Alamos Gold Inc

Latest Alamos Gold Inc News and Updates

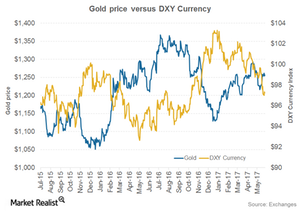

Gold Prices Extend Rally on Depreciating Dollar

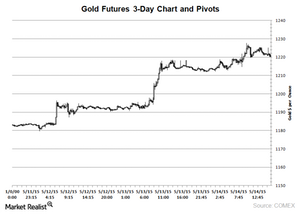

This is the fifth up day for gold prices in the last ten days. Prices increased by 0.72% more on the average up days than on the average down days over the last ten trading sessions.

How the Economic Sentiment Is Playing on Gold

During the past week, average hourly earnings, excluding the farming industry, were below analysts’ expectation of 0.10%.

The Most Crucial Element in the Precious Metals Downtrend

Gold ended the day almost flat on Wednesday, May 2, and closed at $1,304.90 per ounce.

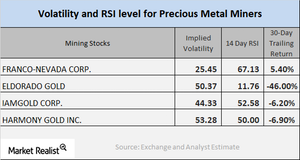

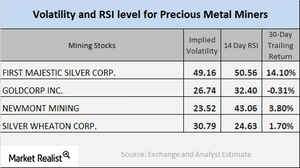

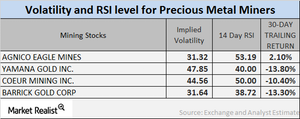

Analyzing the Technicals of Mining Stocks in January 2018

Most mining stocks have risen during the past month due to the revival in precious metals prices.

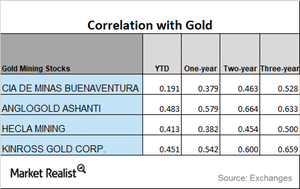

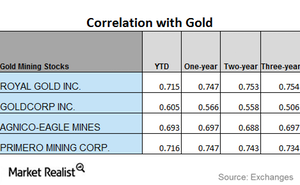

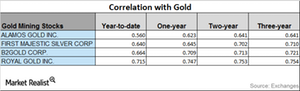

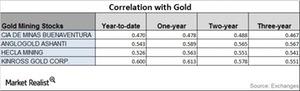

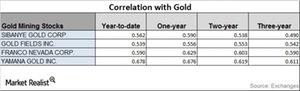

Analyzing the Correlation of Gold to Miners in January 2018

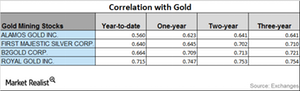

First Majestic Silver saw correlation drop during the past three years. On a three-year basis, its correlation with gold was 0.57.

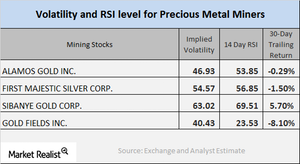

The Revival of Miners and Technical Indicators on December 20

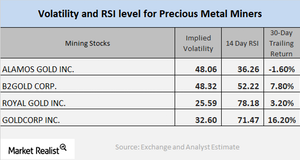

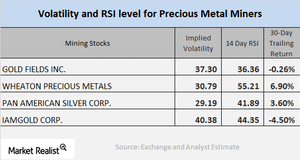

Alamos Gold, Sibanye Gold, Agnico Eagle Mines, and Pan American Silver have call-implied volatilities of 43.2%, 50.5%, 22.1%, and 27.5%, respectively.

Today’s Correlation Study of Key Mining Stocks with Gold

The Global X Silver Miners ETF (SIL) and the Sprott Gold Miners (SGDM) have fallen 3.5% and 4.4%, respectively, on a 30-day trailing basis.

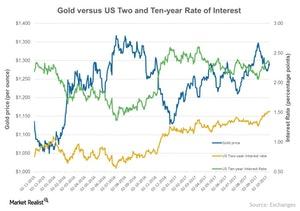

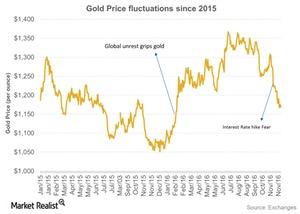

Rate Hike Could Move Precious Metals and Miners

Investors have their eyes set on the interest rates. A rise in the interest rates causes the demand for precious metals to fall.

