WisdomTree India Earnings Fund

Latest WisdomTree India Earnings Fund News and Updates

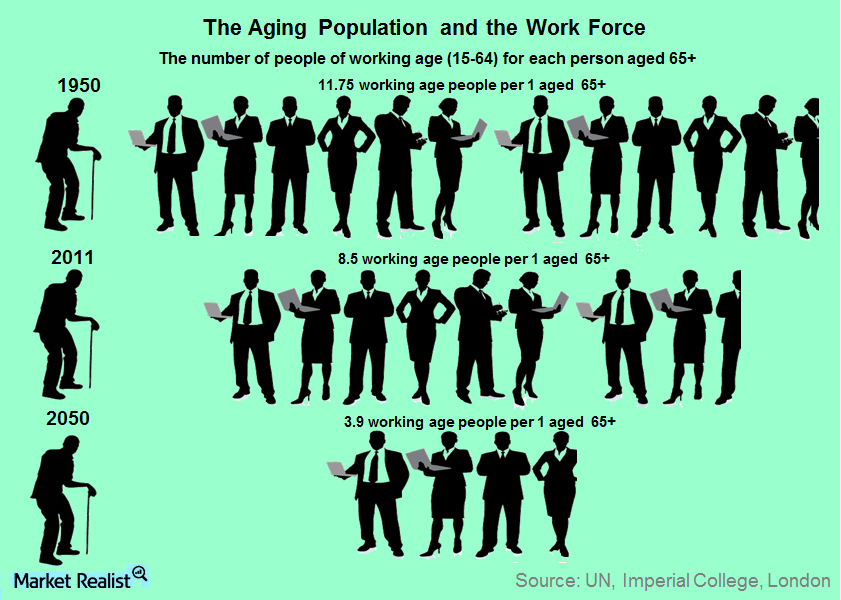

Aging Population May Keep Global Growth Muted

An aging population is likely to keep global economic growth muted in the years to come. This is primarily because the dynamics of the population are rapidly changing.

Facebook Determined to Make Money in Africa

Through Internet.org, Facebook offers various countries in the developing world a free app that enables users there to access certain websites and apps without any data charges.

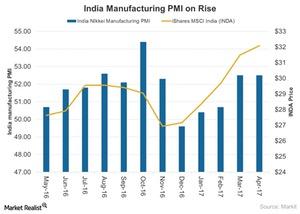

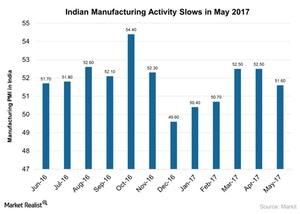

Improved Manufacturing in India, But Recovery?

The Nikkei India Manufacturing PMI for April 2017 matched its reading for the previous month.Financials Must-know: Why did the Indian rupee free-fall in 2013?

India’s current account deficit rose to 4.8% of GDP in 2012–2013, largely financed through hot money flows, and exceeded the government’s target level of 2.5% to 3% of GDP.

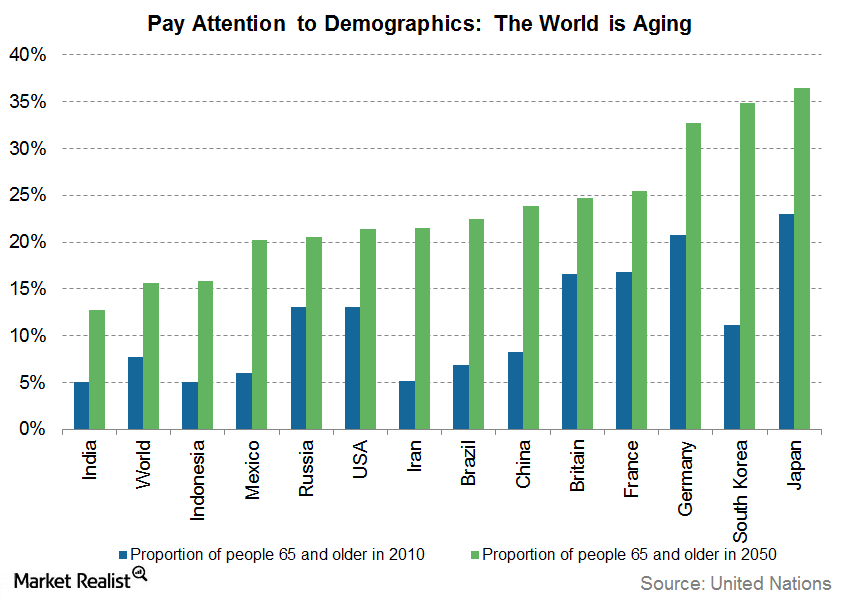

Beyond the Ephemeral: Pay Attention to Demographics

Lost in all the chatter about interest rates is a structural phenomenon that may be of far greater significance: demographics.

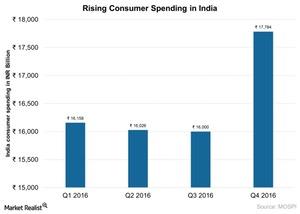

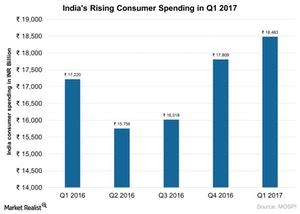

Consumer Activity Is on the Rise in India

Consumer spending in India (INDL) stood at ~17.8 trillion rupees in 4Q16, an 11% increase compared to 16.0 trillion rupees in 3Q16.

