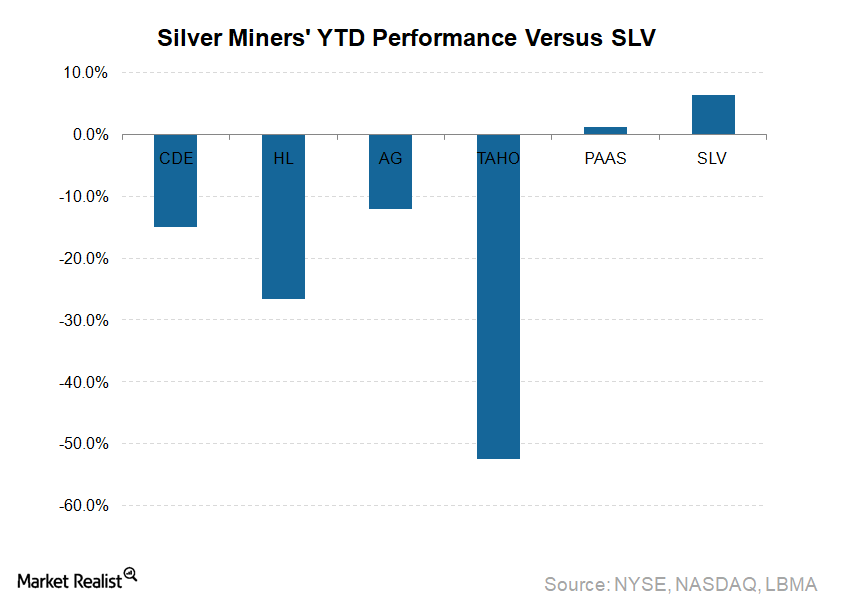

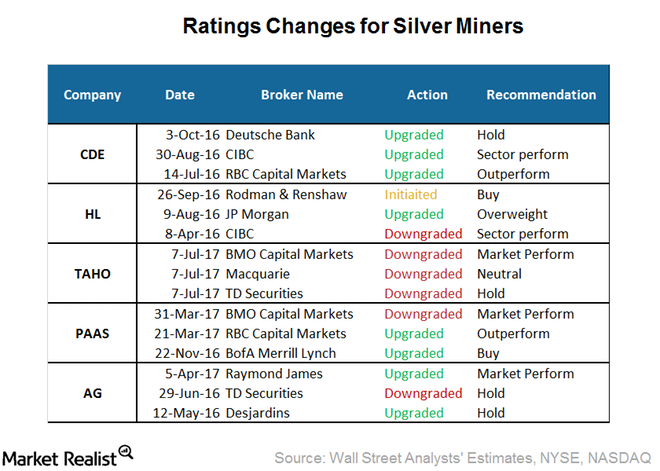

Behind the Recent Analyst Rating Changes for Silver Miners

After the Guatemalan government’s decision to suspend Tahoe Resources’ (TAHO) license, the company saw several downgrades.

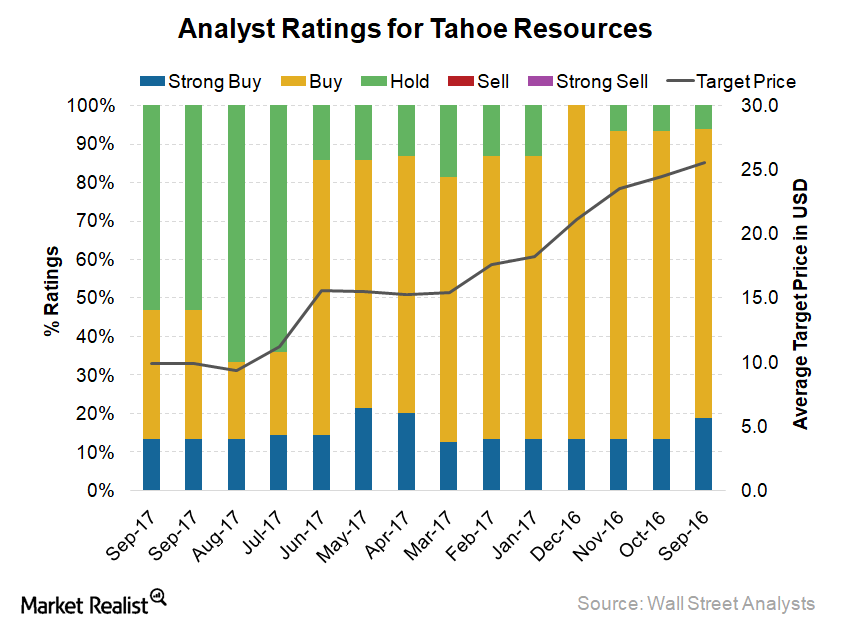

How Do Analysts View Tahoe Resources despite Its Underperformance?

