Matthews India Fund

Latest Matthews India Fund News and Updates

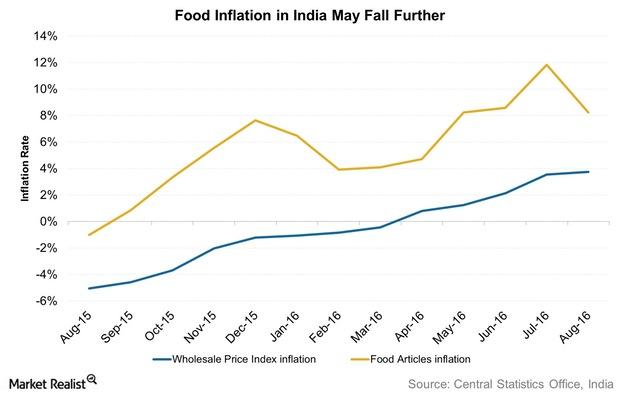

How Does the RBI See Food Inflation Panning out in India?

Components of inflation While food inflation in India has been pushing retail inflation up, fuel inflation (BP) (STO) (RDS.B), another important component, has been subdued. According to the October monetary policy statement issued by the RBI (Reserve Bank of India), “Fuel inflation has moderated steadily through the year so far.” The RBI has also announced […]

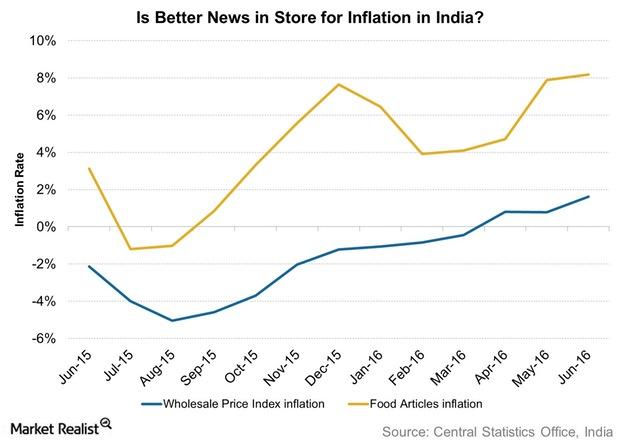

What Risks Does the RBI See for Retail Inflation?

The RBI thinks that risks to inflation are “tilted to the upside.” A subsequent rise in inflation could have a negative impact on consumer spending.

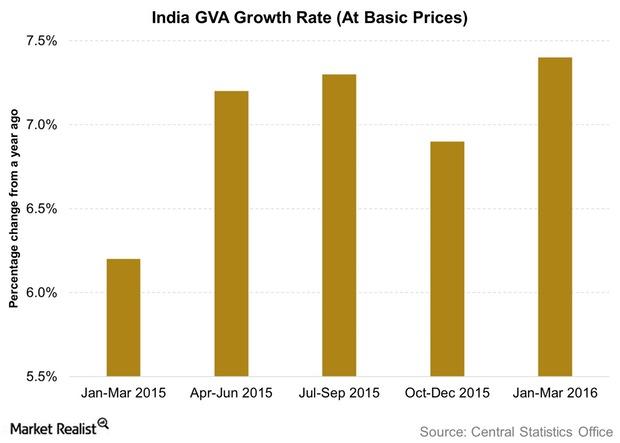

Reserve Bank of India Sees India on Firm but Uneven Ground

Industrial production remains a problem for India, with the RBI (Reserve Bank of India) noting that the index measuring industrial production decelerated in fiscal 2015–16.

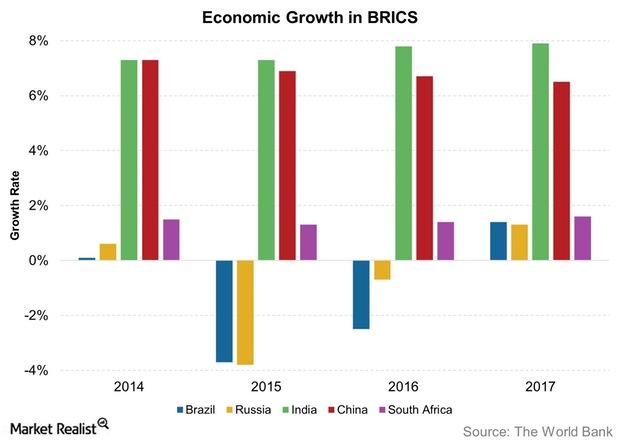

Are the BRICS Nations Standing on a Shaky Foundation?

