Franklin India Growth A

Latest Franklin India Growth A News and Updates

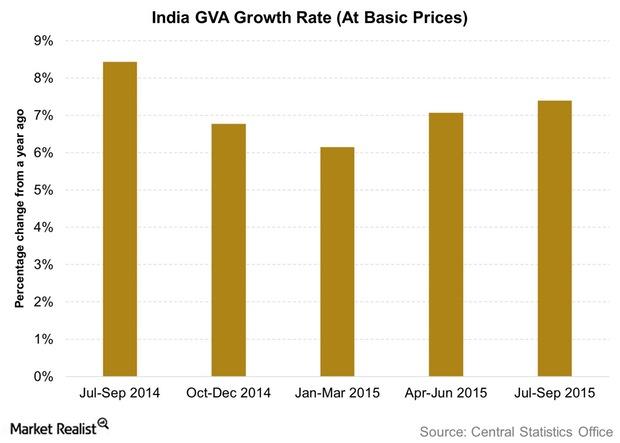

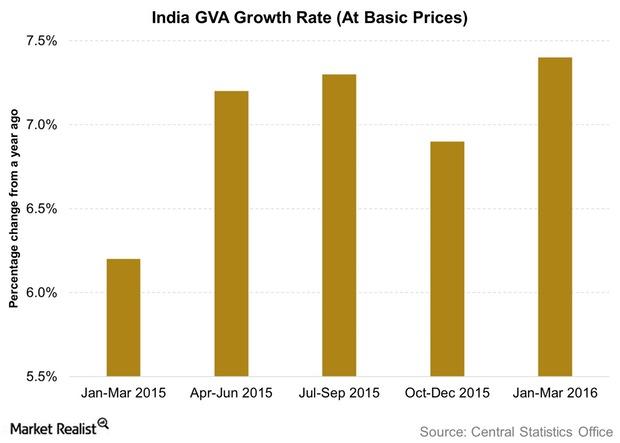

India’s Economic Growth in GVA Terms: What Does the RBI Expect?

For financial year 2016–2017, the RBI forecasts the GVA growth at a 7.6% pace. This assumes that there aren’t any significant headwinds.

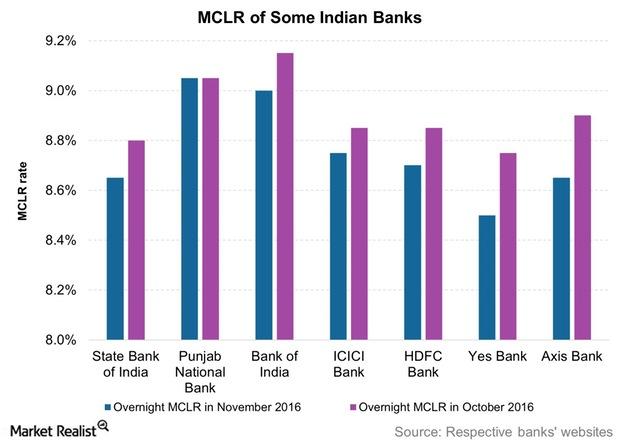

Will Demonetization in India Impact Your Loan Burden?

Banks saw a rise in term deposit accounts since the demonetization. As a result, commercial banks sharply reduced their deposit rates.

Reserve Bank of India Sees India on Firm but Uneven Ground

Industrial production remains a problem for India, with the RBI (Reserve Bank of India) noting that the index measuring industrial production decelerated in fiscal 2015–16.