Wipro Ltd

Latest Wipro Ltd News and Updates

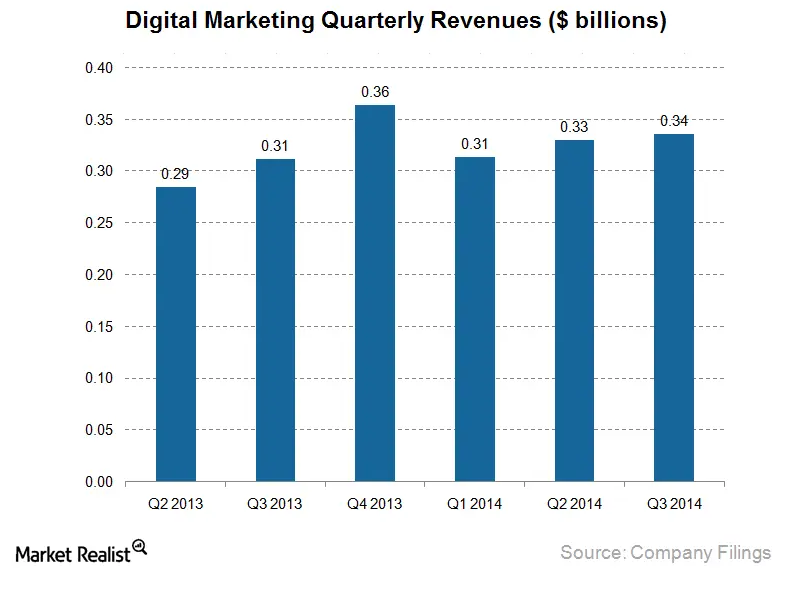

Adobe’s Digital Marketing segment is its strong pillar of growth

The Digital Marketing segment of Adobe (ADBE) provides solutions and services for creating, managing, and executing advertising and marketing initiatives.

