Pete Raine

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Pete Raine

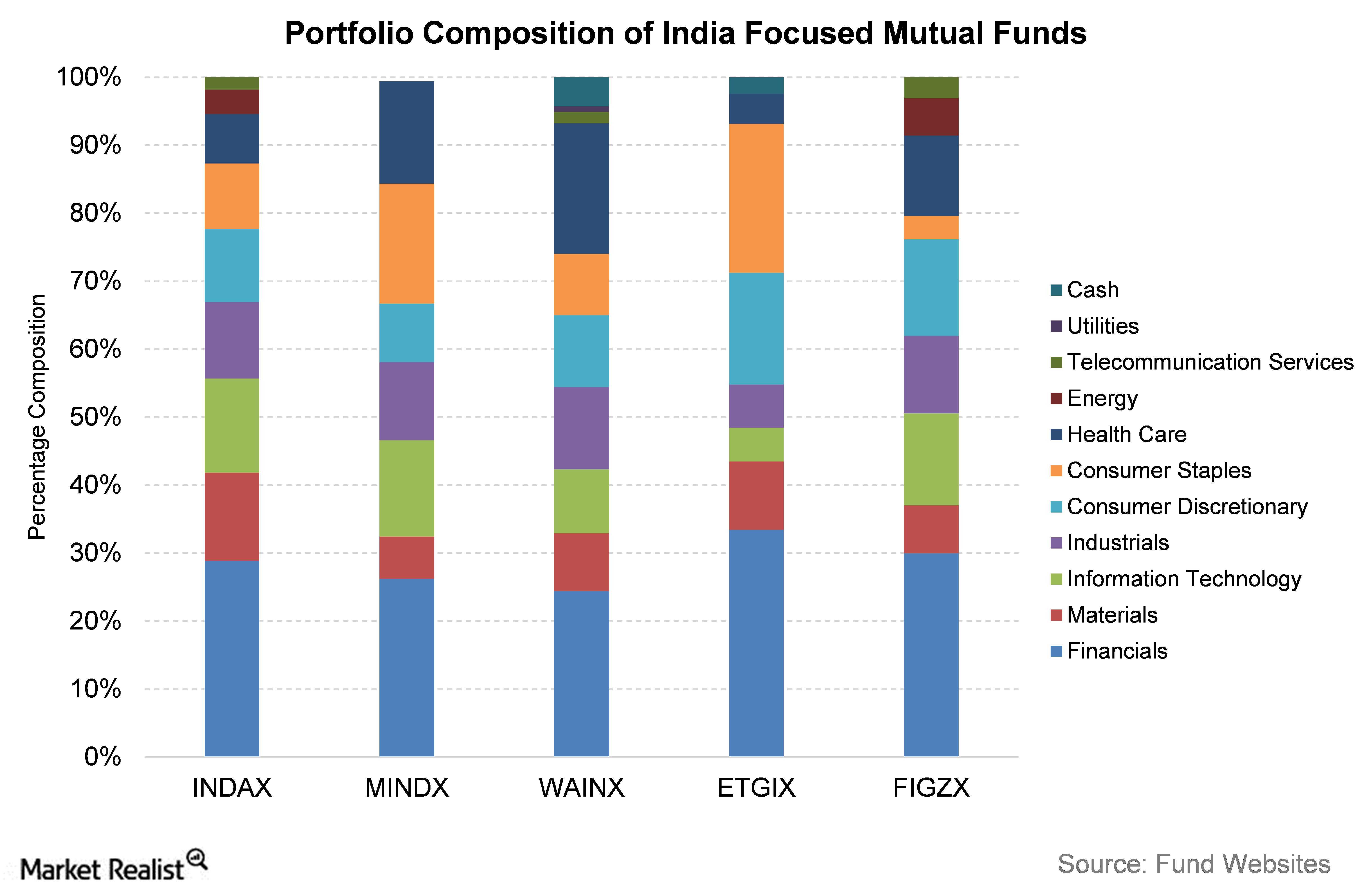

Looking ahead for Indian-Focused Funds

All five India-focused funds have their highest individual sectoral exposure to financials. As reported in the news, 2015 has been a year of global economic stress.

