Invesco DB Gold Fund

Latest Invesco DB Gold Fund News and Updates

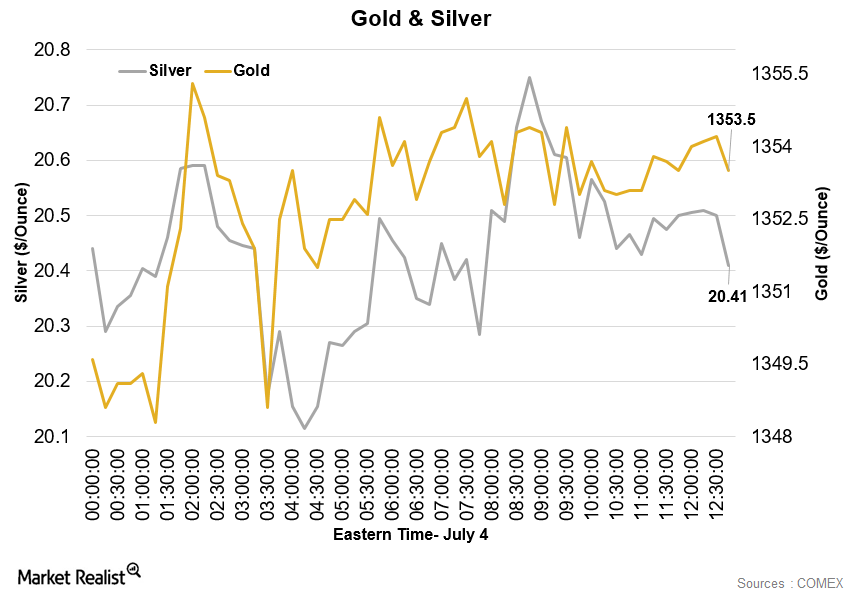

Copper Stabilizes While Gold Trades near Two-Year High

Copper prices stabilized on Monday, July 4, amid expectations of stimulus from central banks.

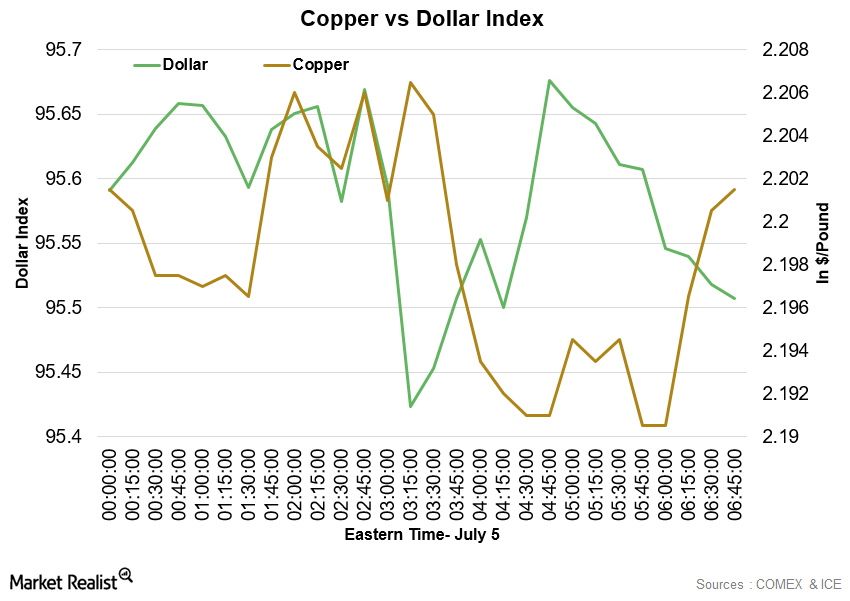

Copper Fell and Gold Stabilized on July 5

At 6:40 AM EST on July 5, the COMEX Copper futures contract for September delivery was trading at $2.2 per pound—a drop of 0.81%.

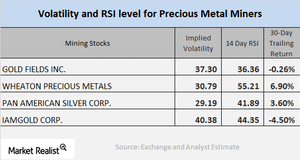

A Quick Look at the Precious Metals Revival, Miners’ Performances

Precious metals prices shot up on January 19, 2018, with concerns looming over the shutdown the of the US government.

