HDFC Bank Ltd

Latest HDFC Bank Ltd News and Updates

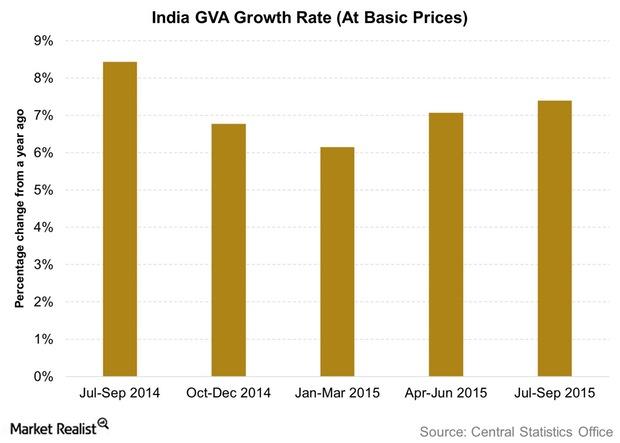

India’s Economic Growth in GVA Terms: What Does the RBI Expect?

For financial year 2016–2017, the RBI forecasts the GVA growth at a 7.6% pace. This assumes that there aren’t any significant headwinds.

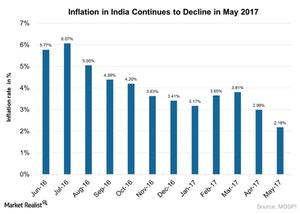

Inside India’s Inflation in May 2017

Consumer price inflation in India stood at ~2.2% on a YoY (year-over-year) basis in May 2017, as compared to its 2.99% rise in April 2017.

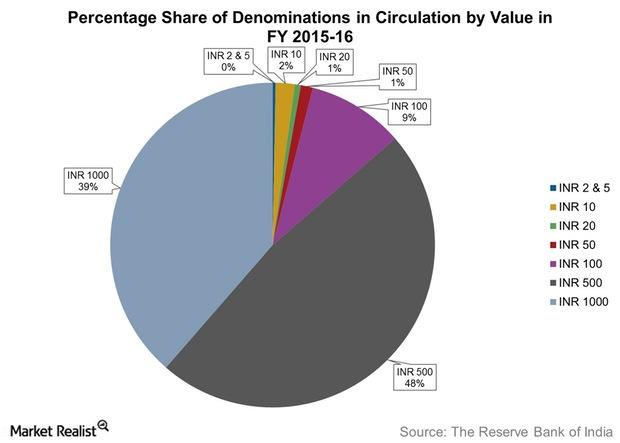

Why India Demonetized 2 Currency Notes

The 500 rupee note and the 1,000 rupee note were demonetized at midnight on November 8. The move aimed to curb black money in the financial system.

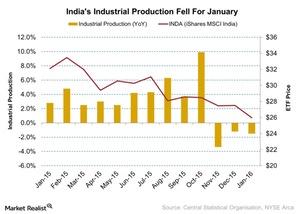

Why Did India’s Industrial Production Fall?

India’s industrial production fell by 1.5% in January, according to the Central Statistical Organization. In January 2015, the industrial production index rose to 2.8%.Company & Industry Overviews AEPGX’s Low Volatility and Low Returns: What Does This Mean?

The American Funds EuroPacific Growth Fund (AEPGX) has been in existence since April 1984.

