Eaton Vance Greater India Fund

Latest Eaton Vance Greater India Fund News and Updates

Looking ahead for Indian-Focused Funds

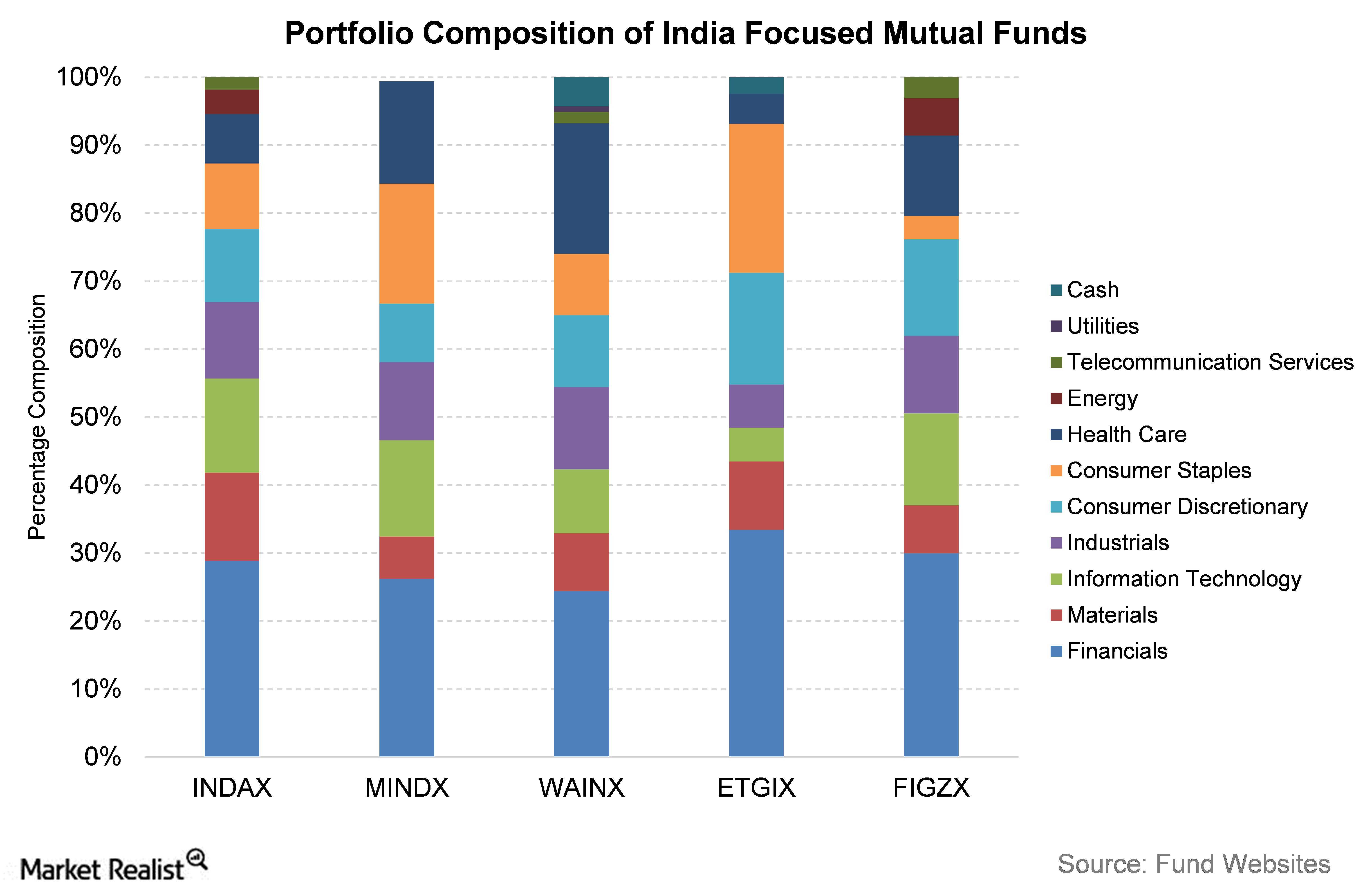

All five India-focused funds have their highest individual sectoral exposure to financials. As reported in the news, 2015 has been a year of global economic stress.

Which Sector Has Attracted the Most FDI This Year?

