Wasatch Emerging India Fund

Latest Wasatch Emerging India Fund News and Updates

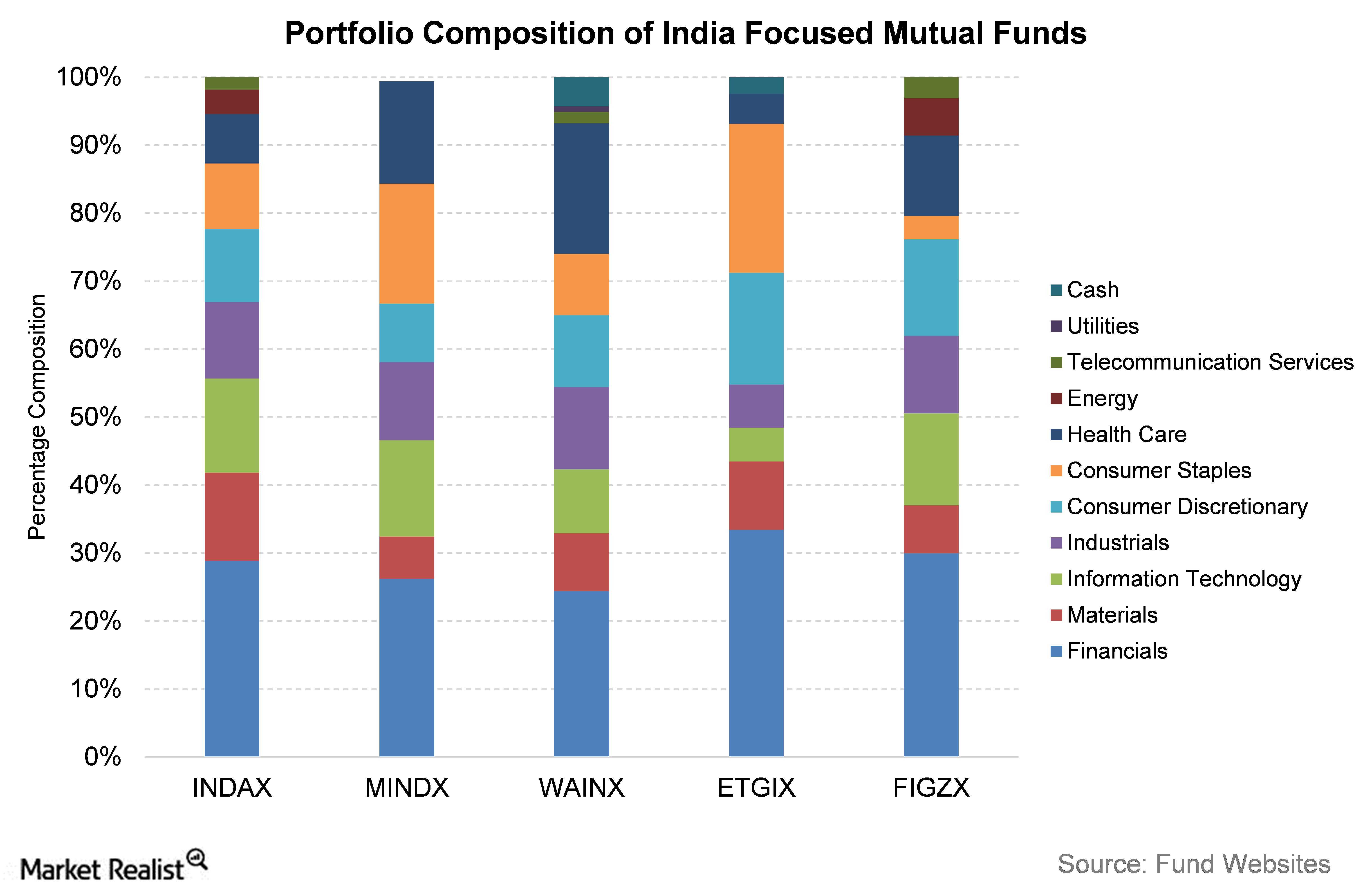

Looking ahead for Indian-Focused Funds

All five India-focused funds have their highest individual sectoral exposure to financials. As reported in the news, 2015 has been a year of global economic stress.

