Tata Motors Ltd

Latest Tata Motors Ltd News and Updates

Company & Industry Overviews Analyzing Ferrari’s Separation from Fiat Chrysler Automobiles

In October 2014, Fiat Chrysler Automobiles (FCAU) announced its intentions to spin off Ferrari (RACE) as an independent entity.

Autonomous Vehicles: Jaguar Ties Up with BlackBerry

Jaguar Land Rover has partnered with BlackBerry to develop autonomous vehicles. BlackBerry will assist Jaguar in various areas via AI and machine learning.

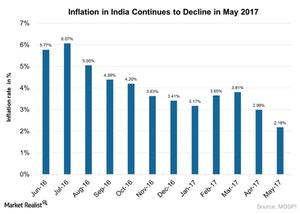

Inside India’s Inflation in May 2017

Consumer price inflation in India stood at ~2.2% on a YoY (year-over-year) basis in May 2017, as compared to its 2.99% rise in April 2017.

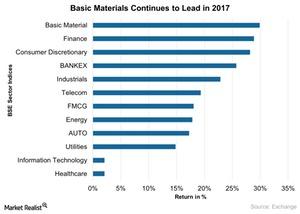

Does the Basic Materials Sector Still Lead in India in 2017?

India’s stock market performance has picked up pace since the beginning of 2017. The S&P BSE Sensex has gained about 10% year-to-date through May 18, 2017.

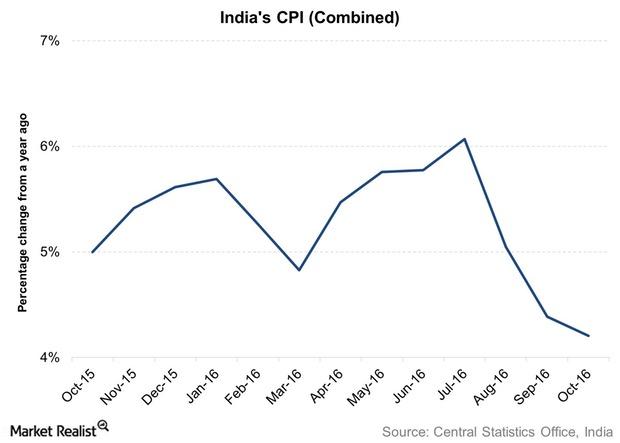

Will Demonetization Impact India’s Inflation?

The demonetization that has been in effect since November 9 is expected to have a negative impact on inflation. Consumer spending activity almost stopped.

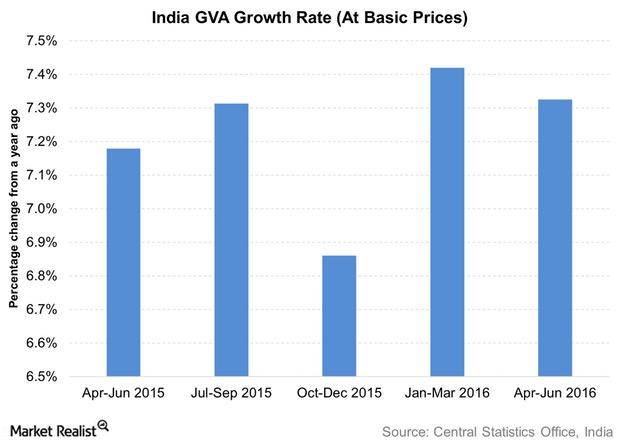

How Could Demonetization Impact the Indian Economy?

The demonetization of the 500 rupee note and the 1,000 rupee note will likely hit the Indian economy hard in the short term.

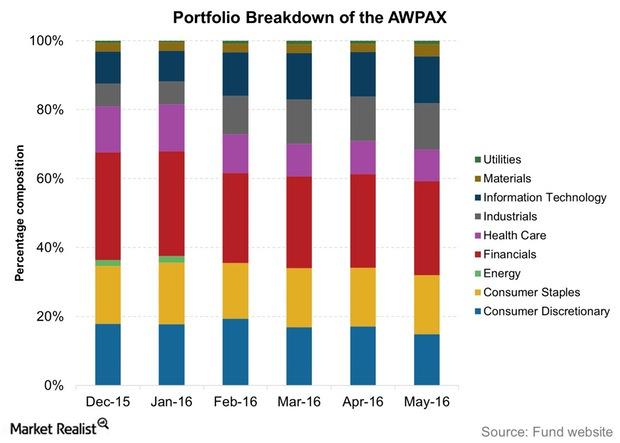

Portfolio Moves of the AB International Growth Fund in YTD 2016

The AB International Growth Fund’s assets were spread across 57 holdings in May 2016, and it was managing $334.2 million in assets.