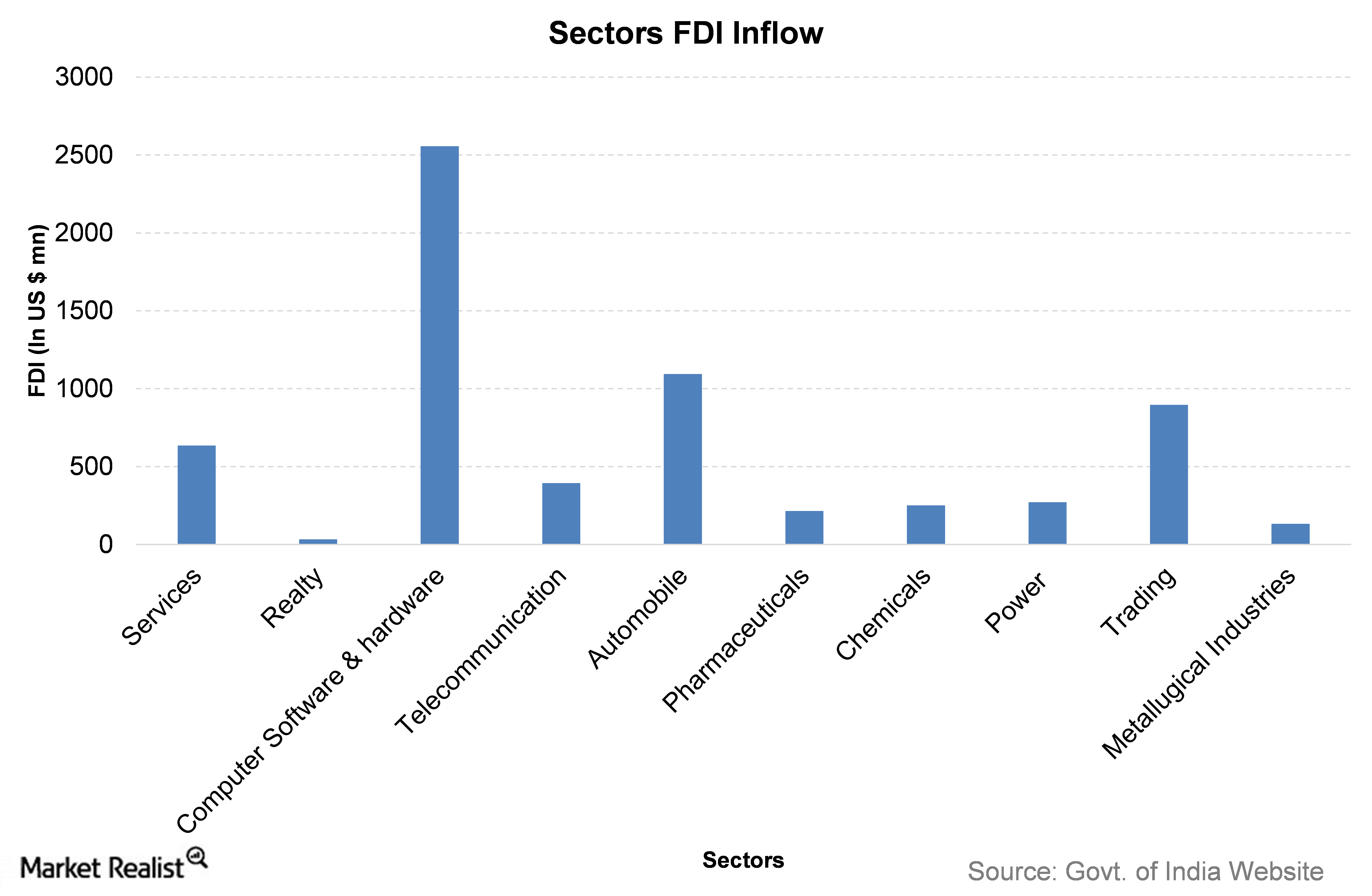

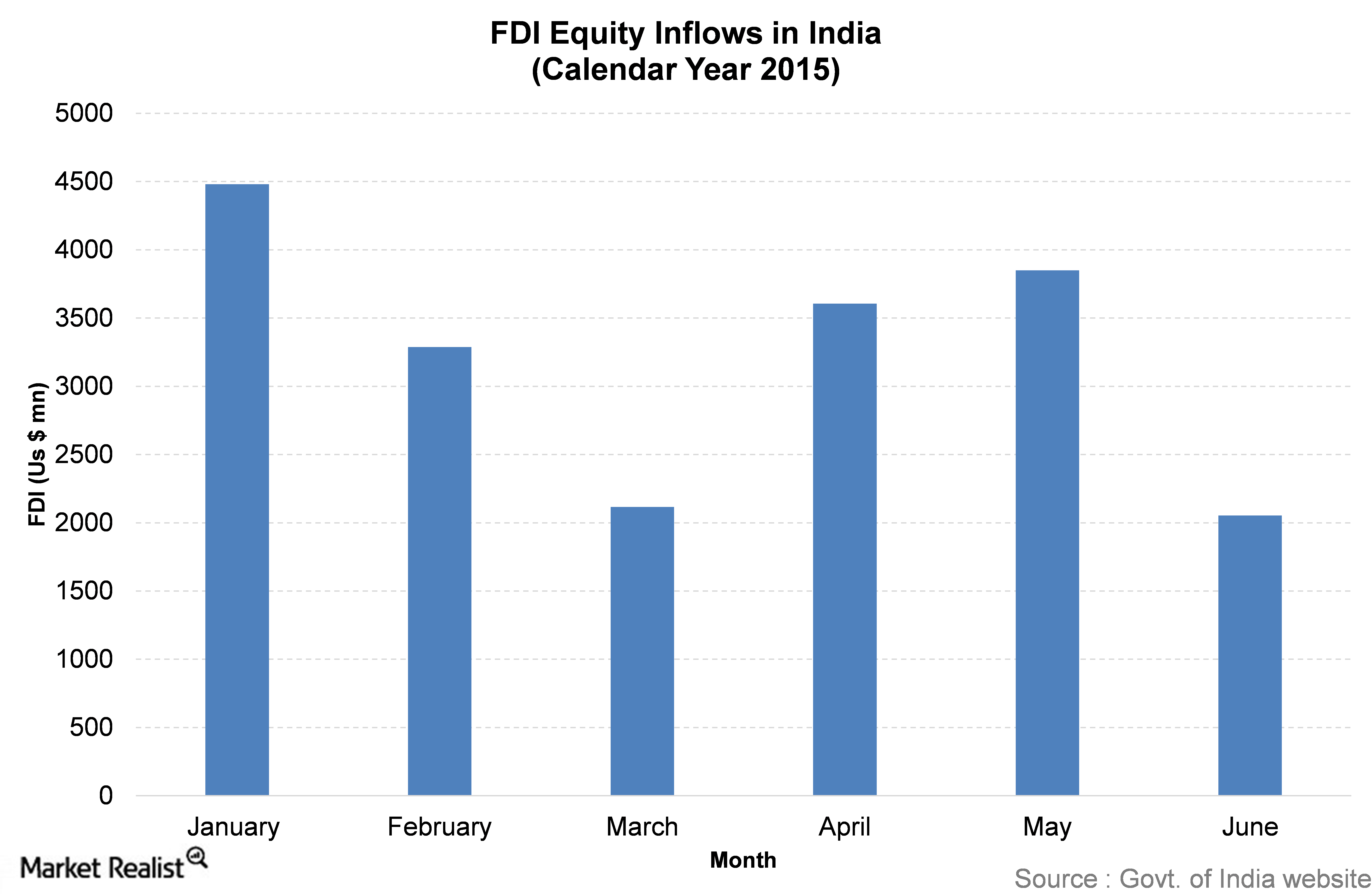

Which Sector Has Attracted the Most FDI This Year?

Cumulative data of FDI inflows since April 2000 show the services sector has received 17% of the total FDI inflows in India.