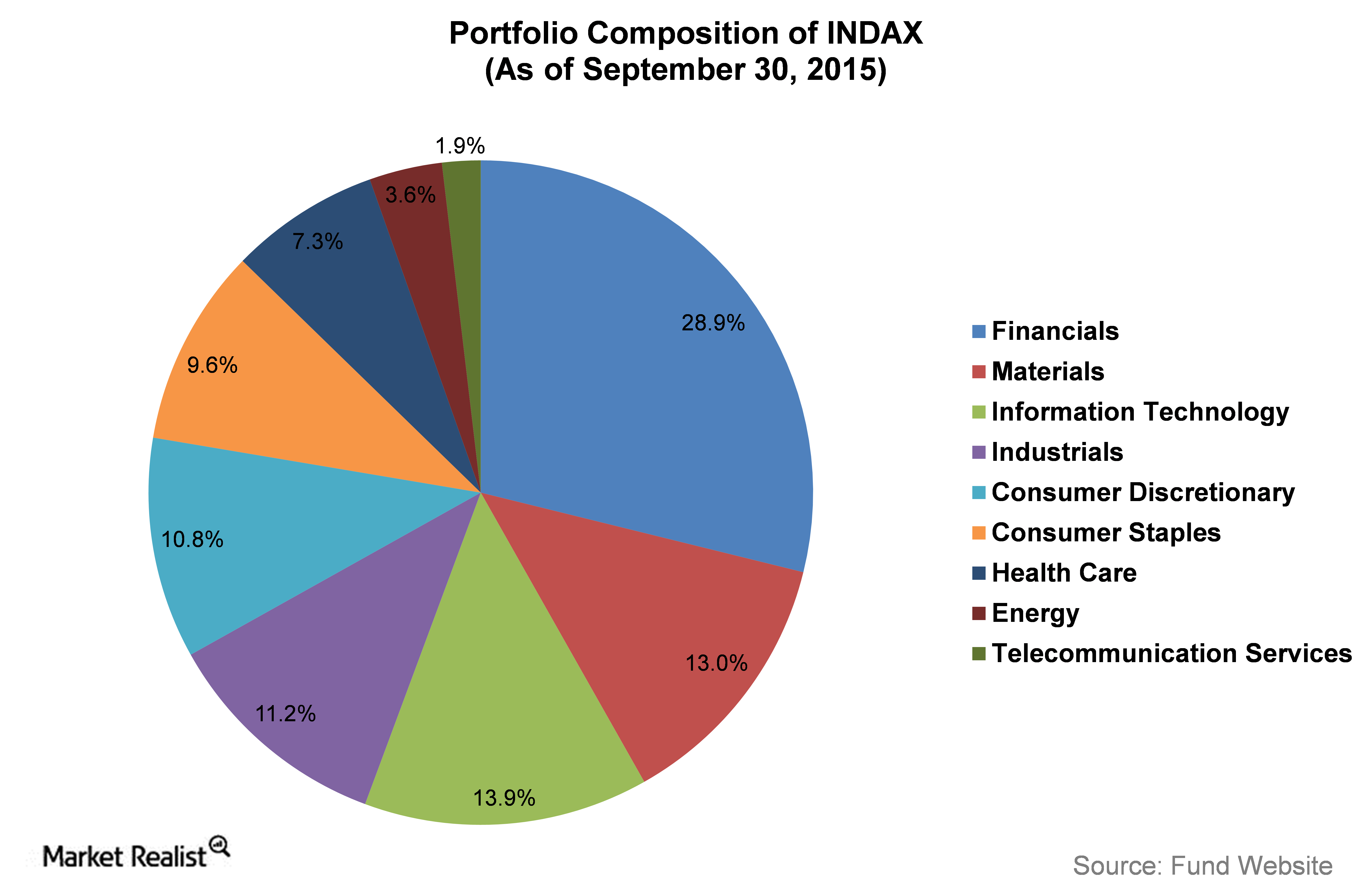

The ALPS Kotak India Growth Fund (INDAX) Portfolio Analysis

The ALPS Kotak India Growth Fund (INDAX) intends to invest at least 80% of its net assets directly or indirectly in equity and equity linked securities of Indian companies.

