Tahoe Resources Inc

Latest Tahoe Resources Inc News and Updates

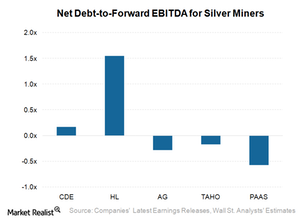

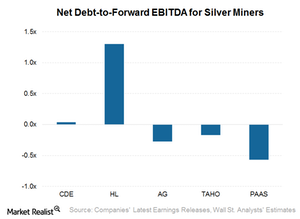

Behind Silver Miners’ Debt Repayment Capacities

Silver companies try to maintain an optimal level of debt-to-equity to lower their costs of capital and maintain an optimum level of risk-reward for shareholders.

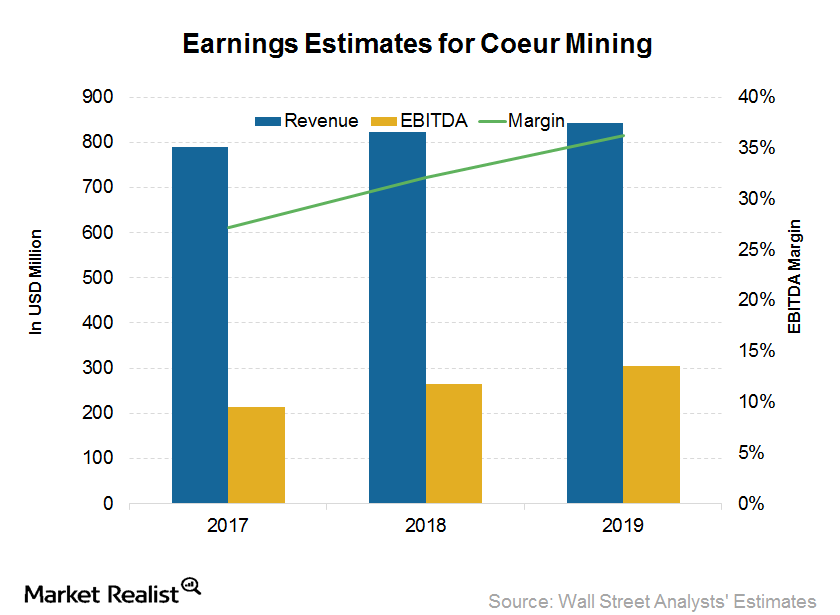

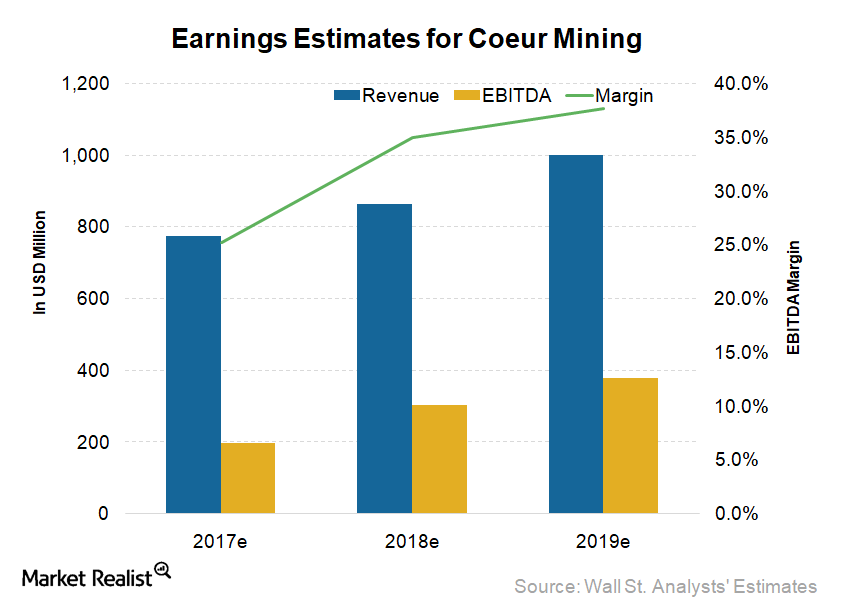

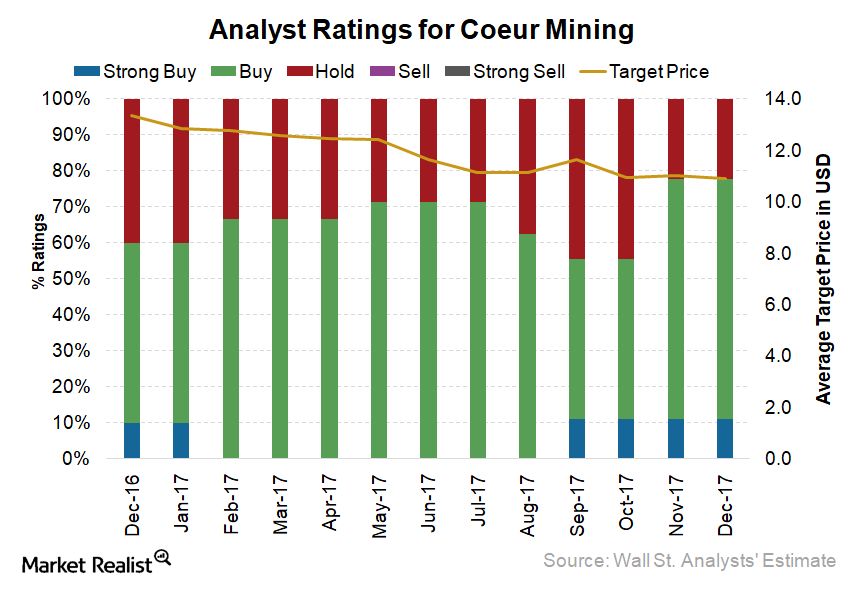

Analysts Are Optimistic about Coeur Mining