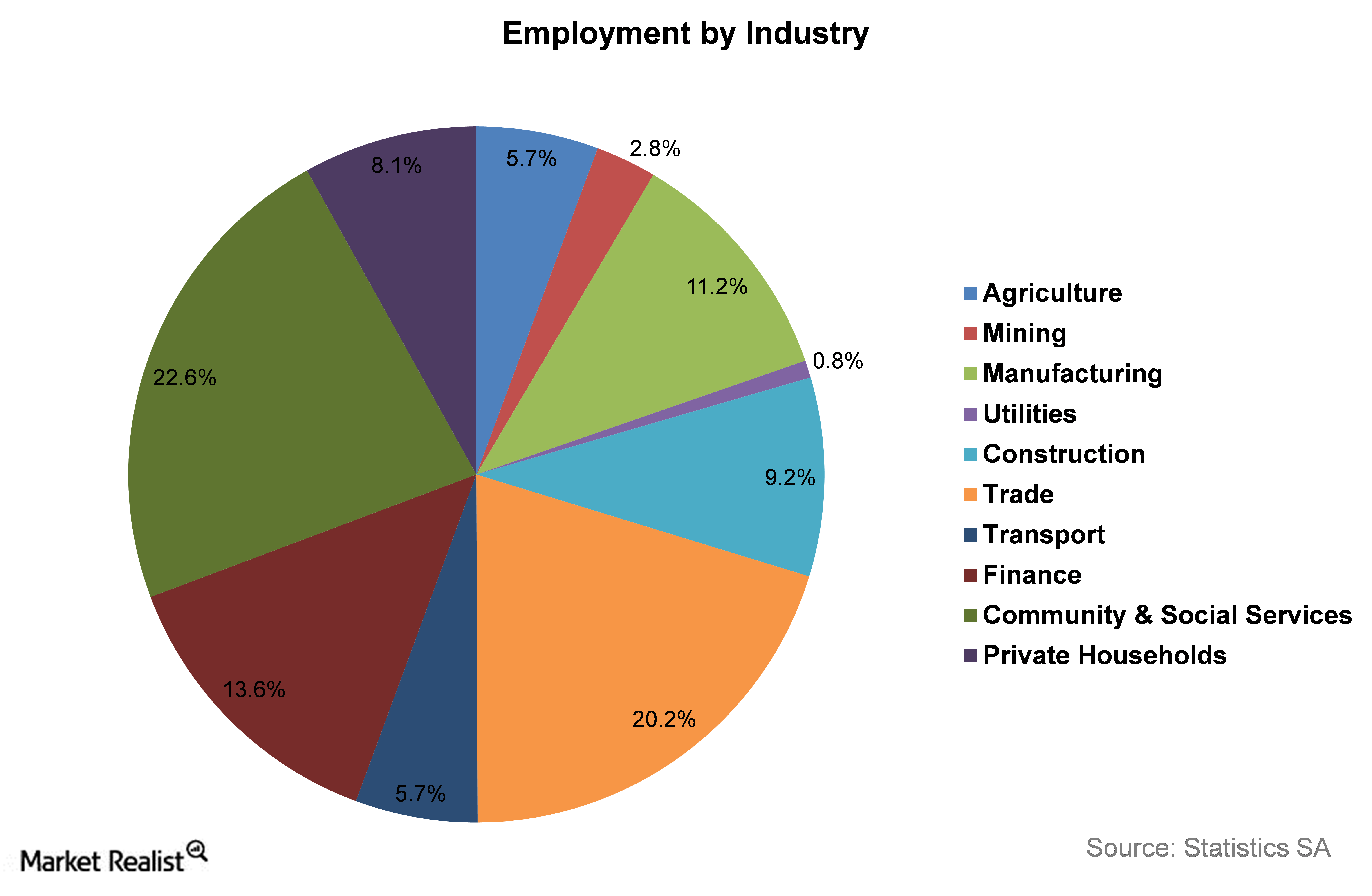

Unemployment Remains a Major Concern for South Africa

South Africa’s unemployment rate was as high as 25% in 2015. The high unemployment rate has been a serious issue in the country for several years now.

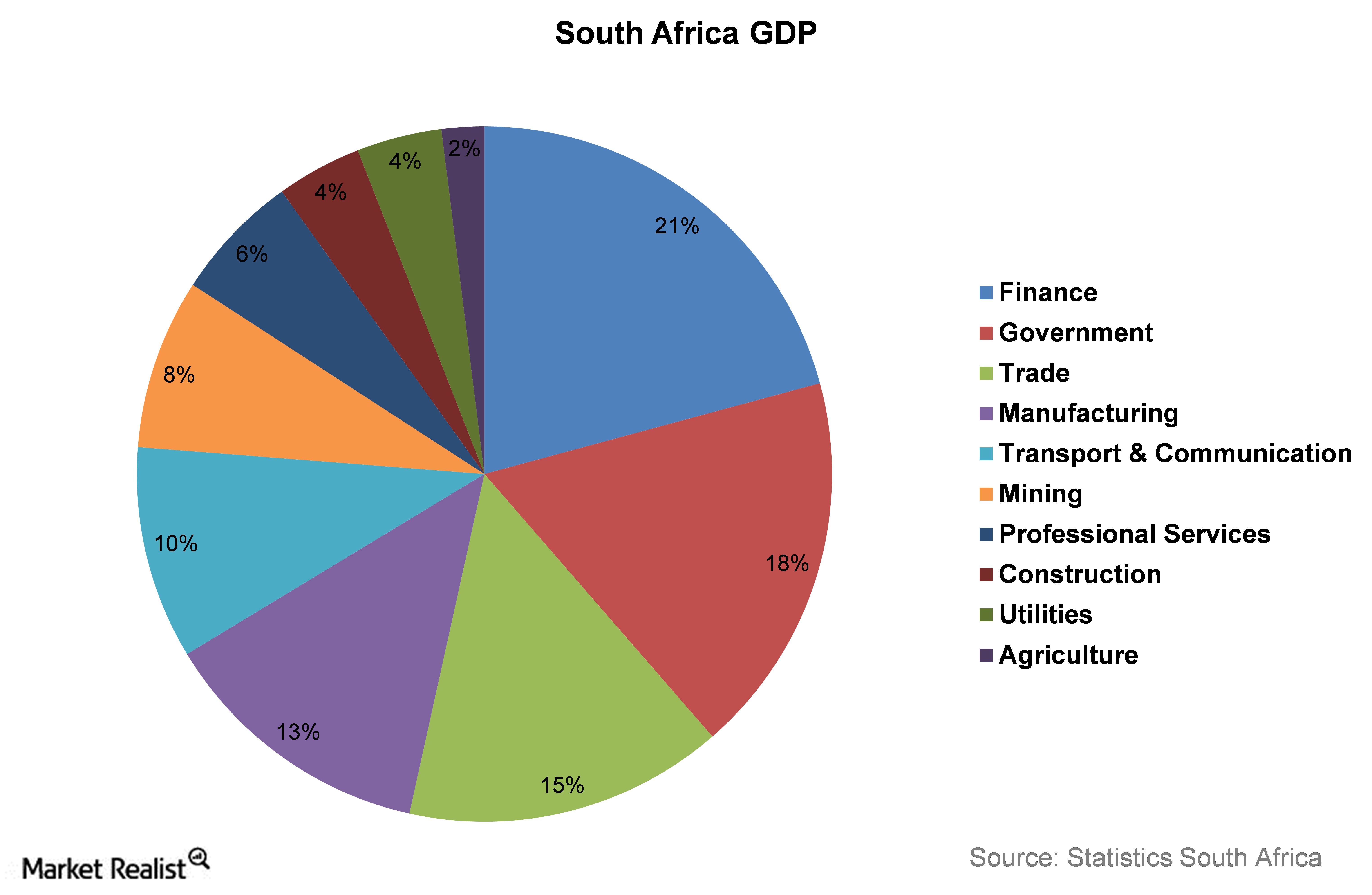

An Overview of the South African Economy’s Structure

The finance sector here consists of finance, real estate, and business services. The South African economy depends heavily on the manufacturing sector.

