ALPS|Kotak India Growth A

Latest ALPS|Kotak India Growth A News and Updates

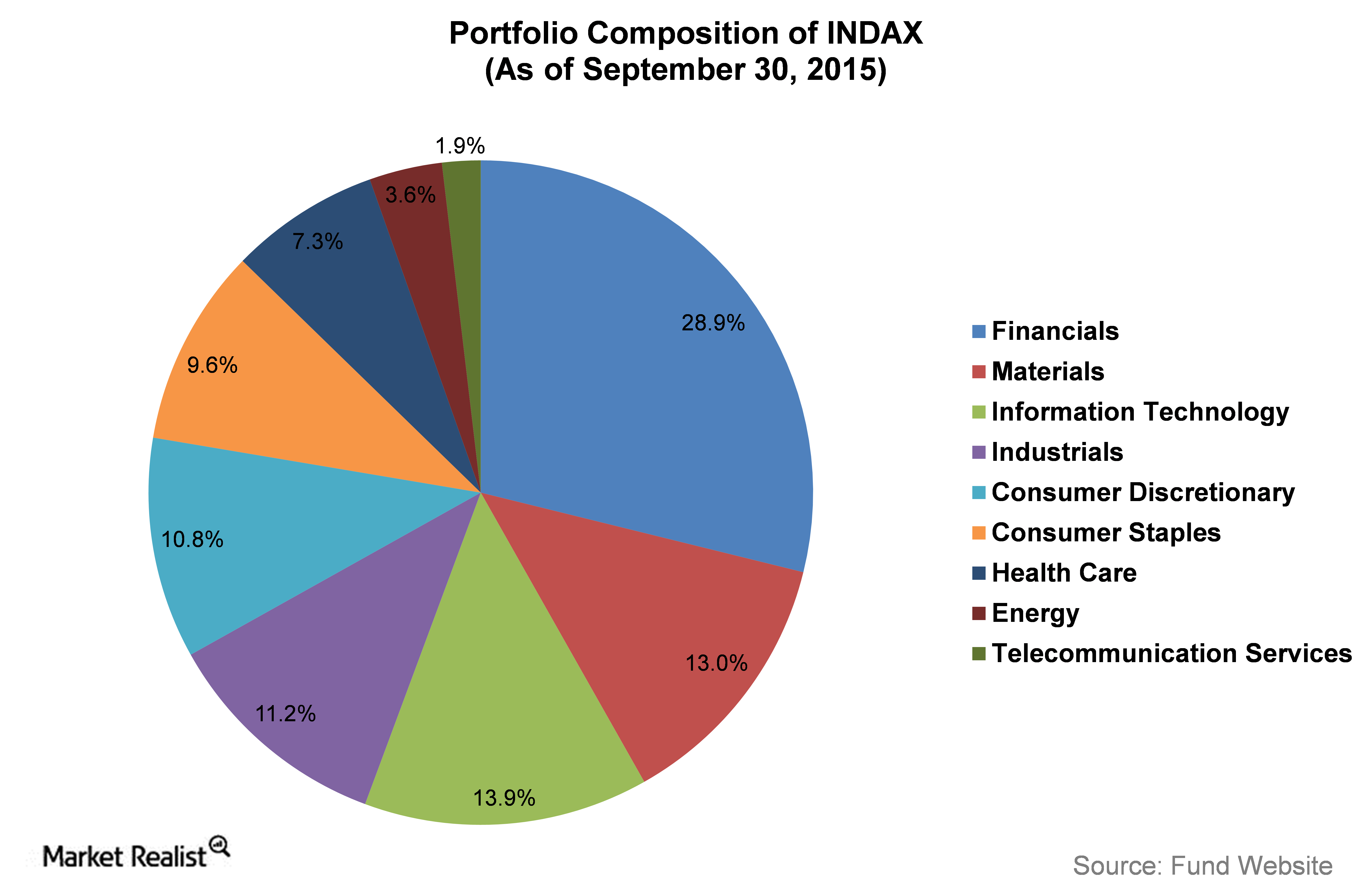

The ALPS Kotak India Growth Fund (INDAX) Portfolio Analysis

The ALPS Kotak India Growth Fund (INDAX) intends to invest at least 80% of its net assets directly or indirectly in equity and equity linked securities of Indian companies.