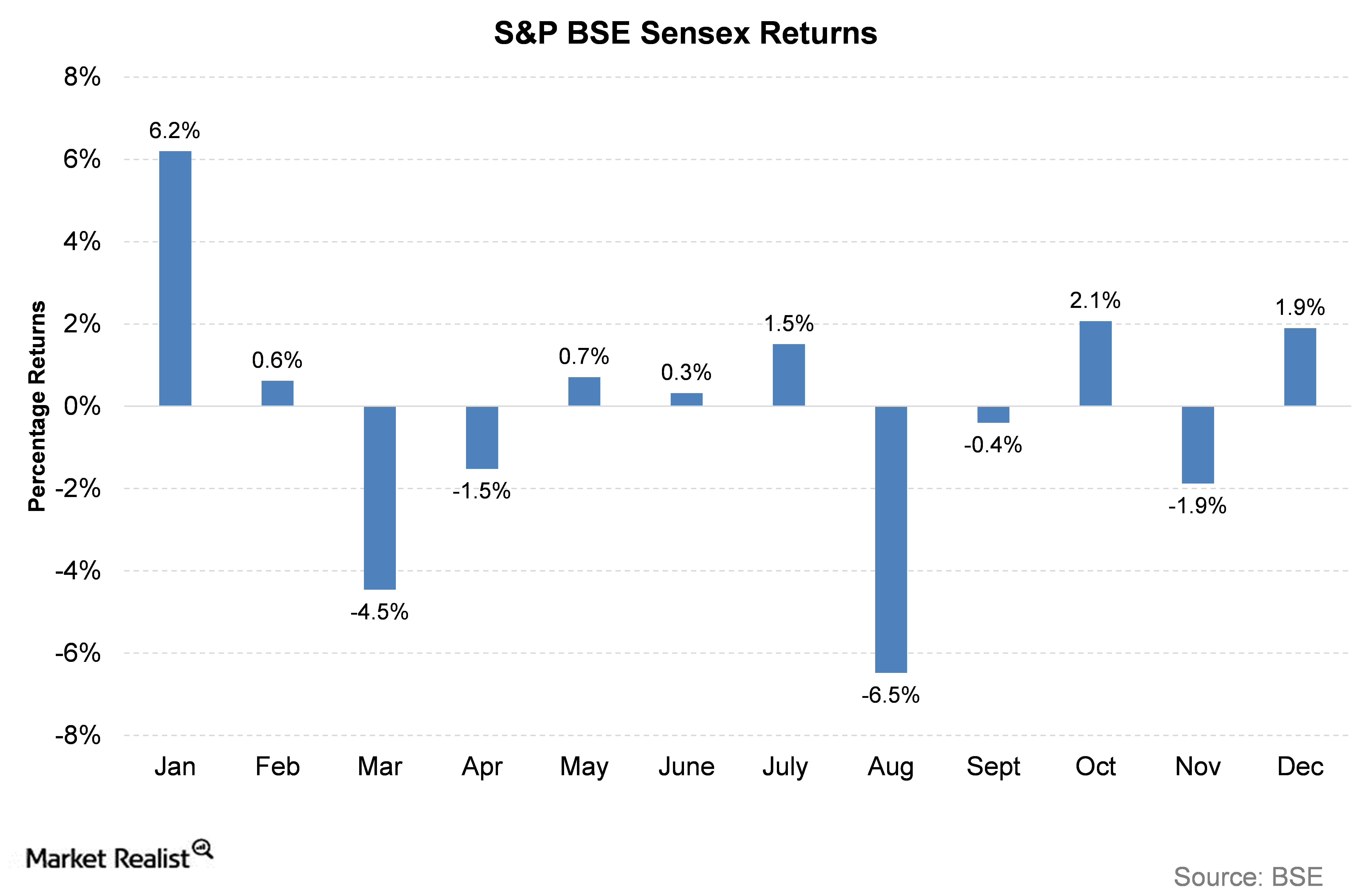

What Factors Affected the Indian Equity Market in 2015?

In this series, we will analyze the performance of the Indian equity market in 2015. The S&P BSE Sensex, considered as a benchmark index, gave a return of -3.7% in 2015, expressed in Indian rupees.