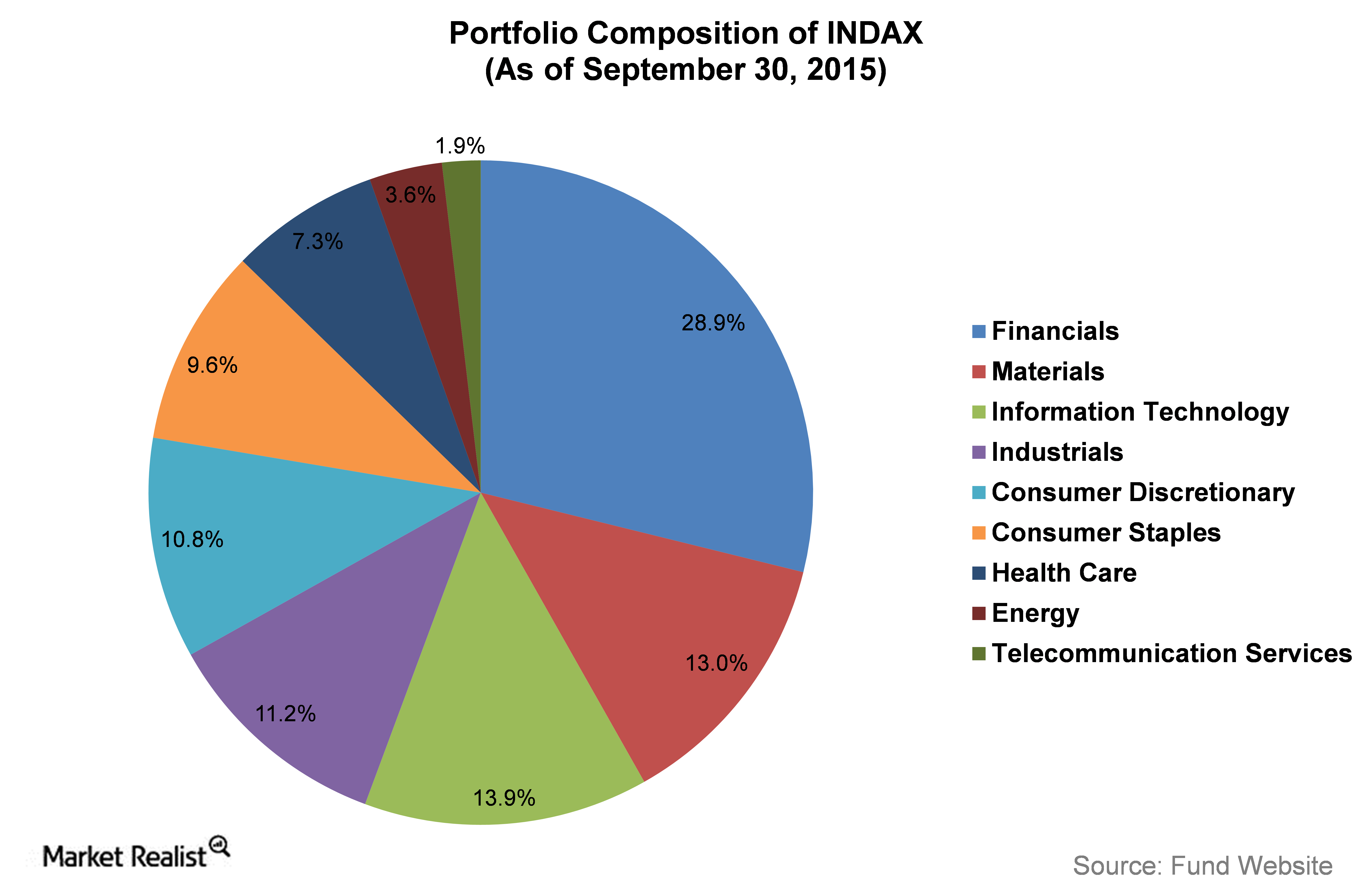

The ALPS Kotak India Growth Fund (INDAX) Portfolio Analysis

The ALPS Kotak India Growth Fund (INDAX) intends to invest at least 80% of its net assets directly or indirectly in equity and equity linked securities of Indian companies.

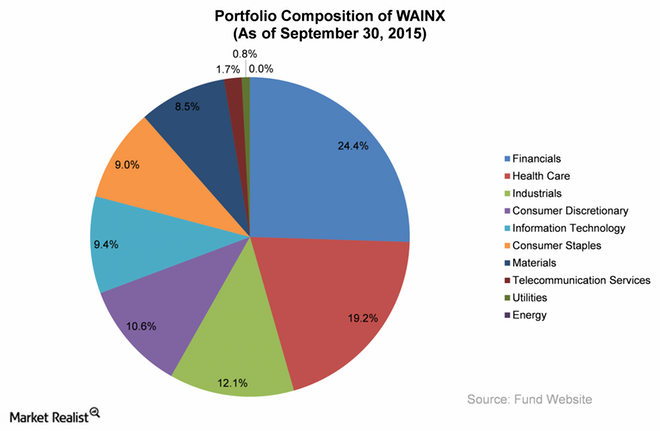

The Wasatch Emerging India Fund Portfolio Composition

As of December 2015, the Wasatch Emerging India Fund has ~$69.2 million in assets under management. As of September 30, 2015, the fund had 76 holdings in its portfolio.

