PSLV or SLV: Which Is a Better ETF Stock to Buy and Bet on Silver?

The Sprott Physical ETF (PSLV) and the iShares Silver Trust (SLV) are among the popular ETFs to get exposure to silver. Which is a better stock to buy?

Feb. 15 2022, Published 8:56 a.m. ET

As broader markets have looked volatile, some investors are looking to invest in precious metals like silver and gold. The Sprott Physical ETF (PSLV) and the iShares Silver Trust (SLV) are among the popular ETFs to get exposure to silver. Which of these is a better ETF to buy?

While both silver and gold are precious metals and portfolio diversifiers, their risk-reward dynamics are different. Apart from the jewelry demand, silver also has industrial demand. Usually, silver is more volatile than gold. To invest in silver, you can choose from multiple alternatives, including stocks of companies that produce silver.

Which is the best way to invest in silver?

If you're looking at pure-play exposure to silver, buying physical gold is among the best options. However, there are other costs associated with buying physical silver including storage and insurance costs, which makes some investors apprehensive about buying physical silver.

Another option is to either buy stocks of companies that produce silver or an ETF that invests in silver-producing companies. However, stock prices of silver producers are a leveraged bet on the underlying and they don’t fully track the price action of silver. Along with silver, market sentiments also impact silver producers’ stock prices.

Silver ETFs, which invest in physical silver, have emerged as an attractive option for investors looking for exposure to the precious metal. PSLV and SLV are the two popular ETFs that invest in silver.

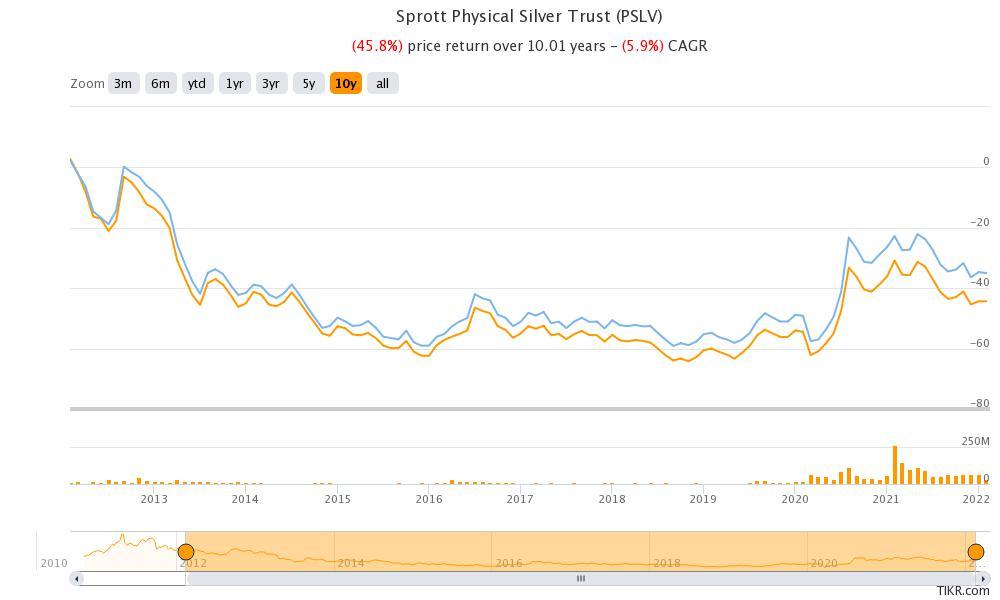

PSLV has underperformed SLV.

PSLV has an annual expense ratio of 62 basis points, which is 12 basis points higher than SLV. PSLV has underperformed SLV consistently and the gap keeps getting wider. For example, while PSLV underperformed by around 6 percentage points over the last three years, the gulf is over 10 percentage points wide when comparing their price movement over the last decade.

SLV is sponsored by BlackRock.

SLV is sponsored by BlackRock, which is the world’s largest asset manager. PSLV on the other hand is managed by Sprott, which is a global asset manager specializing in bullion and real assets. Both are credible fund houses and with SLV being a silver ETF, there isn't much that the fund manager can do.

Some investors prefer PSLV.

Despite PSLV's high fees, which means that it would always underperform SLV, some investors prefer PSLV. This is mainly because of the way these two fund houses store and manage their silver holdings.

The silver that PSLV invests in is stored in Royal Canadian Mint while the custodian for SLV is JPMorgan. JPMorgan paid a $920 million fine in 2020 for rigging precious metal and Treasury prices between 2008 and 2016. Also, many people prefer PSLV since the custodian is a sovereign-backed entity, unlike JPMorgan which is a private company.

You can take silver delivery in PSLV.

You can take the delivery of physical silver in PSLV provided they're equivalent to a minimum of 10 London Good Delivery Bars or an integral multiple. The charges associated with taking the physical silver would be borne by the investor.

Some investors think that PSLV is a more trustworthy ETF. They're willing to overlook PSLV's underperformance and lower liquidity, which increases the impact costs. Meanwhile, most investors seem to like SLV for its superior returns, which is reflected in its AUM. SLV's AUM is almost four times that of PSLV.

Should you buy silver ETFs now?

Silver has delivered negative returns over the last decade, both on the absolute as well as an inflation-adjusted basis, and trades well below its all-time highs. Investing in silver can be a good way to diversify your portfolio since broader markets have turned volatile amid the Ukraine-Russia crisis.