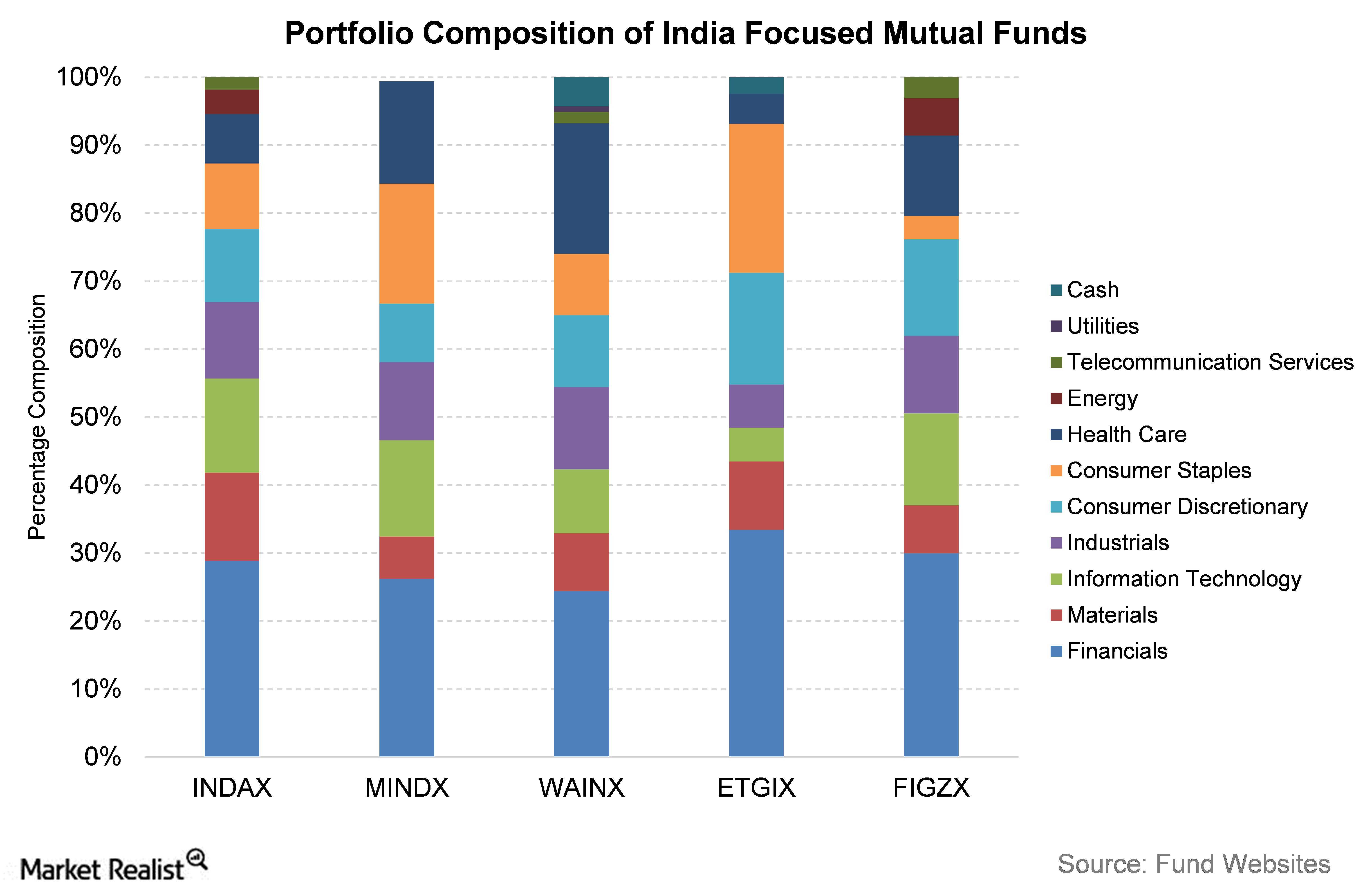

Looking ahead for Indian-Focused Funds

All five India-focused funds have their highest individual sectoral exposure to financials. As reported in the news, 2015 has been a year of global economic stress.

