PowerShares India ETF

Latest PowerShares India ETF News and Updates

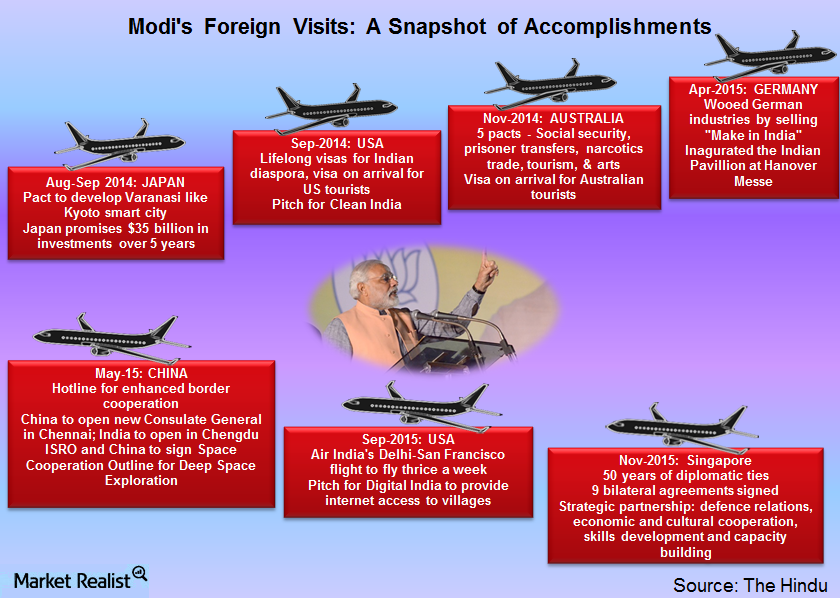

Modi’s Moment: Promises and Accomplishments

India (PIN) has strengthened its ties with Asian powerhouses (GRR) like Japan (JEQ) (EWJ) and Singapore (SGF).

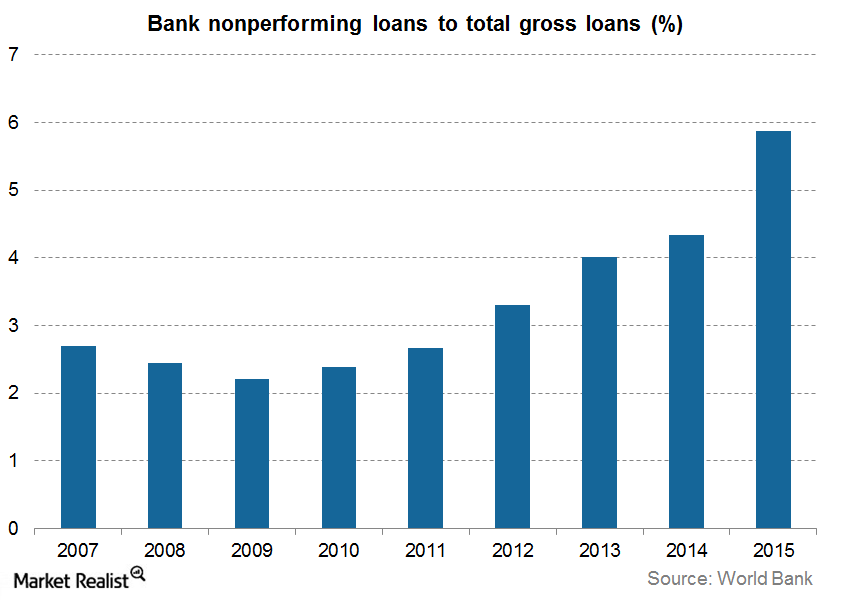

Broke Banks

“Banks are there to support businesses that have justifiable needs.” – Vijay Mallya, Indian businessman and politician, 2015 If corporate India is to thrive, it needs a healthy, functioning banking system. Socially useful projects and initiatives require capital and banks should be able to allocate this capital efficiently. While progress is being made, India’s banks […]