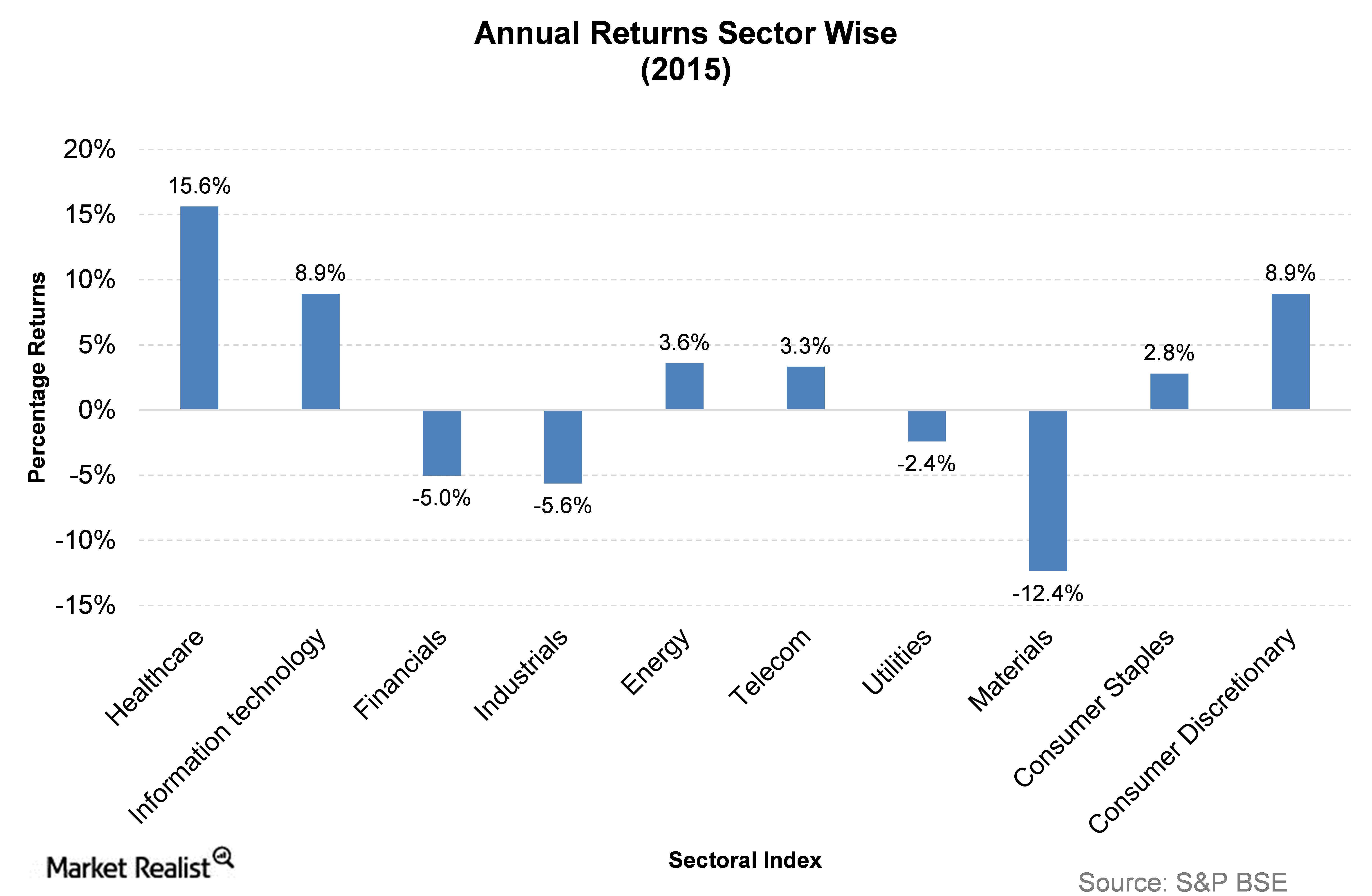

2015’s Gainers and Losers of the Indian Stock Markets

In this article, we will analyze the sector-wise performance of Indian stocks for 2015—a dismal year for all sectors.