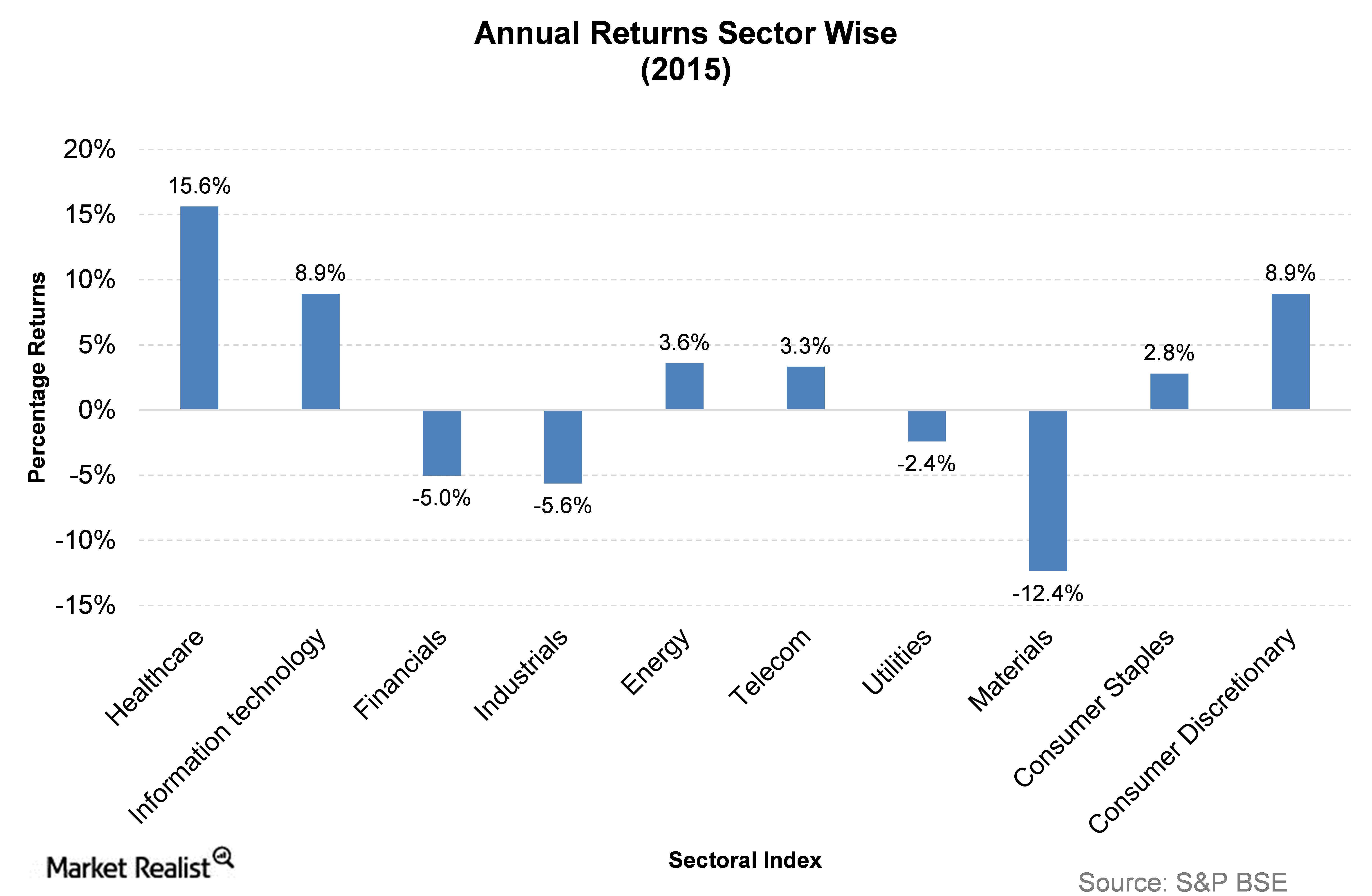

2015’s Gainers and Losers of the Indian Stock Markets

In this article, we will analyze the sector-wise performance of Indian stocks for 2015—a dismal year for all sectors.

