Will Demonetization Impact India’s Inflation?

The demonetization that has been in effect since November 9 is expected to have a negative impact on inflation. Consumer spending activity almost stopped.

Nov. 22 2016, Updated 4:04 p.m. ET

Measures of inflation in India

The RBI (Reserve Bank of India) considers the CPI (consumer price index) as its primary gauge of measuring inflation. Prior to the RBI adopting the CPI in India (PIN) (FINGX), another measure of inflation—the WPI (wholesale price index)—was the key gauge of inflation and it’s still considered for reference. To learn more about these measures of inflation, read India’s different inflation measures—WPI versus CPI.

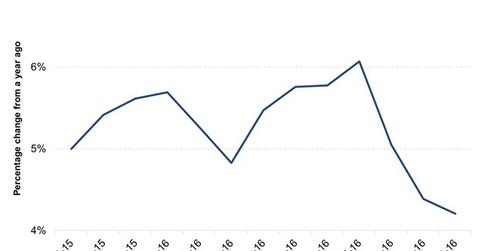

The RBI has CPI growth targets to adhere to while deciding its monetary policy stance. By January 2016, it was supposed to keep inflation below a target of 6%, which it was able to do. Its next target is to keep inflation at or below the 5% mark by March 2017.

Impact of demonetization

The demonetization that has been in effect since November 9 is expected to have a negative impact on inflation. Consumer spending activity fell to a near halt. Consumers are refraining from making any purchases except essential items from the consumer staples, healthcare, and energy segments. Activity in the real estate sector, which includes a lot of cash and undocumented transactions, slowed down significantly, Metropolitan and Tier 1 cities reported up to a 30% fall in house prices.

Food item inflation, measured by changes in the Consumer Food Price Index, accounts for 47.3% of the overall CPI. Due to 86.4% of the value of the currency notes in circulation going out of the financial system and re-monetization being slow, the supply and demand of food items fell. It will exert more downward pressure on inflation.

Investors in India-focused funds (EPI) (WAINX) should continue to monitor CPI inflation. It will determine future rate cuts by the RBI. A change in the repo rate will impact interest rate–sensitive sectors and industries like financials (HDB) (IBN) and automobiles (TTM), among other sectors like the tech (WIT) (INFY) sector.

In the next part, we’ll discuss how demonetization could impact India’s monetary policy.