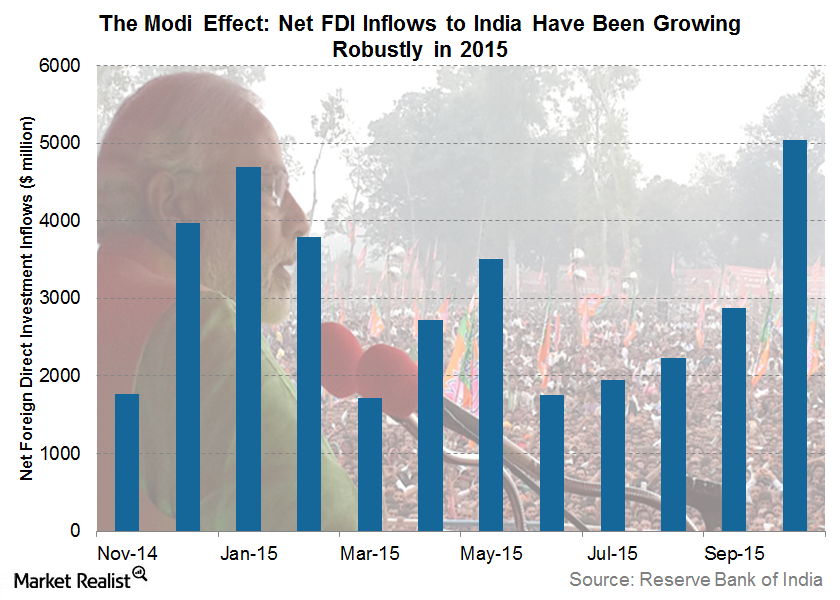

The Modi Effect: Transforming India One Step at a Time

Global investors’ perception of India has dramatically transformed in the last two years.

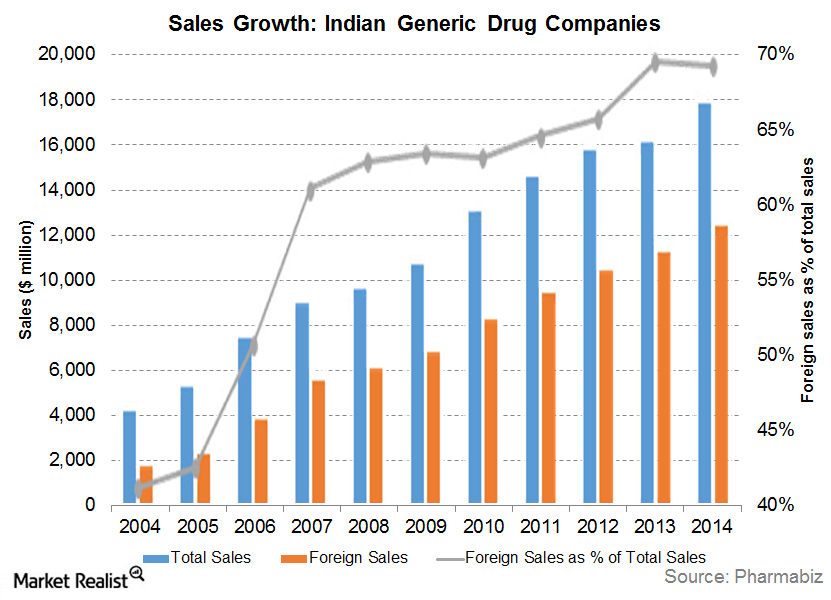

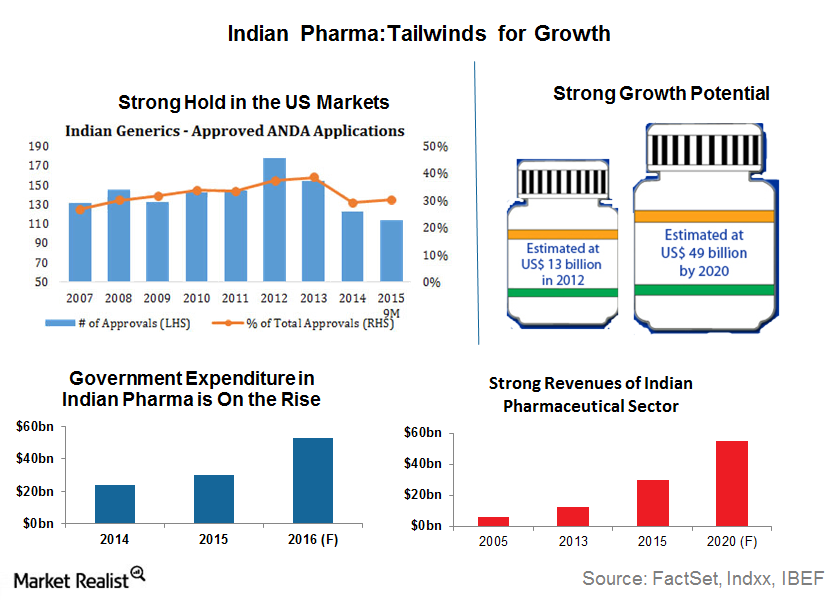

Why India Is So Important for Global Pharma

There are several compelling reasons for India’s rising pharma stature, including inexpensive labor, strong government support, and lower production costs.

Indian Pharma: Analyzing the Tailwinds for Growth

India’s strength within the pharmaceutical sector can be seen in the sheer number of pharmaceutical manufacturing plants in the country, which number approximately 10,500.Financials Overview: The must-know characteristics of frontier markets

Looking for the next frontier in emerging market investing? Del Stafford dives into these underdeveloped countries to assess the investment case.

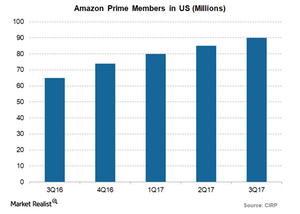

Amazon Unveils Amazon Prime in Southeast Asia

Amazon (AMZN) has finally launched its Prime membership in Singapore, thus expanding its reach in the fastest growing region of Southeast Asia.