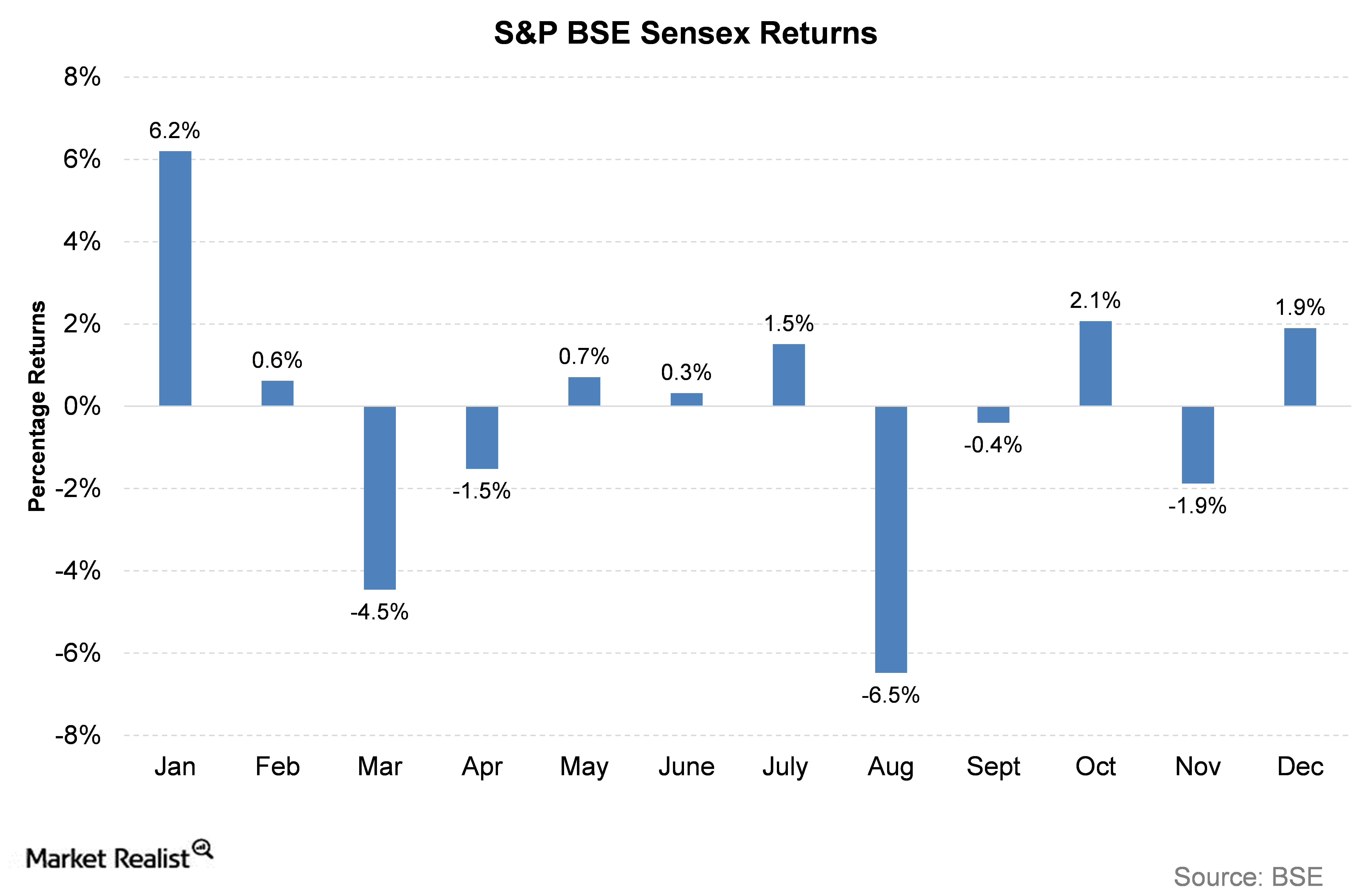

What Factors Affected the Indian Equity Market in 2015?

In this series, we will analyze the performance of the Indian equity market in 2015. The S&P BSE Sensex, considered as a benchmark index, gave a return of -3.7% in 2015, expressed in Indian rupees.