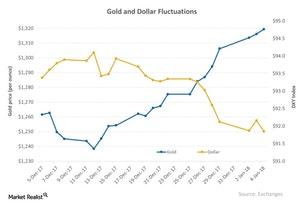

The Dollar and Its Relationship to Precious Metals

The US dollar rose 0.18% on Tuesday, January 9, 2018, which led to the lower price of spot gold (GLD) and silver.

Your End-of-2017 Correlation Study of the Major Miners

The PowerShares DB Gold Fund (DGL) and the VanEck Merk Gold Trust (OUNZ) rose 2.2% over the five trading days leading up to December 27, 2017.

The Revival of Miners and Technical Indicators on December 20

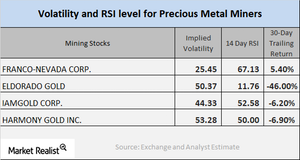

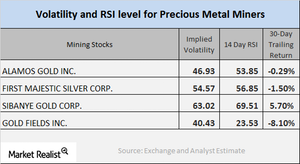

Alamos Gold, Sibanye Gold, Agnico Eagle Mines, and Pan American Silver have call-implied volatilities of 43.2%, 50.5%, 22.1%, and 27.5%, respectively.

Reading Miner Volatility in December 2017

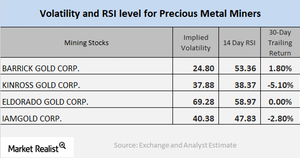

In this article, we’ll take a look at the call-implied volatilities and RSI scores of Barrick Gold, Kinross Gold, Eldorado Gold, and IAMGOLD.

How Is Gold, Commercial and Non-Commercial, Moving?

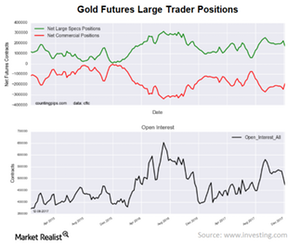

Speculative positions fell sharply last week. It was the most significant one-week fall since May 2016.

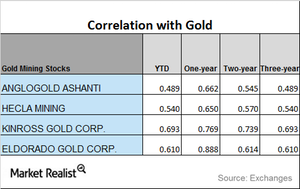

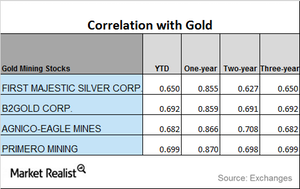

Correlation and Mining Stocks this Month

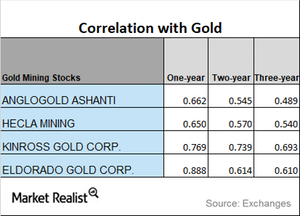

We’ll briefly analyze mining stocks’ correlation with gold. Gold is the most crucial of the precious metals, and mining stocks tend to increasingly take their price changes from gold.

Miners’ Correlation with Gold

Correlation analysis A correlation study of mining stocks to precious metals is important. It gives insights about miners’ potential price movement. Although the mining shares are essentially part of the market’s equity segment, they’re more coordinated with metals’ movement. Gold is the most dominant precious metals. We’ll discuss how Yamana Gold (AUY), Pan American Silver (PAAS), Coeur […]

A Quick Look at Miners’ Technical Details

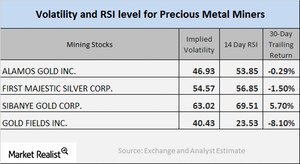

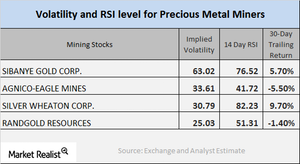

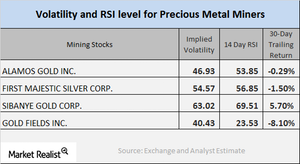

As of November 16, 2017, Alamos Gold, First Majestic Silver, Sibanye Gold, and AngloGold Ashanti had call-implied volatilities of 46.9%, 54.6%, 63%, and 40.9%, respectively.

Directional Changes in the Correlation of Miners to Gold

New Gold and Goldcorp have seen upward trends in their correlations with gold, while Newmont Mining has seen its correlation decline.