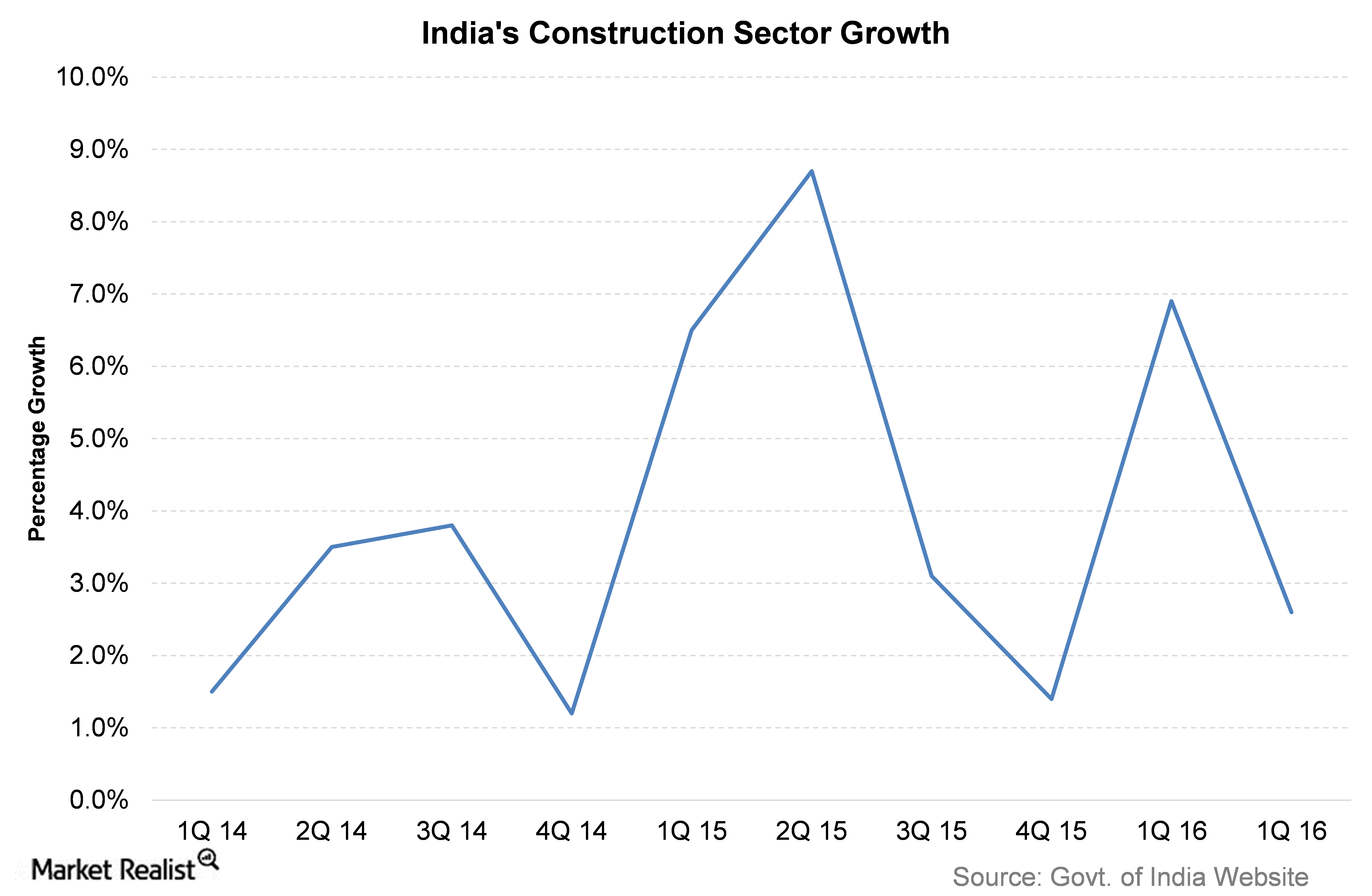

What Drives India’s Construction Sector?

According to India’s government, the construction sector is valued at over $126 billion.