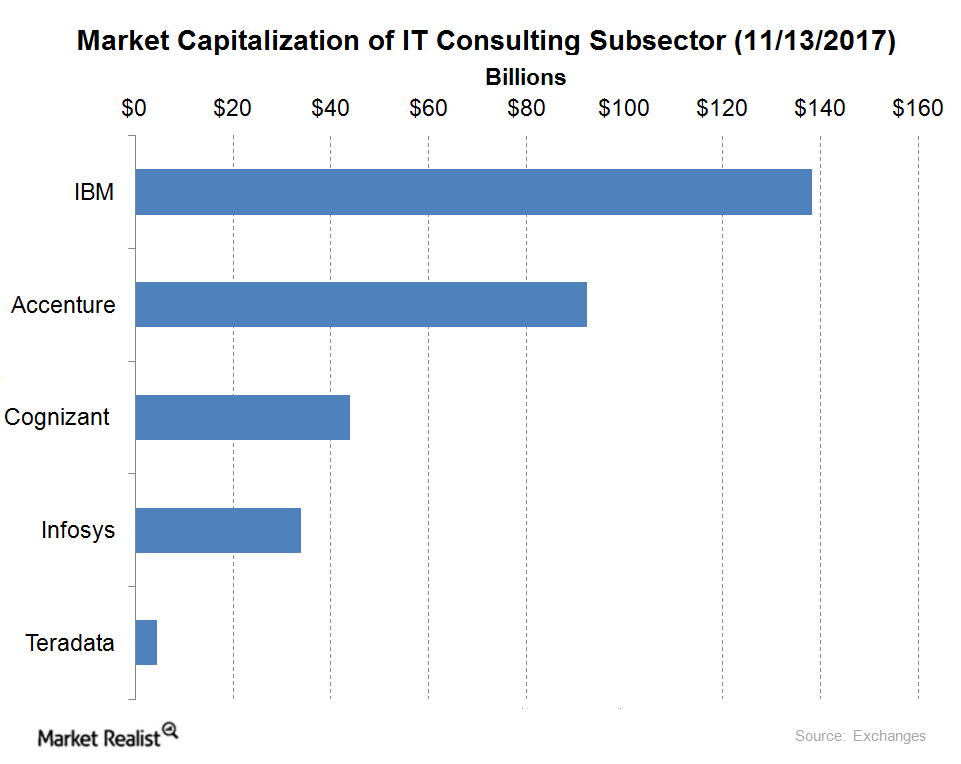

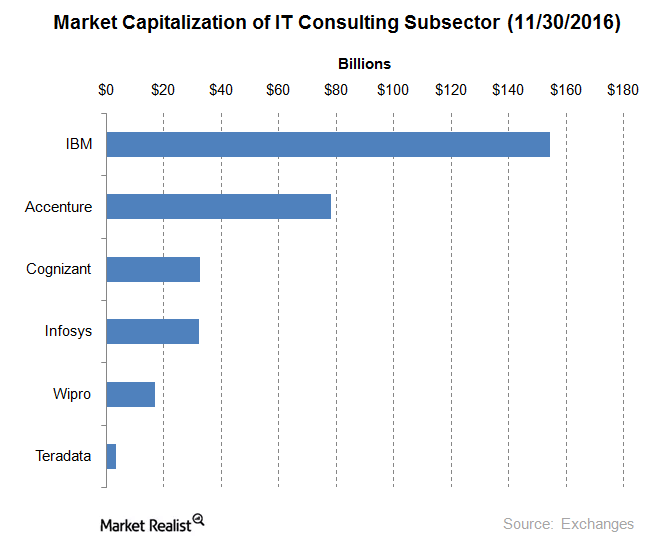

Understanding IBM’s Value Proposition in the IT Consulting Space

IBM was trading at a forward EV-to-EBITDA multiple of ~9.25x on November 11, 2017.

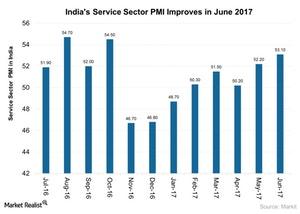

India’s Service Sector Activity Strengthened at the End of 2Q17

The service sector PMI (purchasing mangers’ index) in India (INDA) rose to 53.1 in June 2017, compared to 52.2 in May.

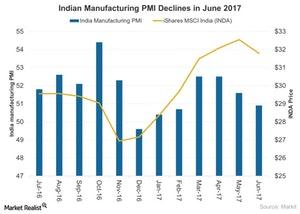

Why Manufacturing Activity in India Fell in June 2017

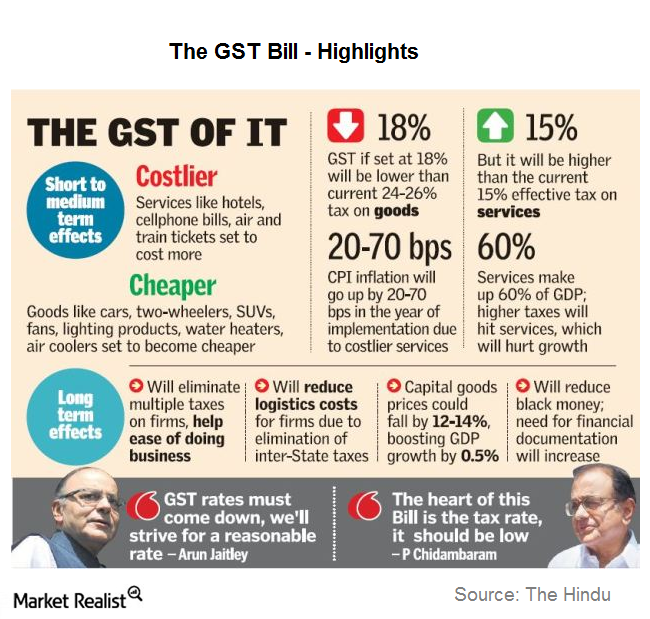

Uncertainty related to India’s new goods and services tax, which was implemented on July 1, 2017, seemed to affect India’s manufacturing activity in June 2017.

