How the Ratings and Potential Upsides for Silver Miners Look Today

The performances of precious metal miners with substantial exposure to silver have been disappointing in 2017. As a group, they’ve returned just 0.9% YTD.

Nov. 20 2020, Updated 3:55 p.m. ET

Performances of silver miners

The performances of precious metal miners with substantial exposure to silver have been disappointing in 2017. As a group, they’ve returned just 0.9% YTD (year-to-date) as of October 6, 2017. By comparison, silver prices have gained 4.7% over the same time.

The individual performances of silver miners have been varied. Tahoe Resources (TAHO) has underperformed its peers (SIL), losing 43.3% YTD, while First Majestic Silver (AG) has lost 4.5% as of October 6, 2017.

Pan American Silver (PAAS), on the other hand, has outperformed peers, rising 15.7% YTD, while Hecla Mining (HL) and Coeur Mining (CDE) have gained 1.3% and 2.6%, respectively.

To read about the latest analyst ratings and earnings estimates, check out Market Realist’s 3Q17 Earnings Preview: How Wall Street Views Silver Miners.

Analysts’ favorite and least favorite

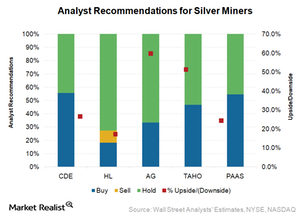

Coeur Mining (CDE) appears to be the analysts’ favorite among the primary silver miners, with 56% “buy” ratings. PAAS has 55% “buy” ratings.

Hecla Mining (HL) has the highest “sell” ratings at 73%, followed by First Majestic Silver’s 67% “sell” ratings.

Rating changes, upsides, and downsides

Among the miners in this group, TAHO has seen the most rating changes over the past few months. Until the end of June, TAHO was the analysts’ favorite, with 85.7% “buy” ratings. But on July 5, 2017, the government of Guatemala decided to suspend Tahoe’s permit to operate its Escobal mine. While the license was reinstated in September, some conditions attached to the ruling have made the license practically useless for now.

Based on current market prices, AG has the highest upside potential of 59.6%, followed by TAHO’s 51.2%.

Below, we’ll discuss how the analysts’ recommendations for silver miners have changed.