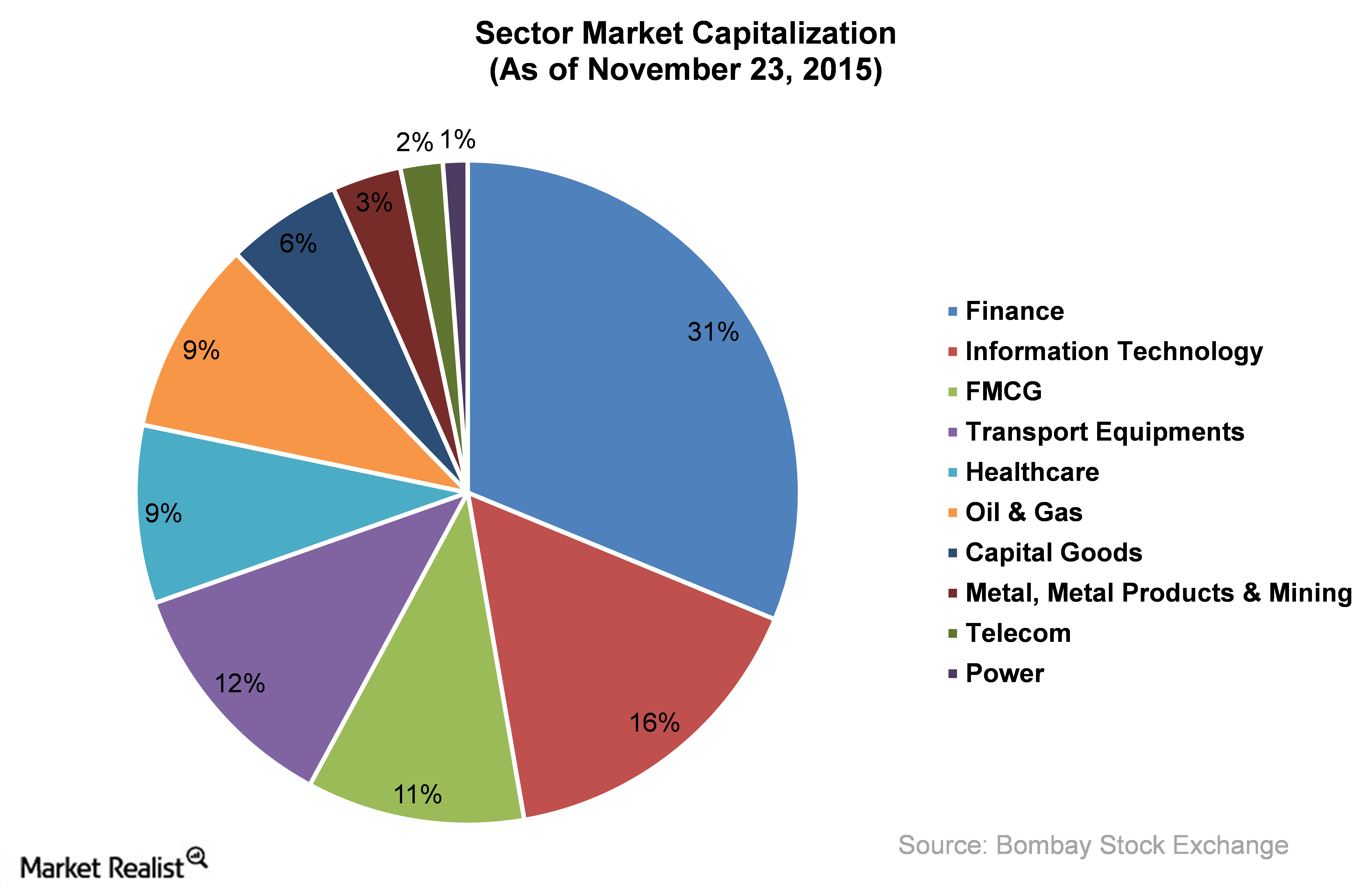

The Major Sectors of the Indian Equity Market

The current global economy is under stress. Major benchmark equity indexes around the globe have given dismal returns, and India is no exception.