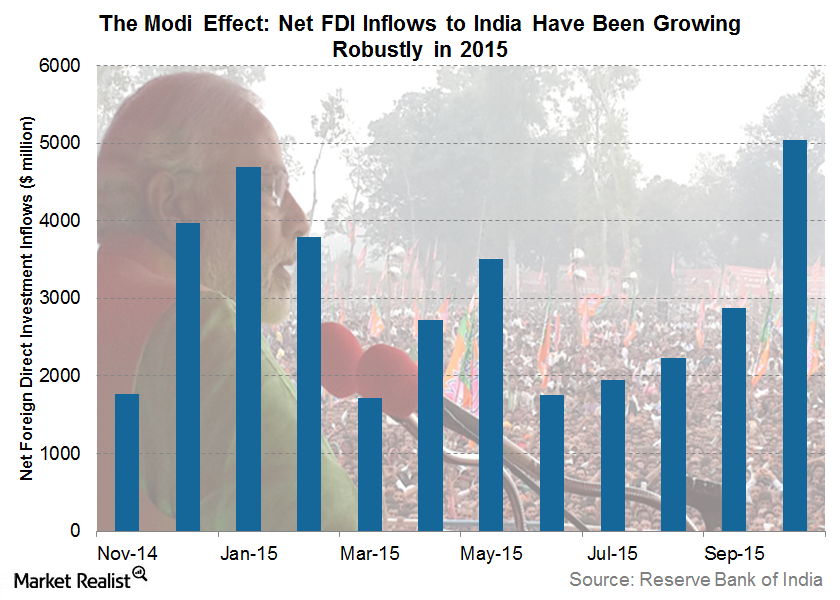

The Modi Effect: Transforming India One Step at a Time

Global investors’ perception of India has dramatically transformed in the last two years.

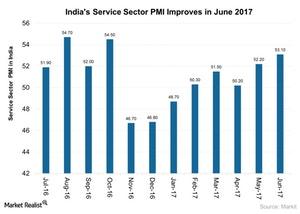

India’s Service Sector Activity Strengthened at the End of 2Q17

The service sector PMI (purchasing mangers’ index) in India (INDA) rose to 53.1 in June 2017, compared to 52.2 in May.

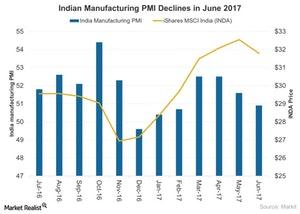

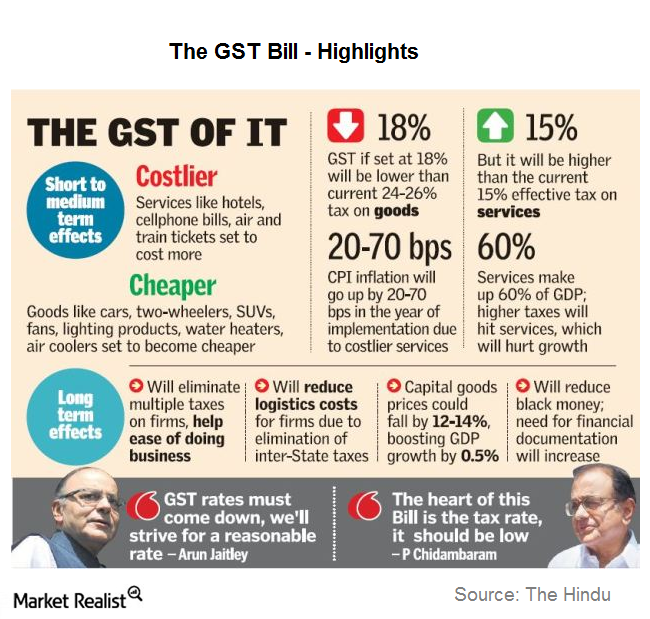

Why Manufacturing Activity in India Fell in June 2017

Uncertainty related to India’s new goods and services tax, which was implemented on July 1, 2017, seemed to affect India’s manufacturing activity in June 2017.

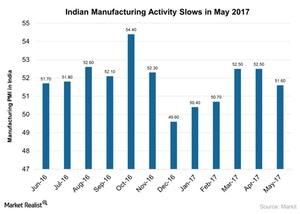

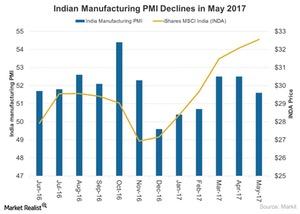

Why India’s Manufacturing Lost Momentum in May

Manufacturing activity in India lost momentum in May 2017, with the India Manufacturing PMI (purchasing managers’ index) recording a decline.

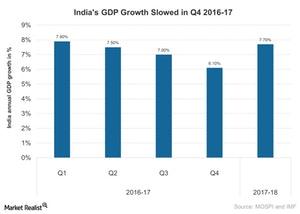

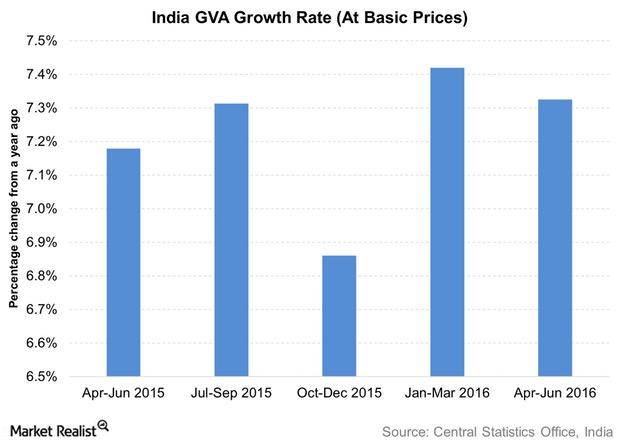

What Happened to Growth in India in Fiscal 4Q16

Economic growth in India (INDA) slowed during the country’s fiscal 4Q16 (January 2017–March 2017), revealing the impact of demonetization.