Tahoe Resources (TAHO) stock has lost 44.1% of its value year-to-date until the end of September.

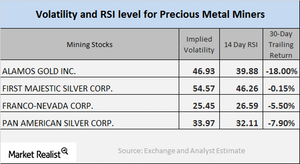

What Are Mining Stock Technical Indicators Telling Us?

On September 29, Alamos, First Majestic Silver, Franco-Nevada, and Pan American had call implied volatilities of 46.9%, 54.6%, 25.5%, and 34%, respectively.

Precious Metals in September: A Review

The negative sentiment toward gold prevailed on Friday, September 29, the last trading day of the month. Gold futures for November expiration fell 0.3%.

Reading the Correlation Analysis of Mining Shares in August 2017

Yamana Gold has the highest correlation with gold, while Pan American Silver has the lowest correlation.

Unpacking the Technical Indicators for Mining Stocks

Mining stocks have bounced back from the choppy markets we’ve seen over the past month. On July 20, most mining stocks saw upward movements in their prices.

How Precious Metals’ Slump Dragged Mining Shares and Funds Lower

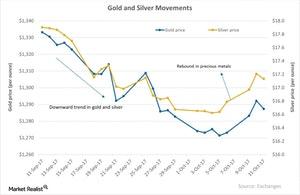

Gold tumbled to an eight-week low on July 3, 2017. Gold futures for August delivery fell almost 1.9% to settle at $1,219.2 per ounce.

These Mining Companies Are Showing an Uptrend Correlation with Gold

When we try to interpret the performance of precious metals, it’s crucial to study the impact of metal price variations on mining shares.

Insight into the Silver Market in June 2017

Silver has seen a five-day trailing loss of 2.6%, while gold and platinum fell 1.7% and 1.9%, respectively.

What’s the Volatility of Mining Stocks?

Though the precious metals survived the Fed’s interest rate hike, the miners took a hit. Most mining stocks saw a considerable down day on Wednesday.

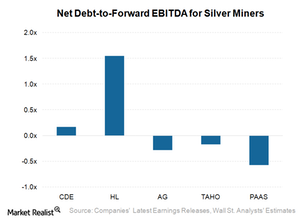

How Silver Miners Rank Based on Debt Repayment Capacity

Coeur Mining (CDE) has a net debt-to-forward-EBITDA ratio of 0.40x, which seems comfortable. Hecla Mining’s (HL) ratio is slightly higher at 1.3x.