Market sentiment for Coeur Mining Coeur Mining (CDE) is a high-cost producer compared with peers (RING) (SIL). While it has initiated several measures to bring down its costs in the last few years, they remain high. Higher costs make CDE more leveraged to gold and silver prices than other low-cost producers such as Barrick Gold (ABX) […]

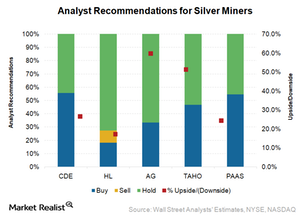

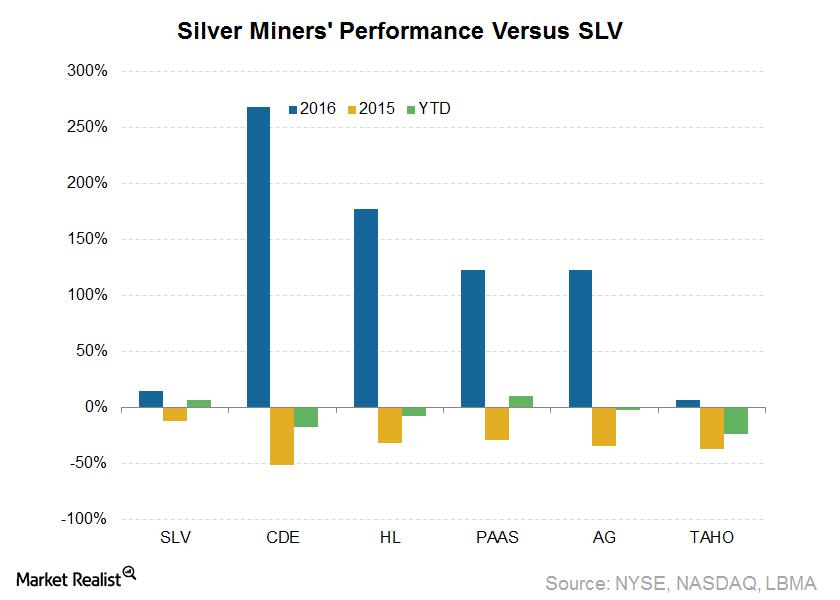

How the Ratings and Potential Upsides for Silver Miners Look Today

The performances of precious metal miners with substantial exposure to silver have been disappointing in 2017. As a group, they’ve returned just 0.9% YTD.