India’s Manufacturing Activity in May 2017

The Nikkei Manufacturing PMI in India dropped to 51.6 in May 2017 compared to 52.5 in April 2017.

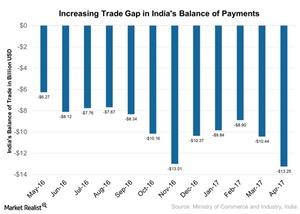

A Look at India’s Trade Gap and Its Economic Impact

India’s trade gap increased 173.5% on a year-over-year basis to ~$13.3 billion in April 2017, beating the market’s expectations of an ~$12.8 billion gap.

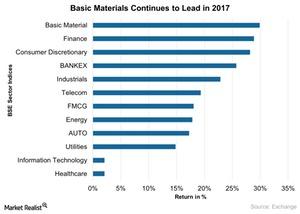

Does the Basic Materials Sector Still Lead in India in 2017?

India’s stock market performance has picked up pace since the beginning of 2017. The S&P BSE Sensex has gained about 10% year-to-date through May 18, 2017.

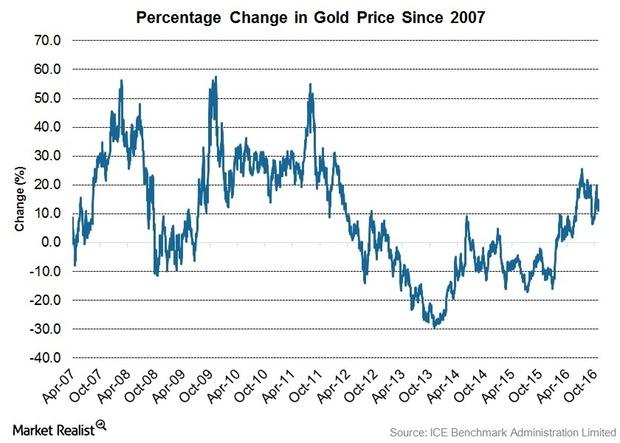

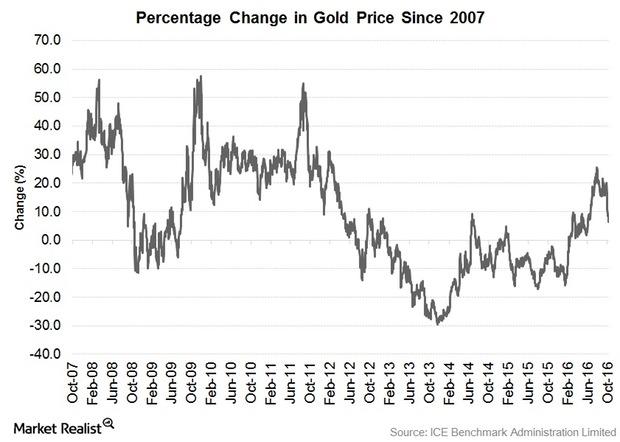

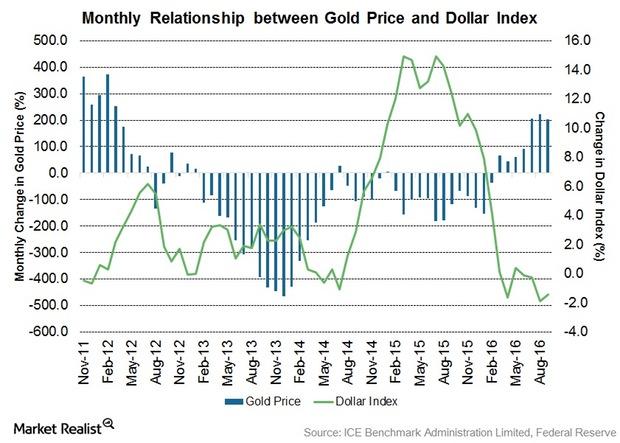

Bull Market: Expected for Gold, Not for Bonds

Long-Term Outlook Remains Positive for Gold Bull Market Our view on the long-term gold price is unchanged. We see the recent weakness as a consolidation phase within what we believe is the early stages of the next bull market for gold. We continue to believe dislocations created by the unconventional policies being implemented by central […]