Among the BRICS, the most concerning at this point in time is China. The world’s second largest economy is slowing down and undergoing a structural shift.

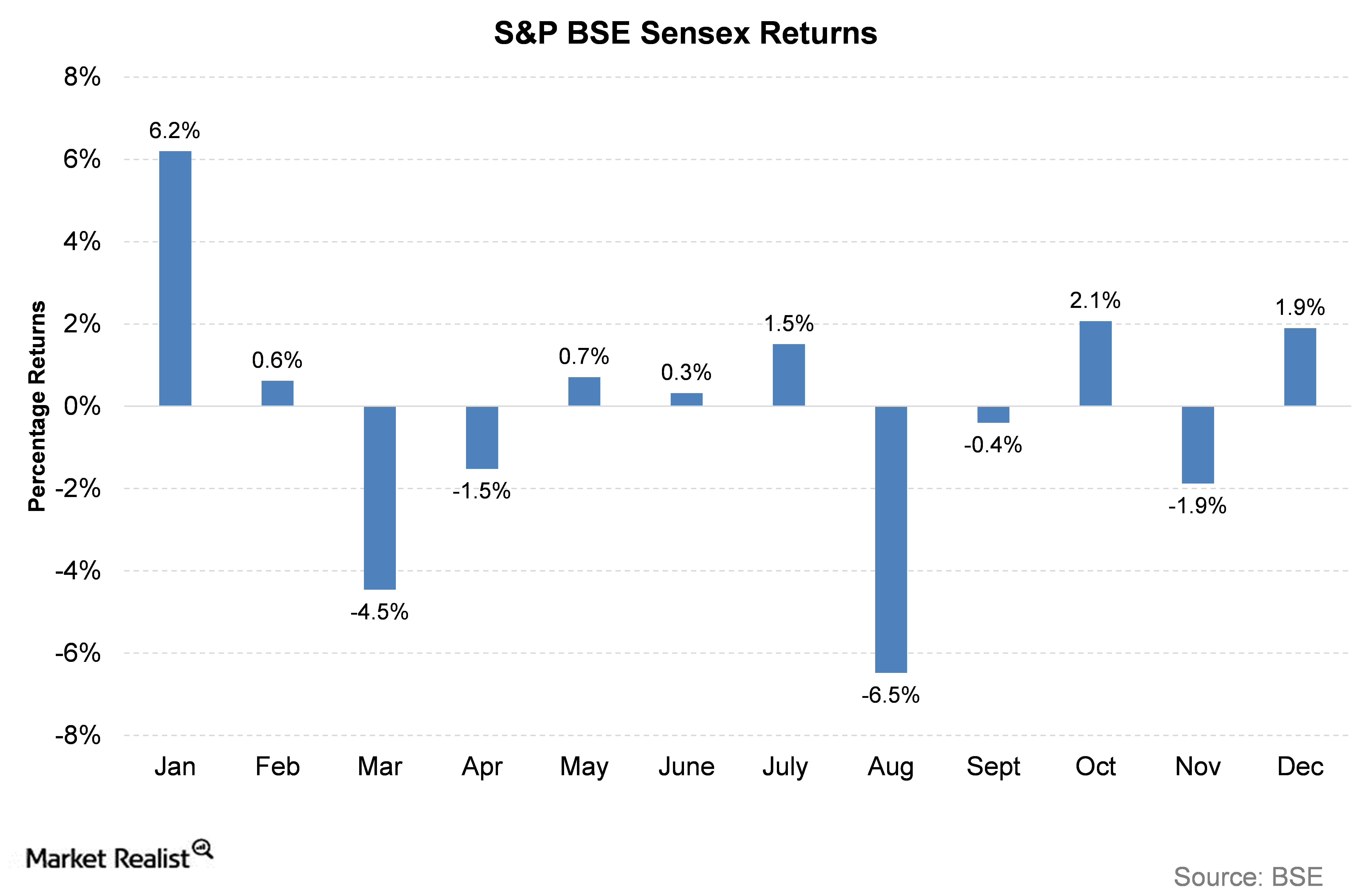

What Factors Affected the Indian Equity Market in 2015?

