Infosys Ltd

Latest Infosys Ltd News and Updates

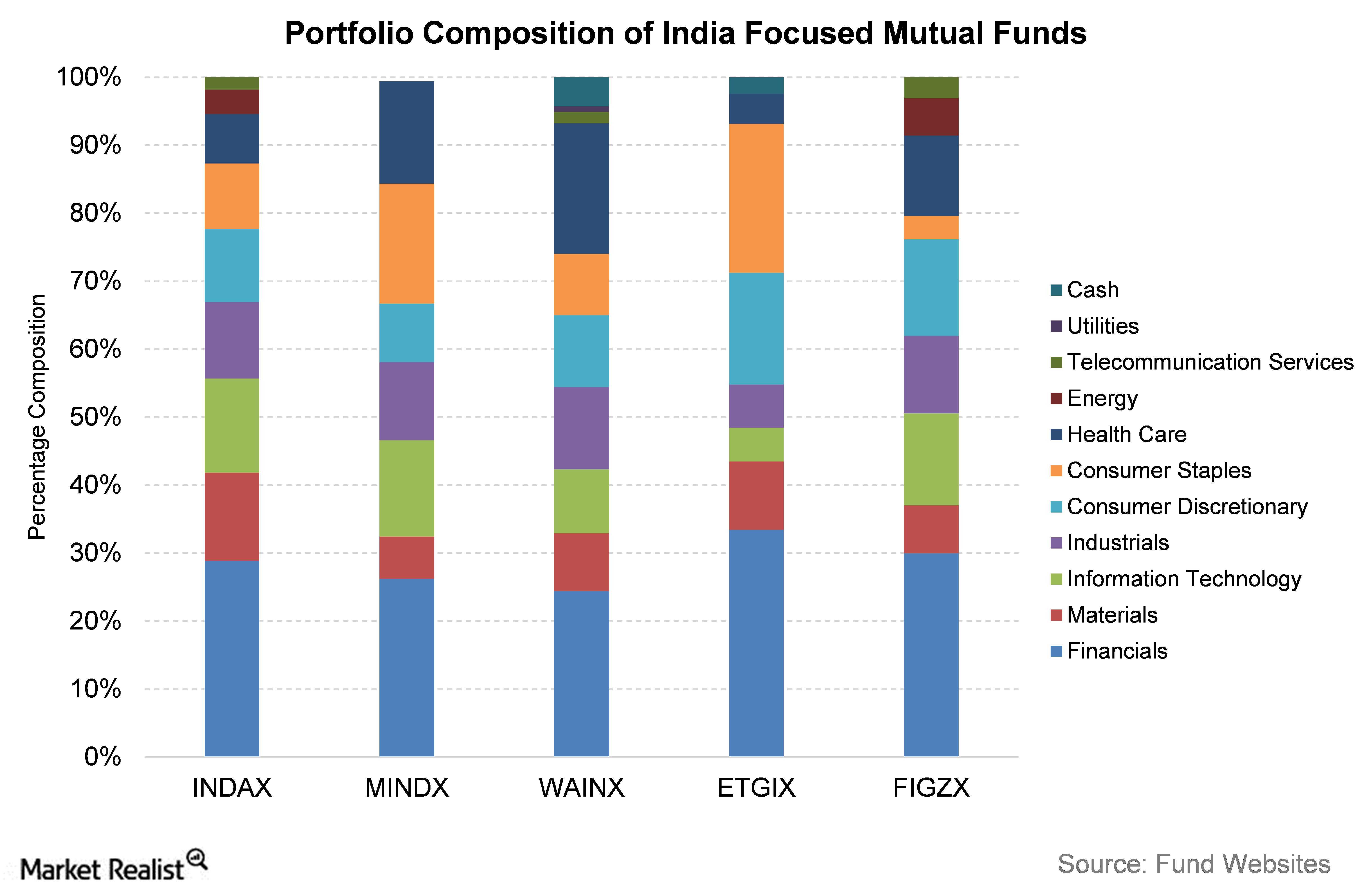

Looking ahead for Indian-Focused Funds

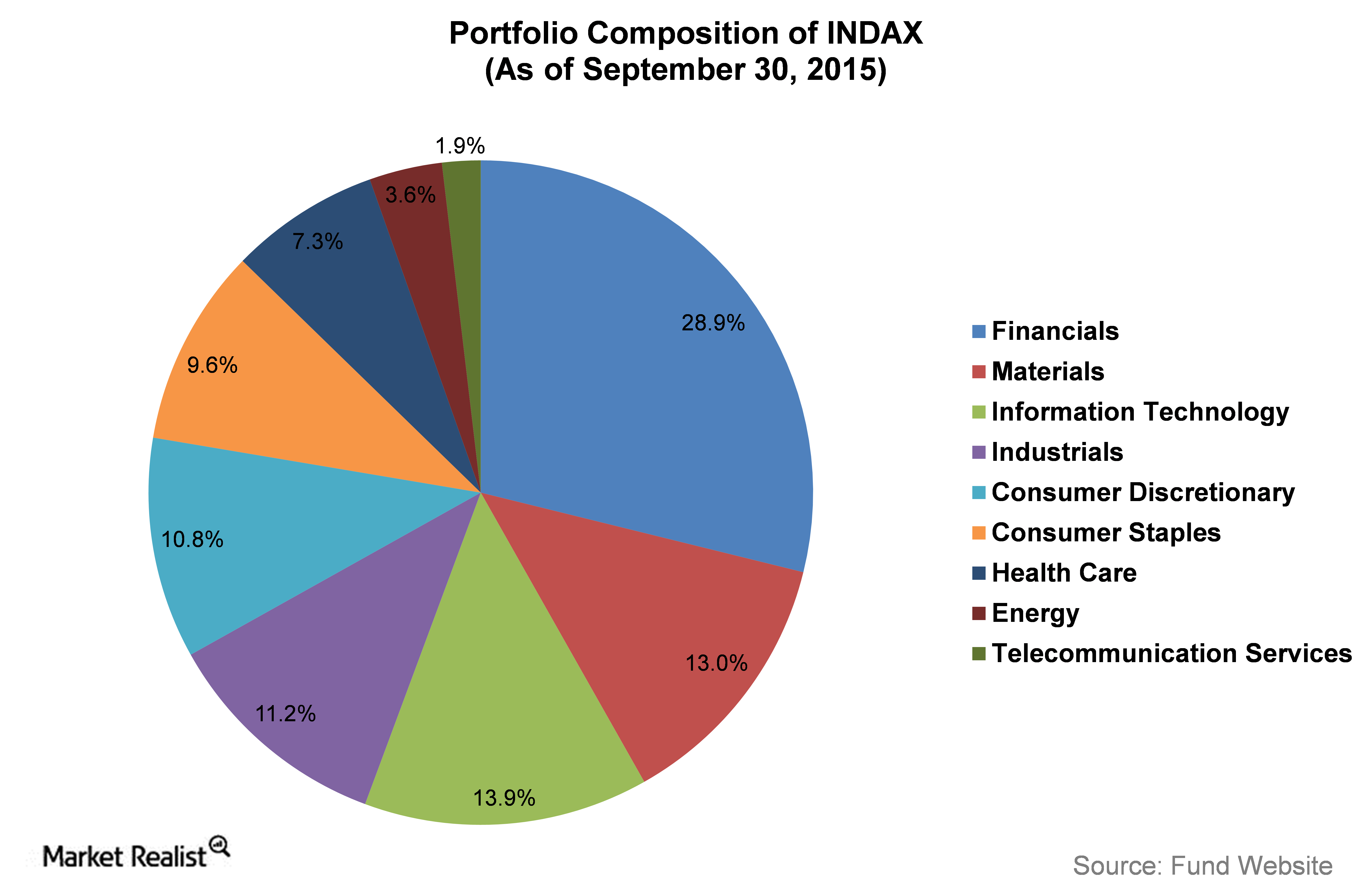