Is Consumer Spending Rising in India amid Reforms in 2017?

Consumer spending in India (INDA) is expected to grow via remonetization and other reforms undertaken by its government in 2017.

Why India’s Manufacturing Lost Momentum in May

Manufacturing activity in India lost momentum in May 2017, with the India Manufacturing PMI (purchasing managers’ index) recording a decline.

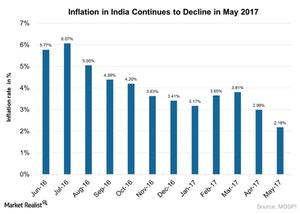

Inside India’s Inflation in May 2017

Consumer price inflation in India stood at ~2.2% on a YoY (year-over-year) basis in May 2017, as compared to its 2.99% rise in April 2017.

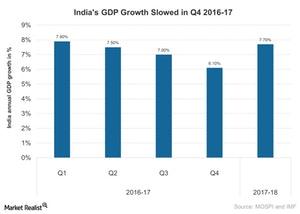

What Happened to Growth in India in Fiscal 4Q16

Economic growth in India (INDA) slowed during the country’s fiscal 4Q16 (January 2017–March 2017), revealing the impact of demonetization.

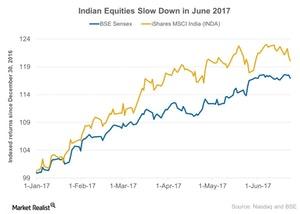

Indian Equity Markets: Waiting for the GST?

Indian equities have remained steady in June 2017, but markets remain cautious about the end of the quarter, given the impact of the GST (Goods and Services Tax).

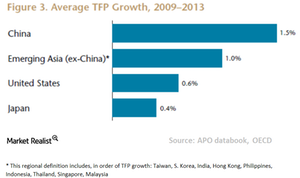

What’s behind Asia’s High Total Factor Productivity Growth?

Total factor productivity measures increases in overall output due to technological advancement without an increase in inputs.

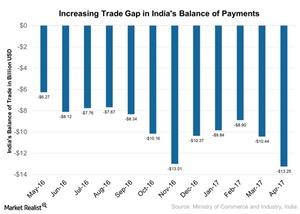

A Look at India’s Trade Gap and Its Economic Impact

India’s trade gap increased 173.5% on a year-over-year basis to ~$13.3 billion in April 2017, beating the market’s expectations of an ~$12.8 billion gap.

Understanding Cognizant’s Value Proposition in the IT Consulting Space

On November 30, IBM was the largest player by market capitalization in this space, followed by Accenture. Cognizant (CTSH), Infosys, Wipro, and Teradata.

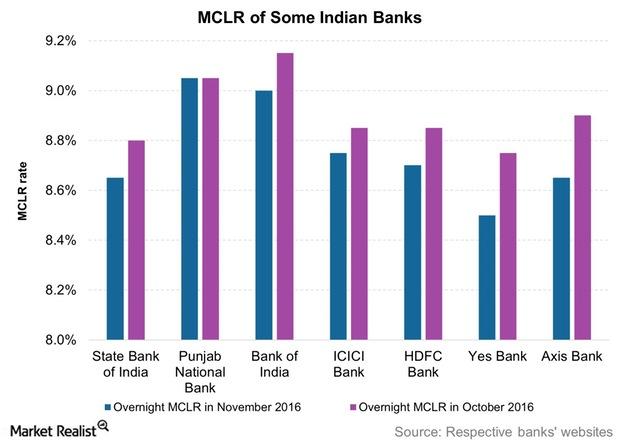

Will Demonetization in India Impact Your Loan Burden?

Banks saw a rise in term deposit accounts since the demonetization. As a result, commercial banks sharply reduced their deposit rates.

Will Demonetization Impact India’s Inflation?

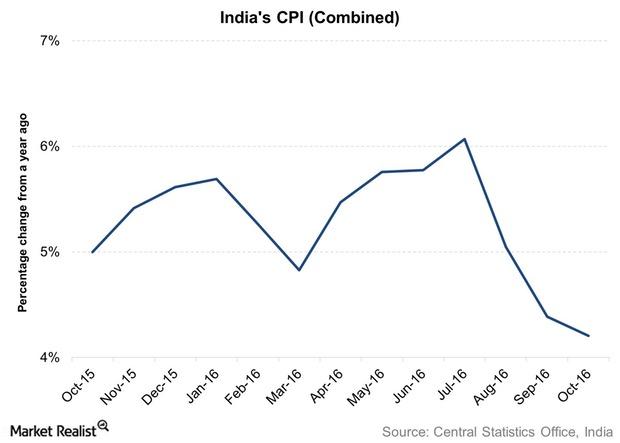

The demonetization that has been in effect since November 9 is expected to have a negative impact on inflation. Consumer spending activity almost stopped.

How Could Demonetization Impact the Indian Economy?

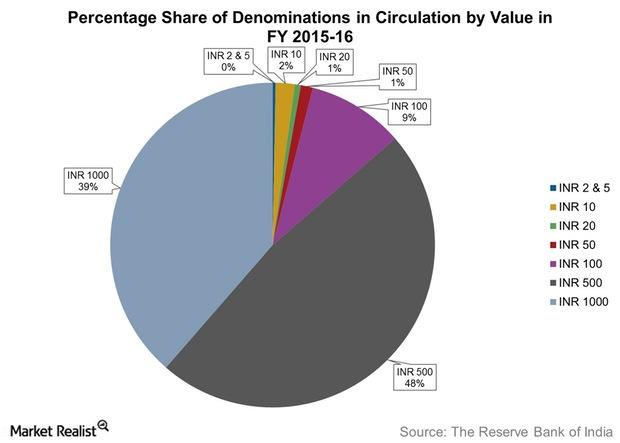

The demonetization of the 500 rupee note and the 1,000 rupee note will likely hit the Indian economy hard in the short term.