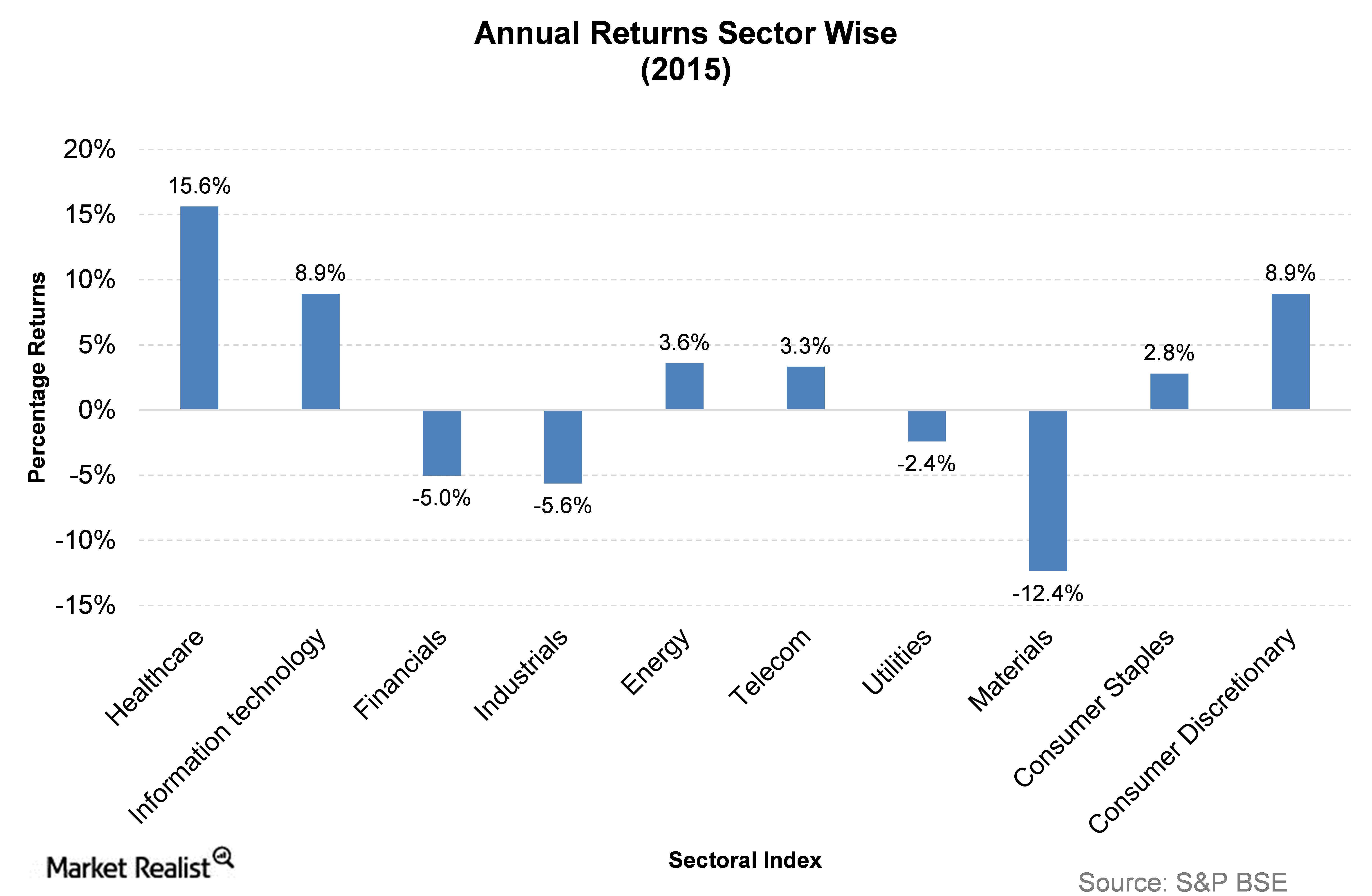

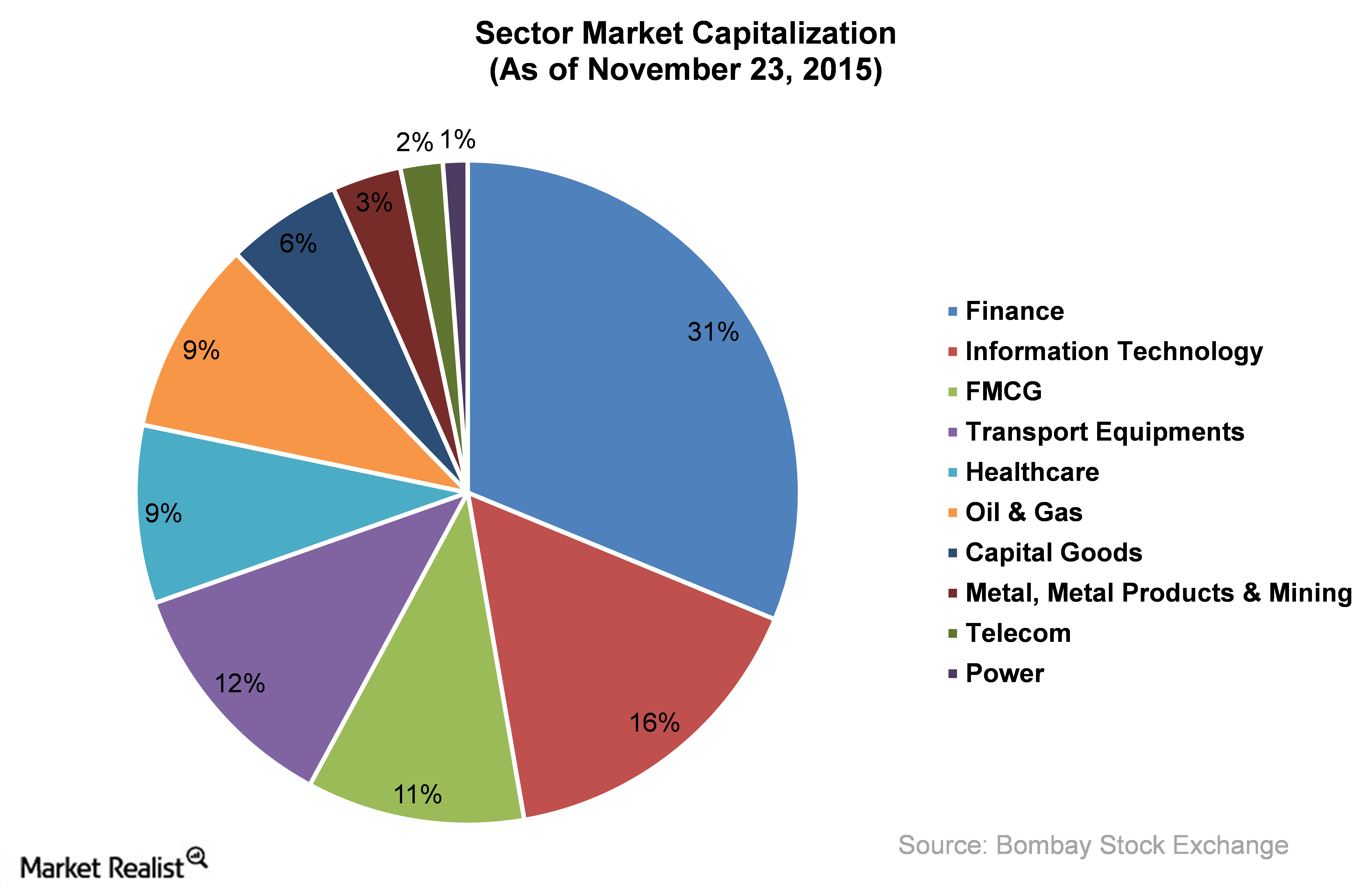

2015’s Gainers and Losers of the Indian Stock Markets

In this article, we will analyze the sector-wise performance of Indian stocks for 2015—a dismal year for all sectors.

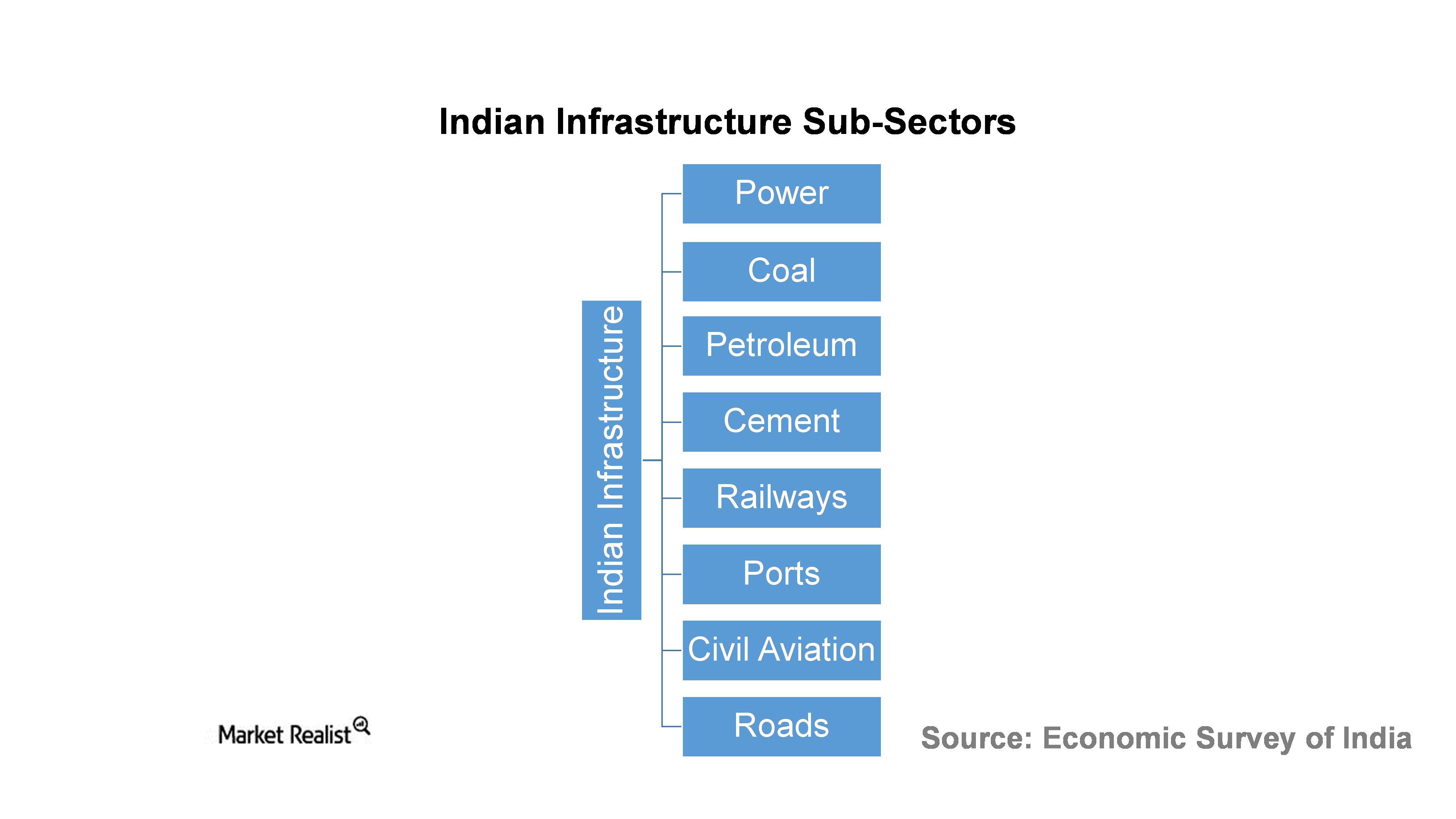

Understanding India’s Infrastructure Sector

The NDA (National Democratic Alliance) government came to power in May 2014. With big promises of development, the party aimed to push major reforms to help speed up India’s recovery process.