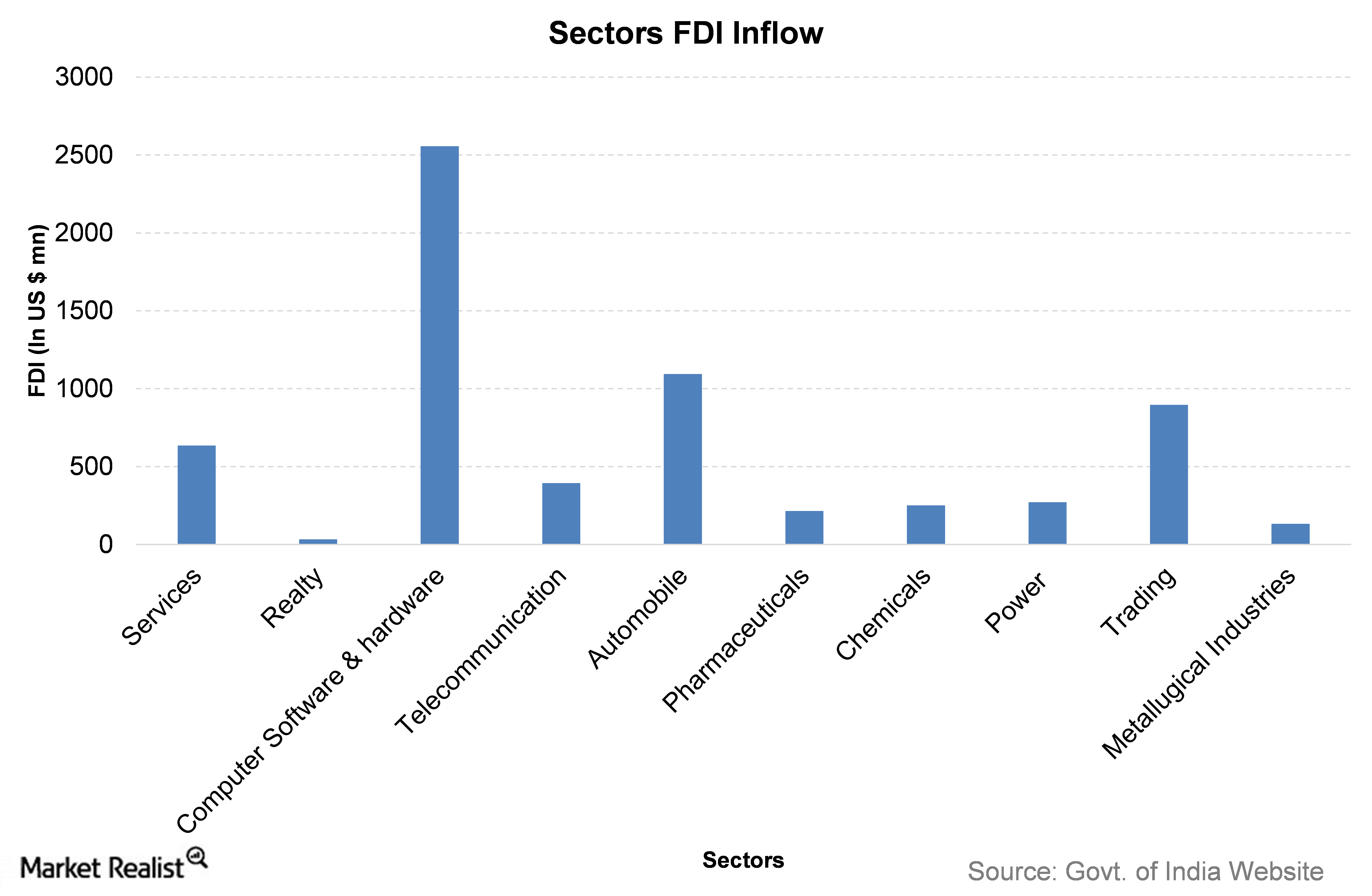

Which Sector Has Attracted the Most FDI This Year?

Cumulative data of FDI inflows since April 2000 show the services sector has received 17% of the total FDI inflows in India.

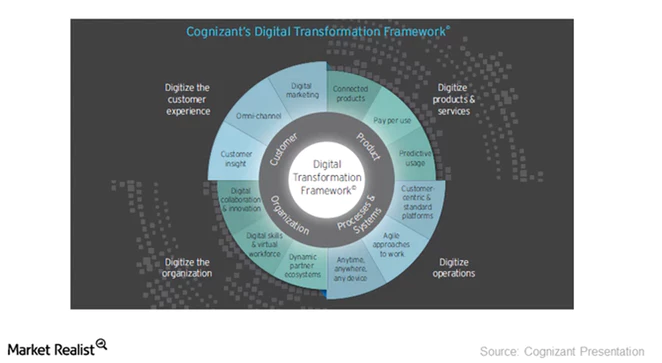

A Look at Cognizant’s Focus on Digital Transformation

To lead the global digital transformation effort, Cognizant (CTSH) is providing solutions to transform businesses’ operating and technology models.

Chinese and Indian Indexes Fall as Trade Talks Resume

On Tuesday, US and Chinese officials resumed trade talks over the phone days after they announced a trade truce.

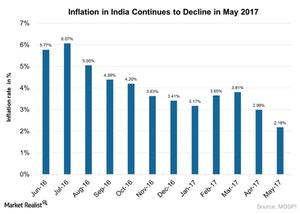

Inside India’s Inflation in May 2017

Consumer price inflation in India stood at ~2.2% on a YoY (year-over-year) basis in May 2017, as compared to its 2.99% rise in April 2017.

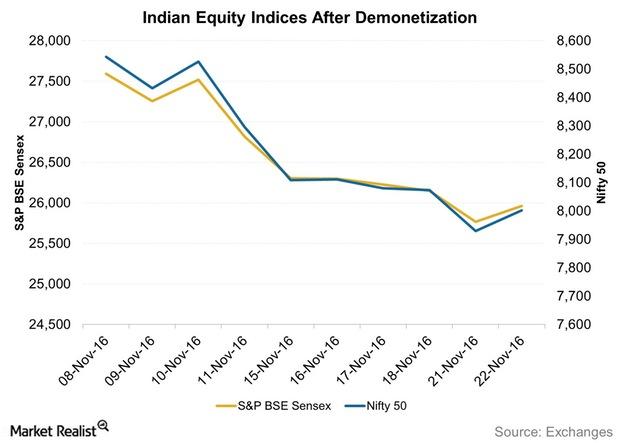

India’s Financial Markets Fell Due to Demonetization

The two benchmark equity indices—the Nifty 50 and the S&P BSE Sensex—fell each trading day since the demonetization except for November 10 and November 22.

