iPath® S&P 500 VIX MT Futures™ ETN

Latest iPath® S&P 500 VIX MT Futures™ ETN News and Updates

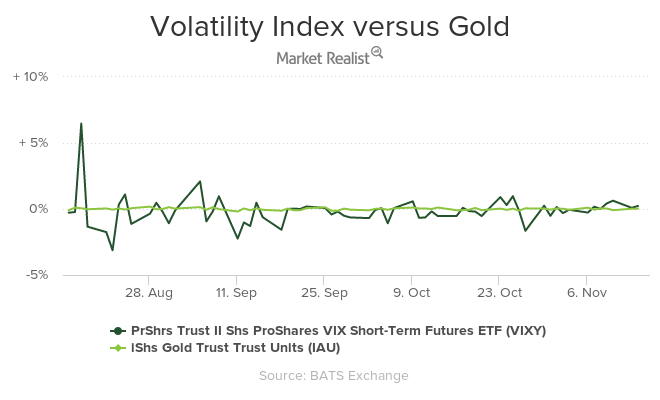

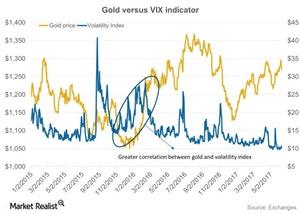

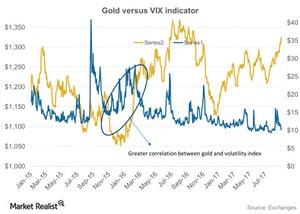

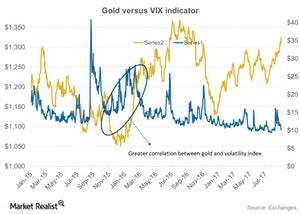

How Is the Volatility Index Impacting Gold?

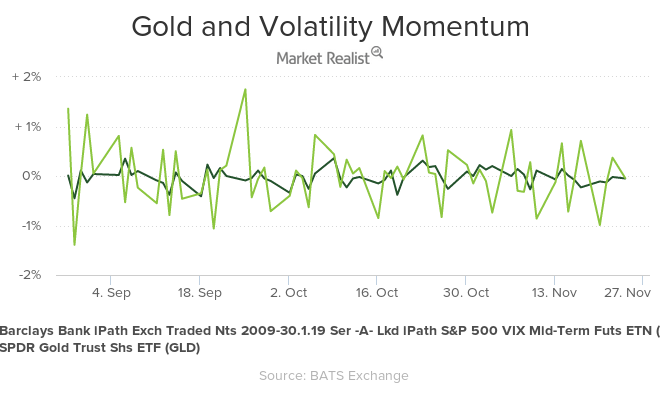

Another critical factor that has been affecting the price movement of precious metals is overall market volatility.

An Update on the Precious Metals as November Comes to an End

The US stock markets were closed on Thursday, November 23, 2017, for Thanksgiving, and the next day (Black Friday) was quite slow for precious metals. Gold played in a narrow range that day.

Analyzing Gold’s Market Performance

Besides the impact of interest rates, there are also other global indicators that could play on precious metals—the most important being the US dollar.

Are North Korea Tensions Continuing to Affect Precious Metals?

All the four precious metals saw an up day on Monday, October 9, 2017.

Could North Korea Be Affecting Precious Metal Prices?

North Korean tensions Like the US dollar, global tensions can be responsible for precious metal price fluctuations. North Korea has interpreted US president Donald Trump’s comments as a declaration of war, stating that Pyongyang has the right to take countermeasures, including shooting down US bombers outside of its airspace. The ongoing unrest in the Korean peninsula has led to a global […]

How North Korea Has Affected the Precious Metal Market

Precious metals have been buoyed by tension in North Korea. If North Korea does another missile test, it could prompt investors to move to haven assets such as gold, silver, Treasuries, and major currencies.

How Strongly Can North Korea Move the Precious Metals Market?

Gold futures for September expiration have risen ~3.9% over the past one-month period. Silver, platinum, and palladium have followed the same track as gold.