What Factors Affected the Indian Equity Market in 2015?

In this series, we will analyze the performance of the Indian equity market in 2015. The S&P BSE Sensex, considered as a benchmark index, gave a return of -3.7% in 2015, expressed in Indian rupees.

Jan. 8 2016, Updated 7:13 a.m. ET

Introduction

In this series, we will analyze the performance of the Indian equity market in 2015. The BSE (Bombay Stock Exchange) and the NSE (National Stock Exchange) are the two major stock exchanges in India. The S&P BSE Sensex, considered as a benchmark index, gave a return of -3.7% in 2015, expressed in Indian rupees.

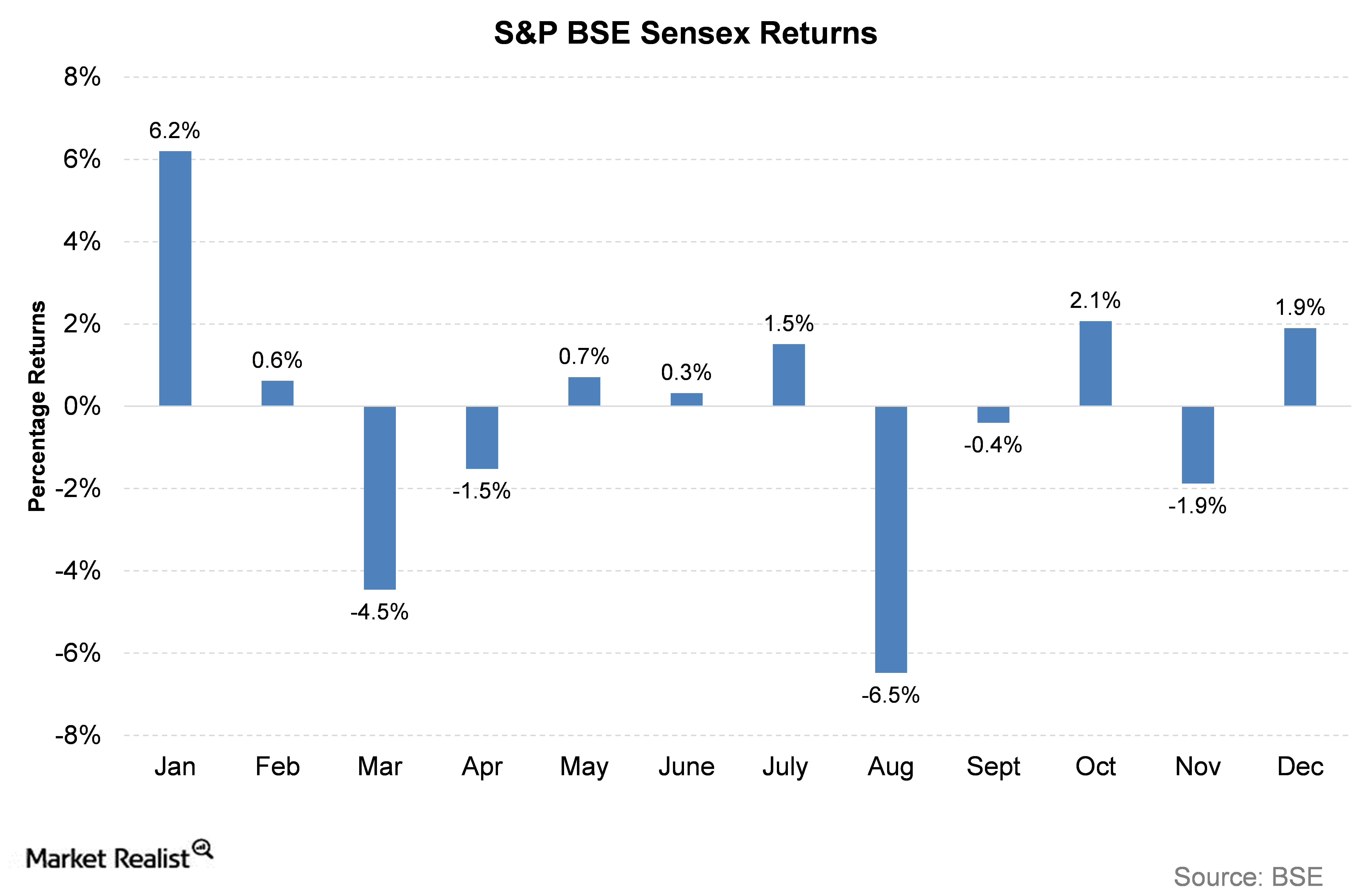

Meanwhile, the Nifty 50, another benchmark index, gave a return of -5.4%. The following chart shows the monthly returns of the S&P BSE Sensex for 2015, shown in rupees.

Indian markets lost because of global events

For investors in Indian stocks, 2015 was a poor year in terms of performance—a sharp contrast to 2014, when the S&P BSE Sensex returned 32%. Although the stellar performance of the previous year may be attributed to election results, the rally did not last beyond January 2015.

August 2015 saw the year’s worst performance. The effect of the Chinese market crash also had its bearing on the Indian markets. While the Indian market recovered to some extent by October, it dropped sharply again in November. Anxiety over the impending rate hike by the US Federal Reserve in December was felt in the Indian markets in November 2015.

India-focused mutual funds

India-focused mutual funds like the Wasatch Emerging India Fund (WAINX) returned about 2% in US dollar terms in 2015. Among the five India-focused funds—the ALPS Kotak India Growth Fund (INDAX), the Matthews India Fund (MINDX), the Wasatch Emerging India Fund (WAINX), the Eaton Vance Greater India Fund – Class A (ETGIX), and the Franklin India Growth Fund (FIGZX)—WAINX was the only fund to give a positive return in 2015.

Several of these funds invest in large-cap banking companies like ICICI Bank Ltd (IBN) and HDFC Bank Ltd. (HDB). The funds also invest heavily in the technology sector (INFY) (WIT).

In the next article, we will analyze the sector-wise performance of Indian equity markets.