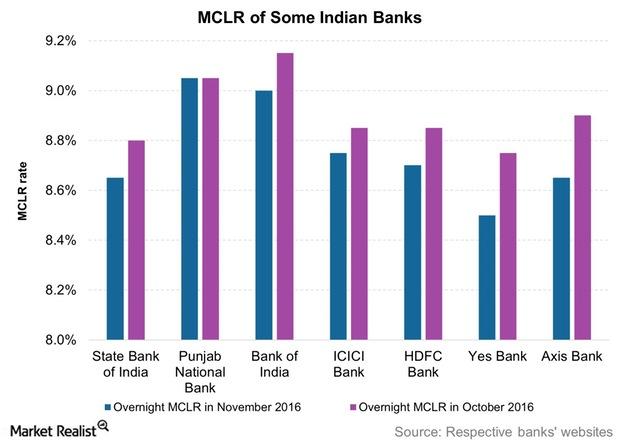

Will Demonetization in India Impact Your Loan Burden?

Banks saw a rise in term deposit accounts since the demonetization. As a result, commercial banks sharply reduced their deposit rates.

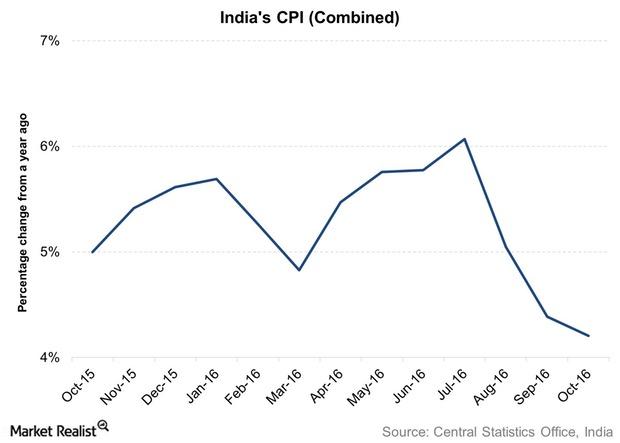

Will Demonetization Impact India’s Inflation?

The demonetization that has been in effect since November 9 is expected to have a negative impact on inflation. Consumer spending activity almost stopped.

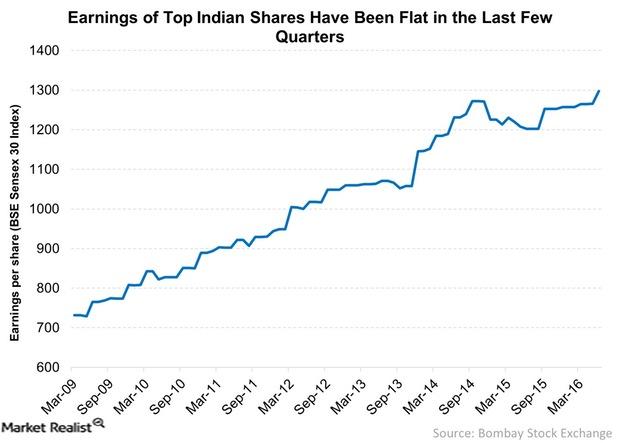

Can Indian Corporate Earnings Take a Turn for the Best?

Are Indian corporate earnings likely to turn around? Earnings have been flat since late 2014.