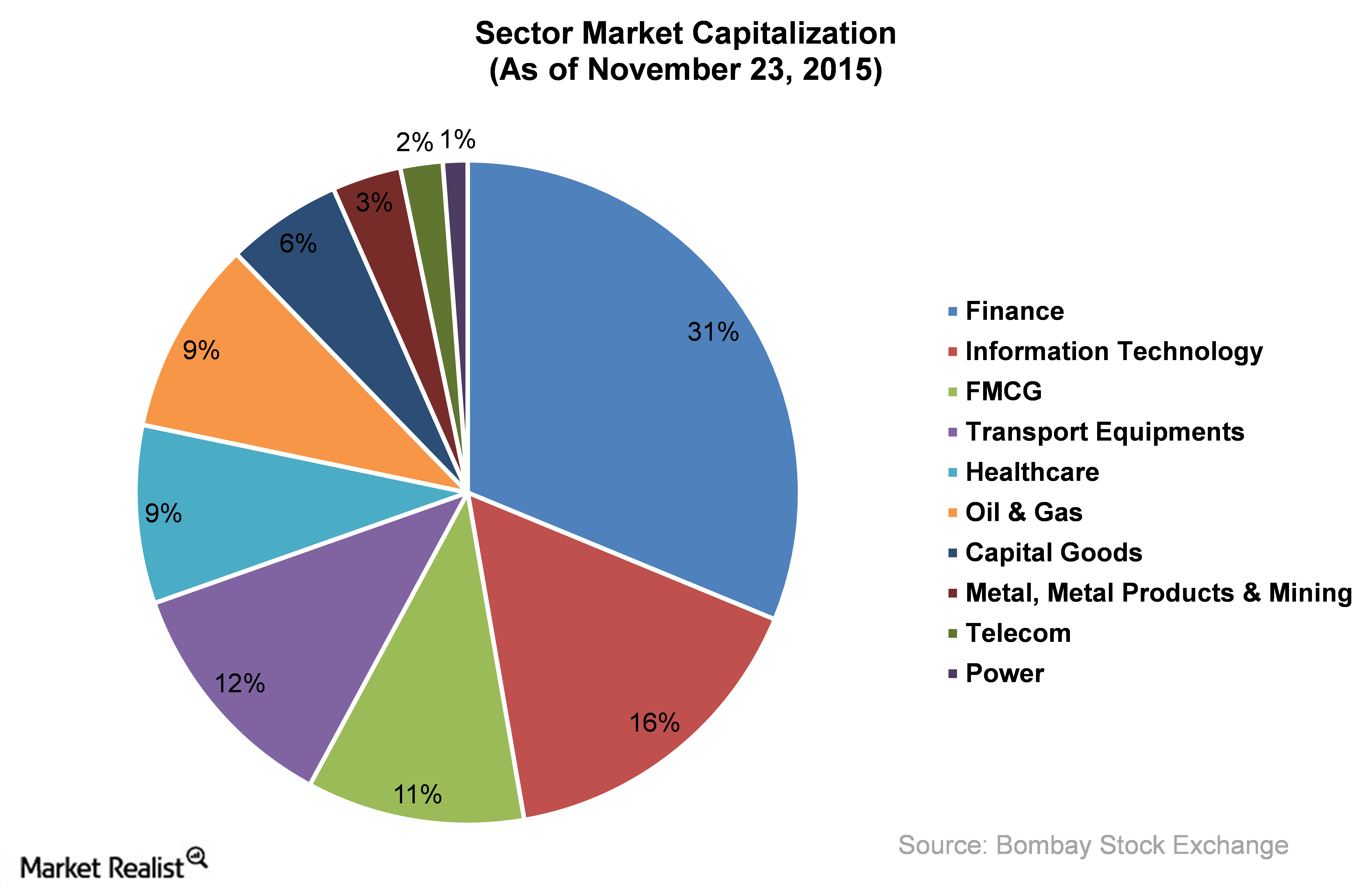

All five India-focused funds have their highest individual sectoral exposure to financials. As reported in the news, 2015 has been a year of global economic stress.