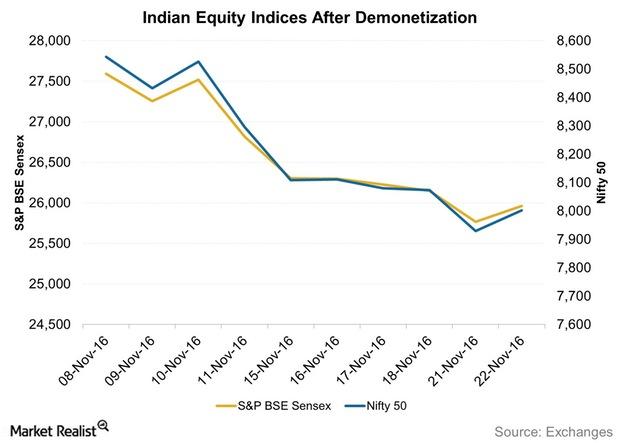

India’s Financial Markets Fell Due to Demonetization

The two benchmark equity indices—the Nifty 50 and the S&P BSE Sensex—fell each trading day since the demonetization except for November 10 and November 22.

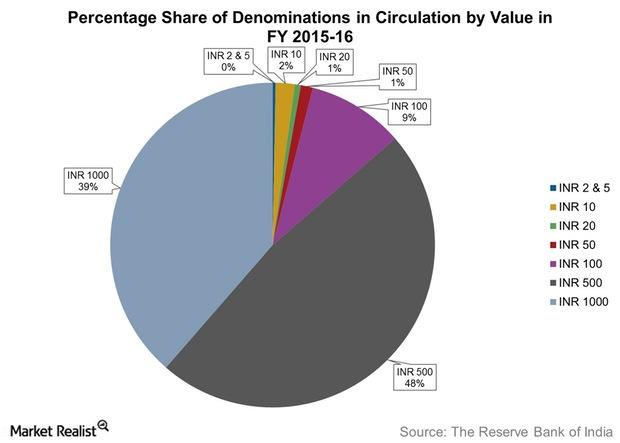

How Could Demonetization Impact the Indian Economy?

The demonetization of the 500 rupee note and the 1,000 rupee note will likely hit the Indian economy hard in the short term.

Why India Demonetized 2 Currency Notes

The 500 rupee note and the 1,000 rupee note were demonetized at midnight on November 8. The move aimed to curb black money in the financial system.

Gold and Gold Miners: Analyzing Recent Performance

Gold bullion ended September at $1,315.75 per ounce for a 0.5% gain while gold stocks experienced more positive returns. The NYSE Arca Gold Miners Index[1. NYSE Arca Gold Miners Index (GDMNTR) is a modified market capitalization-weighted index comprised of publicly traded companies involved primarily in the mining for gold] (GDMNTR) posted a 3.8% gain, while […]

India and Asia’s Festive Season Could Help Gold Prices in October

Gold has fallen below $1,300 per ounce and broken below the longer-term trend line that had been established this year.