In this series, we will analyze the performance of the Indian equity market in 2015. The S&P BSE Sensex, considered as a benchmark index, gave a return of -3.7% in 2015, expressed in Indian rupees.

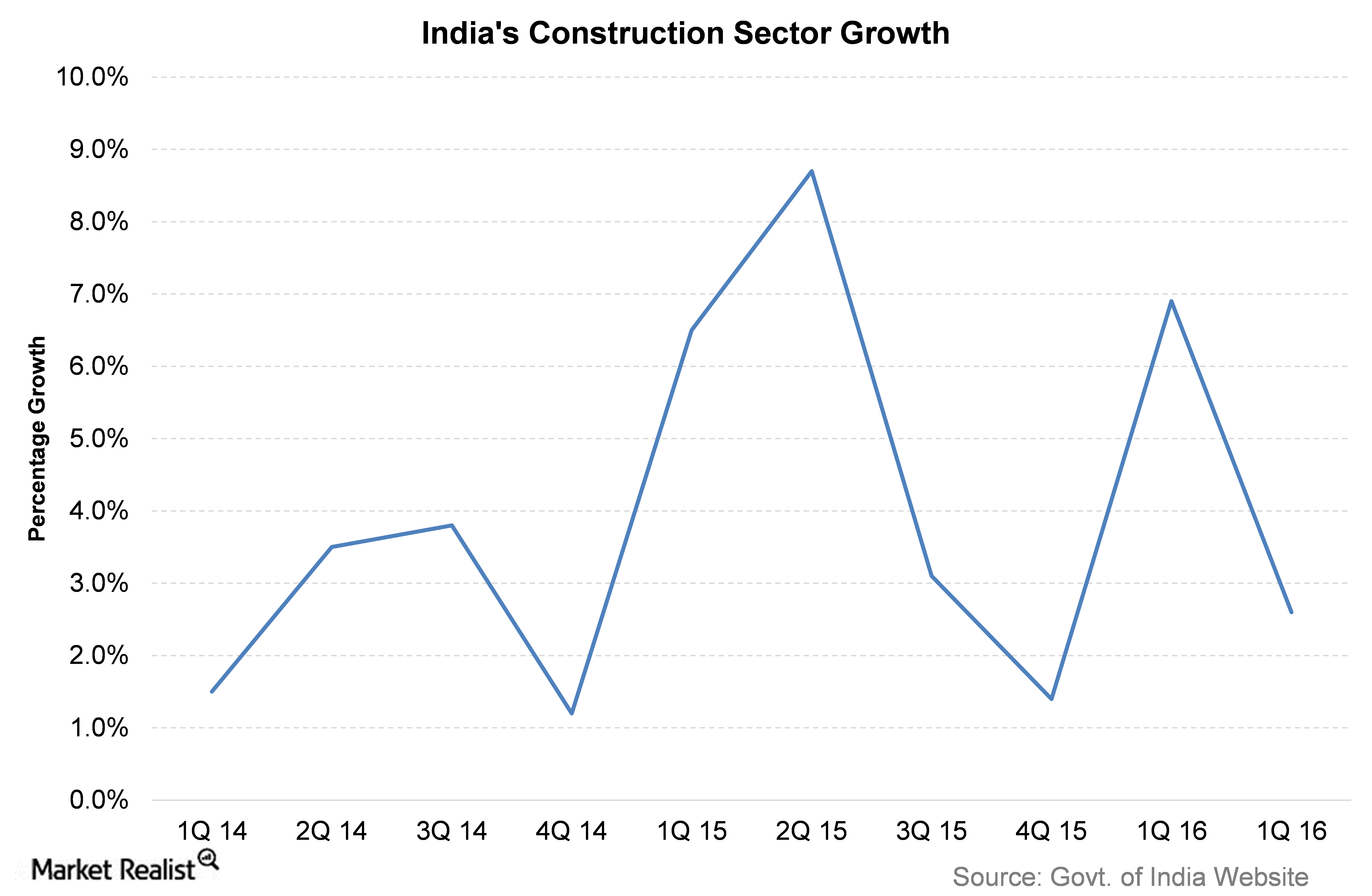

What Drives India’s Construction Sector?