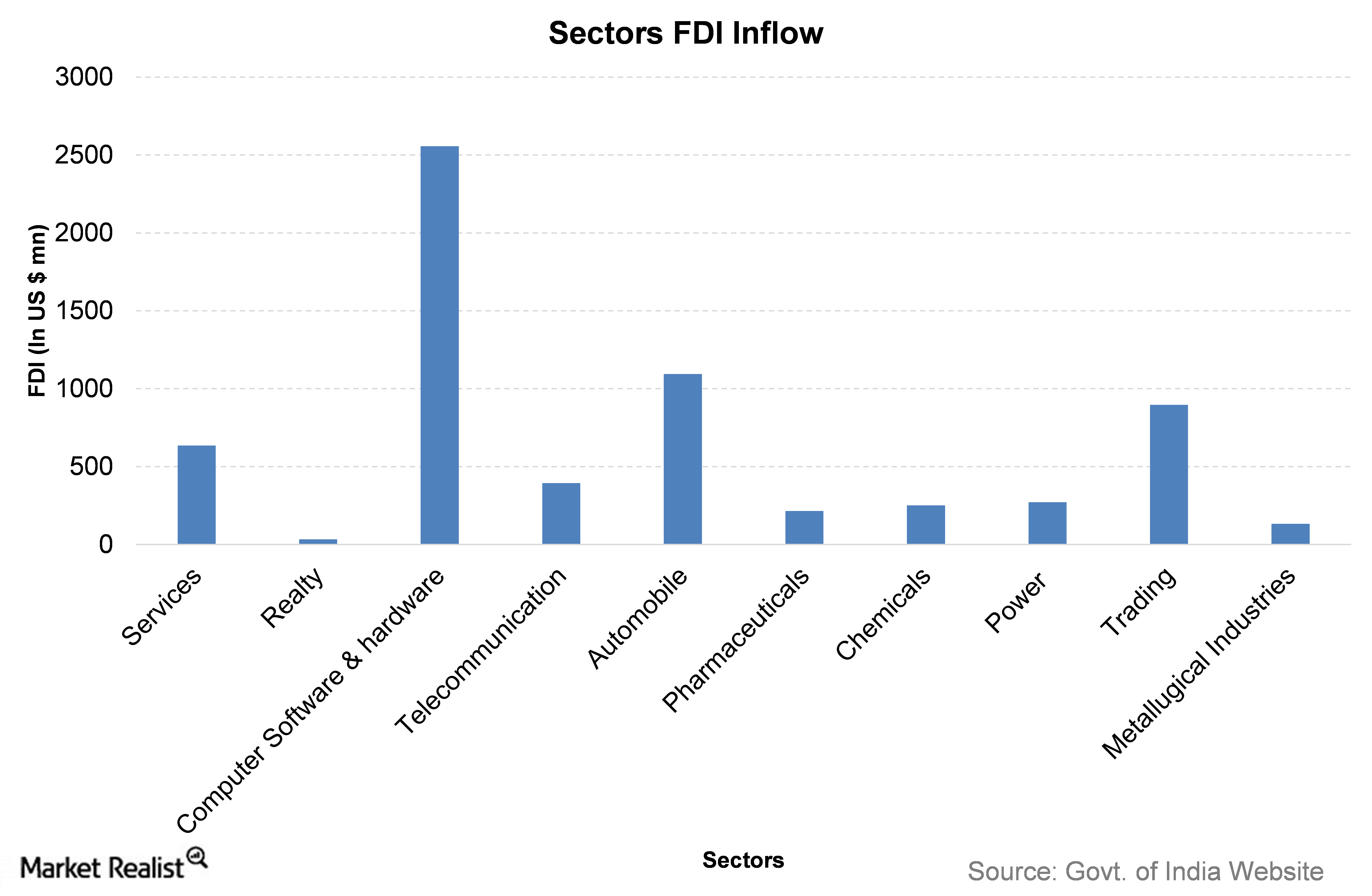

Which Sector Has Attracted the Most FDI This Year?

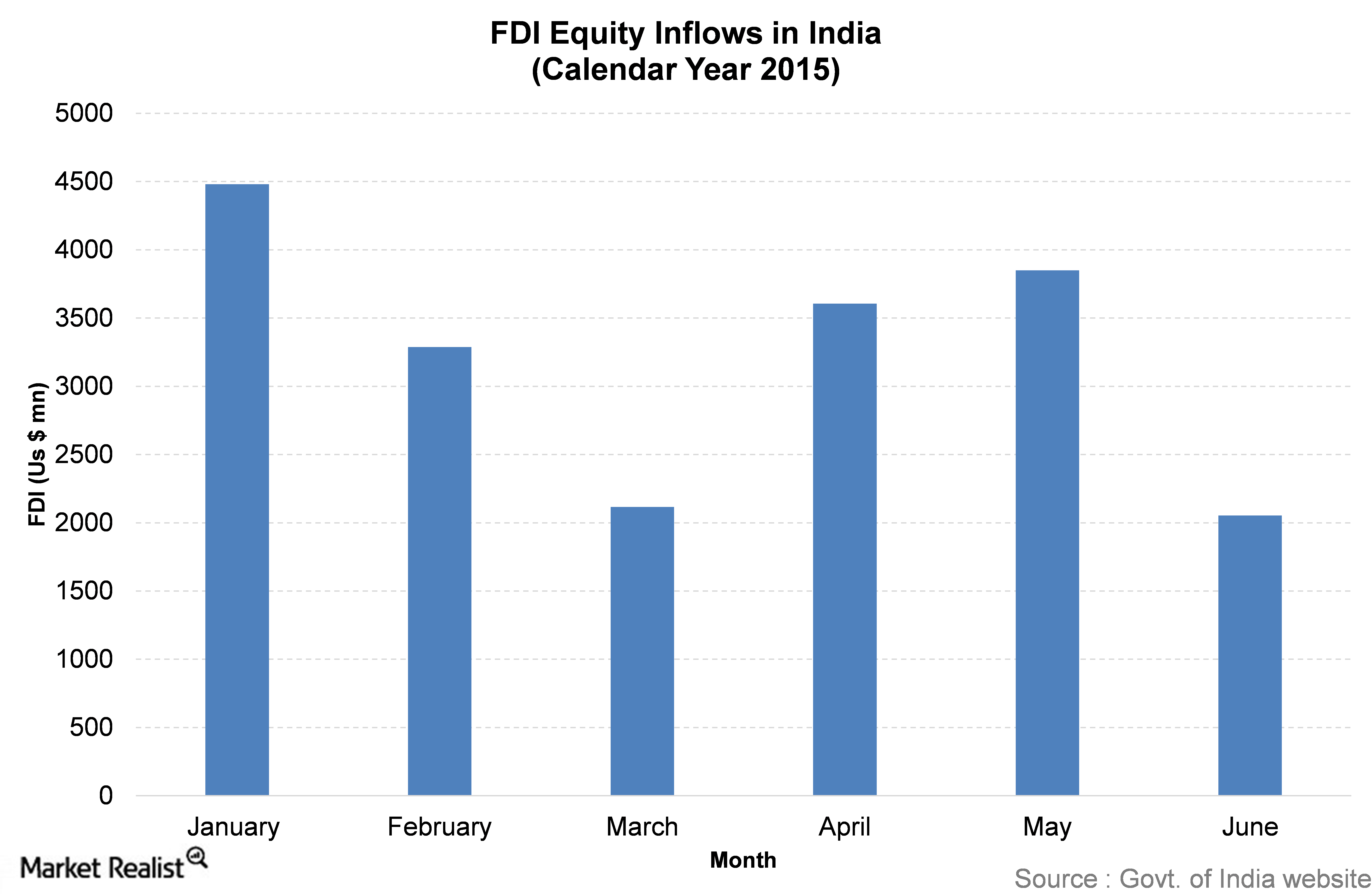

Cumulative data of FDI inflows since April 2000 show the services sector has received 17% of the total FDI inflows in India.

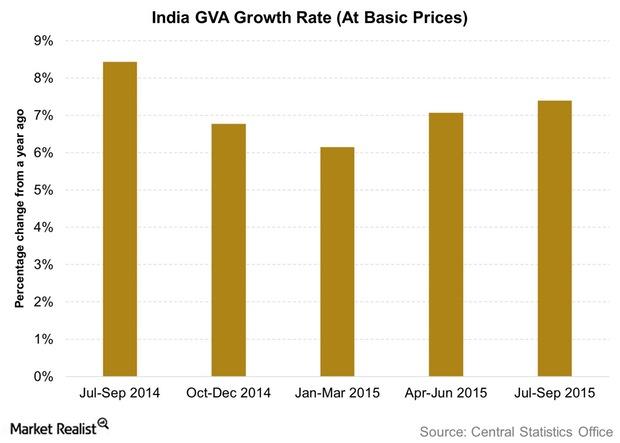

India’s Economic Growth in GVA Terms: What Does the RBI Expect?

For financial year 2016–2017, the RBI forecasts the GVA growth at a 7.6% pace. This assumes that there aren’t any significant headwinds.