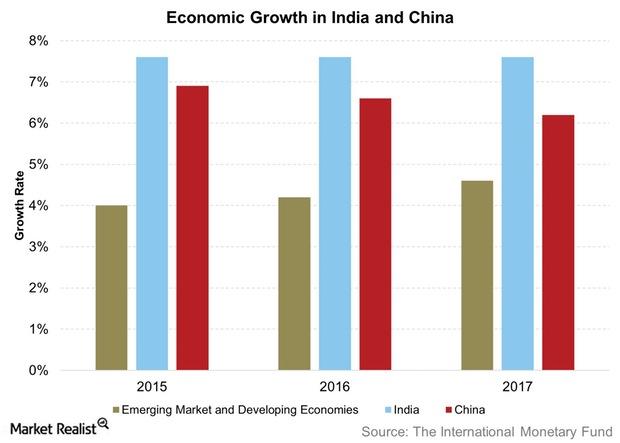

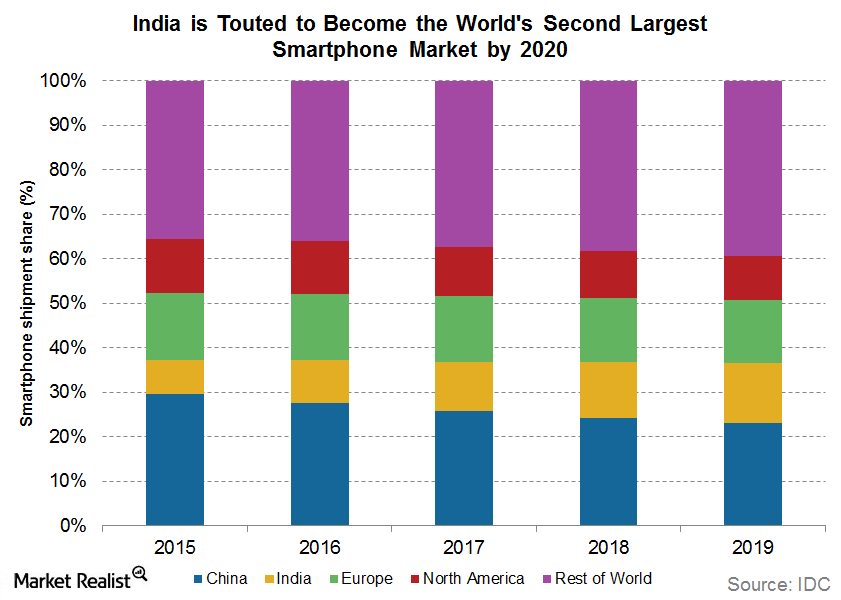

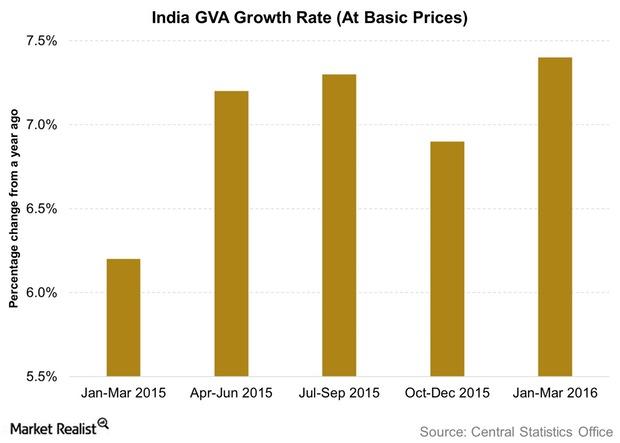

India’s Economic Growth Strong, While China’s May Be Stabilizing

In its October World Economic Outlook, the IMF projected that India’s economic growth would reach 7.6% in both 2016 and 2017.

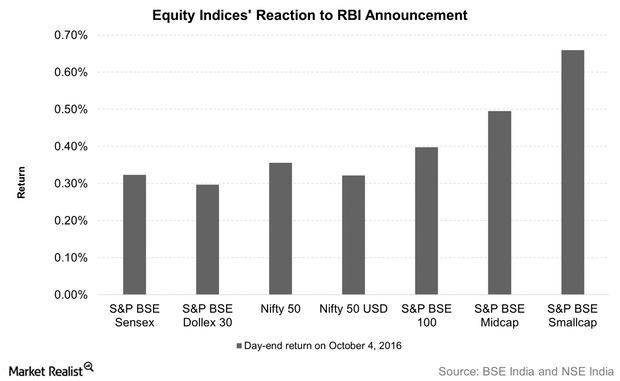

Indian Equities Rise after the RBI’s October 2016 Monetary Policy Announcement

Equities gain Indian equities rose on October 4, 2016, the day of the RBI’s (Rerserve Bank of India) latest monetary policy announcement. The central bank’s cut of its repo rate had a positive effect on equities, with bonds rising initially along with the Indian rupee. Banking and telecom stocks were among major gainers during the […]

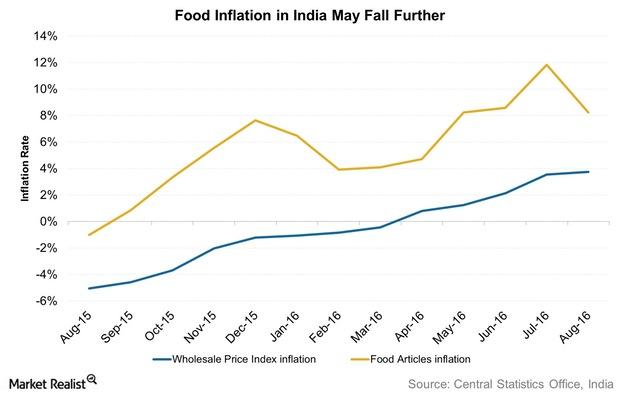

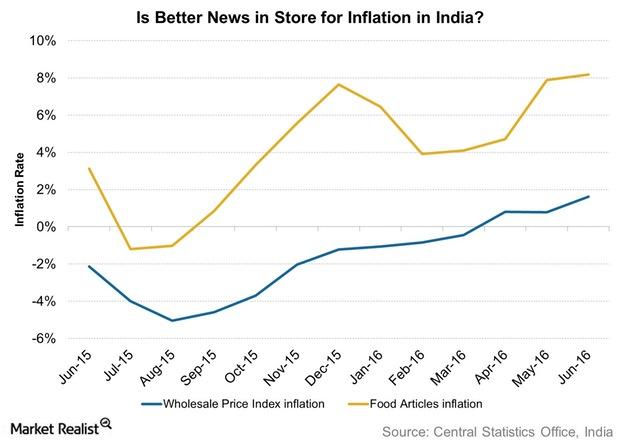

How Does the RBI See Food Inflation Panning out in India?