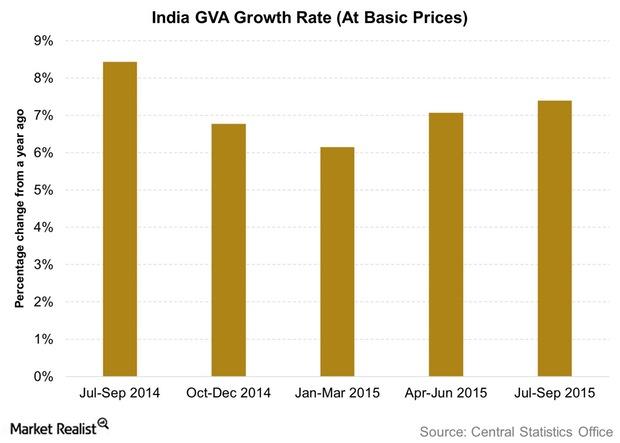

India’s Economic Growth in GVA Terms: What Does the RBI Expect?

For financial year 2016–2017, the RBI forecasts the GVA growth at a 7.6% pace. This assumes that there aren’t any significant headwinds.

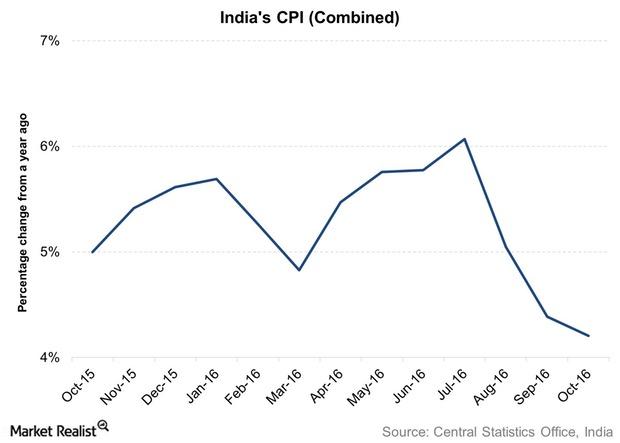

Will Demonetization Impact India’s Inflation?

The demonetization that has been in effect since November 9 is expected to have a negative impact on inflation. Consumer spending activity almost stopped.

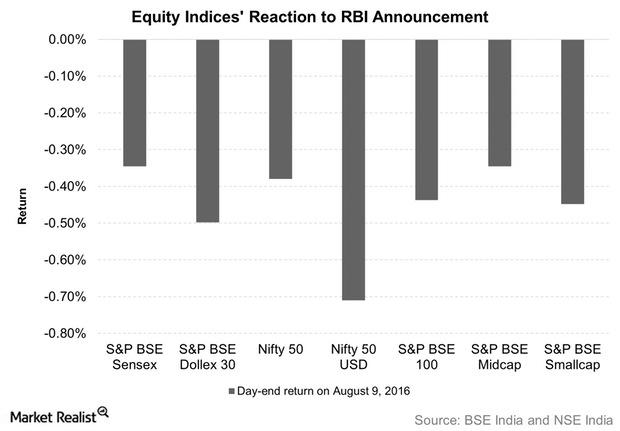

Indian Equities and Funds Fall after the August Monetary Policy

Indian equities fell on August 9, the day of the monetary policy announcement. Benchmark equity indices like the S&P BSE Sensex and the Nifty 50 fell 0.4%.