Tata Motors Opened New Plant in Brazil to Increase Profitability

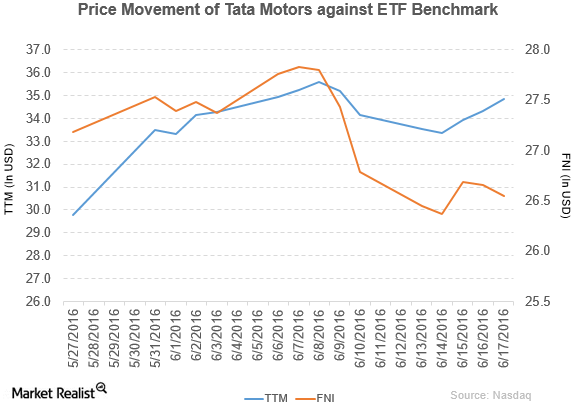

Tata Motors Limited-ADR (TTM) rose by 2.1% to close at $34.83 per share at the end of the third week of June 2016.

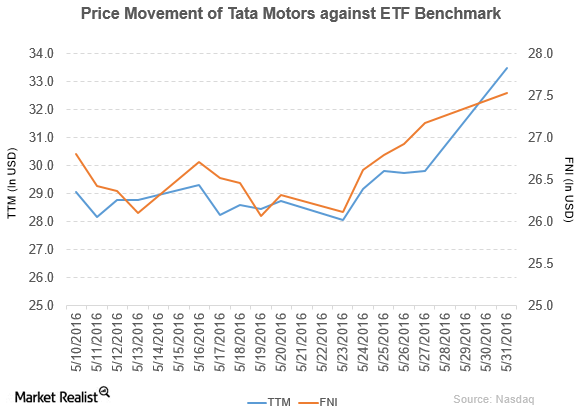

The Reason behind Tata Motors’ Complaint against Jiangling Motors

Price movement of Tata Motors Tata Motors (TTM) has a market cap of $22.1 billion. It rose by 0.32% to close at $34.28 per share on June 3, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 15.3%, 20.8%, and 16.3%, respectively, as of the same day. This means that TTM is […]

Why Tata Motors’ Top and Bottom Lines Rose in Fiscal 4Q16

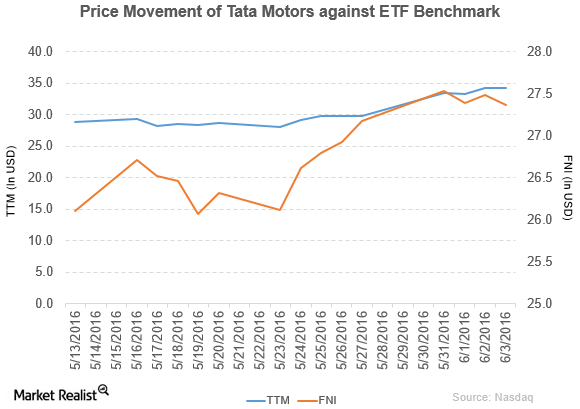

Tata Motors (TTM) has a market capitalization of $21.6 billion. It rose by 12.4% to close at $33.49 per share on May 31, 2016.