A Quick Look at Miners’ Technical Details

As of November 16, 2017, Alamos Gold, First Majestic Silver, Sibanye Gold, and AngloGold Ashanti had call-implied volatilities of 46.9%, 54.6%, 63%, and 40.9%, respectively.

How Mining Stocks Have Moved in October

On October 23, Alamos, First Majestic Silver, Sibanye Gold, and Gold Fields had call implied volatilities of 46.9%, 54.6%, 63%, and 40.4%, respectively.

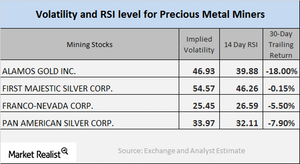

What Are Mining Stock Technical Indicators Telling Us?

On September 29, Alamos, First Majestic Silver, Franco-Nevada, and Pan American had call implied volatilities of 46.9%, 54.6%, 25.5%, and 34%, respectively.

Understanding Mining Company Technicals amid Today’s Turbulence

Many mining stocks saw a revival in prices on Monday, September 25, 2017, since precious metals saw an upswing.

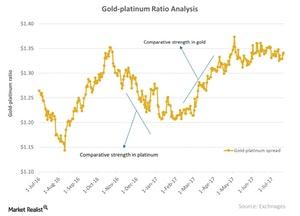

How Gold and Platinum Are Moving in Tandem

Like silver, platinum has industrial uses and has seen growing demand in China.

Why Most Mining Stocks Fell on Friday

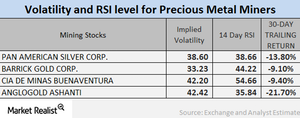

Precious metal mining stocks follow trends in precious metals, and they’re a very volatile segment of the equity markets.

A Look at Mining Stocks’ Correlation with Gold

Miners’ correlation with gold In this part, we’ll look at mining stocks’ correlation with precious metals by comparing their price movement. Specifically, we’ll analyze Alamos Gold (AGI), First Majestic Silver (AG), B2Gold (BTG), and Royal Gold (RGLD). The mining stocks have recovered in the past few weeks. The Direxion Daily Gold Miners Bull 3x Shares […]

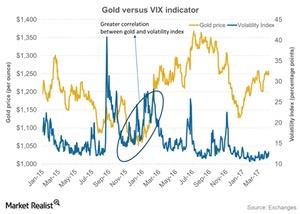

How Strongly Can North Korea Move the Precious Metals Market?

Gold futures for September expiration have risen ~3.9% over the past one-month period. Silver, platinum, and palladium have followed the same track as gold.

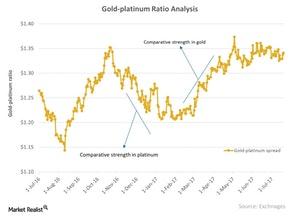

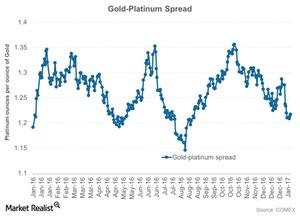

Platinum Market: Reading the Gold-Platinum Ratio

When reading the platinum market, it’s important to look at the relative performance of platinum and gold by using the gold-platinum ratio.

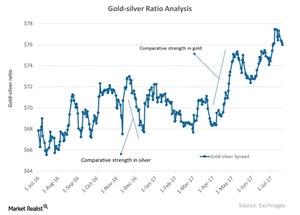

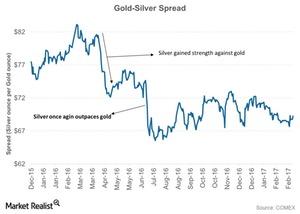

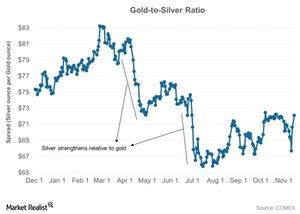

How the Gold-Silver Spread Is Trending

The gold-silver spread measures the price of one ounce of gold in relation to silver.

