Inflation and Its Relationship to Gold Prices

Gold is a traditional hedge against inflation. Conditions that represent inflation include rising property prices, a rising stock market, and increasing asset values.

Sept. 24 2015, Updated 10:00 p.m. ET

Gold as a hedge against inflation

Gold is a traditional hedge against inflation. Conditions that represent inflation include rising property prices, a rising stock market, and increasing asset values. With debt on the rise, the debt burden, representing debt with relation to income, is increasing.

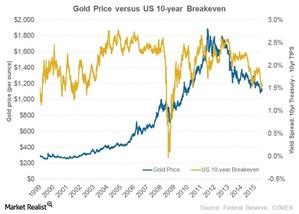

The US 10-year break-even

To depict inflation in the US economy, we can use the yield spread or the break-even spread. This measures the difference between the ten-year US government bond yield and TIPS (Treasury Inflation-Protected Securities).

The principal invested in TIPS is adjusted in line with the CPI (consumer price index). The yield spread, therefore, seems to be a good proxy for the US inflation measure.

High debt burdens

Inflation in the US economy is likely to cause rising prices of all assets. Gold prices may likely decrease as other assets such as stocks and real property may be preferred. However, if gold prices rise against the US dollar, gold becomes more expensive for the buyers around the world, as gold is dollar-denominated.

High inflation usually travels hand in hand with higher debt burdens. Reduced spending should control this ratio, as reduced demand is likely to pull prices down. With lower expenses, workers earn less, as one person’s spending is another person’s income. This can reduce the creditworthiness of these affected borrowers, as lower income makes it difficult to qualify for increased credit and the ability to repay additional or existing debt.

Deleveraging and gold

If borrowers sell assets to repay their debt, a selling rush may take place, leading to lower prices. Lower prices result in decreased value of assets backed as collateral against debt. Decreased collateral value, declining financial markets, and declining real estate prices could result in an overall market bust. This would end the inflationary phase and deleveraging could begin. Deleveraging is different than a recession, where lowering interest rates help the economy. In deleveraging, interest rates are already reduced to their minimum level, so there is not additional room for lowering rates.

Deleveraging can be positive for gold buffs, as demand for gold as a safe haven can boost gold prices. These economic phases that affect gold prices can also affect gold-backed exchange-traded funds like the SPDR Gold Trust ETF (GLD) and gold mining equities like Kinross Gold Corp. (KGC), Goldcorp Inc. (GG), and Alamos Gold Inc. (AGI). These three stocks together account for ~11.5% of the VanEck Vectors Gold Miners ETF (GDX).

The next article will highlight the ways to escape the deleveraging process.