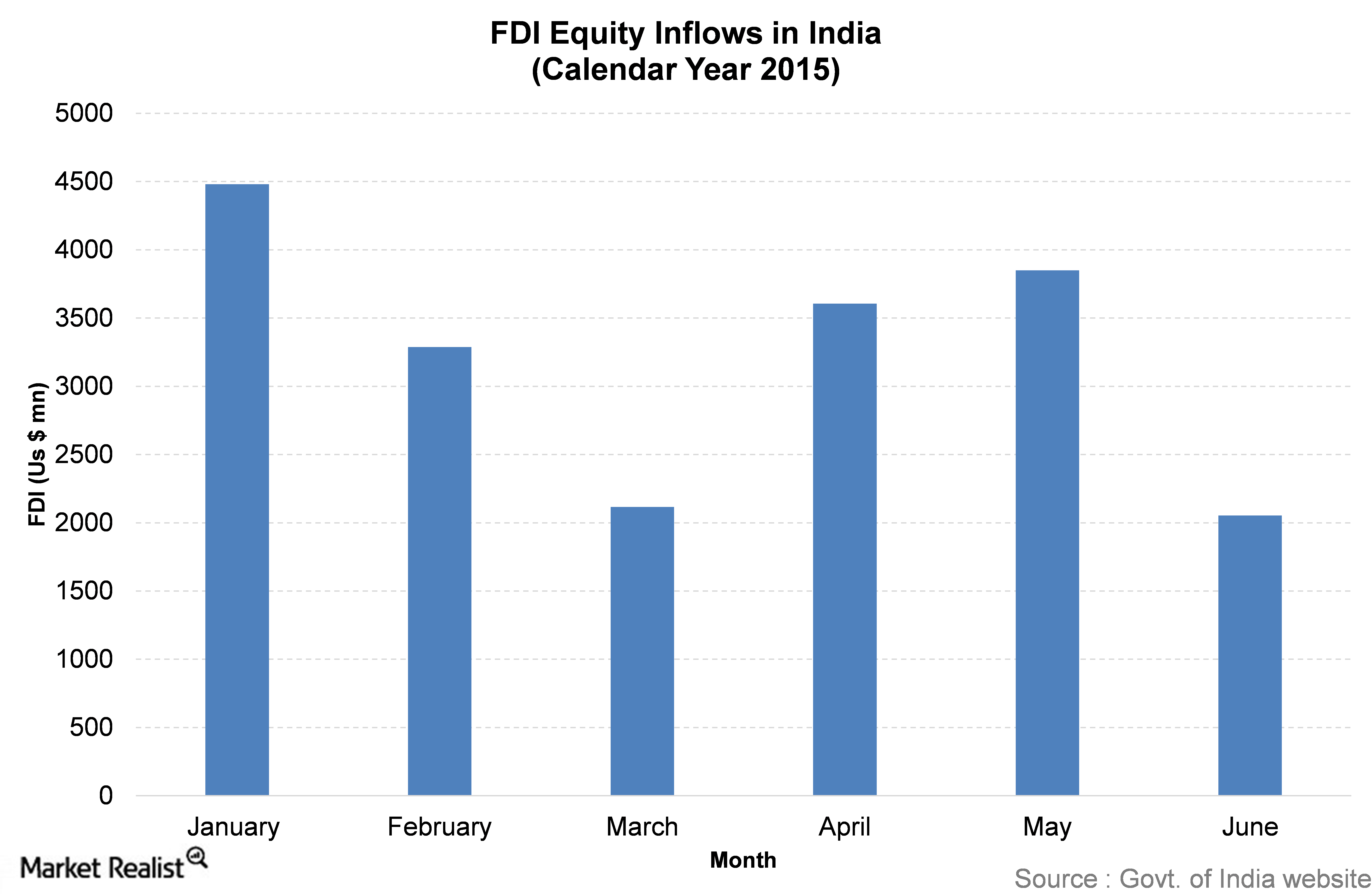

Why India Needed the Major FDI Reforms Announced This Month

On November 10, 2015, the government of India announced major reforms in FDI (foreign direct investment). The government has introduced reforms in 15 major sectors of the economy.