Yield Changes for Precious Metals: What Could Be the Impact?

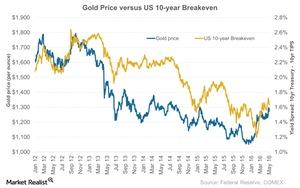

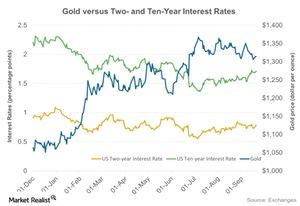

If we look beyond the dollar influence on precious metals, we can analyze how the probability of an interest rate hike could influence precious metals and their miners.

The Importance of Knowing the Technicals of Mining Stocks

On October 30, 2017, ABX, AU, KGC, and IAG had call implied volatilities of 29.1%, 40.9%, 41.6%, and 44.3%, respectively.

A Technical Analysis of Mining Shares as of October 27

On October 26, 2017, Royal Gold, Newmont, Sibanye, and Yamana had call implied volatilities of 24.8%, 25.9%, 63%, and 48.4%, respectively.

A Technical Analysis of Mining Shares in October

When investors look at mining stocks, it’s important that they do a technical analysis of the stocks.

How Mining Stocks Have Moved in October

On October 23, Alamos, First Majestic Silver, Sibanye Gold, and Gold Fields had call implied volatilities of 46.9%, 54.6%, 63%, and 40.4%, respectively.

Analyzing Mining Shares’ Correlation in October

Understanding mining stocks’ correlation with gold is crucial for investors in precious metal mining stocks.

How Key Mining Stocks Are Correlated with Gold in October 2017

The PowerShares DB Gold Fund (DGL) and the Vaneck Merk Gold Trust (OUNZ) have risen 12.1% and 12.95, respectively, year-to-date, taking strong cues from gold.

Will Gold Keep a Close Watch on Inflation Numbers?

Donald Trump’s recent victory is shining a light on the possibility of a rise in inflation and how such a rise could work for gold.

Are Inflation Concerns Likely to Boost Gold’s Performance?

The difference between yields on ten-year US notes and similar-maturity TIPS, a gauge of price expectations, expanded to as much as 1.7% last Tuesday.

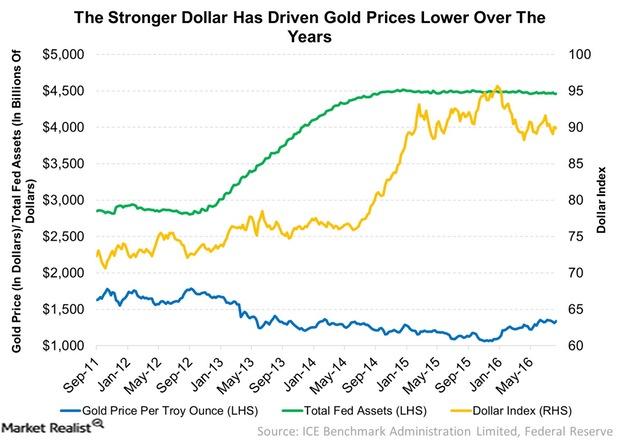

Fed’s Hawkish Stance: Why It Impacted Precious Metals

Last week was rough for precious metals. Gold, silver, platinum, and palladium all fell. Gold had the biggest weekly fall in about three years.

Why Are Precious Metals Showing Weakness?

Gold broke its key level of $1,300 per ounce on Tuesday, October 4, 2016. But investors are seeing gold’s 200-day moving average of $1,258 per ounce as a resistance level.