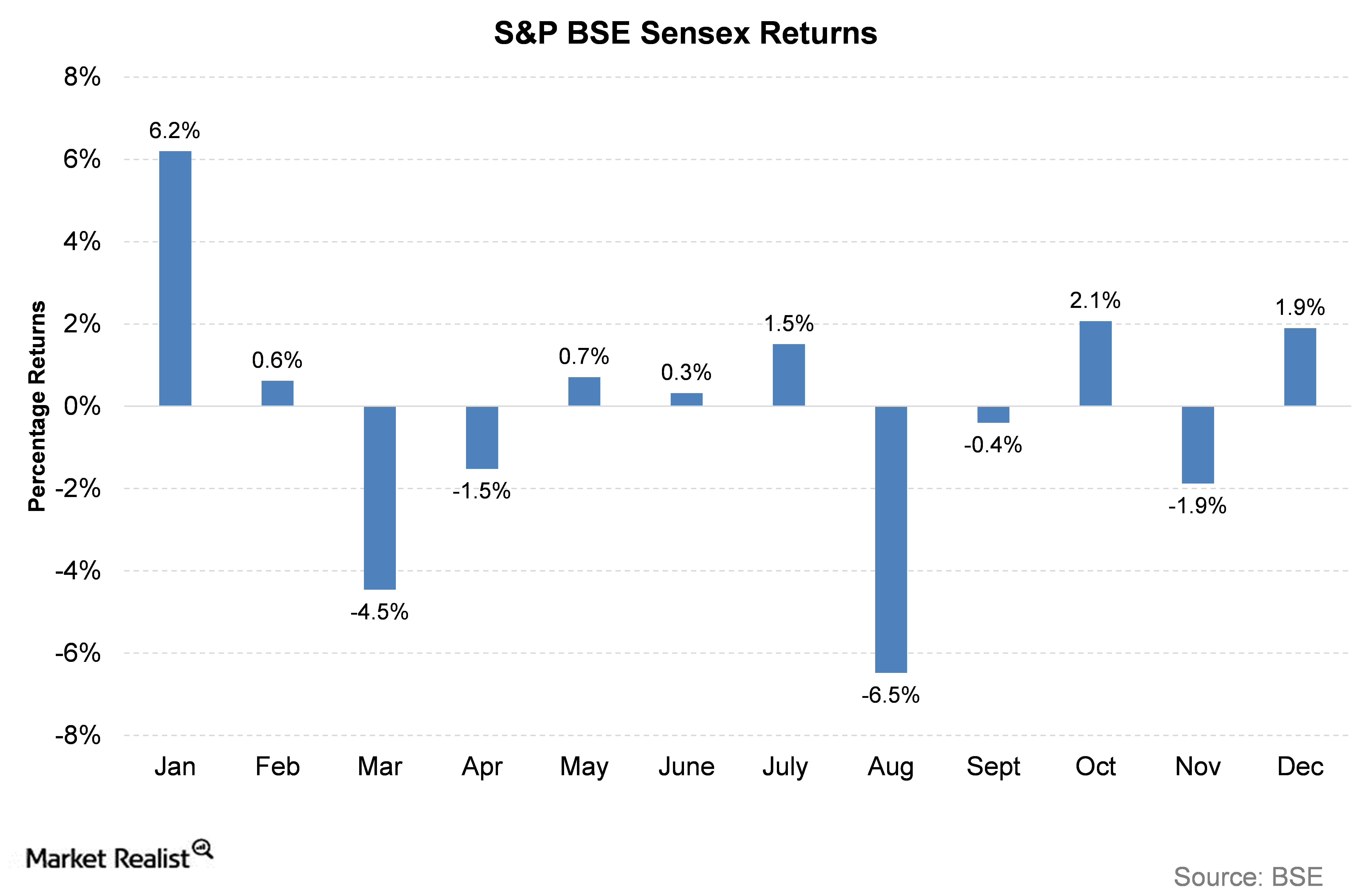

What Factors Affected the Indian Equity Market in 2015?

In this series, we will analyze the performance of the Indian equity market in 2015. The S&P BSE Sensex, considered as a benchmark index, gave a return of -3.7% in 2015, expressed in Indian rupees.