According to India’s government, the construction sector is valued at over $126 billion.

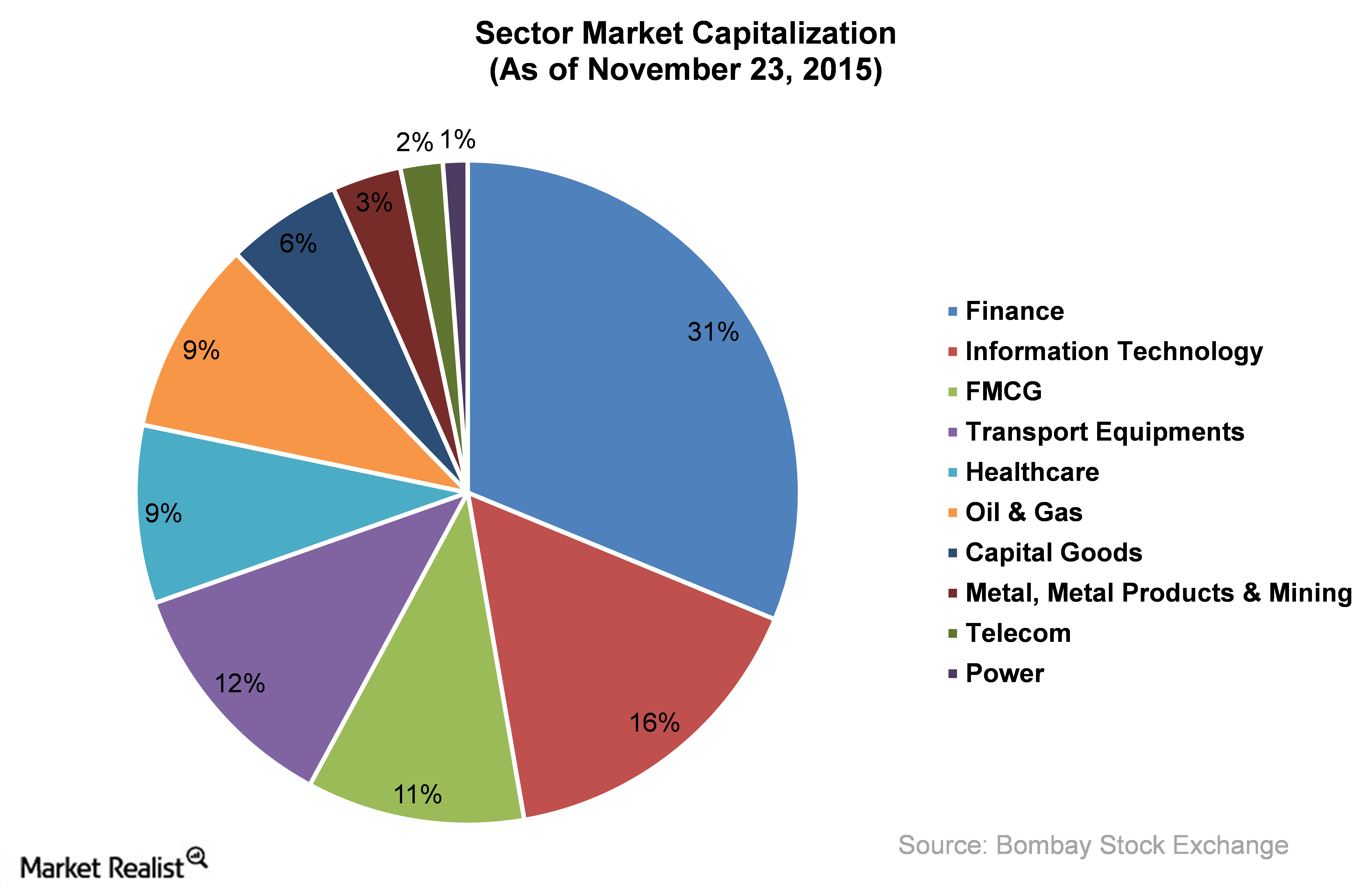

The Major Sectors of the Indian Equity Market

The current global economy is under stress. Major benchmark equity indexes around the globe have given dismal returns, and India is no exception.