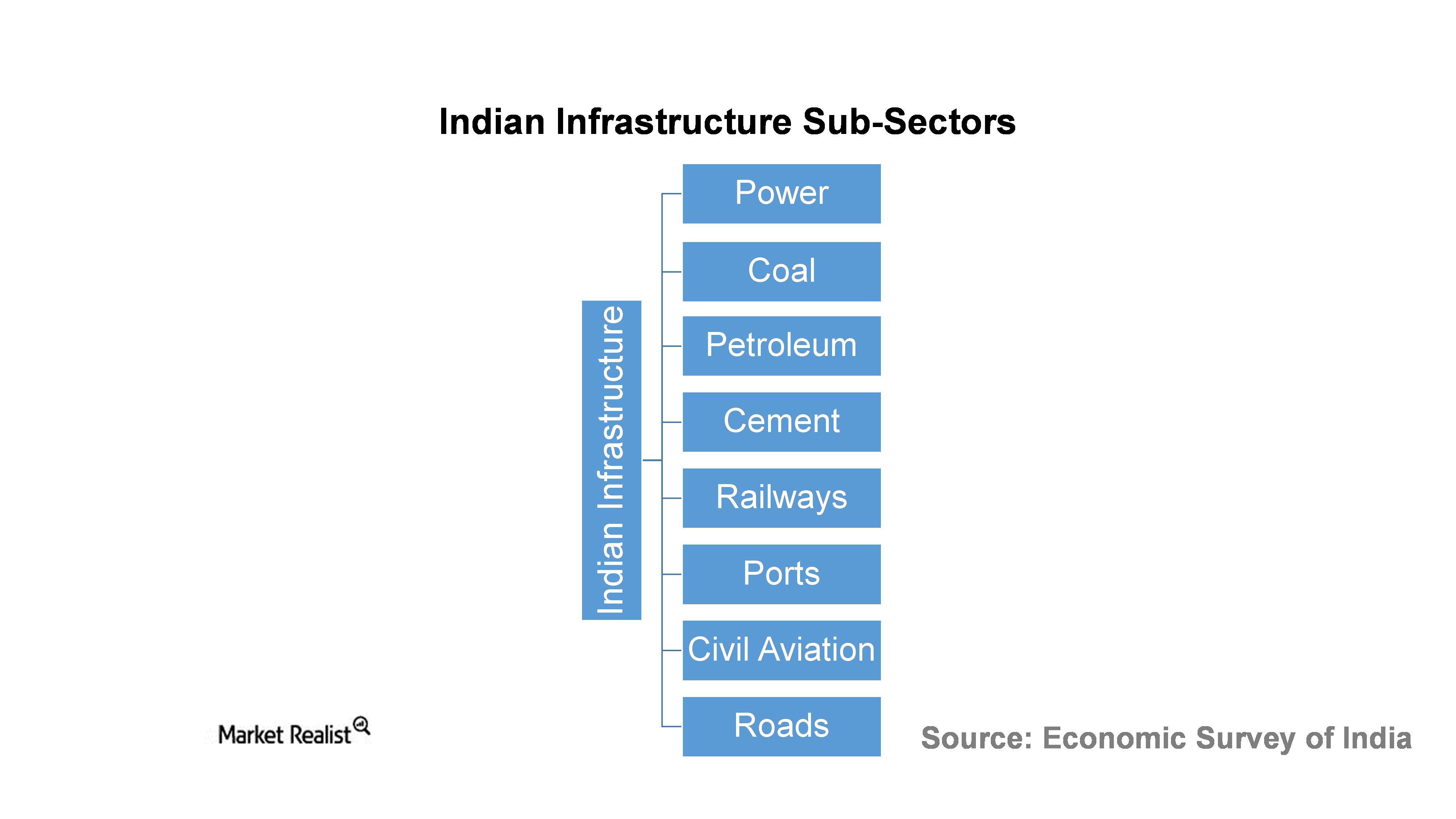

Understanding India’s Infrastructure Sector

The NDA (National Democratic Alliance) government came to power in May 2014. With big promises of development, the party aimed to push major reforms to help speed up India’s recovery process.

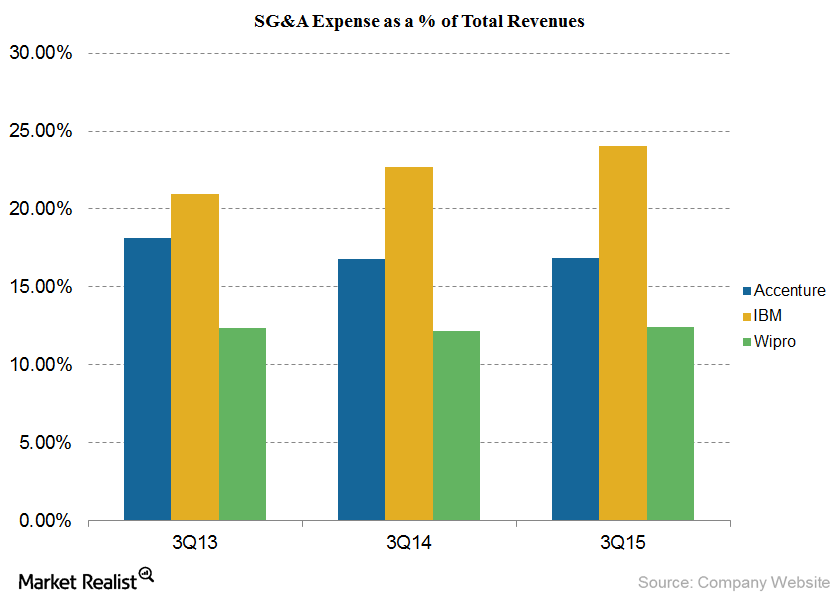

Comparing the SG&A Expenses of Accenture, IBM, and Wipro in 3Q15

In 3Q15, the selling, general, and administrative expenses for Accenture rose to $1.41 billion from $1.38 billion in 3Q14 and $1.36 billion in 3Q13.