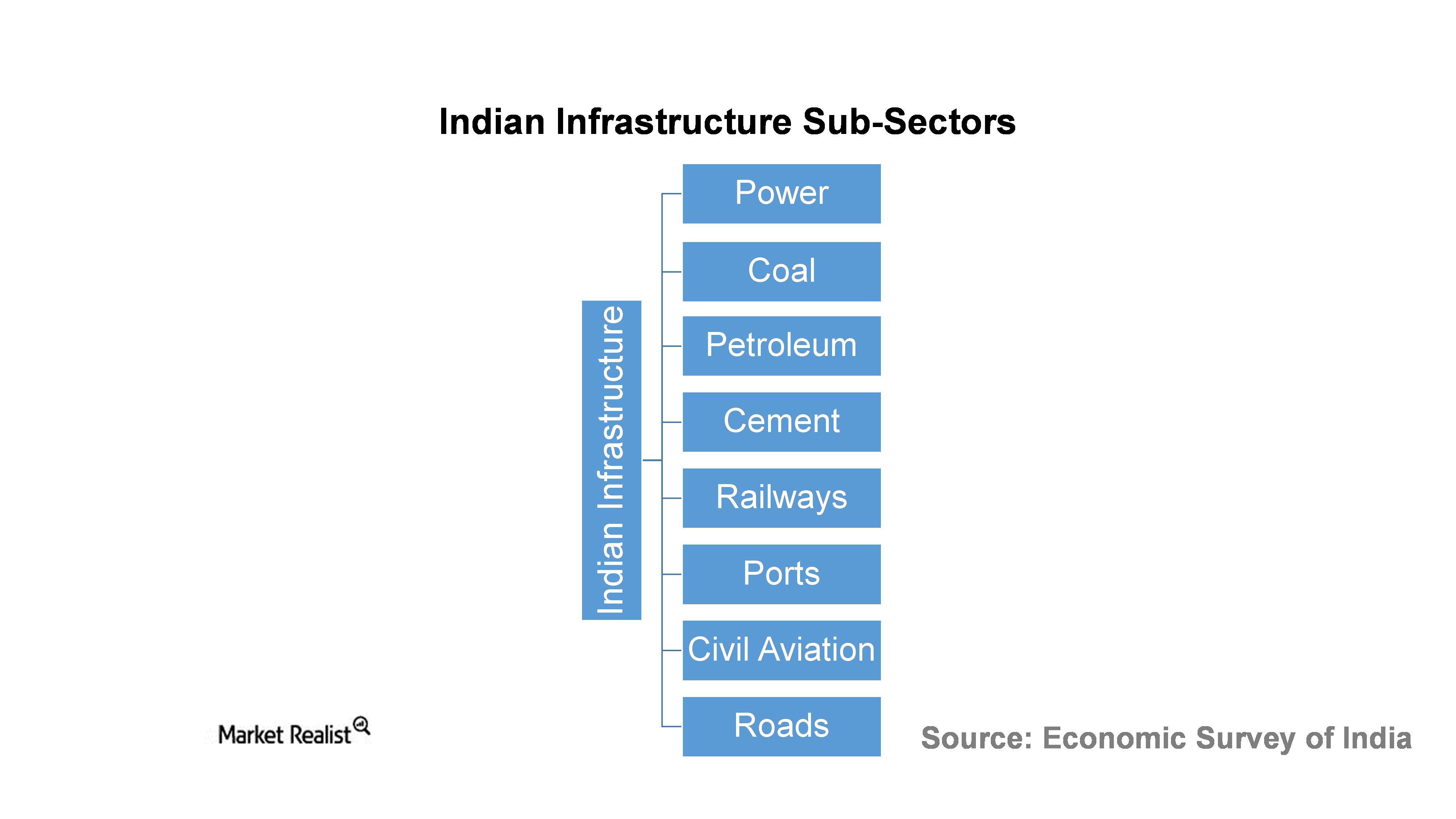

Understanding India’s Infrastructure Sector

The NDA (National Democratic Alliance) government came to power in May 2014. With big promises of development, the party aimed to push major reforms to help speed up India’s recovery process.