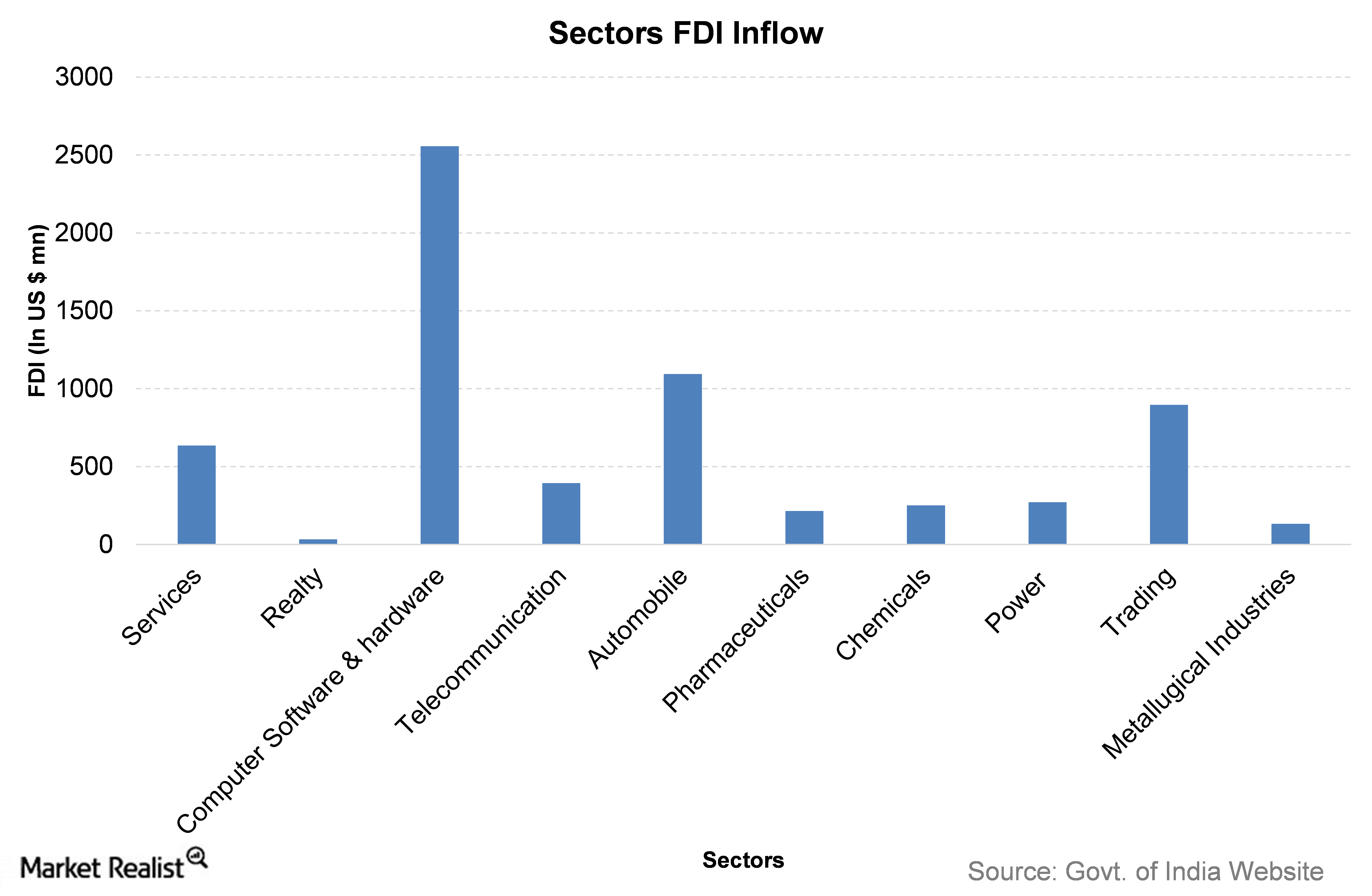

Cumulative data of FDI inflows since April 2000 show the services sector has received 17% of the total FDI inflows in India.

Understanding India’s Infrastructure Sector

The NDA (National Democratic Alliance) government came to power in May 2014. With big promises of development, the party aimed to push major reforms to help speed up India’s recovery process.