Components of inflation While food inflation in India has been pushing retail inflation up, fuel inflation (BP) (STO) (RDS.B), another important component, has been subdued. According to the October monetary policy statement issued by the RBI (Reserve Bank of India), “Fuel inflation has moderated steadily through the year so far.” The RBI has also announced […]

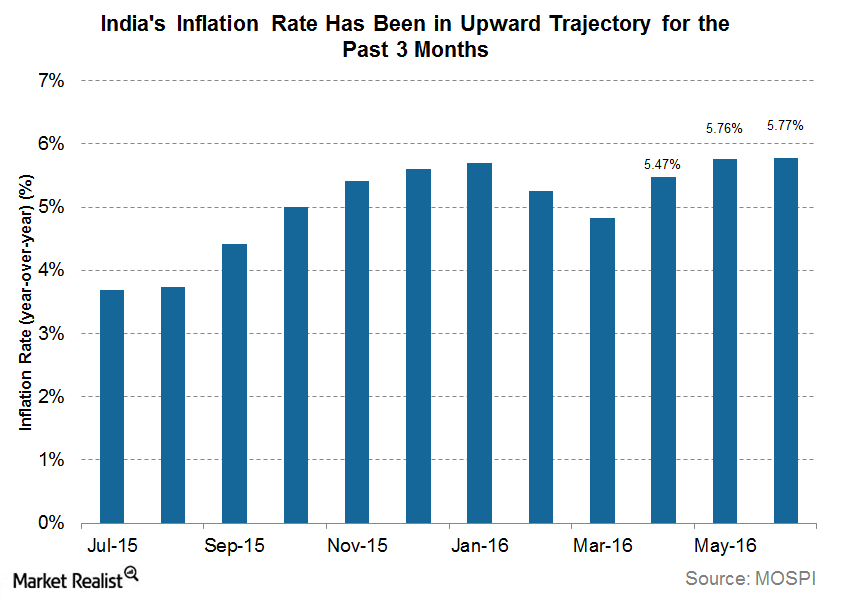

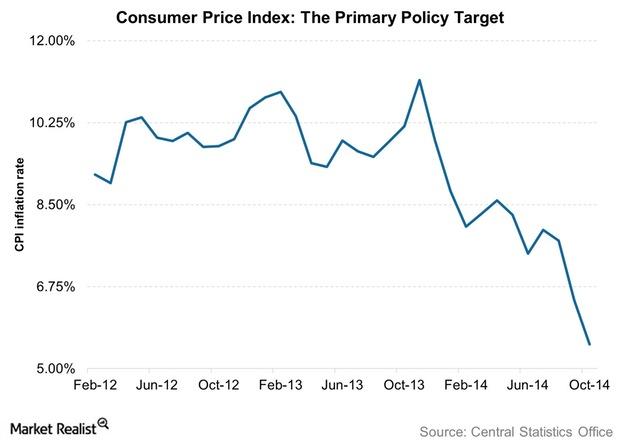

Rajan to the Rescue: The Inflation Story

Consumer prices increased in India by 5.8% in June 2016 on a year-over-year basis.

How Modi’s ‘Digital India’ Campaign Could Spur Growth

Digital India aims to make government services available to all Indian citizens electronically by providing countrywide Internet connectivity and infrastructure.

How Modi Aims to Overhaul India’s Tax System

The GST bill was passed by both houses of the Indian parliament on August 8, 2016.

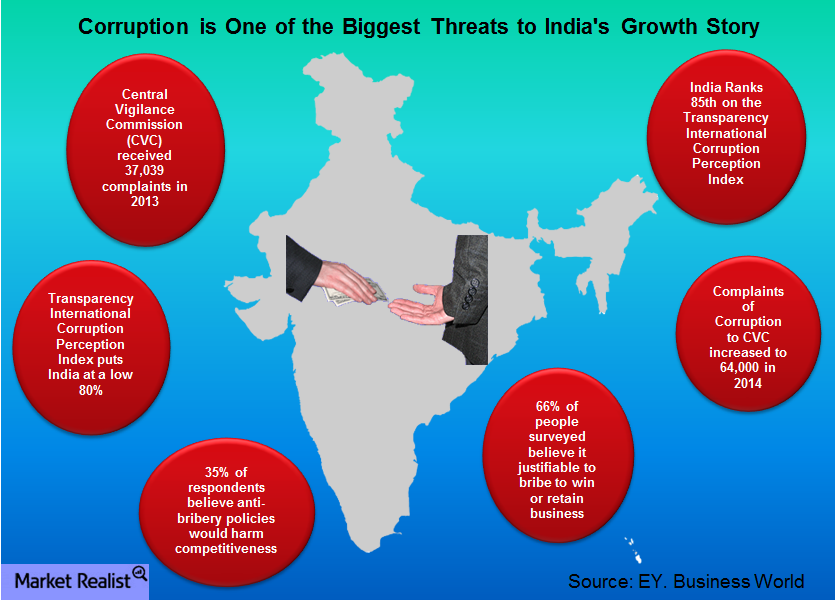

What Could Threaten India’s Growth?

