First Majestic Silver Corporation

Latest First Majestic Silver Corporation News and Updates

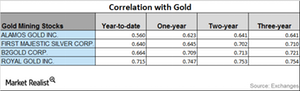

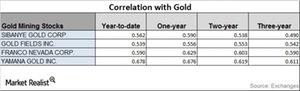

These Mining Stocks Have Downward Trending Correlations with Gold

Uncertainty in the market significantly affects the performances of precious metals. It also affects precious metals mining stocks, which are known to closely track precious metals.

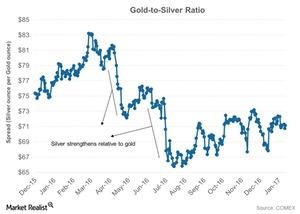

Reading the Ups and Downs of the Gold-Silver Spread

The gold-silver spread was trading at 68.5 on February 23, 2017. The spread suggests that it took 68.5 ounces of silver to buy a single ounce of gold.

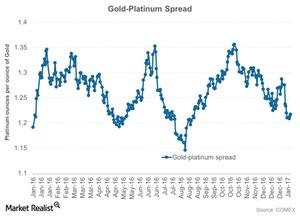

Where the Gold-Platinum Spread Is Headed

Platinum is known for its use in jewelry and as an autocatalyst for diesel-based automobile engines. The demand has been very fragile over the past few years.

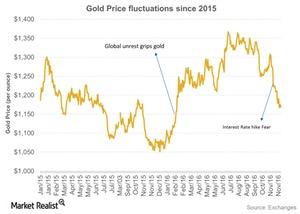

Why Did Gold Fluctuate in 2016?

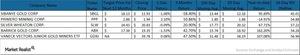

Gold prices for February expiration fell on the last trading day of the year. Gold fell 0.53% and closed at $1,152 per ounce on December 30, 2016.

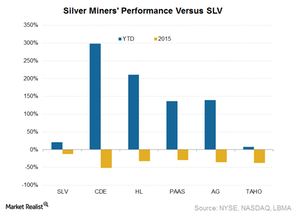

What’s in Store for Silver Miners after the Fed’s Rate Hike?

Silver miners have shown a significant correlation to gold prices, at 0.84 from the start of 2013 to December 14, 2016.

Analyzing the Correlation of Mining Stocks

Mining companies that have high correlations with gold include Alamos Gold (AGI), First Majestic Silver (AG), B2Gold (BTG), and Royal Gold (RGLD).

Why Are Precious Metals Showing Weakness?

Gold broke its key level of $1,300 per ounce on Tuesday, October 4, 2016. But investors are seeing gold’s 200-day moving average of $1,258 per ounce as a resistance level.

Why Mining Stocks Are Rising post-Brexit

Friday was important. Gold rose to a two-year high due to additional haven bids on the Brexit referendum.

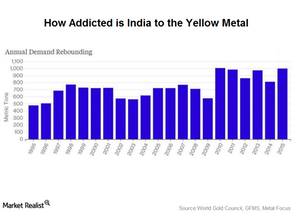

India’s Gold Demand May Touch 1000 Tonnes in 2015

The World Gold Council predicted that India’s gold demand in the October–December quarter would be muted. Gold imports shrank 36.5% to $3.53 billion in November.

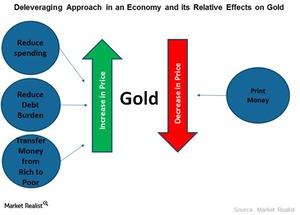

Reviewing an Economy and Its Effect on Gold Prices

Deleveraging can affect gold and other bullion prices, as well as exchange-traded funds such as the iShares Gold Trust ETF (IAU) and the iShares Silver Trust ETF (SLV).

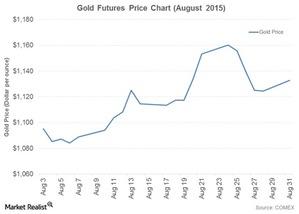

Gold Is Resilient to the Fed’s Likely Questionable Liftoff Move

With the confusing reviews from the Fed on Wednesday, gold on COMEX rose 2.20% on August 20 and closed at $1,153.20 per ounce. Silver for September expiry also rose.

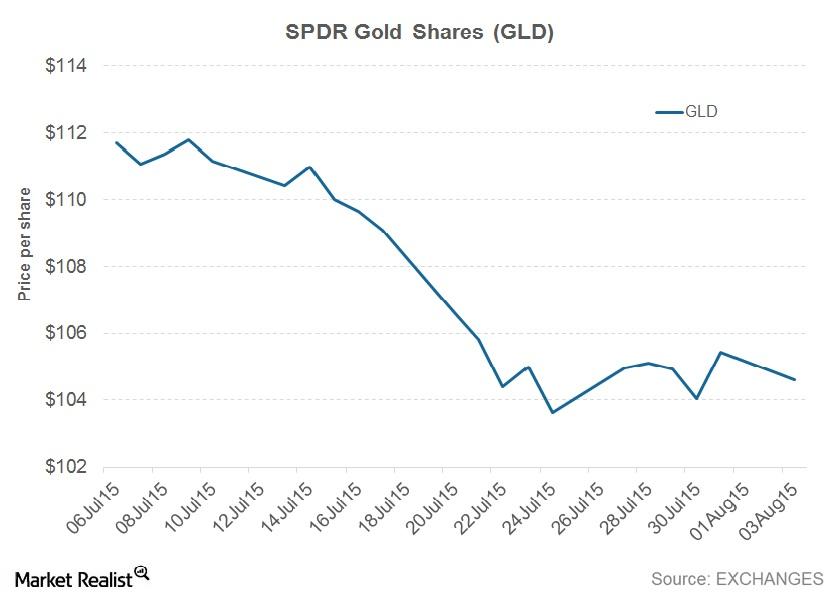

Why Is the SPDR Gold Shares ETF (GLD) Losing Its Sheen?

The SPDR Gold Shares ETF (GLD) is the world’s largest ETF. It’s also the highest-traded. Friday’s price for GLD was $104.39.