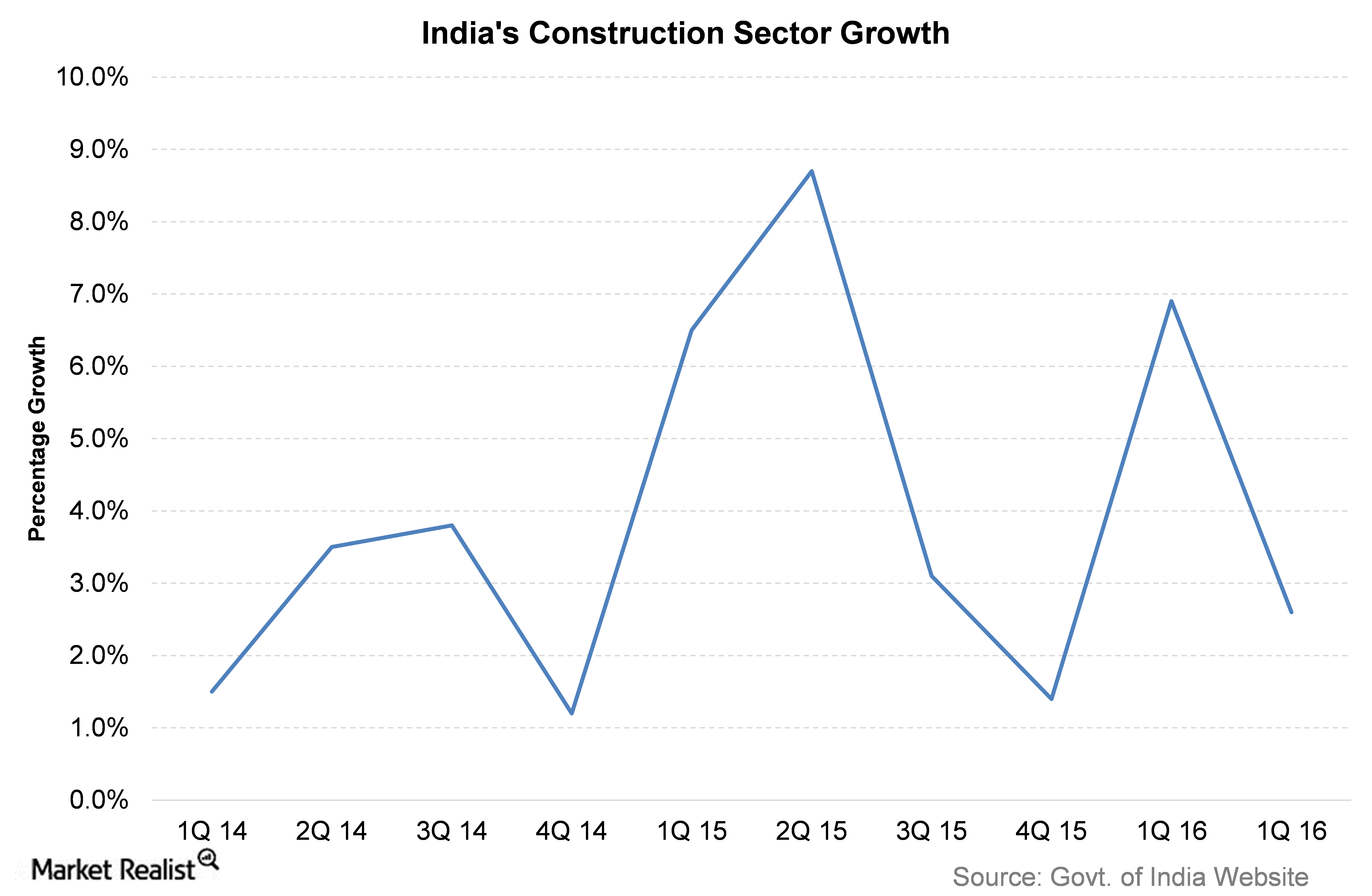

What Drives India’s Construction Sector?

According to India’s government, the construction sector is valued at over $126 billion.