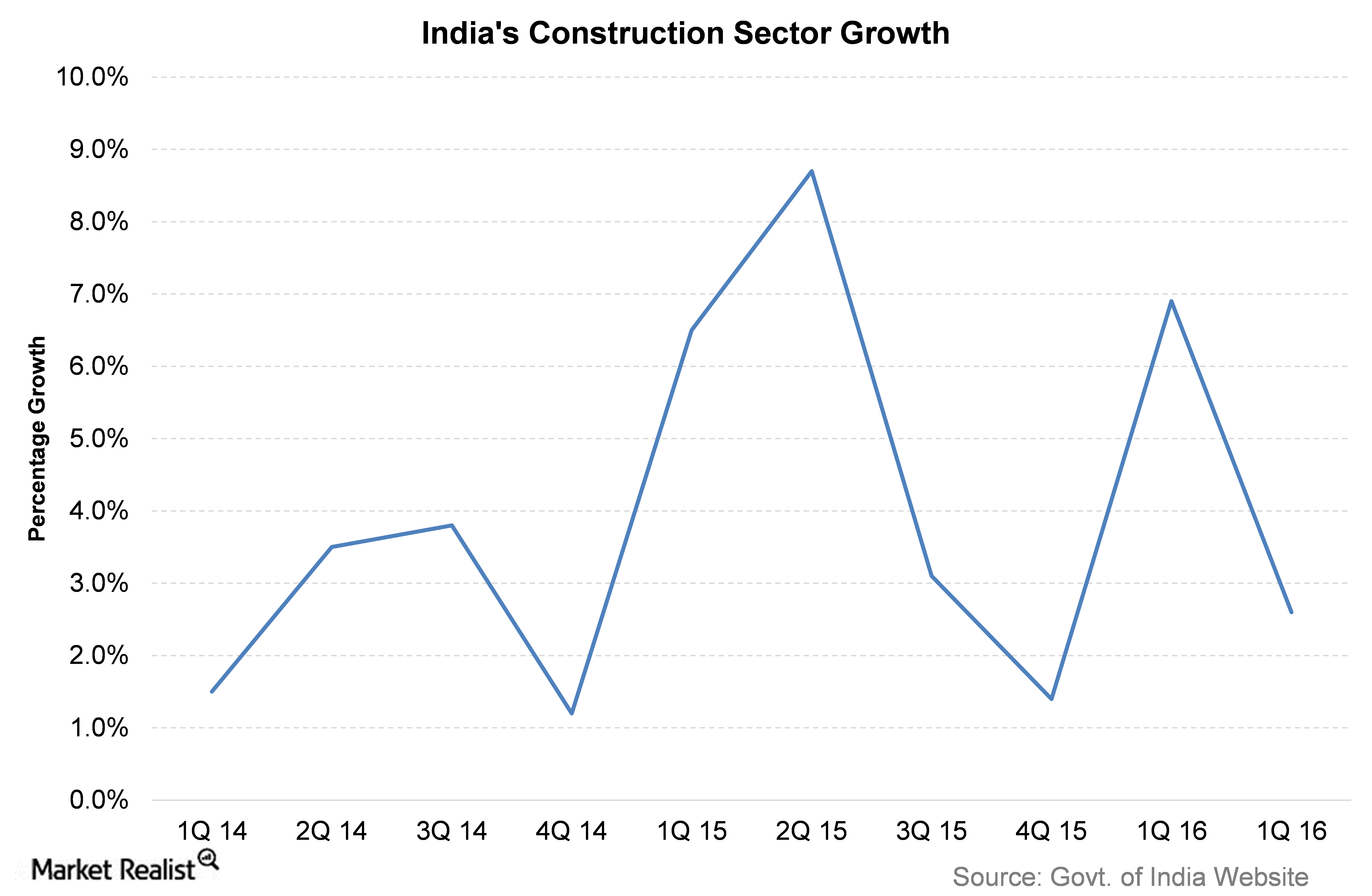

What Drives India’s Construction Sector?

According to India’s government, the construction sector is valued at over $126 billion.

The Major Sectors of the Indian Equity Market

The current global economy is under stress. Major benchmark equity indexes around the globe have given dismal returns, and India is no exception.

Why India Needed the Major FDI Reforms Announced This Month

On November 10, 2015, the government of India announced major reforms in FDI (foreign direct investment). The government has introduced reforms in 15 major sectors of the economy.