The Market Sentiment for Coeur Mining as 4Q17 Begins

CDE stock has risen 2.6% year-to-date. However, during the same period, silver prices gained 4.7% and the Global X Silver Miners ETF (SIL) rose 5.5%.

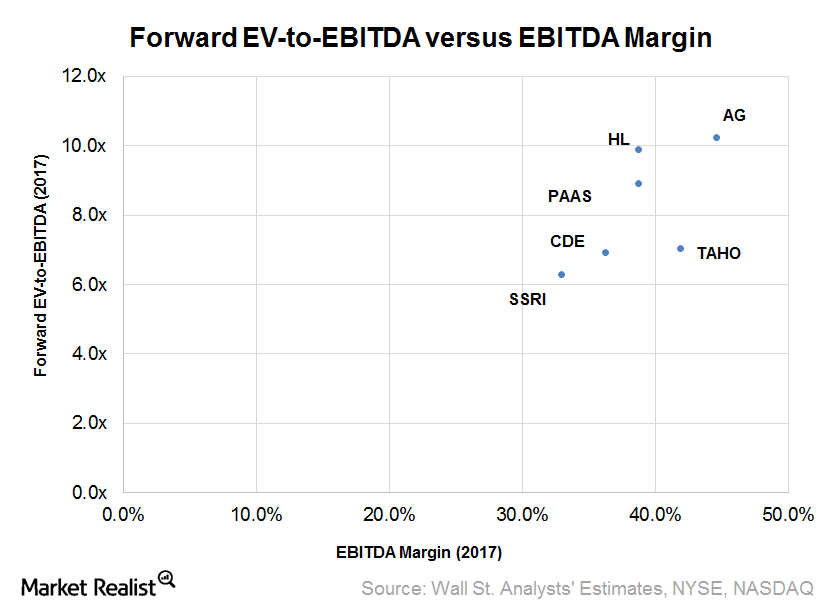

Analyzing Silver Miners’ Relative Valuations

Precious metals miners with substantial exposure to silver are usually classified as silver miners.

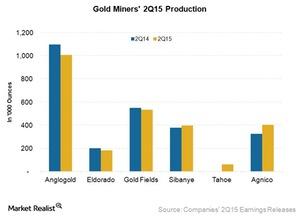

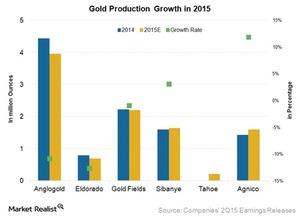

Evaluating Gold Production for Intermediate Gold Miners in 2Q15

Gold production is an important metric for gold miners, because miners generally try to increase gold production in order to reduce costs amid low prices.

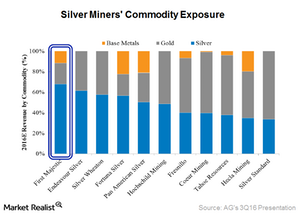

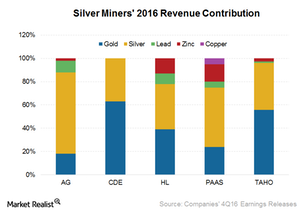

Which Silver Miners Offer Diversified Exposure to Commodities?

For investors considering silver stocks due to their leveraged exposure to silver prices, the higher the company’s revenues derived from silver, the better.

What Put Coeur Mining in 2nd Place?

Right now, of the nine Wall Street analysts covering CDE stock, according to Thomson Reuters, 78% recommend a “buy,” while 22% recommend a “hold.”