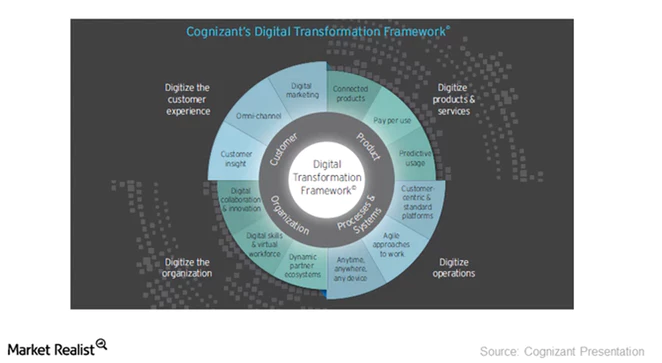

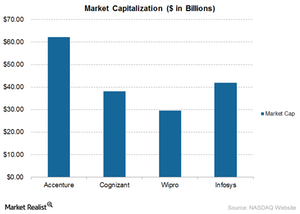

A Look at Cognizant’s Focus on Digital Transformation

To lead the global digital transformation effort, Cognizant (CTSH) is providing solutions to transform businesses’ operating and technology models.

Chinese and Indian Indexes Fall as Trade Talks Resume

On Tuesday, US and Chinese officials resumed trade talks over the phone days after they announced a trade truce.

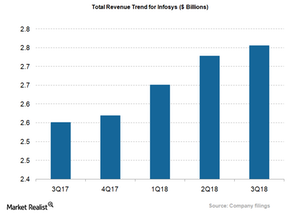

Analyzing Key Drivers for Infosys in Fiscal 2018

Infosys expects its total revenues in fiscal 2018 to expand 6.5%–7.5%.

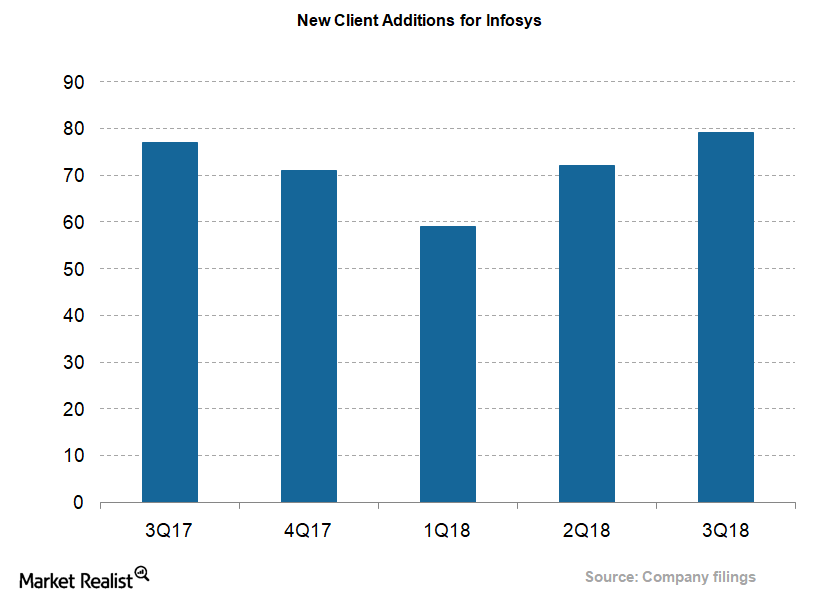

Infosys Gains from Its Growing Client Portfolio

At the end of fiscal 3Q18, Infosys recorded 110 clients with a ticket size of $50 million–$100 million.

Analyzing Accenture’s Key Growth Drivers

Accenture (ACN) continues to gain from the latest digital transformation trend taking place throughout the world.

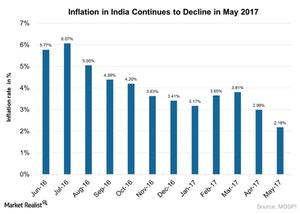

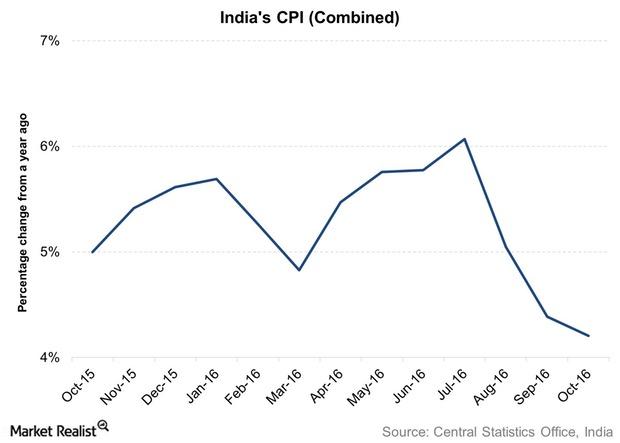

Inside India’s Inflation in May 2017

Consumer price inflation in India stood at ~2.2% on a YoY (year-over-year) basis in May 2017, as compared to its 2.99% rise in April 2017.

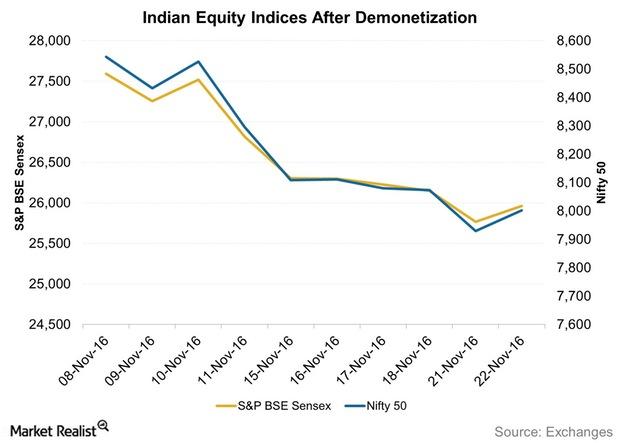

India’s Financial Markets Fell Due to Demonetization

The two benchmark equity indices—the Nifty 50 and the S&P BSE Sensex—fell each trading day since the demonetization except for November 10 and November 22.

Will Demonetization Impact India’s Inflation?

The demonetization that has been in effect since November 9 is expected to have a negative impact on inflation. Consumer spending activity almost stopped.

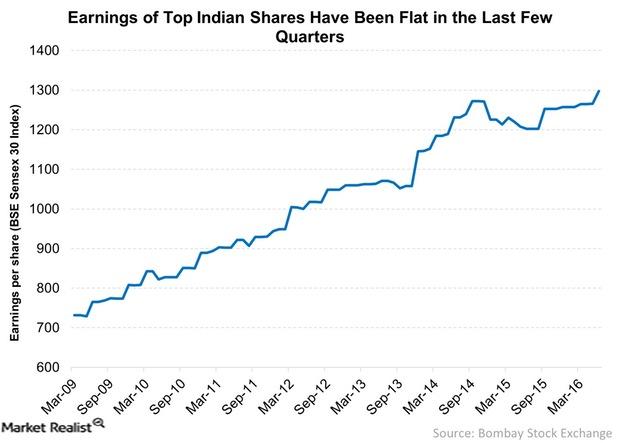

Can Indian Corporate Earnings Take a Turn for the Best?

Are Indian corporate earnings likely to turn around? Earnings have been flat since late 2014.