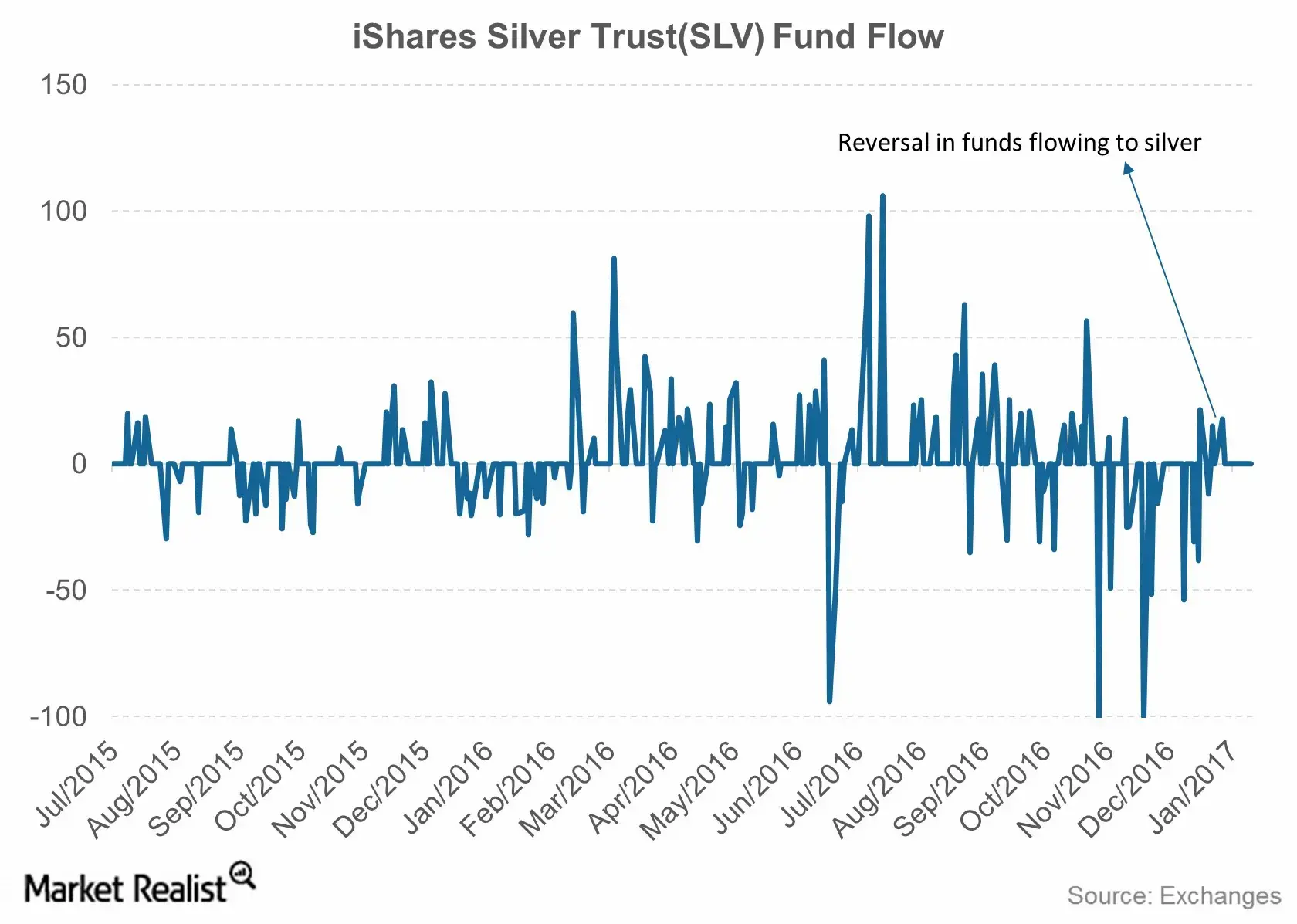

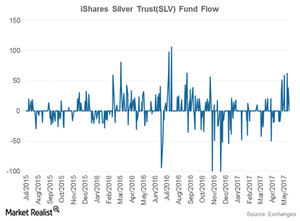

Reading the Fund Flows of the iShares Silver Trust

Over the past year, silver has been very volatile compared to the other three precious metals. Silver was the highest among precious metals in mid-April 2017.

Gold and Other Precious Metals Fell on May 18

Gold futures for June expiration fell 0.47% and ended May 18 at $1,252.8 per ounce. The call implied volatility in gold rose to 11.3%.

Analyzing Silver’s Fundamentals

When analyzing the performance of a metal, investors should look at its fundamentals. In this series, we’ll look at various metrics for silver and other precious metals.

How Is Gold Fields’ Correlation with Gold Trending?

Turbulence in markets due to the viability of the Trump Administration, the upcoming French elections, and the Brexit vote caused precious metals to rise.

How Did Mining Stocks Correlate with Gold in March 2017?

Yamana’s correlation with gold has increased from a three-year correlation of ~0.74 to a one-year correlation of ~0.80.

Mining Stock RSI levels: What the Indicators Suggest

NUGT and AGQ have seen YTD rises of 18.6% and 27.5%, respectively. But the volatility of such mining funds can be higher than that of precious metals.

A Look at Silver Miners’ 2016 Commodity Exposure

Commodity exposure In the previous part of this series, we looked at miners’ geographic exposure, which is important to consider due to the geopolitical risks some jurisdictions face. It’s equally important to consider their revenue compositions in terms of commodity exposure. Contribution from silver Silver companies are rarely pure-play miners. For investors considering silver […]

Analyzing the Correlation between Silver Prices and Miners

Mining funds such as the iShares MSCI Global Gold Min (RING) and the leveraged ProShares Ultra Gold (AGQ) have also seen significant correlations with their respective precious metals.

These Factors Have Been Driving Silver Prices

Silver has performed slightly better than gold and platinum on a year-to-date basis.

Understanding the Fall in the US Dollar and How Precious Metal Reacted

All four precious metals witnessed a rise in price on Monday, March 20, as the US dollar slipped to its six-week low.

Analyzing the Upward-Downward Correlation of Precious Metals

Mining companies with high correlations to gold include Randgold Resources (GOLD), Yamana Gold (AUY), Pan American Silver (PAAS), and Coeur Mining (CDE).

Reading the Correlation Movement of Mining Stocks

Sibanye Gold has the closest correlation to gold on a YTD basis among the four miners under review.

How Miners’ Correlations Are Moving

Precious metals prices have risen from the ten-month lows they saw in December 2016. As a result, most mining stocks have also risen substantially.