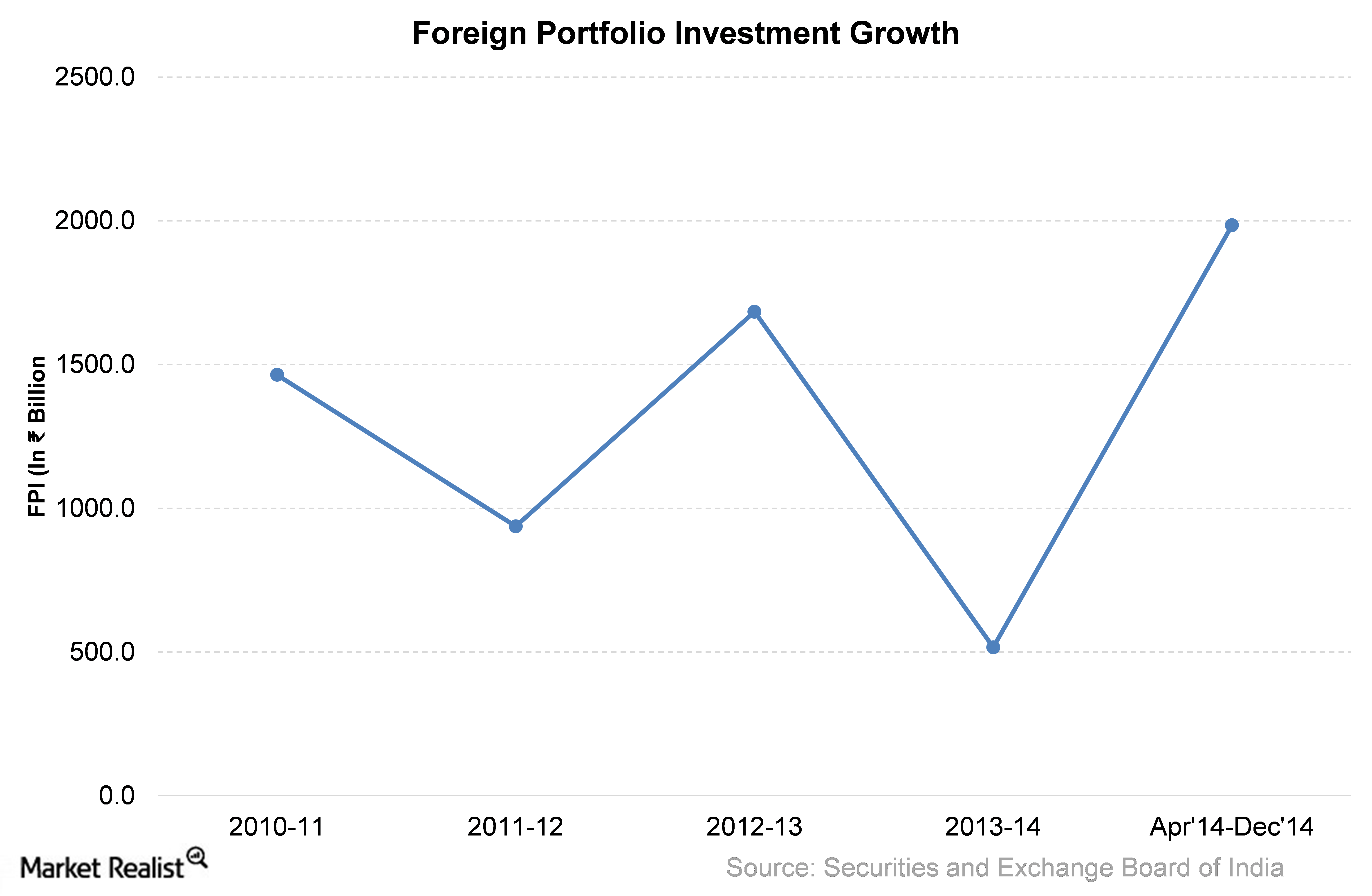

Overview: Last 5 Years of Foreign Portfolio Investment in India

India’s fiscal 2013 was the lowest in terms of market capitalization in the past five years. However, the foreign portfolio witnessed an impressive growth of about 80% in fiscal 2013 over the previous year.