How Modi Aims to Overhaul India’s Tax System

The GST bill was passed by both houses of the Indian parliament on August 8, 2016.

Aug. 31 2016, Updated 3:04 p.m. ET

“Great works are performed not by strength but by perseverance.” – Samuel Johnson, English writer, 1759

Among Modi’s more contentious reforms is an overhaul of India’s tax system. In the words of Finance Minister, Arun Jaitley, implementation of tax reforms will “… put to rest various disputes and issues and make sure that the scope of discretions is eliminated and there is a greater degree of stability and predictability…” A key element of the reforms is the replacement of numerous complicated inter-state taxes with a single uniform goods and sales tax (GST). A single, simplified tax regime is expected to improve compliance and revenue collections, as well as allowing the free flow of goods and services between states.

The GST bill needs a two-thirds majority of both Houses of Parliament and consensus and ratification by more than half of the states. Almost every economist and political analyst we’ve spoken to expects the GST bill to be passed by late 2016 at the earliest, with ratification by the states and subsequent enactment by the central government to follow. GST will provide a boost to growth, but the extent of that depends on the quality of bill passed. A poor quality bill with many exemptions could result in only a minor boost to GDP of 0.5% or less (alcohol is currently exempted). A good quality bill; however, could boost growth by more than 1.5%. The rate has not yet been finalized yet, but here again there is disagreement between the government, opposition parties and some states regarding what rate GST should be fixed at and whether net producing states should receive an additional levy or not. Clearly, further work needs to be done.

However, it is important to remember that the GST debate is not just a Congress/BJP issue. States that stand to lose have been among the fiercest opponents, including the PM’s home state of Gujarat. The objections of Gujarat and other net producing states are that under a destination-based consumption tax model, they will suffer loss of revenue. The government argues that such states will benefit from additional service taxes but a lack of clarity on the figures is providing some uncertainty. The pertinent question is whether it is better to be patient and negotiate a high-quality bill, or to try to fast track a watered-down bill.

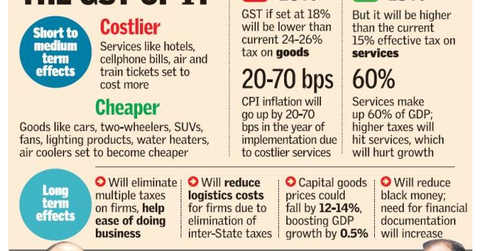

Market Realist – The GST bill was passed by both houses of the Indian parliament on August 8, 2016. The bill was passed by the Lok Sabha last year. However, the Rajya Sabha sent back the bill to the house with some major changes last week. All 443 members present in the house unanimously voted in favor of the bill. Prime Minister Narendra Modi described the national sales tax as a major step “that will deliver us from tax terrorism.” He also called the GST a “Great step taken by India, a great step of transformation, and a great step towards transparency” (Source: The Hindu). The government hopes to decrease cases of tax evasion and improve ease of business by implementing the bill. The previous infographic from The Hindu explains the major highlights of the GST.

However, this is not the last hurdle. The bill must be ratified by 15, or half, of India’s (EPI) (IFN) 29 states. Once that is done, a GST Council will be formed with both the center and states as its members. The council will recommend rates and other modalities for the tax.

Foreign investors have lauded the passing of the bill by the Indian houses (INDA) (PIN) of Parliament.