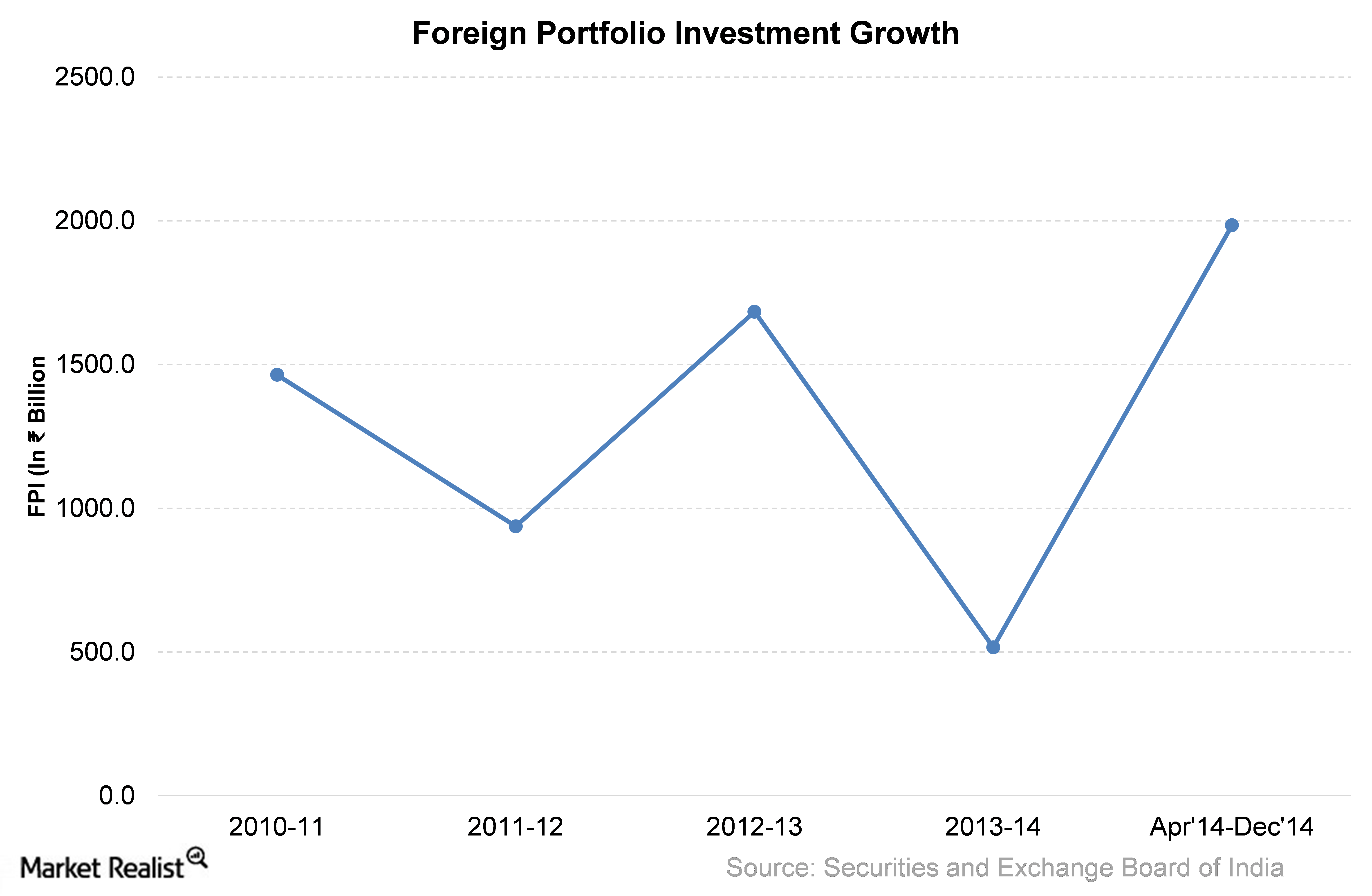

Overview: Last 5 Years of Foreign Portfolio Investment in India

India’s fiscal 2013 was the lowest in terms of market capitalization in the past five years. However, the foreign portfolio witnessed an impressive growth of about 80% in fiscal 2013 over the previous year.