The Nile Pan Africa A Fund: Negative Returns for 5 Years

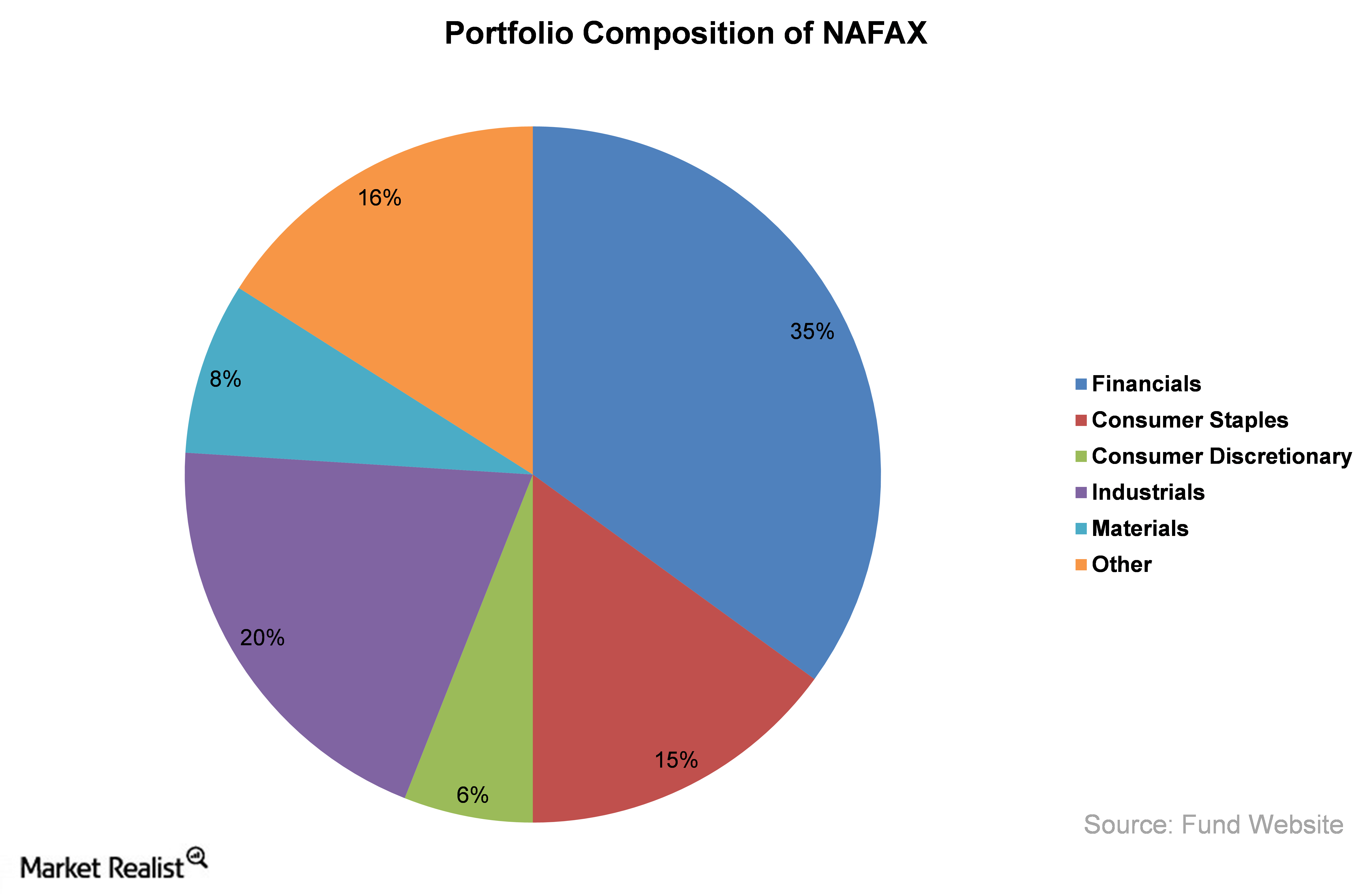

The Nile Pan Africa A Fund (NAFAX) invests at least 80% of its portfolio in the stocks of Africa-based companies. The majority of the fund’s exposure is in South Africa.

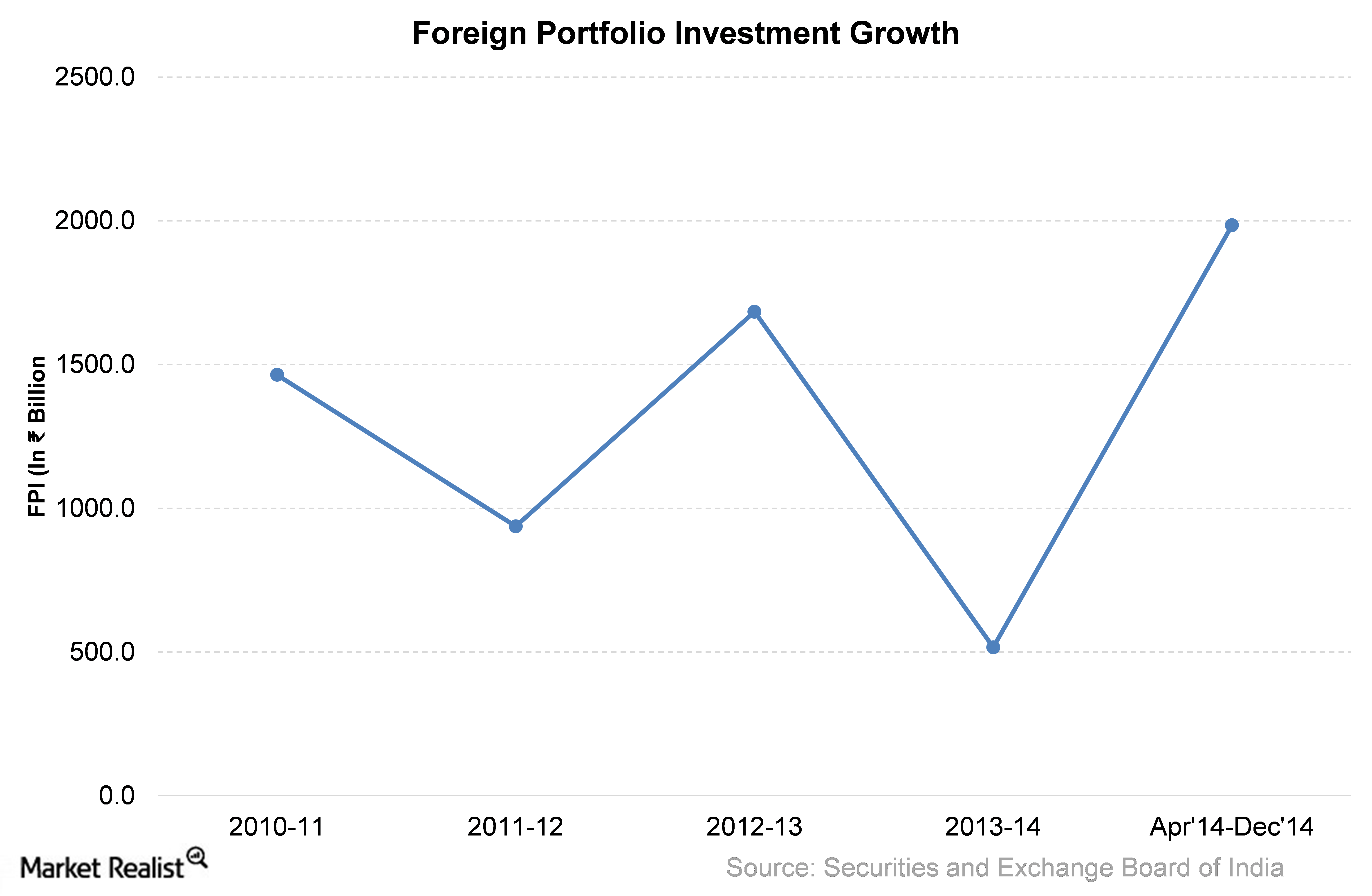

Overview: Last 5 Years of Foreign Portfolio Investment in India

India’s fiscal 2013 was the lowest in terms of market capitalization in the past five years. However, the foreign portfolio witnessed an impressive growth of about 80% in fiscal 2013 over the previous year.