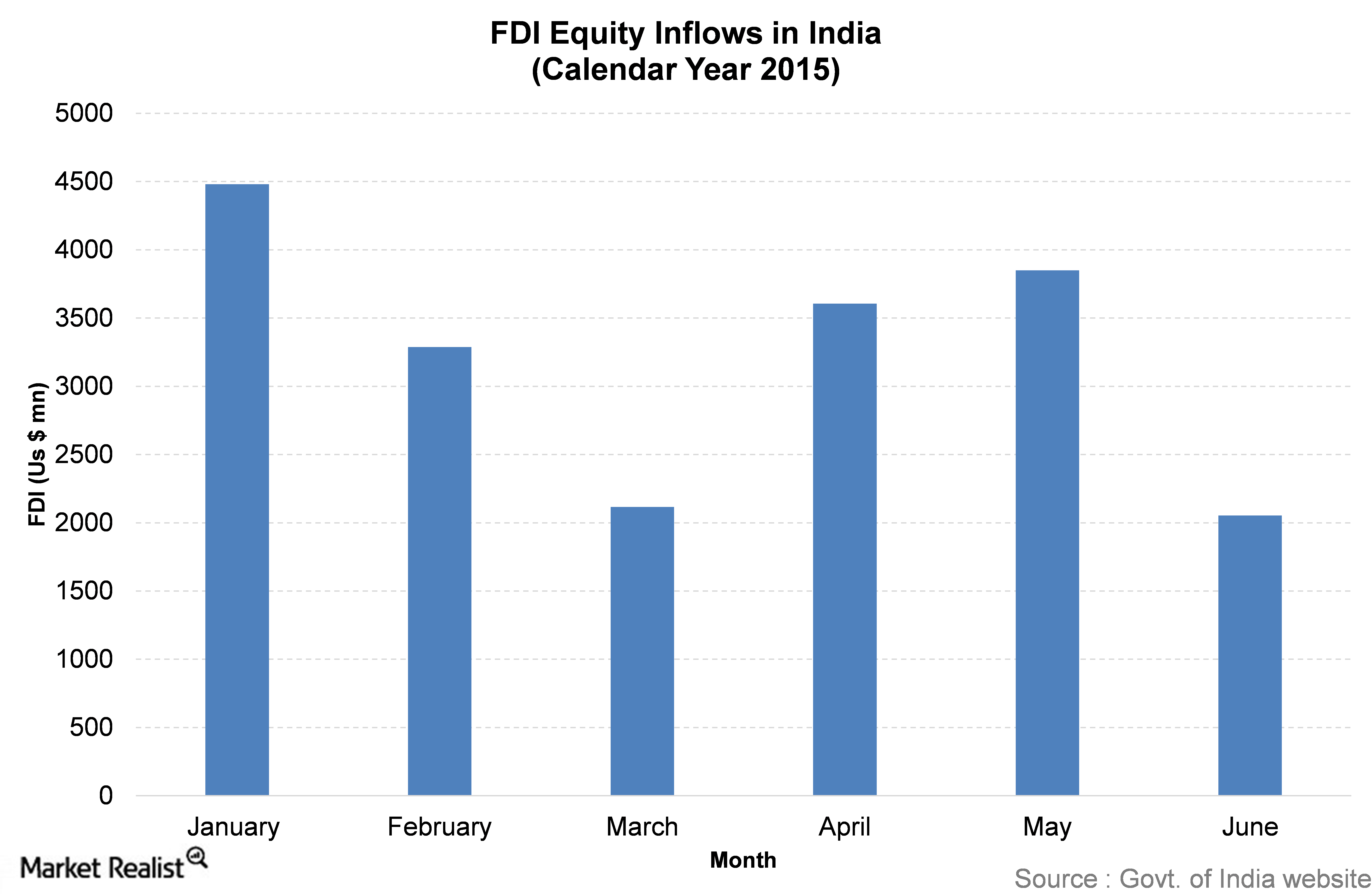

Why India Needed the Major FDI Reforms Announced This Month

On November 10, 2015, the government of India announced major reforms in FDI (foreign direct investment). The government has introduced reforms in 15 major sectors of the economy.