Pan American Silver Corp

Latest Pan American Silver Corp News and Updates

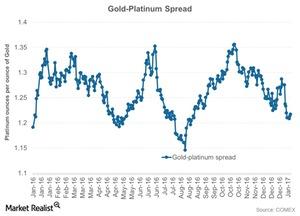

How the Gold-Platinum Spread Could Move More

The demand for platinum has been very fragile over the past few years, affected by the reduced market forecast for sales of diesel-based vehicles.

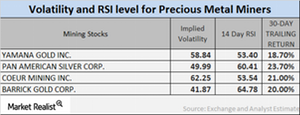

Analyzing the Volatility of Miners in February 2017

Call implied volatility takes into account the changes in an asset’s price due to variations in the price of its call option.

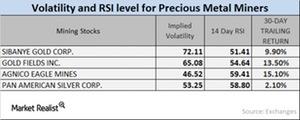

Volatility among the Miners in 2017

Sibanye Gold, Gold Fields, Agnico-Eagle Mines, and Pan American Silver had RSI levels of 51.4, 54.6, 59.4, and 58.8, respectively.

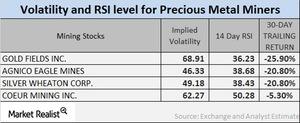

What Are Miners’ Volatility and RSI Levels?

Precious-metal-based funds such as the ProShares Ultra Silver (AGQ) and the Direxion Daily Gold Miners (NUGT) have seen a revival in their price during the last month.

What’s in Store for Silver Miners after the Fed’s Rate Hike?

Silver miners have shown a significant correlation to gold prices, at 0.84 from the start of 2013 to December 14, 2016.

Broad Commodities Market Sell-Off: Impact on Gold

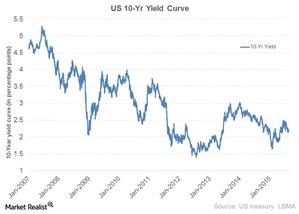

The benchmark US ten-year note yield fell by eight basis points, or 0.08%, to 1.96% as of Monday, August 24. Recent buying ended a bearish period in gold.

China’s Falling Stock Market Pushes Gold Upward

The turnaround from the direction that gold was headed during the last month has also supported silver prices. Silver fell marginally by 0.68% last month.

Gold Is Resilient to the Fed’s Likely Questionable Liftoff Move

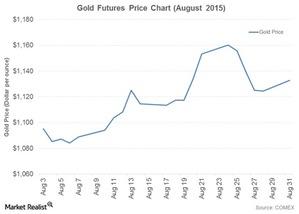

With the confusing reviews from the Fed on Wednesday, gold on COMEX rose 2.20% on August 20 and closed at $1,153.20 per ounce. Silver for September expiry also rose.