Why India Demonetized 2 Currency Notes

The 500 rupee note and the 1,000 rupee note were demonetized at midnight on November 8. The move aimed to curb black money in the financial system.

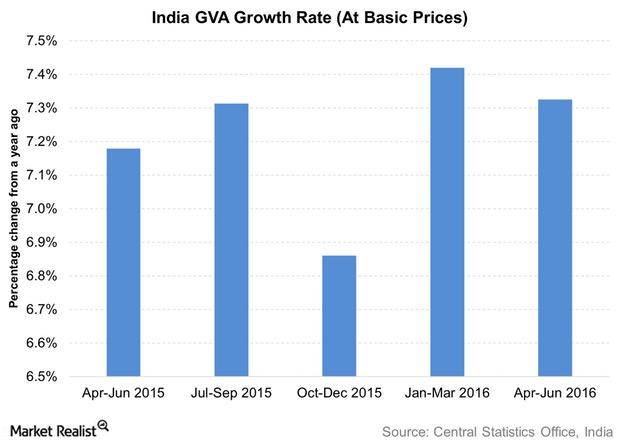

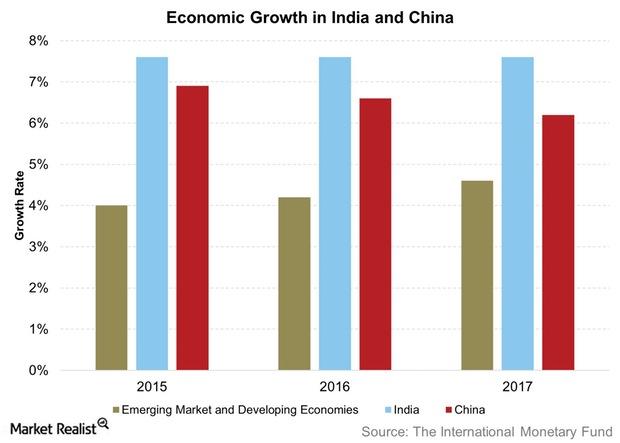

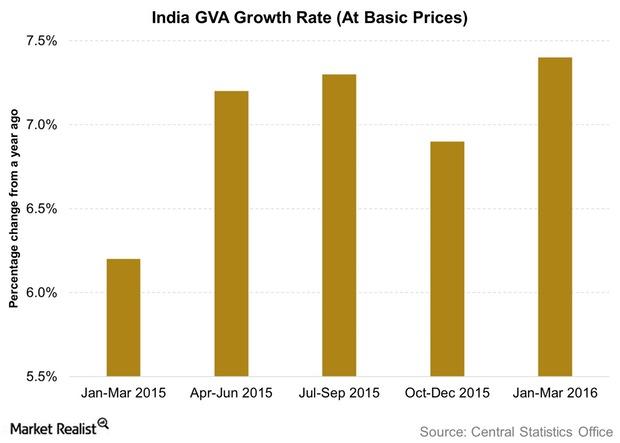

India’s Economic Growth Strong, While China’s May Be Stabilizing

In its October World Economic Outlook, the IMF projected that India’s economic growth would reach 7.6% in both 2016 and 2017.

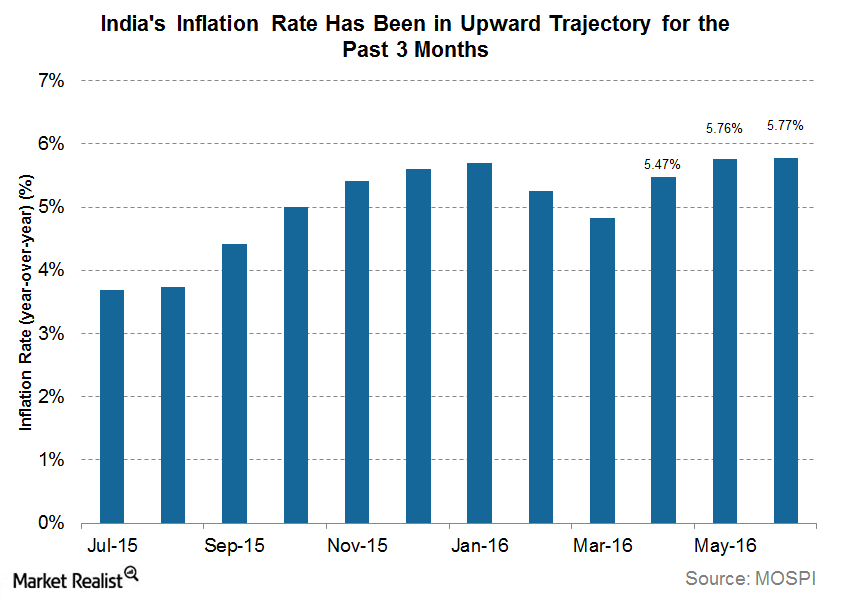

Rajan to the Rescue: The Inflation Story

Consumer prices increased in India by 5.8% in June 2016 on a year-over-year basis.

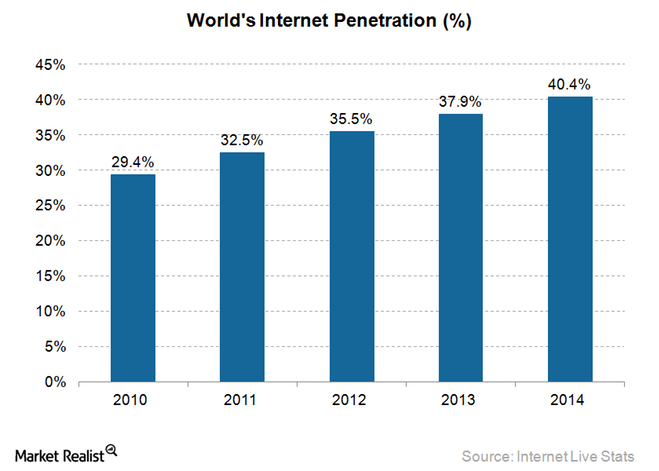

How Modi’s ‘Digital India’ Campaign Could Spur Growth

Digital India aims to make government services available to all Indian citizens electronically by providing countrywide Internet connectivity and infrastructure.