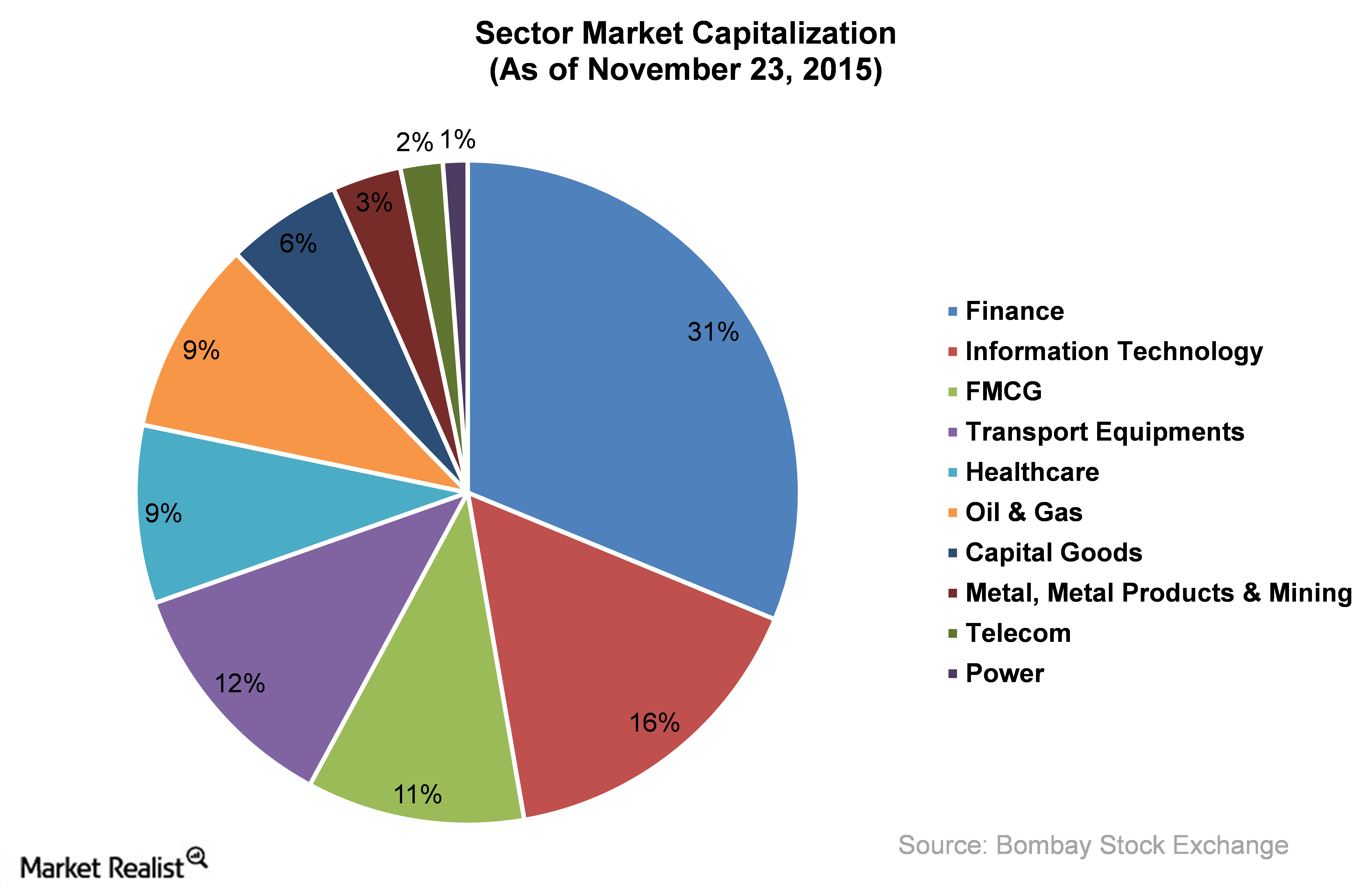

The Major Sectors of the Indian Equity Market

The current global economy is under stress. Major benchmark equity indexes around the globe have given dismal returns, and India is no exception.