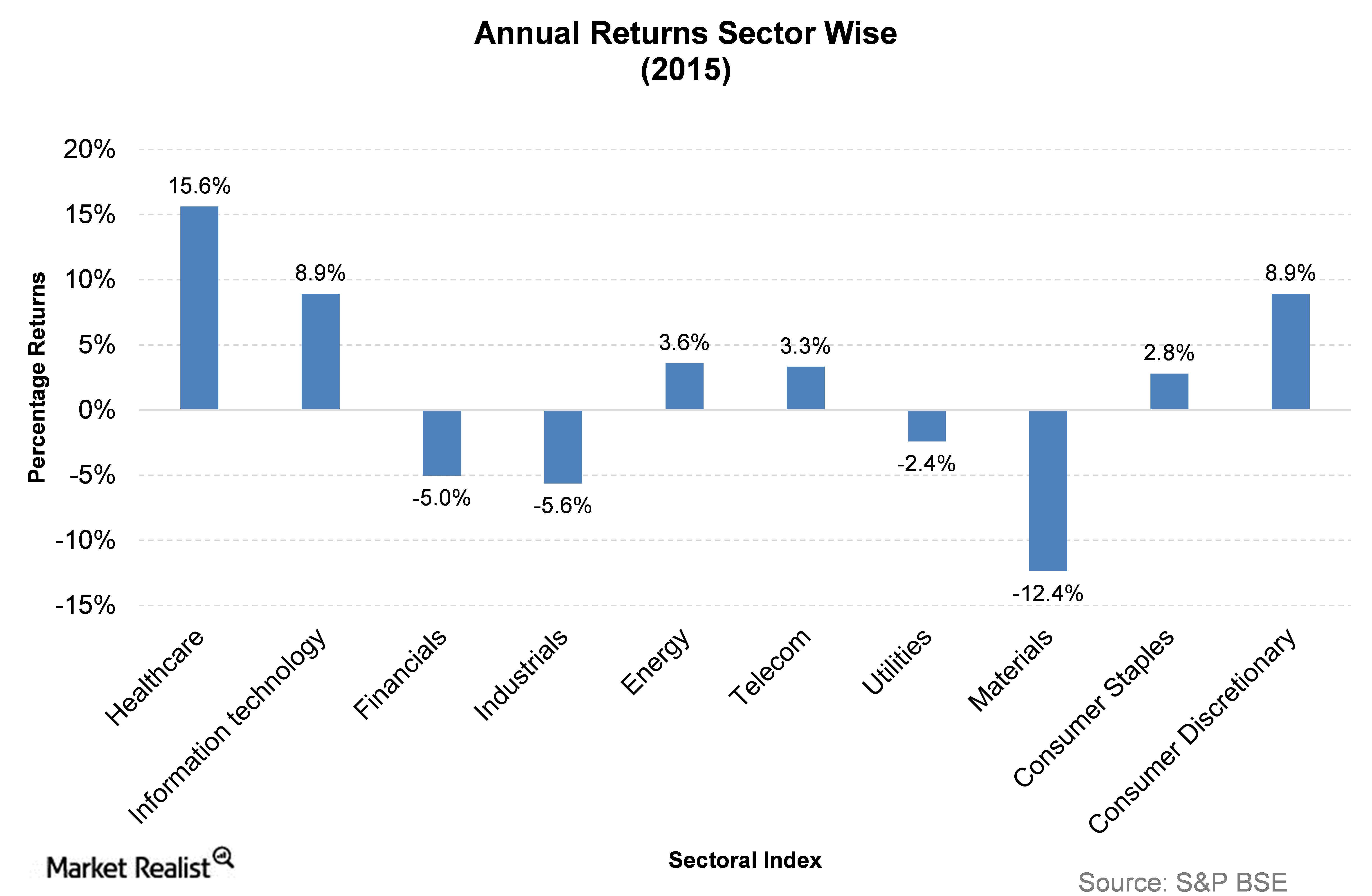

2015’s Gainers and Losers of the Indian Stock Markets

In this article, we will analyze the sector-wise performance of Indian stocks for 2015—a dismal year for all sectors.

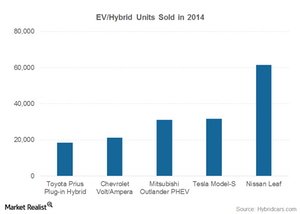

What Value Proposition Does Tesla Offer Its Customers?

Tesla’s value proposition is centered on the electric vehicle market. However, the share of EVs in total vehicle sales is minuscule at best.

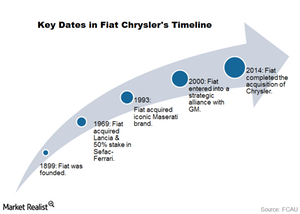

An Investor’s Guide to Fiat Chrysler’s Timeline

In this part, we’ll explore some key dates on Fiat Chrysler’s timeline. Fiat Chrysler (FCAU) debuted on the NYSE on October 14, 2014, after Fiat Motors acquired Chrysler.

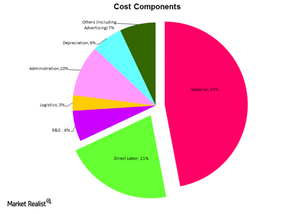

Raw materials – the biggest cost driver in the auto industry

Raw materials contribute about 47% to the cost of a vehicle. On average, an automobile is 47% steel, 8% iron, 8% plastic, 7% aluminum, and 3% glass.