The Revival of Miners and Technical Indicators on December 20

Alamos Gold, Sibanye Gold, Agnico Eagle Mines, and Pan American Silver have call-implied volatilities of 43.2%, 50.5%, 22.1%, and 27.5%, respectively.

Dec. 26 2017, Published 12:40 p.m. ET

Mining stock analysis

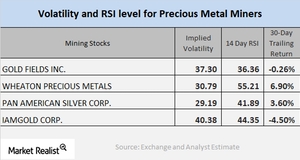

In the final part of our series, we’ll look at the technical indicators for mining stocks. We’ll discuss the call-implied volatility and RSI (relative strength index) metrics for Alamos Gold (AGI), Sibanye Gold (SBGL), Agnico Eagle Mines (AEM), and Pan American Silver (PAAS).

Volatility analysis

Alamos Gold, Sibanye Gold, Agnico Eagle Mines, and Pan American Silver have call-implied volatilities of 43.2%, 50.5%, 22.1%, and 27.5%, respectively. The call-implied volatility measures the changes in an asset’s price given the changes in the call option.

Among the four miners that we are discussing, AGI and SBGL have seen 30-day trailing losses of 0.78% and 9.2%, respectively. AEM and PAAS have 30-day trailing gains of 0.77% and 5.3%, respectively.

RSI readings

A stock’s RSI level that is greater than 70 indicates that it could be in overbought territory, and the price could fall. A stock’s RSI indicator that is less than 30 indicates that it could be oversold, and its price could rise. AGI, SBGL, AEM, and PAAS have RSI scores of 50.3, 24.2, 54.5, and 60.4, respectively.

The precious metal–based funds that have seen price revivals due to the recent rebound in precious metals include the PowerShares DB Gold ETF (DGL) and the VanEck Merk Gold Trust ETF (OUNZ). These funds rose 0.90% and 0.89%, respectively, on a five-day trailing basis.