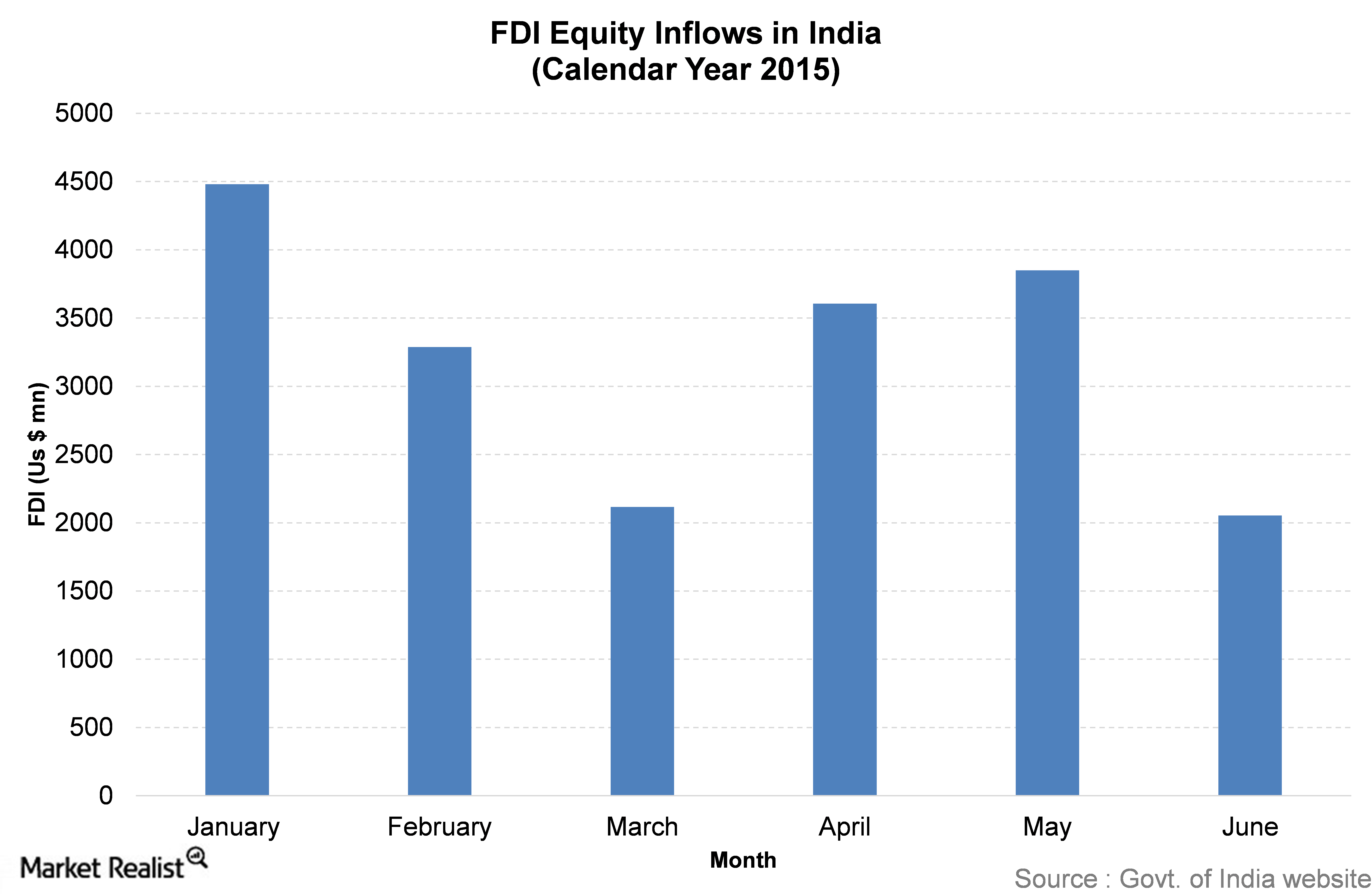

Why India Needed the Major FDI Reforms Announced This Month

On November 10, 2015, the government of India announced major reforms in FDI (foreign direct investment). The government has introduced reforms in 15 major sectors of the economy.

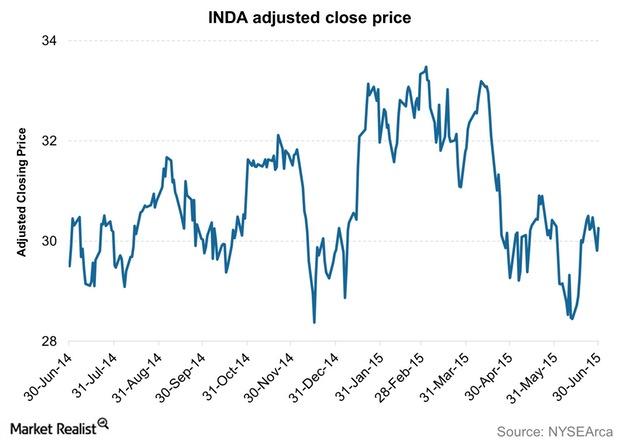

The Booming Indian Stock Market: Will It Last?

Indian stocks had a strong run in the last half of 2014 through early 2015, but the ride since then hasn’t been smooth. The INDA is up only 2.6% in the one year ended June 2015.Macroeconomic Analysis Why India’s poor infrastructure is a detractor

The primary reason for India’s slow infrastructure development is poor implementation.