Despite the impressive reform agenda and robust GDP growth, there are several challenges facing the Indian economy (PIN) (EPI).

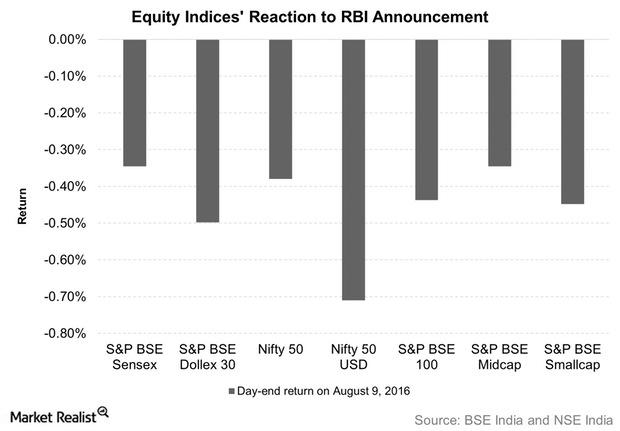

Indian Equities and Funds Fall after the August Monetary Policy

Indian equities fell on August 9, the day of the monetary policy announcement. Benchmark equity indices like the S&P BSE Sensex and the Nifty 50 fell 0.4%.

What Risks Does the RBI See for Retail Inflation?

The RBI thinks that risks to inflation are “tilted to the upside.” A subsequent rise in inflation could have a negative impact on consumer spending.

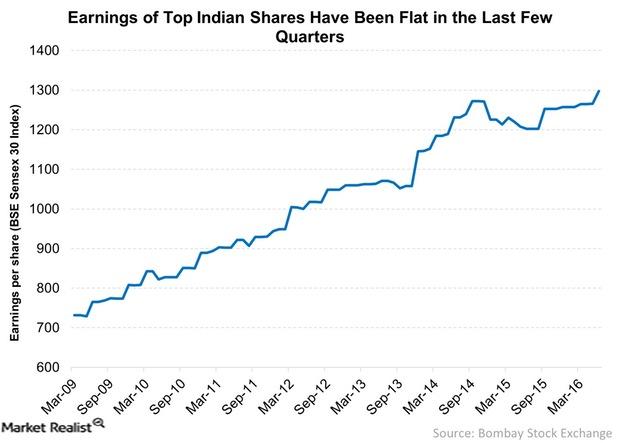

Can Indian Corporate Earnings Take a Turn for the Best?

Are Indian corporate earnings likely to turn around? Earnings have been flat since late 2014.

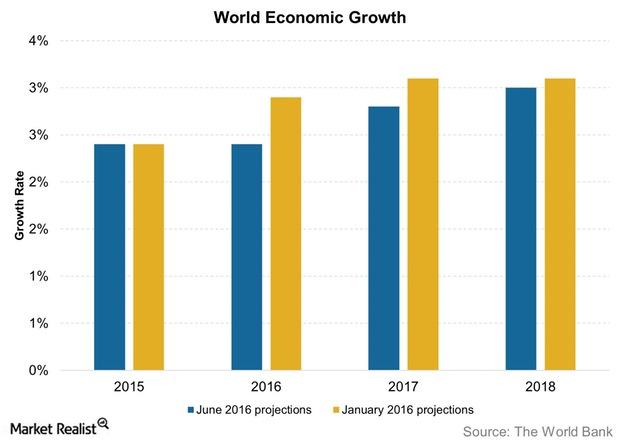

The World Bank Has News about the Global Economy, and It’s Not Good

In its 25th annual Global Economic Prospects report, the World Bank did not have many good things to say about the global economy in 2016.

Reserve Bank of India Sees India on Firm but Uneven Ground

Industrial production remains a problem for India, with the RBI (Reserve Bank of India) noting that the index measuring industrial production decelerated in fiscal 2015–16.