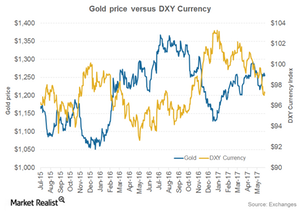

How the Euro Pushed the Dollar Lower and What It Meant for Gold

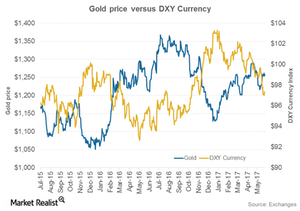

July 20, 2017, was an up day for the euro, which put downward pressure on the US dollar as represented by the U.S. Dollar Index (or DXY).

RSI Levels Have Fallen: Will Miners Rebound Soon?

Gold and silver-based funds such as SGOL and SIVR are impacted by changes in precious metal prices. They fell due to the fall in precious metals on Friday.

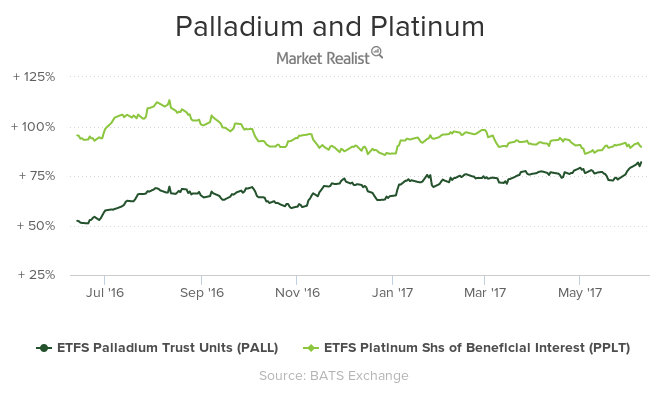

Palladium Skyrockets: A Look at What’s in Store Next

Although gold and silver had a down day on Friday, June 9, 2017, platinum and palladium rose about 0.23% and 1.2%, respectively.

Why RSI levels of Mining Shares Are Rising

On June 6, the implied volatilities of Alamos Gold, Primero Mining, Silver Wheaton, and Franco-Nevada were 51.1%, 90.6%, 30.8%, and 24.5%, respectively.

The Ups and Downs of the Dollar and Gold

On June 6, 2017, the US Dollar Index plunged to its lowest level in seven months, which helped dollar-denominated precious metals regain value.

What’s the Correlation between the Dollar and Gold?

The rise in gold on June 6 also boosted the other three precious metals. Silver futures for August delivery were 1.4% higher for the day and closed at $17.6 per ounce.

How Silver-Based Funds Plunged Their Way through April 2017

Precious metals were doing considerably well until the first half of April 2017. As investors’ risk appetites revived, haven assets slumped. Among these metals, silver has plummeted the most.

Inside the Monthly Mining Correlations as of May 3

Metal investors have to study upward and downward trends as price change predictability can be affected by rises and falls in precious metal prices.

A Look at Mining Stocks’ Correlation with Gold in 2017

Mining stocks and precious metals As global tumult grips markets and investors are turning to mining stocks as safe havens, it’s crucial to understand which stocks are closely tied to precious metals. Stocks with a higher correlation with precious metals will likely be impacted more by global indicators that influence precious metals. The Direxion Daily […]

Upcoming French Elections Could Impact Gold

Since the French elections are right around the corner, investors might start parking their money in safe-haven assets like gold.

Analyzing the Gold-Silver Spread as Investors Await Further Cues

When analyzing the precious metals market, it’s important to take a look at the relationship between gold (SGOL) and silver (SIVR).

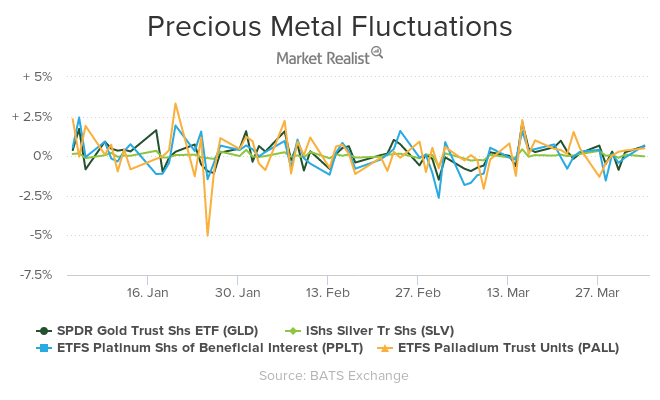

Reading the Performances of Precious Metals in 1Q17

Precious metals had a bright first quarter, which ended March 31, 2017. Gold rose about 8.4%, marking its best quarter in almost a year.