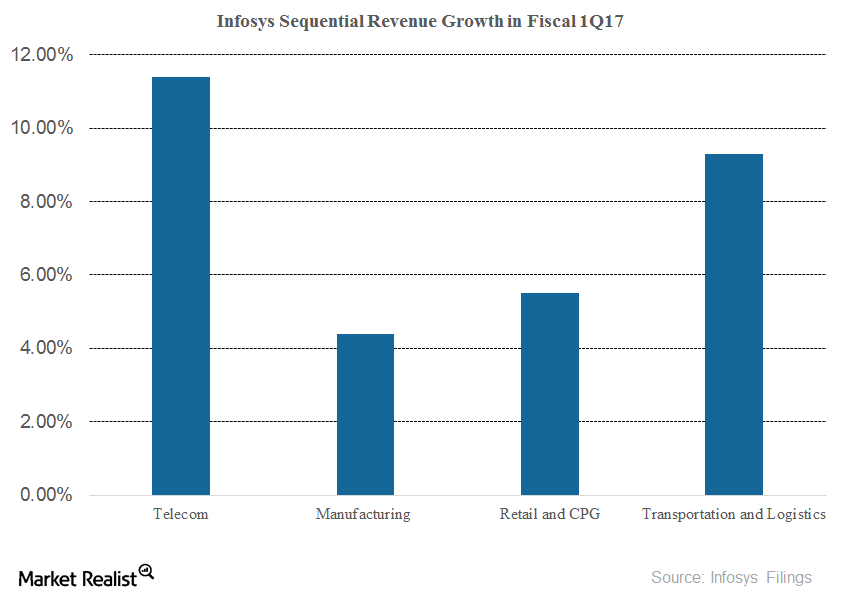

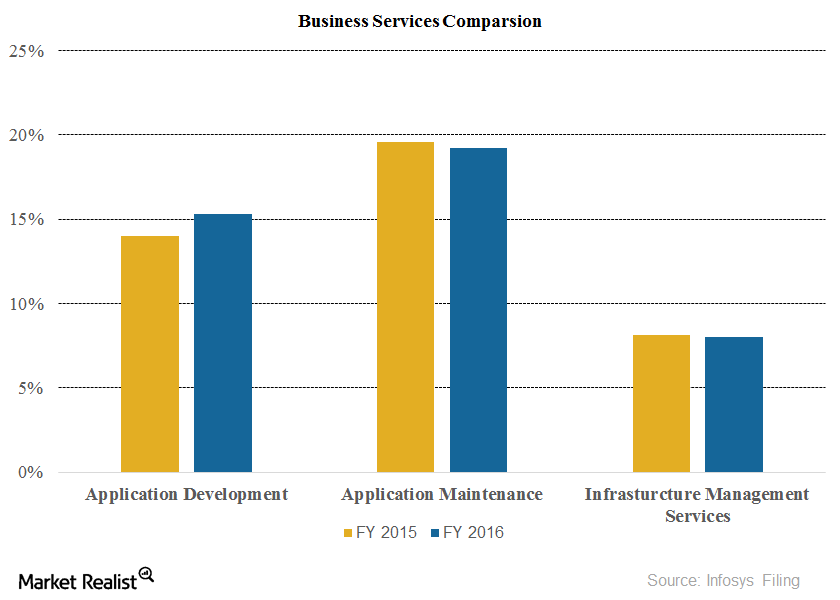

How Did Infosys’s Major Business Segments Perform in Fiscal 1Q17?

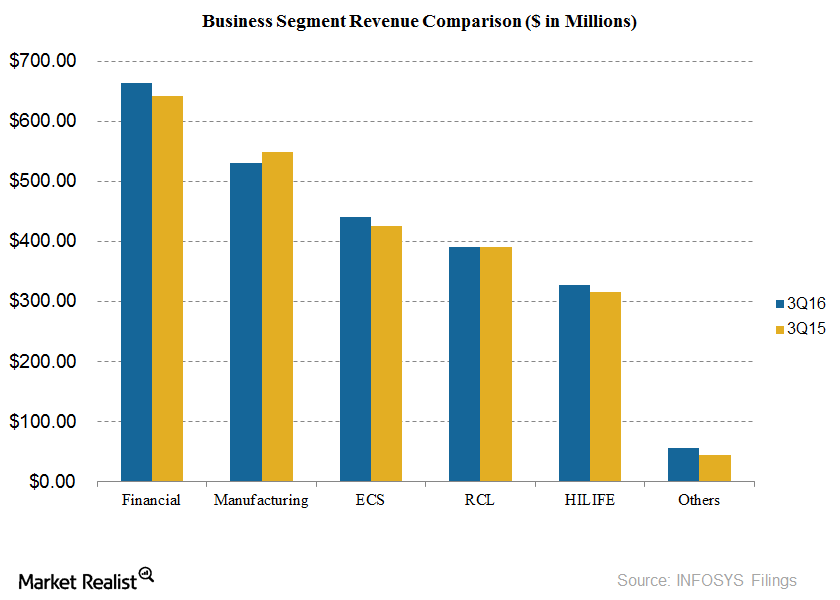

In fiscal 1Q17, revenues for India-based IT firm Infosys (INFY) rose by over 10% year-over-year and by 2.2% quarter-over-quarter.

Infosys Signs Major Deals with ConAgra Foods and Welsh Water

In fiscal 2016, Infosys (INFY) was chosen by ConAgra Foods (CAG) as a strategic partner for a multiyear managed services deal.

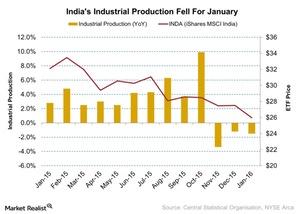

Why Did India’s Industrial Production Fall?

India’s industrial production fell by 1.5% in January, according to the Central Statistical Organization. In January 2015, the industrial production index rose to 2.8%.

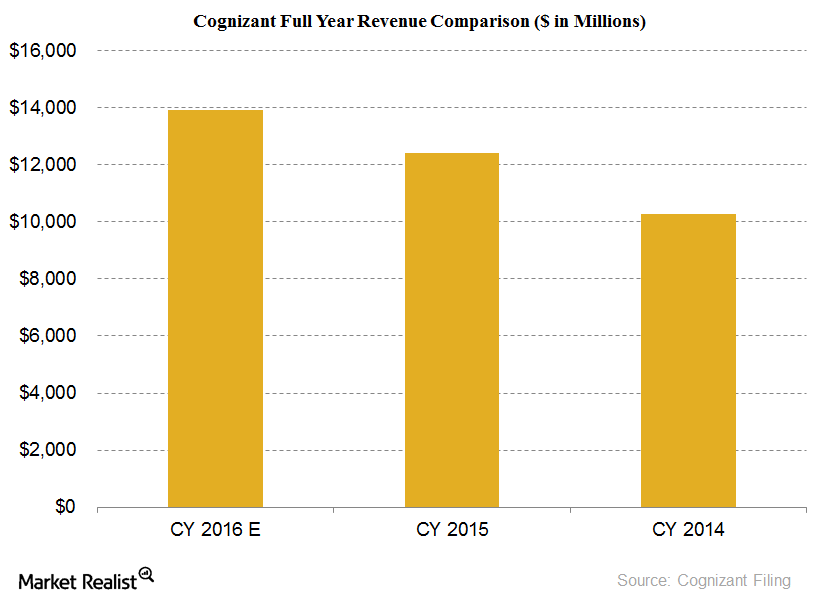

How Cognizant Hopes to Increase Market Share in 2016

Cognizant’s (CTSH) revenues in 2015 rose by an impressive 21% to $12.4 billion from $10.3 billion in 2014.