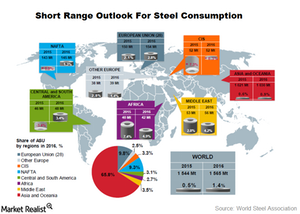

Global Steel Consumption Is Expected to Grow 0.5% in 2015

The WSA expects global steel consumption to grow by 0.5% in 2015 on a YoY basis. This was highlighted in the short range outlook released on April 20.

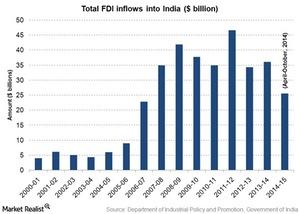

Make in India: A key campaign for India’s manufacturing sector

The Make in India campaign, introduced last September, is expected to create job opportunities for at least 100 million youths in India over time.

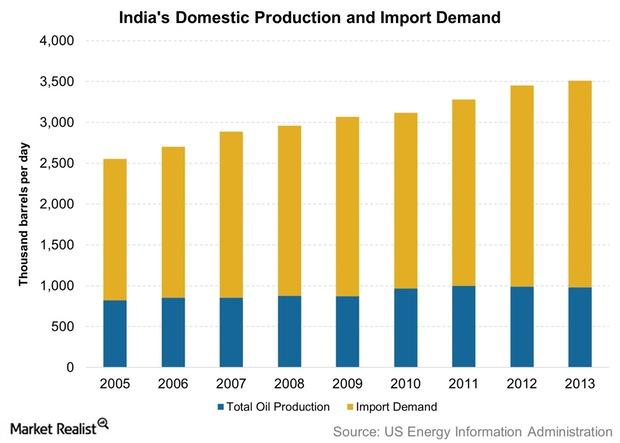

What amount of crude oil does India produce?

India produces a little under a quarter of its crude oil demand. The EIA estimates that India had close to 5.7 billion barrels of proven oil reserves at the beginning of 2014.

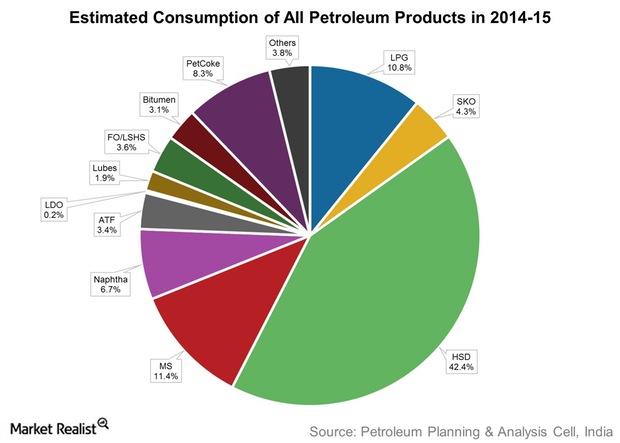

Analyzing India’s oil consumption

In India, the consumption of oil products saw steady growth over the years. The CAGR (compound annual growth rate) for the ten years ending in March 2014 is above 3.5%.

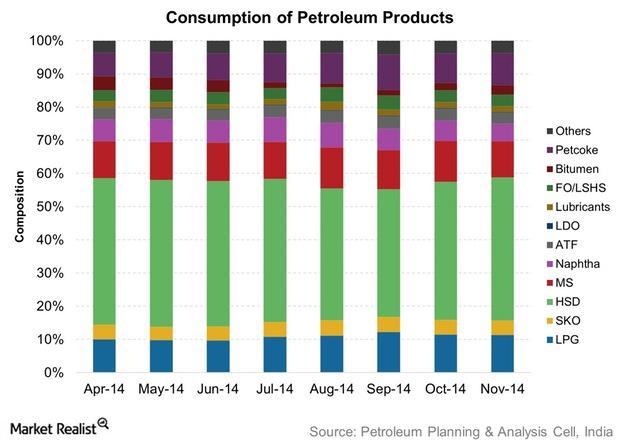

What products does India produce and consume?

Before moving on to India’s petroleum consumption, production, and refining, it would be beneficial to take a look at the various products that India produces and consumes.Macroeconomic Analysis Why India’s poor infrastructure is a detractor

The primary reason for India’s slow infrastructure development is poor implementation.Macroeconomic Analysis To do or not to do business in India

Doing business has been a major concern for international businesses interested in setting up shop in India.

Must-know: India’s monetary policy

The RBI is India’s central bank. It used to announce its monetary policy twice in a financial year. In India, a financial year begins in April and ends in March the next year.Macroeconomic Analysis Where India spends and earns its revenues

Plan expenditure is closely associated with economic growth. It focuses on investment in order to enhance productive capacity. Non-plan expenditure is mainly obligatory in nature.Macroeconomic Analysis Understanding India’s political system—making decisions

In India, the decision-making process isn’t fast. It’s affected by the current assembly’s constitution. Slow decisions hurt a nation’s image.