How Modi Aims to Overhaul India’s Tax System

The GST bill was passed by both houses of the Indian parliament on August 8, 2016.

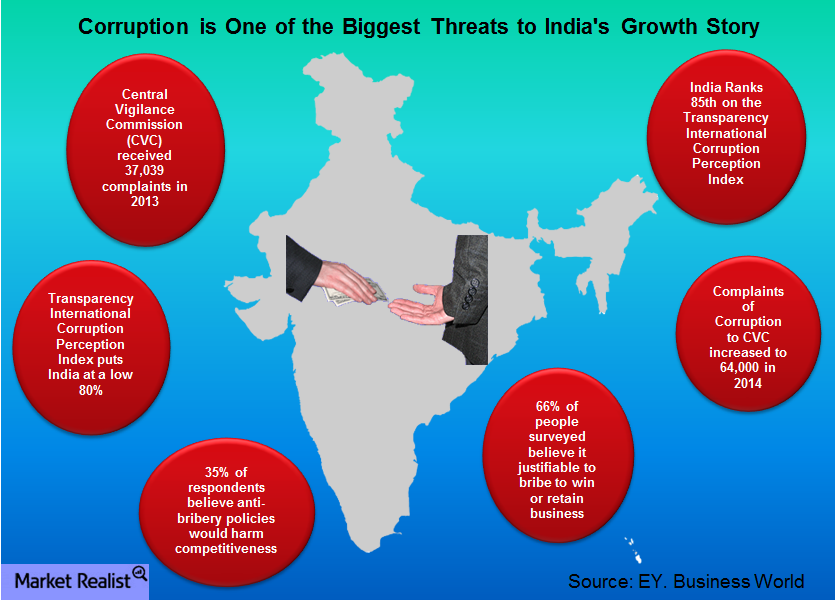

What Could Threaten India’s Growth?

Despite the impressive reform agenda and robust GDP growth, there are several challenges facing the Indian economy (PIN) (EPI).

RBA Minutes Exhibit Dovish Bias, Wholesale Prices Rise in India

The RBA released its minutes. Inflationary pressures were subdued—noted by a sluggish rise in consumer prices in Australia of 1% in 2Q16.

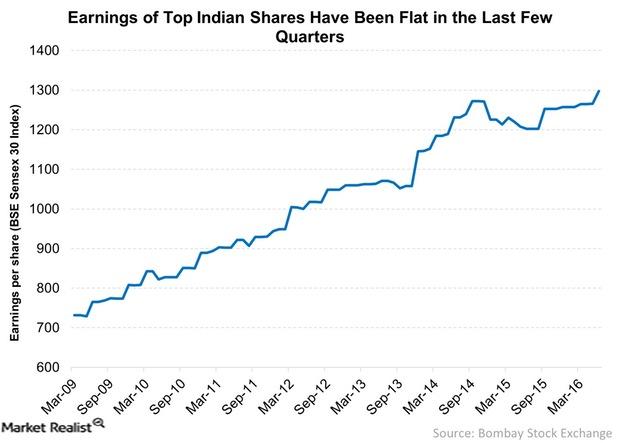

Can Indian Corporate Earnings Take a Turn for the Best?

Are Indian corporate earnings likely to turn around? Earnings have been flat since late 2014.

Reserve Bank of India Sees India on Firm but Uneven Ground

Industrial production remains a problem for India, with the RBI (Reserve Bank of India) noting that the index measuring industrial production decelerated in fiscal 2015–16.

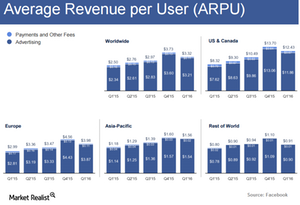

How Is Facebook’s Average Revenue per User Trending?

Average revenue per user (or ARPU) is a key metric for Internet companies, as it helps in analyzing how well a company can monetize its user base.

How Cognizant Hopes to Increase Market Share in 2016

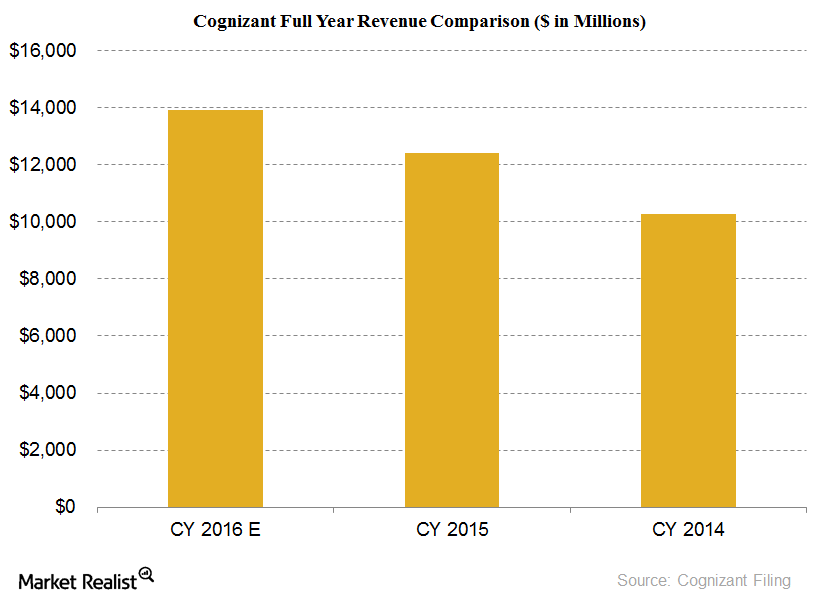

Cognizant’s (CTSH) revenues in 2015 rose by an impressive 21% to $12.4 billion from $10.3 billion in 2014.