Infosys Revenues by Segment: Financial Services Take the Lead

Revenues from the financial services segment of the India-based (EPI) Infosys (INFY) were $663 million in fiscal 3Q16. This is 27.5% of total revenues.

The ALPS Kotak India Growth Fund (INDAX) Portfolio Analysis

The ALPS Kotak India Growth Fund (INDAX) intends to invest at least 80% of its net assets directly or indirectly in equity and equity linked securities of Indian companies.

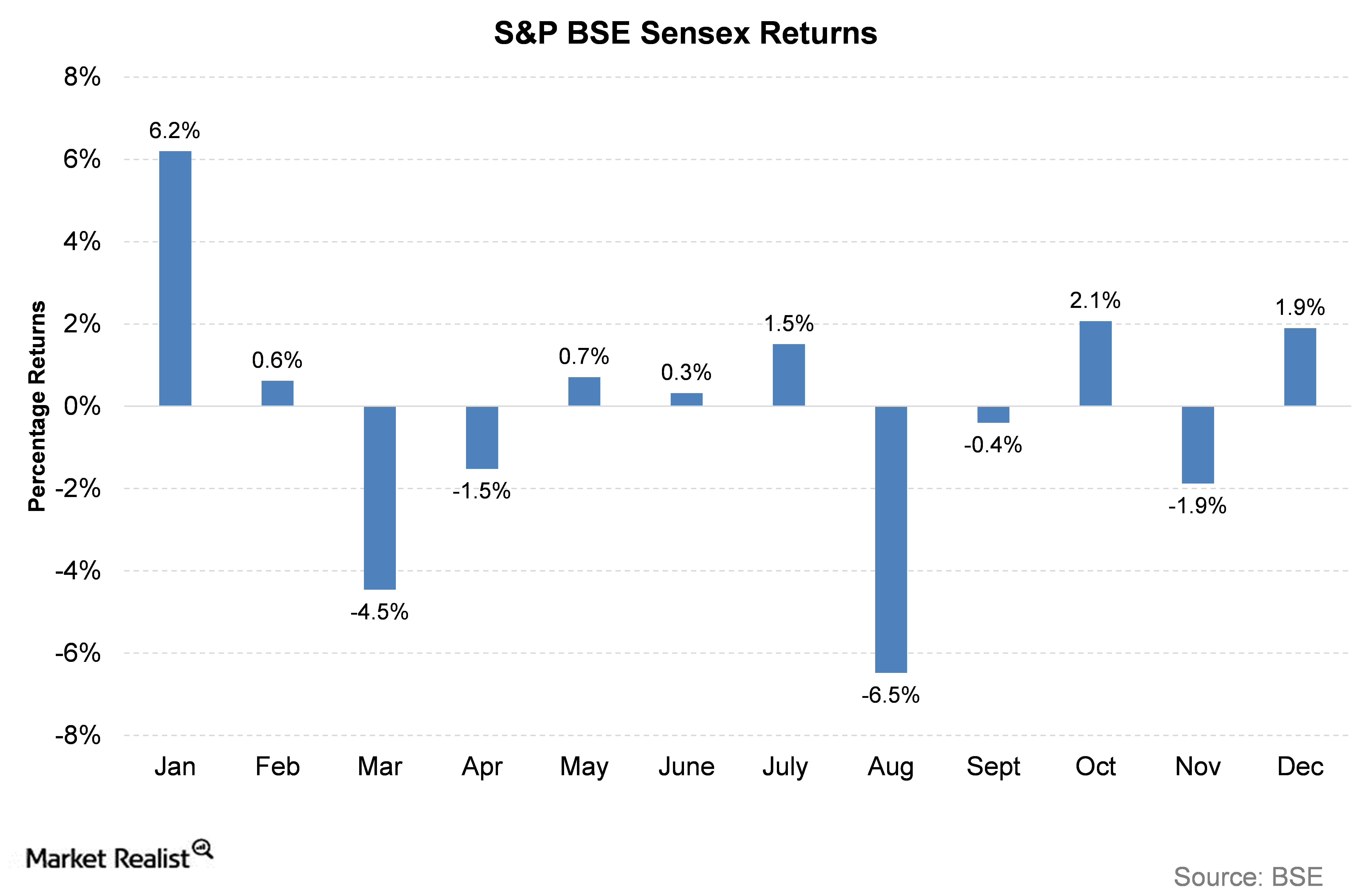

What Factors Affected the Indian Equity Market in 2015?

In this series, we will analyze the performance of the Indian equity market in 2015. The S&P BSE Sensex, considered as a benchmark index, gave a return of -3.7% in 2015, expressed in Indian rupees.