These Mining Stocks Have Downward Trending Correlations with Gold

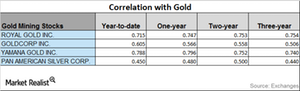

Uncertainty in the market significantly affects the performances of precious metals. It also affects precious metals mining stocks, which are known to closely track precious metals.

Reading the Ups and Downs of the Gold-Silver Spread

The gold-silver spread was trading at 68.5 on February 23, 2017. The spread suggests that it took 68.5 ounces of silver to buy a single ounce of gold.

Where the Gold-Platinum Spread Is Headed

Platinum is known for its use in jewelry and as an autocatalyst for diesel-based automobile engines. The demand has been very fragile over the past few years.

What’s the Correlation between Mining Stocks and Gold?

Mining companies that have high correlations with gold include Agnico Eagle Mines (AEM), Alacer Gold (ASR), Alamos Gold (AGI), and AngloGold Ashanti (AU).

Why Did Gold Fluctuate in 2016?

Gold prices for February expiration fell on the last trading day of the year. Gold fell 0.53% and closed at $1,152 per ounce on December 30, 2016.

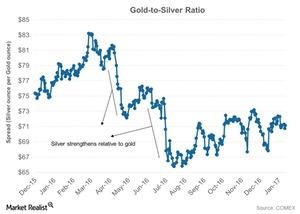

How Has the Gold-Silver Ratio Trended in 2016?

Gold and silver have been strong for the past few days. However, silver has substantially outperformed gold year-to-date.

Analyzing the Correlation of Mining Stocks

Mining companies that have high correlations with gold include Alamos Gold (AGI), First Majestic Silver (AG), B2Gold (BTG), and Royal Gold (RGLD).

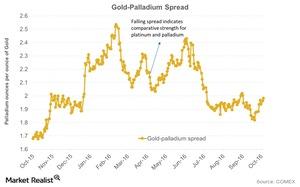

What’s Affecting the Gold-Palladium Spread?

Palladium has seen a year-to-date rise of 24.9%, which is higher than the increase in platinum, silver, and gold.

Where Is the Gold-Palladium Spread Headed?

The gold-palladium spread has seen its ups and downs over the past few months. But the United Kingdom’s Brexit vote resulted in some strength for palladium.

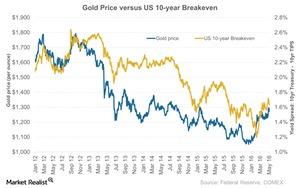

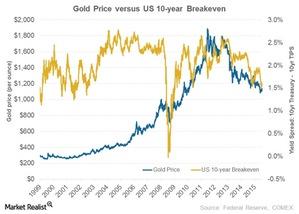

Are Inflation Concerns Likely to Boost Gold’s Performance?

The difference between yields on ten-year US notes and similar-maturity TIPS, a gauge of price expectations, expanded to as much as 1.7% last Tuesday.

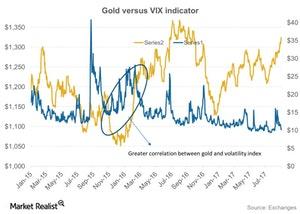

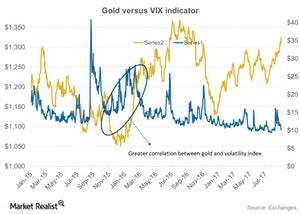

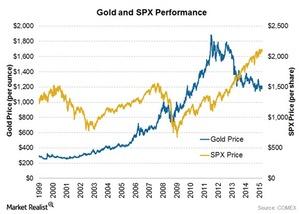

Gold’s Correlation to the Equity Markets

A look at gold and equity market performance demonstrates that a falling stock market isn’t necessarily a catalyst for a major rally in gold.

Inflation and Its Relationship to Gold Prices

Gold is a traditional hedge against inflation. Conditions that represent inflation include rising property prices, a rising stock market, and increasing asset values.