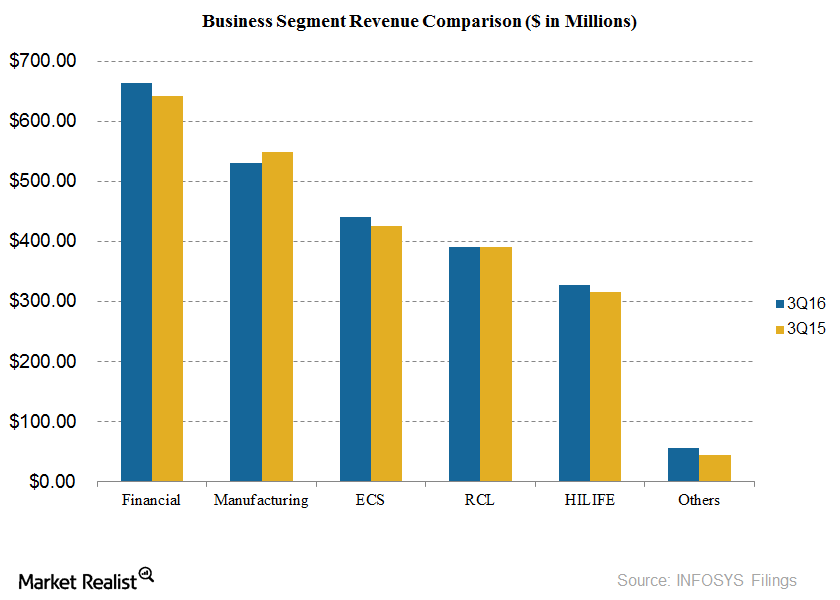

Infosys Revenues by Segment: Financial Services Take the Lead

Revenues from the financial services segment of the India-based (EPI) Infosys (INFY) were $663 million in fiscal 3Q16. This is 27.5% of total revenues.

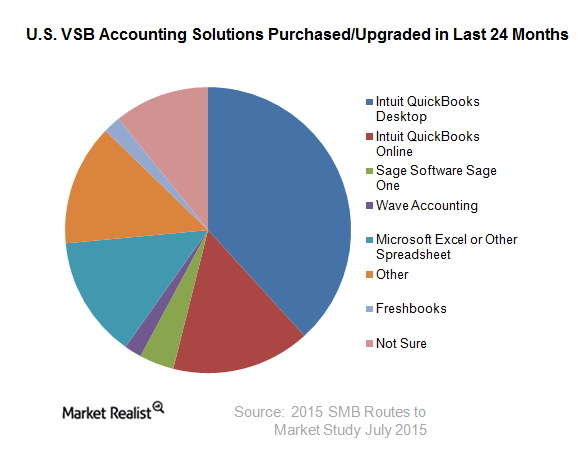

Intuit’s Persistent Focus on Small Business Benefits Investors

Intuit’s tax and accounting software and offerings dominate the very small business (or VSB) accounting market in the United States.

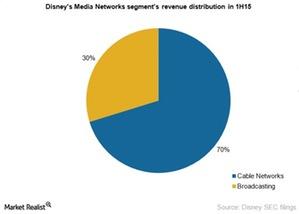

Disney’s Media Networks: The Largest Segment for Revenue

The Walt Disney Company’s (DIS) Media Networks segment is the company’s largest segment in terms of revenue. It had 45% revenue share in 1H15.

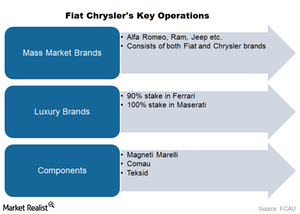

Understanding Fiat Chrysler’s Key Operations

Fiat Chrysler’s key operations include mass-market car brands such as Alfa Romeo, Chrysler, Dodge, Jeep, and Ram. Its luxury brands are Ferrari and Maserati.

The Booming Indian Stock Market: Will It Last?

Indian stocks had a strong run in the last half of 2014 through early 2015, but the ride since then hasn’t been smooth. The INDA is up only 2.6% in the one year ended June 2015.

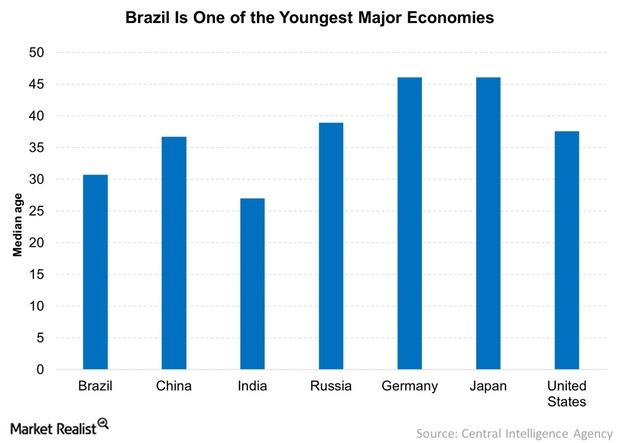

Why the Young Brazilian Population is Key to Brazil’s Success

The young Brazilian population could revive the economy. A younger population is a key demographic indicator to watch out for.