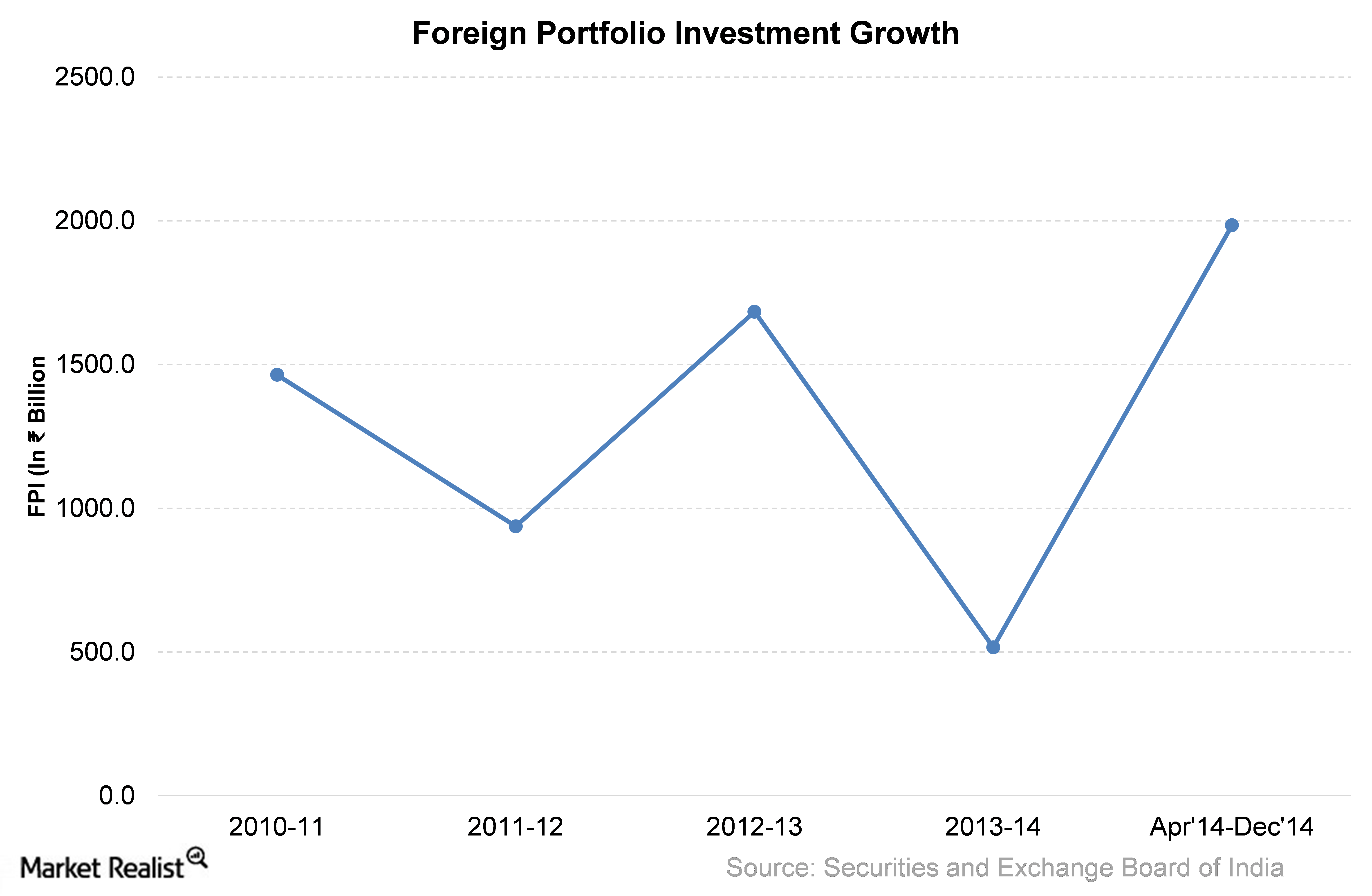

Overview: Last 5 Years of Foreign Portfolio Investment in India

India’s fiscal 2013 was the lowest in terms of market capitalization in the past five years. However, the foreign portfolio witnessed an impressive growth of about 80% in fiscal 2013 over the previous year.