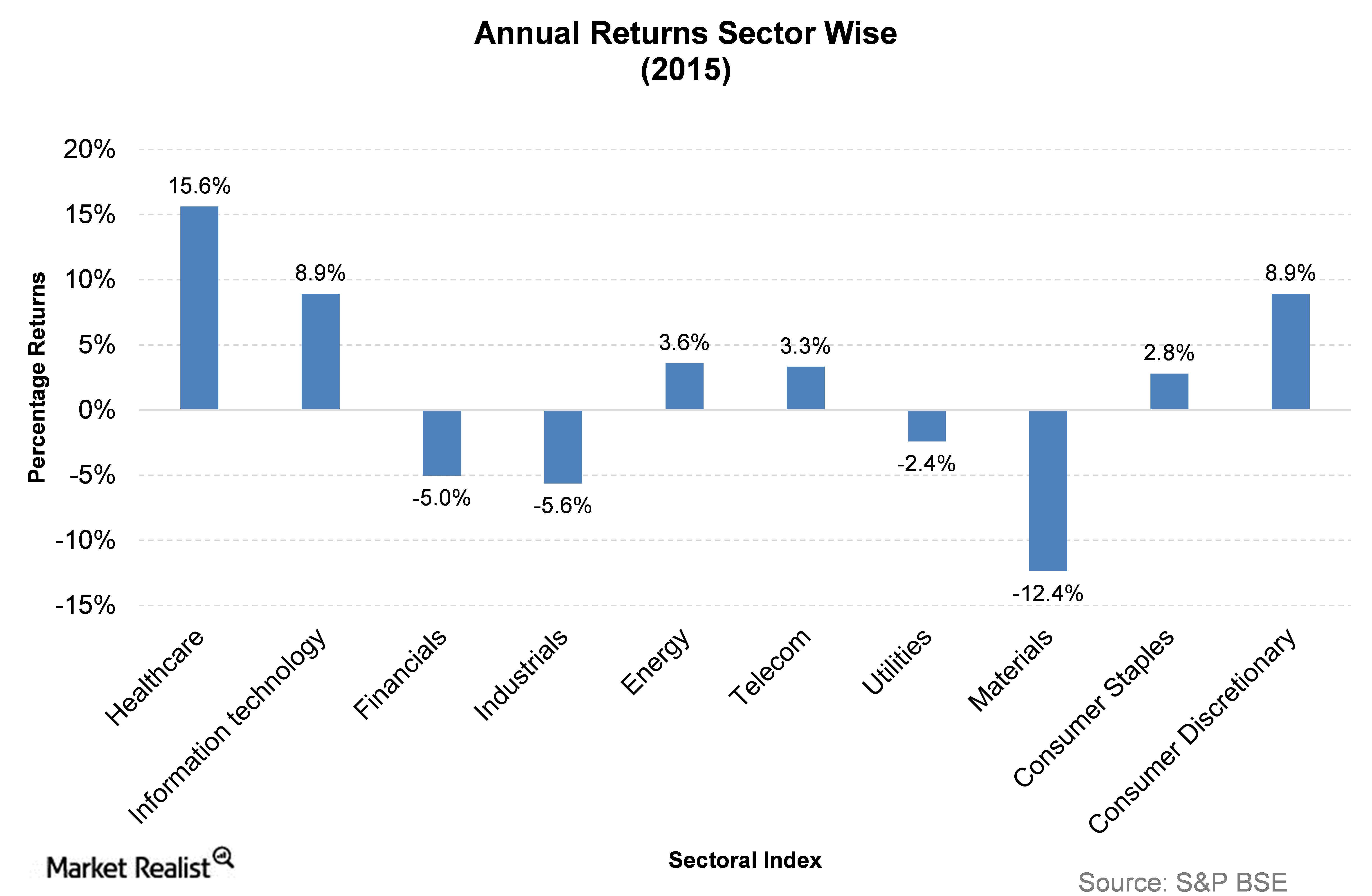

2015’s Gainers and Losers of the Indian Stock Markets

In this article, we will analyze the sector-wise performance of Indian stocks for 2015—a dismal year for all sectors.

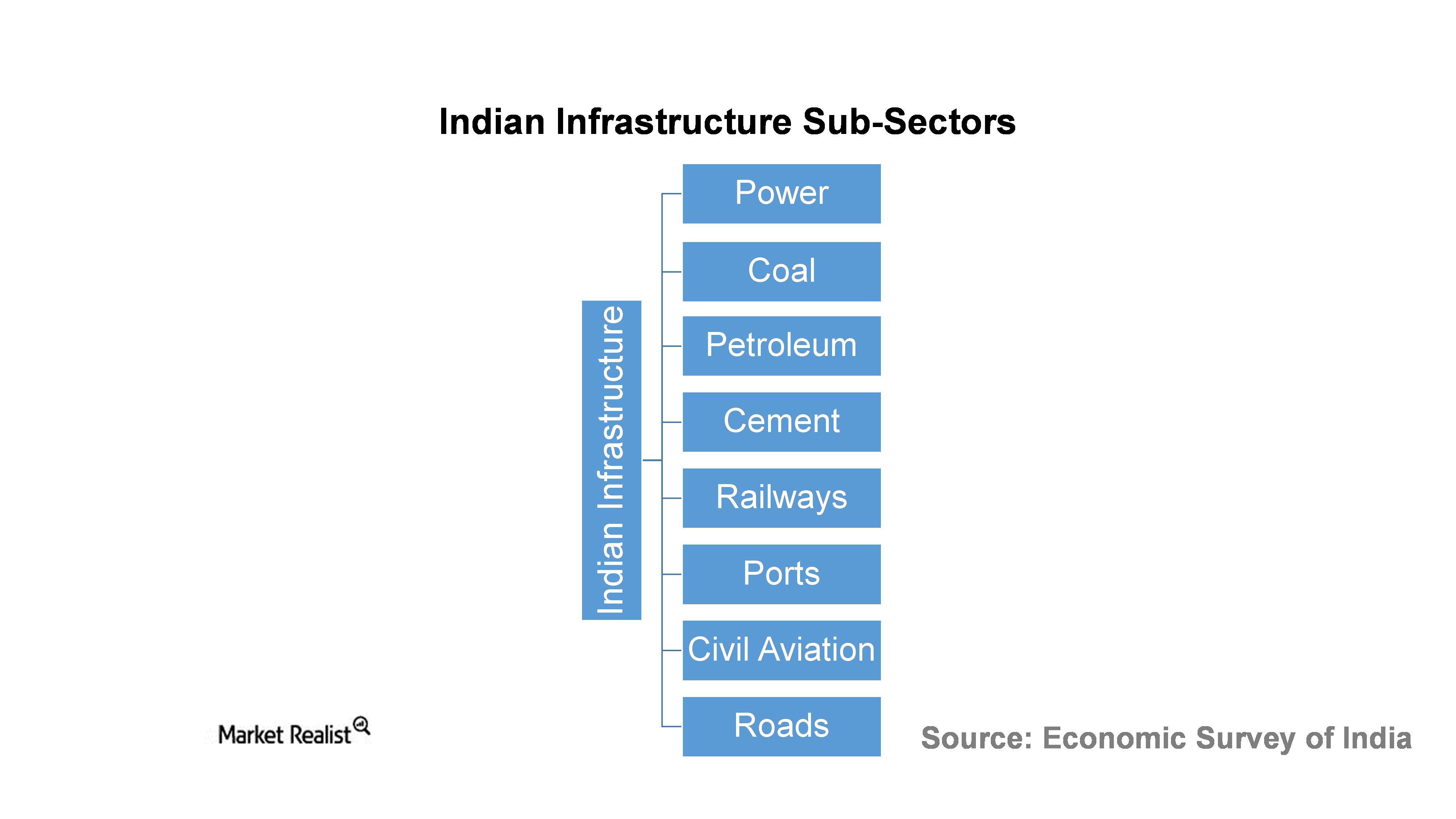

Understanding India’s Infrastructure Sector

The NDA (National Democratic Alliance) government came to power in May 2014. With big promises of development, the party aimed to push major reforms to help speed up India’s recovery process.