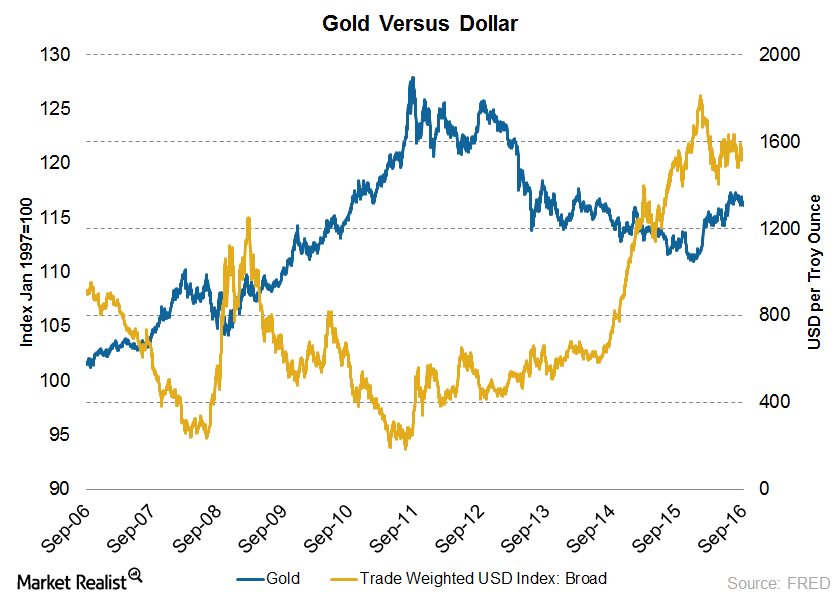

How Did the Dollar’s Move Affect the Price of Gold?

Gold is valued in dollars. As a result, the stronger dollar, driven by the recovery of the US economy, is pushing the gold prices further down.

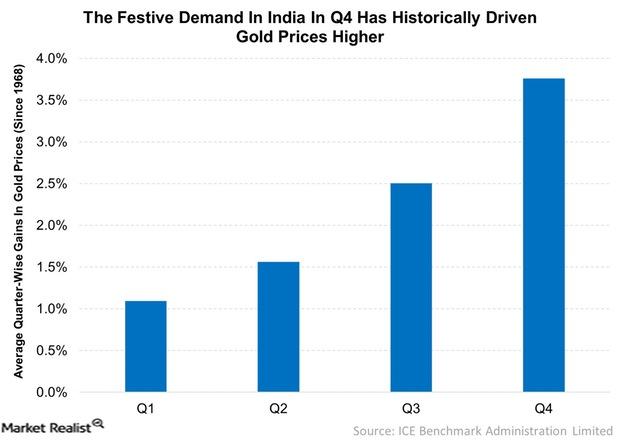

Demand from India Could Lend Support to the Gold Market

Demand from India Could Lend Support In the near term, India could lend support to the gold market. Indian gold demand has been very weak this year due mainly to the higher gold price. This suggests there is pent-up demand. A good monsoon season in India can lead to a bountiful fall harvest that typically […]

Jackson Hole: An Important Takeaway and What It Means for Gold

Yellen Channels Doobie Brothers’ “What Were Once Vices Are Now Habits” Another aspect of Janet Yellen’s Jackson Hole speech furthered our conviction for strong gold prices in the long term. She described all of the unconventional monetary policies implemented since the financial crisis (e.g., zero rates, QE, etc.) as components of the Fed’s “toolkit”. Perhaps […]

Rising Volatility Continues to Affect Miners’ Stocks

The precious metals price correction that happened on September 2, 2016, extended to September 6. How did equities and funds respond?

How Did the Rebound in the US Dollar Impact Gold?

The US dollar rebounded on Tuesday, August 2, after losing on Friday due to weak US economic data. The US dollar rose by 0.15% against world currencies.

How Much Can Brexit Affect the Precious Metals?

Brexit could send jitters around the globe, and investors may jump to safe-haven assets such as gold and silver, which have risen 21.2% and 25.6%, respectively, on a YTD (year-to-date) basis.

Why Hedge Funds Liquidated Some of Their Gold

Hedge funds increased their bets on gold as prices fell after gold’s gains in 1Q16. However, hedge funds and money managers curbed their bets on gold as it fell steadily in May.

Why Predicting Gold Returns Is a Dubious Exercise

Generally, gold is viewed as a hedge against rapid inflation and lower interest rates. That makes it hard to value gold as there are no cash flows or earnings associated with it.

How Strong Is China’s Gold Demand?

China’s love for gold is world famous, and demand had touched its peak in 2013 when gold experienced a steep price fall.