Indian Pharma: Analyzing the Tailwinds for Growth

India’s strength within the pharmaceutical sector can be seen in the sheer number of pharmaceutical manufacturing plants in the country, which number approximately 10,500.

Sept. 1 2020, Updated 9:46 a.m. ET

India’s strength within the pharmaceutical sector can be seen in the sheer number of pharmaceutical manufacturing plants in the country, which number approximately 10,500.[1. Source: Brand India Pharma, https://www.brandindiapharma.in/infographic-on-pharma-sector-business/] Outside of the U.S., India boasts the largest number of U.S. Food and Drug Administration (or FDA) compliant plants. Additionally, India has 1,400 plants that have been approved by the World Health Organization Good Manufacturing Practices (WHO GMP) and 253 by the European Directorate of Quality Medicines (or EDQM).[2. Source: Government of India, Department of Pharmaceuticals, https://pharmaceuticals.gov.in/pharma-industry-promotion]

Generics are currently the highest earners within India’s pharmaceutical industry, accounting for 70% of market share by revenues. Over-the-counter drugs follow at 21% of revenues and patented drugs at 9%.[3. India Brand Equity Foundation, January 2016] Future growth in generics may come from biosimilars, the generic form of biologics. Biosimilars are on the rise worldwide; India is already home to the development of many such products. The country’s biosimilar industry is expected to grow at an annual rate of 30% as its government continues to offer support with plans to allocate $70 million to biosimilars development.[4. India Brand Equity Foundation, January 2016]

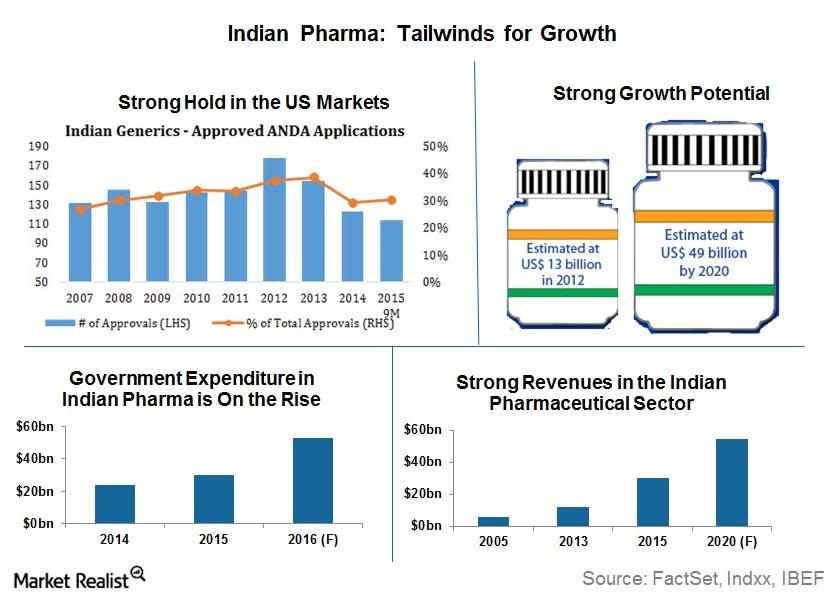

Market Realist – As we discussed in the previous part of this series, India’s (EPI)(INDA) pharmaceutical market is poised for growth. Many tailwinds are driving the market forward.

- India’s strong presence in the US pharma market: There’s no denying that Indian generic drug makers have gained a strong foothold in the United States (PPH). According to data from FactSet, Indian drug makers have the second-largest share of ANDA[1. Abbreviated new drug application.] approvals, after US producers. As you can see in the first chart from FactSet in the previous graph, Indian drug makers maintain a total share of 30%–40% on average every year (Source: FactSet, Indxx). Plus, over 25% of the first ANDA approvals tend to be snagged by Indian generic drug makers, giving them a first mover advantage.[5. Source: Brand India Pharma, https://www.brandindiapharma.in/infographic-on-pharma-sector-business/] First ANDA approvals mean exclusive rights to sell for 180 days after patent expiration.] India has over 120 FDA-approved drug manufacturing facilities (Source: IBEF). Indian pharmaceutical companies registered 49% of overall drug master files or DMFs in the United States in 2012. According to the FDA, India accounts for 23.7% of the 3,652 facilities approved to produce active pharmaceutical ingredients or APIs and full dosage forms or FDFs. This strong foothold in the United States (VTI) helps strengthen Indian generic drug makers’ (GNRX) position, especially as more and more drugs go off patent in the next five years.

- Low production costs: As we discussed in the previous part of this series, production costs for generic drug makers in India are 65% less than in the United States and 50% less than in Europe. These lower costs spur revenues. Plus, due to the low-cost advantage, India is also quickly becoming an attractive destination for clinical trials.

- A focus on R&D: Research and development or R&D are one of the most important focuses of the pharmaceutical industry. Indian generic drug makers are steadily increasing their R&D spending. According to figures from FactSet, total R&D investment from Indian generic companies rose from 3.8% of sales in 2010 to 6% in 2015. In absolute numbers, R&D spending increased from $252 million to $833 million over the past five years (Source: FactSet, Indxx). These numbers bode extremely well for Indian generic drug companies.

- Government expenditure: The Indian government views India as the global leader in end-to-end drug manufacturing, as it outlined in its Pharma Vision 2020. In fact, the government plans to set up a $640 million venture capital fund to strengthen the infrastructure for the pharmaceutical industry and promote drug discovery. As you can see in the graph above, government expenditure is indeed rising—which will only improve the sector’s prospects.

The Indian generic drug market could prove to be an exciting investment opportunity if you’re seeking growth.

We believe investors targeting generics manufacturers in their portfolios should take a global view. The evolving dynamics in India’s drug sector further secures its foothold in worldwide generics development and exports, making it an appealing destination for foreign investment.