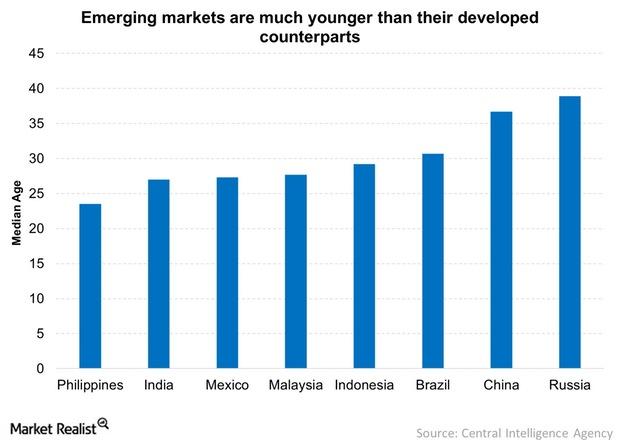

A Young Population Makes Emerging Markets Attractive

A young population in emerging markets makes them attractive, but beware! Some of the emerging economies are facing a lot of headwinds.

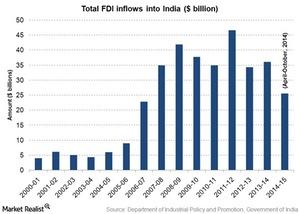

Make in India: A key campaign for India’s manufacturing sector

The Make in India campaign, introduced last September, is expected to create job opportunities for at least 100 million youths in India over time.

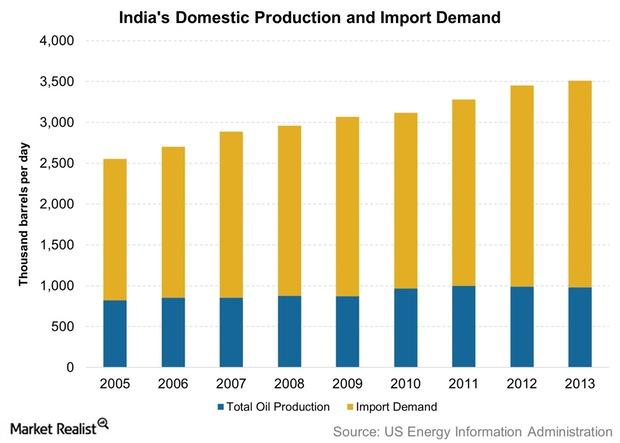

What amount of crude oil does India produce?

India produces a little under a quarter of its crude oil demand. The EIA estimates that India had close to 5.7 billion barrels of proven oil reserves at the beginning of 2014.

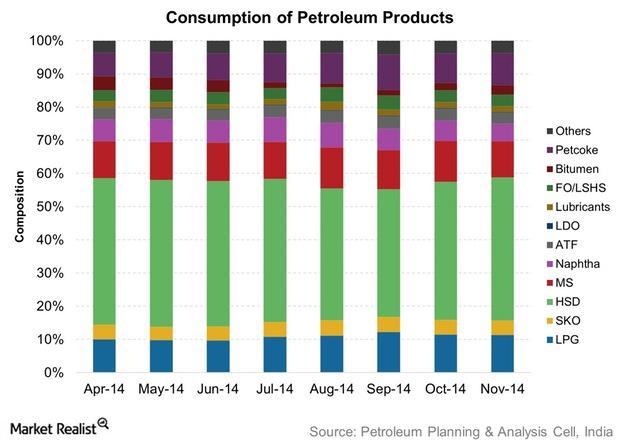

Analyzing India’s oil consumption

In India, the consumption of oil products saw steady growth over the years. The CAGR (compound annual growth rate) for the ten years ending in March 2014 is above 3.5%.

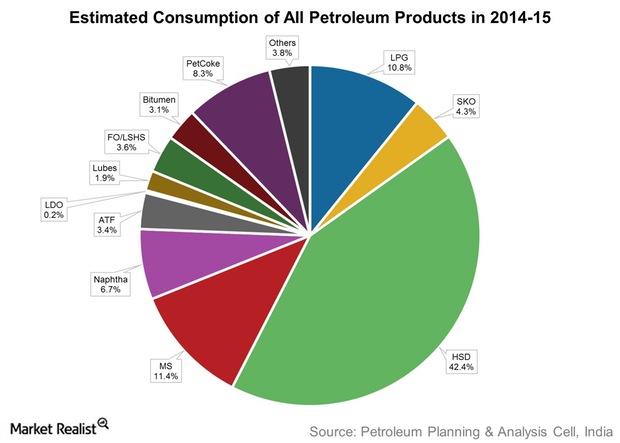

What products does India produce and consume?

Before moving on to India’s petroleum consumption, production, and refining, it would be beneficial to take a look at the various products that India produces and consumes.Macroeconomic Analysis Why India’s poor infrastructure is a detractor

The primary reason for India’s slow infrastructure development is poor implementation.Macroeconomic Analysis To do or not to do business in India

Doing business has been a major concern for international businesses interested in setting up shop in India.

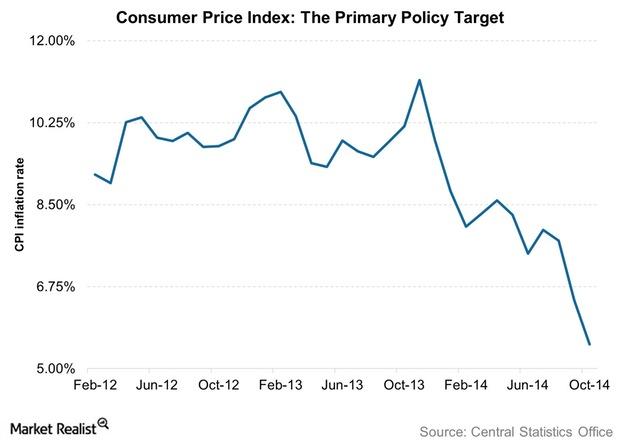

Must-know: India’s monetary policy

The RBI is India’s central bank. It used to announce its monetary policy twice in a financial year. In India, a financial year begins in April and ends in March the next year.