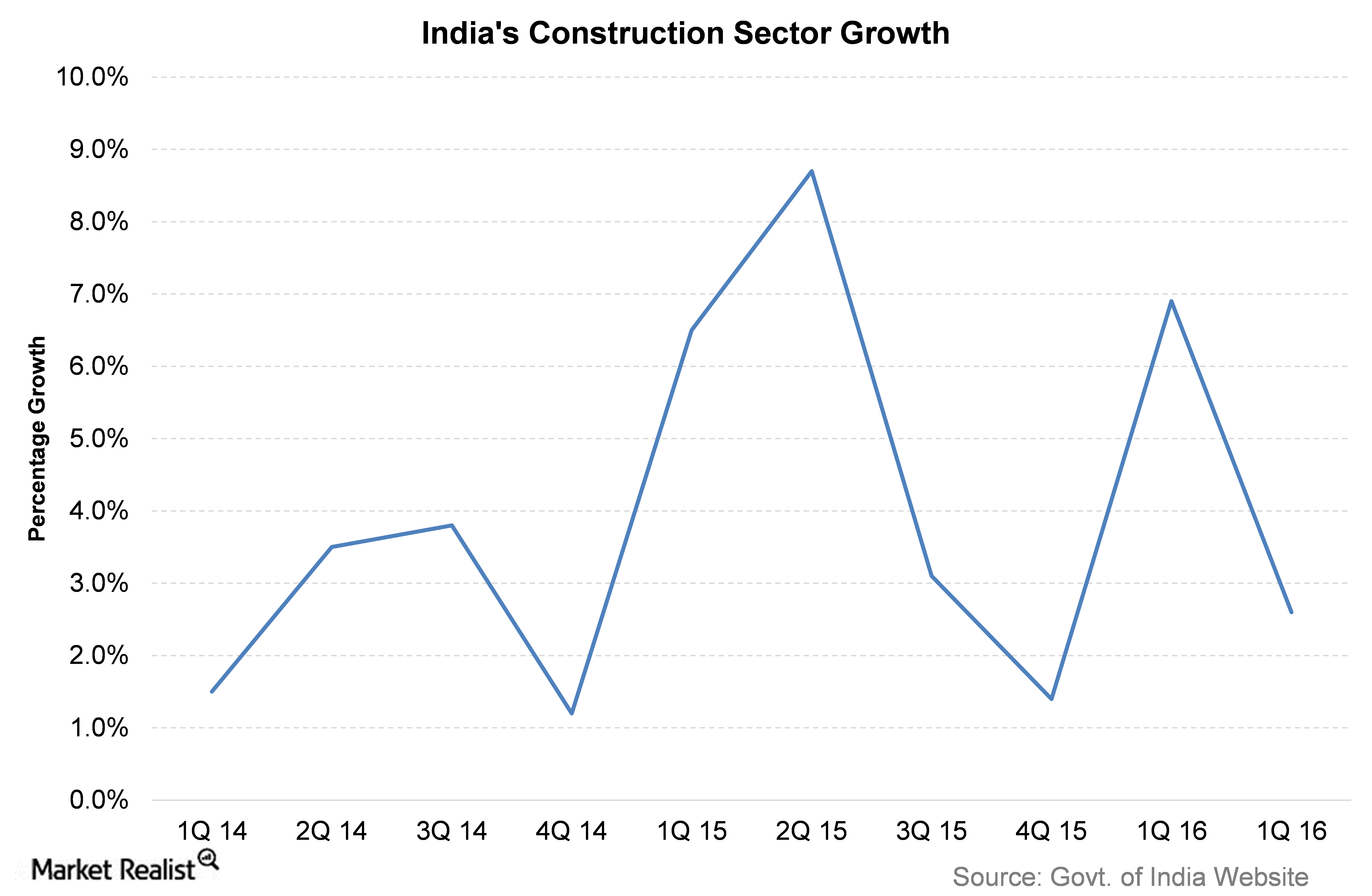

What Drives India’s Construction Sector?

According to India’s government, the construction sector is valued at over $126 billion.

The Major Sectors of the Indian Equity Market

The current global economy is under stress. Major benchmark equity indexes around the globe have given dismal returns, and India is no exception.

Why India Needed the Major FDI Reforms Announced This Month

On November 10, 2015, the government of India announced major reforms in FDI (foreign direct investment). The government has introduced reforms in 15 major sectors of the economy.

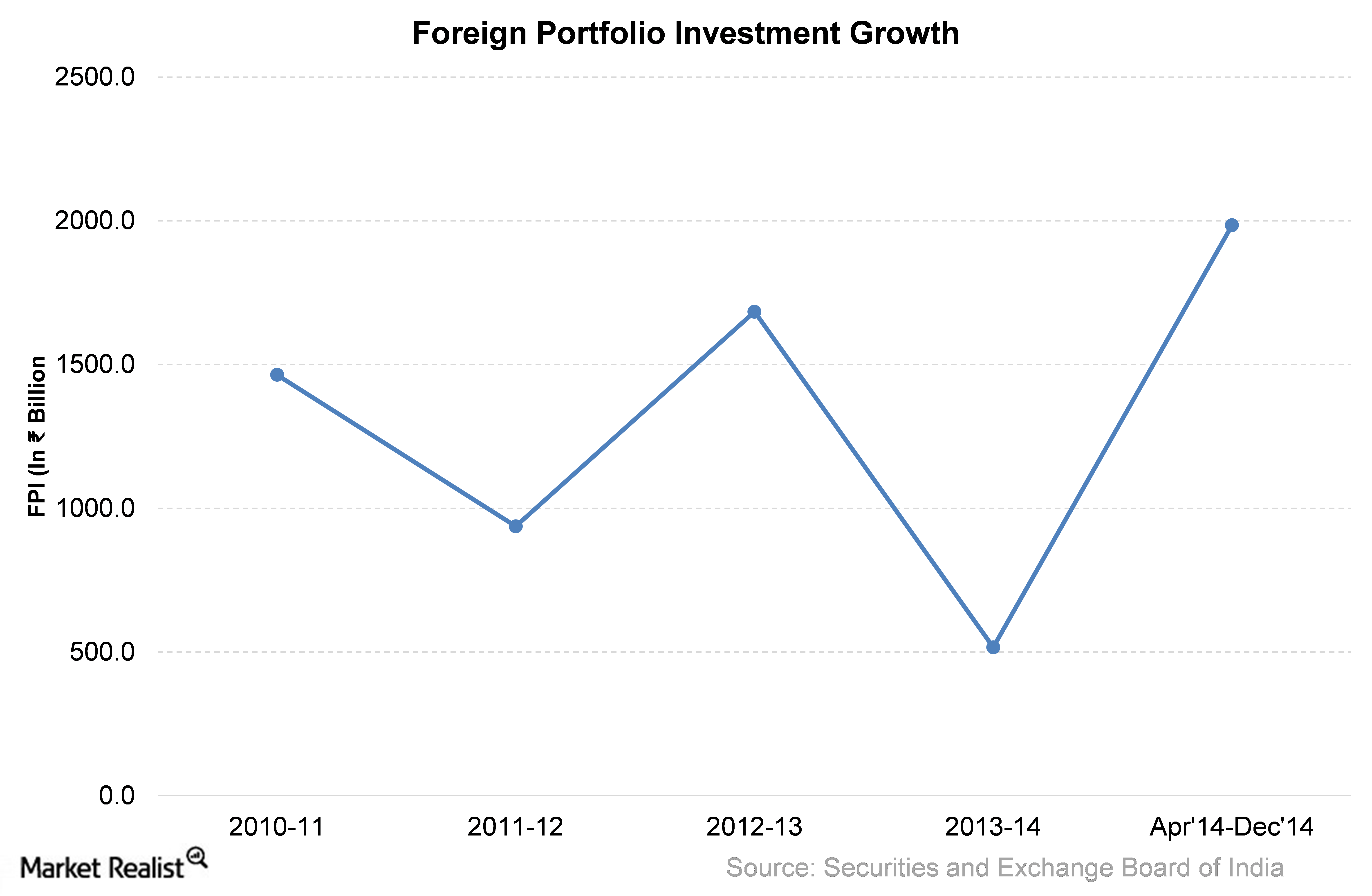

Overview: Last 5 Years of Foreign Portfolio Investment in India

India’s fiscal 2013 was the lowest in terms of market capitalization in the past five years. However, the foreign portfolio witnessed an impressive growth of about 80% in fiscal 2013 over the previous year.

Introducing Accenture, the Largest Global IT Consulting Firm in Revenues

Accenture is one of the world’s largest multinational technology services, management consulting, and outsourcing companies and is headquartered in Dublin.

The Booming Indian Stock Market: Will It Last?

Indian stocks had a strong run in the last half of 2014 through early 2015, but the ride since then hasn’t been smooth. The INDA is up only 2.6% in the one year ended June 2015.