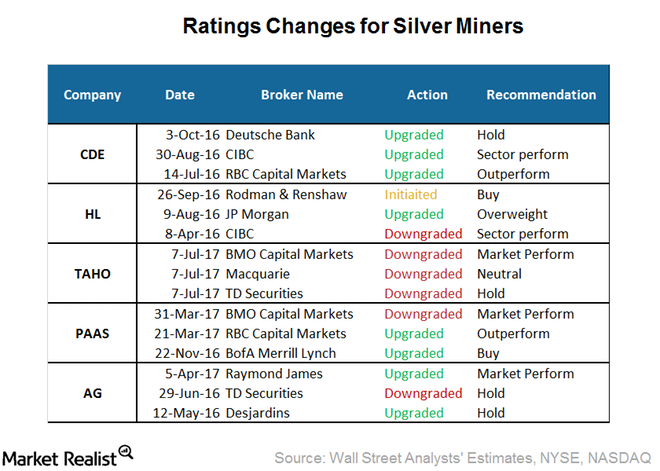

Behind the Recent Analyst Rating Changes for Silver Miners

After the Guatemalan government’s decision to suspend Tahoe Resources’ (TAHO) license, the company saw several downgrades.

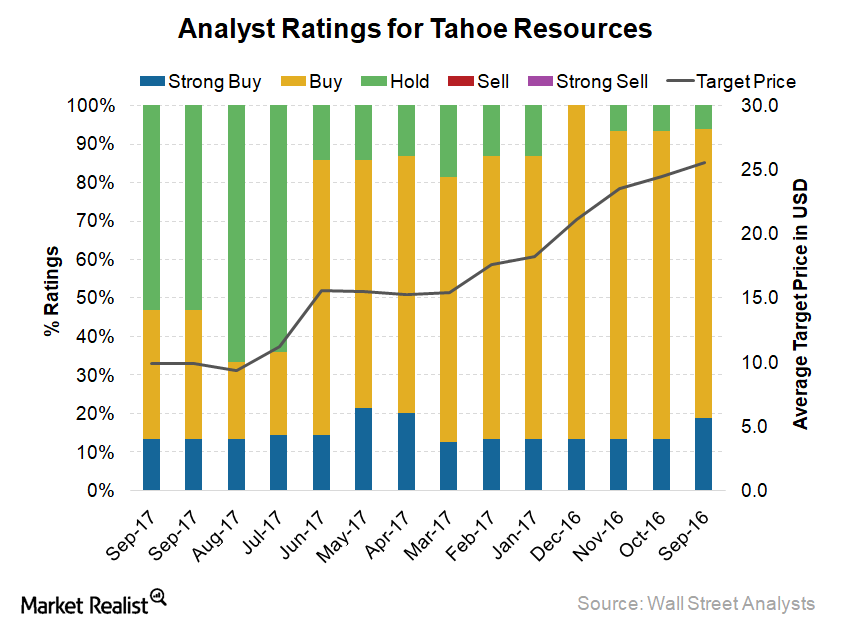

How Do Analysts View Tahoe Resources despite Its Underperformance?

Tahoe Resources (TAHO) stock has lost 44.1% of its value year-to-date until the end of September.

How Silver Miners Rank Based on Debt Repayment Capacity

Coeur Mining (CDE) has a net debt-to-forward-EBITDA ratio of 0.40x, which seems comfortable. Hecla Mining’s (HL) ratio is slightly higher at 1.3x.

A Look at Silver Miners’ 2016 Commodity Exposure

Commodity exposure In the previous part of this series, we looked at miners’ geographic exposure, which is important to consider due to the geopolitical risks some jurisdictions face. It’s equally important to consider their revenue compositions in terms of commodity exposure. Contribution from silver Silver companies are rarely pure-play miners. For investors considering silver […]

Looking at Silver Miners after the Federal Reserve’s Rate Hike

Silver miners (SIL) are usually a levered play on gold. Notably, silver has outperformed gold year-to-date.

Why Growth in Gold Production Is Important for Gold Miners

Future gold production growth is important because the gold market is forward-looking, making future gold production a key driver of gold miners’ revenue.

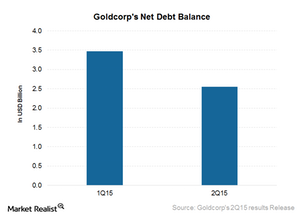

Goldcorp’s FCF Growth Could Strengthen Its Balance Sheet

Goldcorp has the strongest balance sheet in its peer group. Goldcorp’s liquidity is also comfortable at $3.2 billion, including $940 million in cash and cash equivalents.